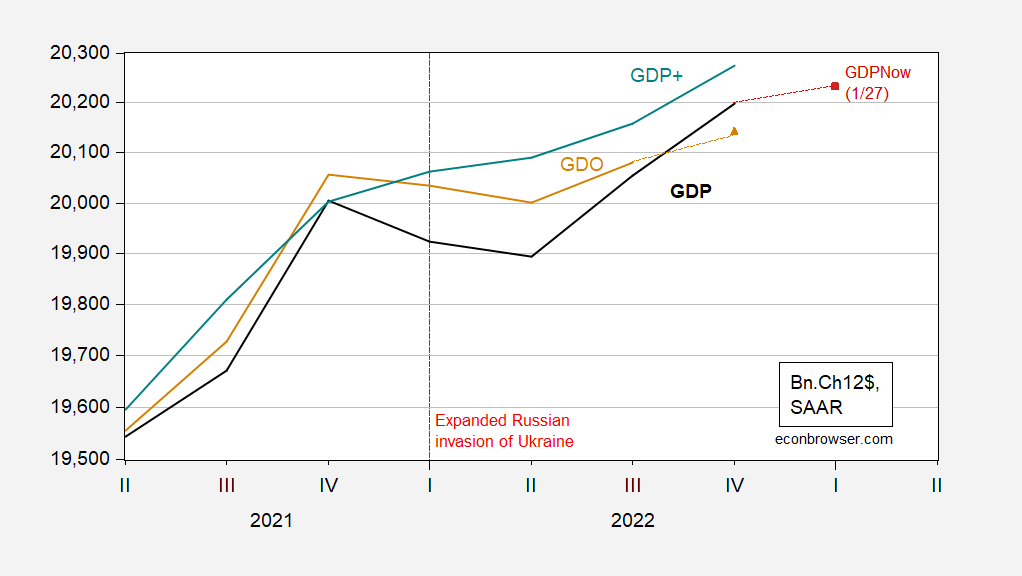

According to some aggregate measure, there was a slowdown in 2022H1, but GDP+ says not.

Figure 1: GDP (black), GDPNow of 1/27 (red square), GDO (tan), GDO estimate for Q4 (tan triangle), GDP+ (teal), all in billions Ch.2012$ SAAR. 2022Q4 GDO based on GDI where net operating surplus set to equal 2022Q3 value. GDP+ level calculated by iterating growth rates on 2019Q4 actual GDP. Source: BEA, 2022Q4 advance, Atlanta Fed, Philadelphia Fed, and author’s calculations.

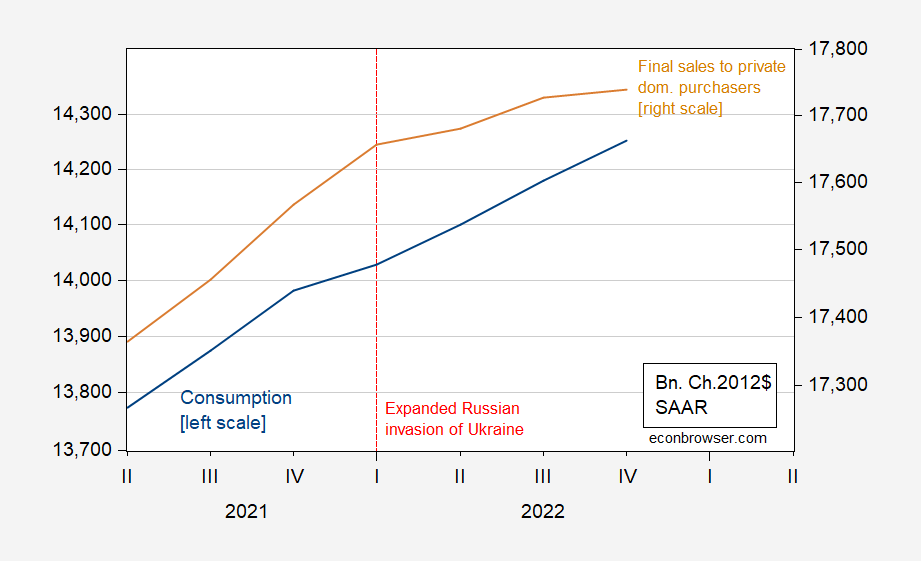

While GDP and GDO declined in H1, it’s interesting that neither final sales to private domestic purchasers and consumption declined.

Figure 2: Consumption (blue, left scale), and final sales to private domestic purchasers (tan, right scale), all in bn. Ch.2012$ SAAR. Source: BEA 2022Q4 advance release.

In every (NBER-defined) recessions since 1967, final sales always fell. Consumption too, with the exception of the 2001 recession (the WSJ January survey median response indicates the recession begins in 2023Q1, contra GDPNow as of 1/27). In other words, it does not appear the recession is here yet; nor does it appear that there was a recession in 2022H1 given the previous, employment trends, and the Sahm rule (contra Kopits).

Update, 1/29 noon Pacific:

New Deal Democrat reminds me that NBER does not pay primary attention to GDP and its variants, but rather to nonfarm payroll employment and personal income ex-current transfers, and several other indicators, most recently tabulated in this Friday post.

I am also reminded that tracking private NFP employment can be done using other four measures if one is suspicious of the CES (as Mr. Kopits is), although Goto et al. (2021) have pointed out that initial NFP from CES is most reliable for business cycle tracking. (Discussion of overall NFP, vs. QCEW, CPS series adjusted to NFP concept etc. in this post). The foregoing suggest to me no recession as of December 2022 data.

It’s either been a very long time since I have read these BEA terms or I need to review them again, or both. Makes me feel a little stupid but I guess it might be helpful to know these things later. I guess “final sales blablabla” subtracts out inventories to get a more meaningful number (depending on the question being asked/answered??) This blog has a knack for making me feel like a damned idiot.

You ever met Francis Diebold in person Menzie?? Something tells me he must be an interesting as hell type of cat.

Business Insider is not exactly FOX news folks:

https://www.businessinsider.com/nancy-pelosi-stock-trades-congress-investments-2022-7

What does showing your freezer jam-packed with premium salon ice cream on nationwide TV during a serious economic downturn tell you about a person’s character?? I don’t know, you people tell me, you’re obviously better at seeing into leaders’ souls than I am. Obviously…….. I’m a “misogynist”, what the hell other reason would there be??

that is guilt by association. at this point in time, stock trading is legal. show me the trades based on inside information, and I am willing to throw the book at them. but you need some evidence. on the other hand, I don’t mind restricting trades to index, etf and mutual funds. minimizes the potential for conflict of interest, but does not eliminate it.

‘Let me reiterate what I said:

1. H1 was a recession by the most commonly used standard’

followed by the usual blah, blah, blah. Reminds me of the adults in a Charlie Brown skit. Blah, blah, blah but NO ONE cares.

“Biden just yesterday crowed that he had reduced the budget deficit by $1.4 trillion in little over a year. That’s about 7% of GDP, so we might expect a contraction on the order of 4% of GDP (allowing for intervening, underlying GDP growth), and that’s about what we have seen.”

Stevie keeps making the mistake of seeing a fall in the deficit caused by a booming economy and conflating this with fiscal contraction. That alone should disqualify this Know Nothing from ever commenting on an economic blog ever again.

But a 4% drop relative to “underlying GDP growth”? Now had real GDP in 2022Q4 been the same as it was in 2020Q4 then maybe but that is so far off one has to wonder if Stevie ever learn to count past 2.

Never mind his continuing babble about monetary policy. Let’s face it – Stevie never learn economics but he bloviates incoherently anyway.

It seems real GDP as of 2022Q4 was 6.7% higher than it was as of 2020Q4. Now “underlying GDP growth” (to quote Stevie pooh) is about 2% per annum so the decrease in the output gap was about 2.7% over this period. But Stevie pooh somehow claims the gap rose by 4%.

Now this may be one of the worst examples of not learning preK arithmetic but it is not THE worst. JohnH just told us that the 10-year interest rate now is only 0.5% above where it was a year ago. A year ago it was 1.85%. It is now 3.49%.

Let’s see – 3.49% minus 1.85% equals 0.5%????

Come on dudes – please learn how to do simple arithmetic. Damn!

A couple of quibbles: I would be careful about saying “it does not appear the recession is here yet” based on GDP alone, without looking at the monthly coincident measures favored by the NBER. Frequently recessions have begun in quarters where real GDP was positive. For example, the Great Recession began in December 2007 despite real GDP for that quarter being +2.5% annualized.

We have no monthly data for January yet, and one applicable monthly metric was just updated Friday for November. Although it’s interesting that the Atlanta Fed’s last nowcast for Q4 was +3.5%; its first nowcast for Q1 is only +0.7%. In light of the above, that’s not exactly reassuring.

Also, the Sahm Rule is better viewed as a *sufficient* but not *necessary* indicator of recession, since several recessions have begun with only a 0.1% increase in the unemployment rate, although they met the Sahm Rule several months later.

New Deal Democrat: Good points. I thought I’d made this point in the previous posts on NBER business cycle indicators and five measures of private NFP, but I will add it to this post.

Putting up papers with matrices is just mean, cruel, vicious, and inhuman. It’s doggone mean. Meanie.

The Q1 GDPNow estimate assumes real final sales to domestic purchasers up roughly 1.3% SAAR, private real final domestic sale roughly 0.9%. Inventories return to being a drag, residential investment remains a drag. Declines in real personal consumption in November and December mean a low base for consumption spending going into Q1. Pretty healthy monthly gains in PCE will be needed to hit the 1.3% add to GDP assumed in the current estimate.

I think we have found the one person who has more insane ideas about foreign policy than even Princeton Steve:

https://www.thedailybeast.com/tucker-carlson-suggests-the-us-should-send-an-armed-force-to-liberate-canada

Fox News host Tucker Carlson, in his never-ending quest to be the most ludicrous host in cable news history, called on the United States military to invade Canada and “liberate” the country from “authoritarian” leader Justin Trudeau. “And I mean it,” he insisted Thursday, just in case viewers thought he was joking. Interviewing “manly” Canadian college professor David Azerrad on his Fox Nation show, Carlson discussed last year’s “Freedom Convoy” made up of anti-vax truckers protesting against Canada’s vaccine mandates. Carlson, along with most of Fox News, was a major proponent of the demonstrations.

“So I have to ask you about Canada, and what we saw happen there last winter—the trucker protest and then the crackdown by the authoritarian government of Canada,” Carlson said. Azerrad, meanwhile, joked that he thought Carlson was going to ask whether “Trudeau was Castro’s son,” prompting the far-right Fox host to then go on a tangent in which he invoked America’s botched 1961 invasion of Cuba. “I’m completely in favor of a Bay of Pigs operation to liberate that country,” Carlson declared. “Why should we stand back and let our biggest trading partner, the country with which we share the longest border, and actually, I’ll just say, a great country, I love Canada, I’ve always loved Canada because of its natural beauty, why should we let it become Cuba?” He continued: “Like, why don’t we liberate it? We’re spending all this money to liberate Ukraine from the Russians, why are we not sending an armed force north to liberate Canada from Trudeau? And, I mean it.”

As I have stated to the point of making everyone here ill, I feel a lot of affection to semi truckers. Most of them are great people and have good intentions. But they largely embarrassed themselves on this issue, as they often and are seemingly wanton to do.