Last Thursday, I talked on WPR’s Central Time about the national economy and Wisconsin’s outlook given President Biden’s policies. I noted that the macro outlook had improved substantially since last December, as the economy proved more resilient than expected, and inflation decelerated more than anticipated. That was true nationally, as well as locally.

The Wisconsin Economic Outlook

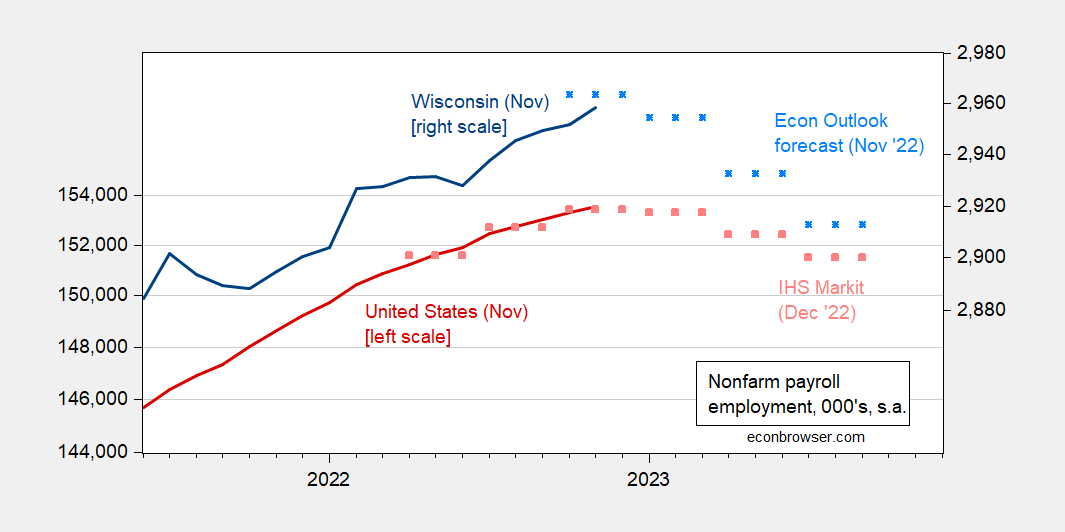

Figure 1 shows the projections from the November Wisconsin Economic Forecast update and the December IHS Markit forecast for the nation (the Economic Forecast is based on national inputs from the IHS Markit forecast). Hence, the forecasted downturn in nonfarm payroll employment is driven by the downturn at the national level.

Figure 1: US nonfarm payroll employment, November release (red), and forecast from December IHS Markit forecast (pink squares), Wisconsin nonfarm payroll employment, November release (blue), and Wisconsin Economic Forecast update of November (sky blue squares), all in 000’s, s.a. Source: BLS via FRED, IHS Markit (Dec. 13, 2022), WI Dept of Revenue (November, released in Dec.)

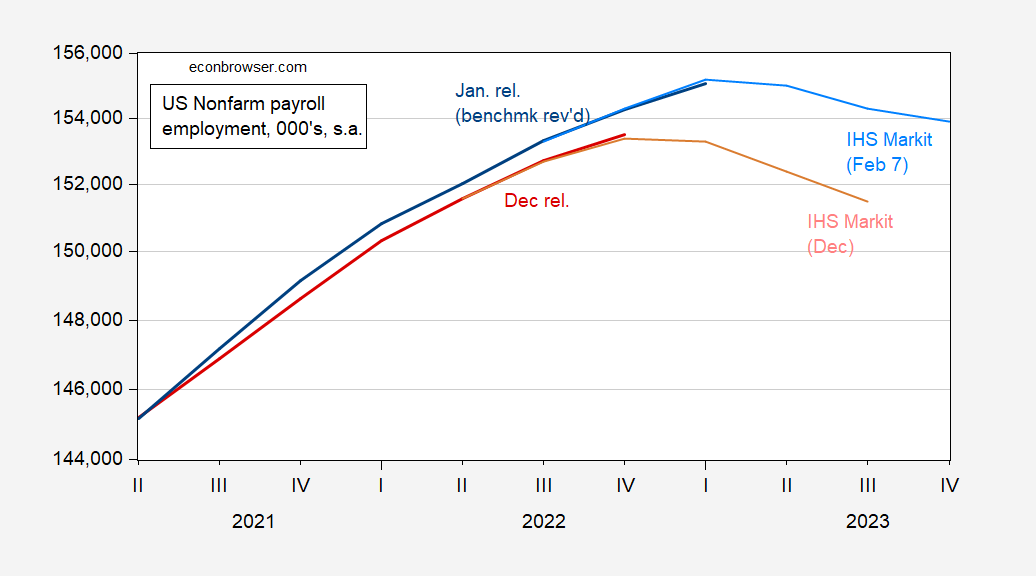

Since November, the economic outlook has improved, as was discussed in this post from yesterday. Since the Department of Revenue forecast relies on IHS Markit forecasts, it pays to examine how the IHS Markit forecast has evolved since December, as shown in Figure 2.

Figure 2: US nonfarm payroll employment from December release (red), from January release (blue), IHS December forecast (pink), and February forecast (sky blue), all in 000’s, s.a. Source: BLS via FRED, IHS December 13, and February 7.

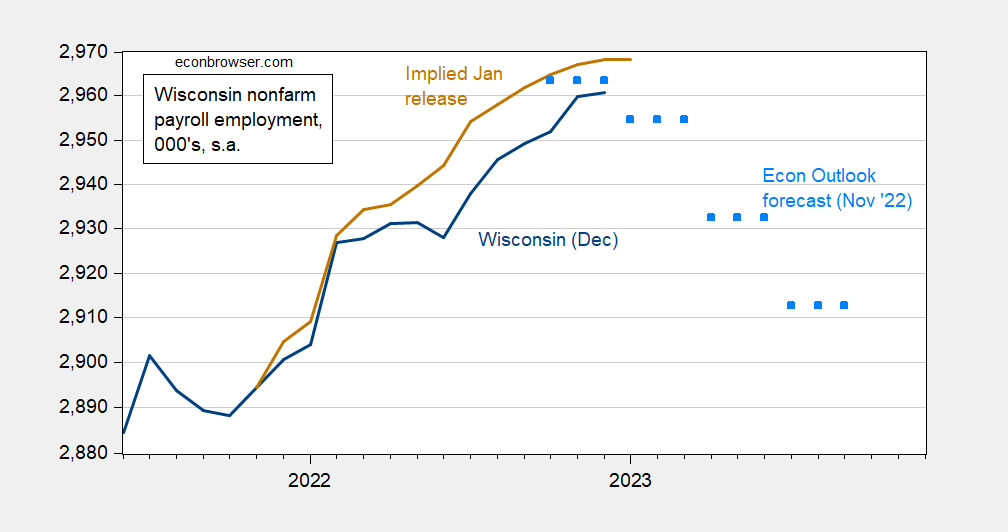

What does this imply for the Wisconsin outlook? Figure 3 shows the employment numbers from the December release (blue) and the November Department of Revenue forecast (sky blue squares).

Figure 3: Wisconsin nonfarm payroll employment from December release (blue), Wisconsin Economic Forecast update of November (sky blue squares), and estimated Wisconsin nonfarm payroll employment from January release (brown line). Source: BLS, WI Dept of Revenue (November, released in Dec.), and author’s calculations.

Given the upgrade in outlook, I would expect the next Wisconsin Economic Forecast to show a less pronounced — and a later — downturn in nonfarm payroll employment. Given the national level benchmark revision which raised national level NFP employment in December by about 800K, we should anticipate an analogous effect on Wisconsin level employment. Unfortunately, we won’t see the state level benchmark revisions and January numbers until early March. Hence, I use the first-difference relationship between Wisconsin employment and national employment in logs, 2021M12-2022M12, to estimate a relationship:

ΔnpfWI = -0.002 + 1.44ΔnfpUS

Adj-R2 = 0.40, SER = 0.0017, DW = 1.90, Nobs = 13, bold denotes significance at 5% msl using HAC robust standard errors.

I then use the benchmark revised growth rates in national employment to predict the new level of Wisconsin employment (working off of the actual level of Wisconsin employment in 2021M11). This implied level shows up in Figure 3 as a brown line.

Federal Policies and Impact on Wisconsin

How has legislation enacted since January of 2021 affected the Wisconsin economy. I pointed out that several policy measures have been put into place, including the Bipartisan Infrastructure Law ($1.2 trillion over five years), the Inflation Reduction Act ($400-$800 billion in tax credits etc.), and CHIPS ($280 billion).

The first measure is the easiest to assess. As of November 2022, $2.7 billion had been allocated, of which $2.4 billion was to transportation. The Administration anticipates about $5.4 billion to be allocated to Wisconsin eventually. Using a rule of thumb that a $100 billion expenditure results in 1 million FTE years means that one gets about 54,000 person years of enhanced employment. Distributed over five years means that nonfarm payroll employment is about 1% higher than otherwise.

Another way to look at this is to think of $5.4 billion multiplied by 1.6 (Moody’s number for infrastructure, CBO range is 0.4-2.2) is about 0.6% of GDP for each of 5 years (where Wisconsin GDP was $303 billion in 2021).

The other provisions are harder to assess. The Inflation Reduction Act provides tax credits and incentives for green technology investment, along with an extension of the Affordable Care Act, at about $400 billion. To the extent that Wisconsin, as a medium industry heavy state, is involved, the enhanced investment will spur further GDP and employment increases.

Finally, the CHIPS act ($280 billion) provides funds to subsidize the building of semiconductor chip facilities. Wisconsin came close to an investment from Intel (to use the Foxconn facilities – that is another story), but missed out. However, to the extent that semiconductor chip supply is enhanced, this will reduce the cost of production for Wisconsin manufacturing firms.

Then there are other non-actions. In particular, the Administration has retained the Section 232 aluminum and steel tariffs, as well as the Section 301 tariffs levied against China. Since Wisconsin is a user of steel and aluminum, as well as other intermediate inputs imported from abroad, on net the retention of these tariffs and restrictions is likely subtracting away from employment.

Russ (2020) estimates 75,000 jobs were lost in 2019 due to the steel and aluminum tariffs, with probably more occurring since then. Since Wisconsin accounted for about 3.8% of national manufacturing employment in 2019, that meant that Wisconsin lost perhaps around 3000 manufacturing jobs. That’s roughly 0.6 of Wisconsin manufacturing employment in 2022. (A big number or not? Remember, the Scott Walker administration and Republican legislature were going to pay out as much as $3 billion in state funds to entice Foxconn to bring 13,000 jobs to Wisconsin.)

Foxconn is a Walker/WIGOP boondoggle that continues to cost WI taxpayers. Not only do they squat on taxpayer provided land and deny Intel a chance to develop it – it remains unclear that anyone besides a few Walker/WIGOP cronies/lobbyists is actually employed there. According to reports about its Fair Labor lawsuit, “Foxconn where little is known, despite the company saying it employs about 1,000 people and receiving $37.4 million in state tax credits.” Must be nice to put up an empty glass globe in the middle of a field and get $37 million a year. Another example supporting my adage – Do not trust Republicans with money or responsible governance. https://www.msn.com/en-us/money/companies/federal-class-action-lawsuit-alleges-foxconn-not-fully-paying-wisconsin-employees/ar-AA17kkWN

I always think these stories on bank capital are important. Especially when weaselly and greasy bank lobbyists are intermingling with national and state legislators. The TBTF bankers keep pushing for another crisis that they think the American taxpayer will bail them out on. So I think voters and taxpayers need to be continually vigilant in letting their legislators know we will not support ANOTHER swaps and derivatives crisis with notional value debt taken out with depositors’/savers’ money.

https://www.politico.com/newsletters/morning-money/2023/02/13/big-banks-gear-up-for-fed-fight-00082473

The only way to ensure not having another big banker crisis similar to 2007–2008 is making sure large banks, and really all banks, have sufficient equity/capital/collateral. But the emphasis here being on capital.

We always hear this garbage about “liberal media bias”. I’m wondering how that works when a Republican state governor makes a few phone calls and then an NPR journalist gets fired.

https://www.npr.org/2023/02/13/1153590012/west-virginia-public-journalist-dismissed-wvpb-political-interference

Off topic, a recent article from CEPR looks at energy price pass-through to core inflation:

https://cepr.org/voxeu/columns/inflationary-impact-energy-prices

The conclusion is that there isn’t much. The authors assert that this is contrary to a common view regarding oil-embargo shocks and the inflation of the 1970s. I’m not sure I understand the received wisdom regarding the oil shocks the way the authors describe it. My understanding is that central bank policy *allowed* for core prices to rise so as to limit the relative price increase of petroleum – perhaps unintentionally. It was not a simp!e, mechanical pass-through. Perhaps I’m mistaken about the received wisdom.

I notice that graphic representation of pass-through is limited to the past three years. The authors note, as many others have, that the energy input/GDP ratio is smaller now than in the past. I seems likely that simple, mechanical pass-through was higher in the past.

Anyhow, the article s easy reading.

I find this interesting, as I was just (seriously, no joke) scratching my head on why natural gas prices in Europe have been low lately, but this is seemingly not helping Europe’s overall inflation picture. Would the logic be the same as in the paper you just shared??

I’m gonna guess “yes”, as far as core inflation goes.

It’s hard to argue with the reality of the numbers, but in my head it seems so counterintuitive. But then maybe that’s why it’s an interesting topic.

MD is confused and so are the authors: ” Perhaps I’m mistaken about the received wisdom.”

The article’s title is ” The inflationary impact of energy prices“, yet they limit their study to: “… rising prices of diesel fuel, jet fuel, natural gas and electricity have reinforced these inflationary pressures, independently of oil markets, drawing further attention to the role of energy prices.” But actually concentrate their study on the fuels listed above and even further limit the data mention to gasoline prices.

If only the price increases were so limited! No mention of the OTHER products created from oil and natural gas. Lip service mention of the increased transportation costs, and no mention of the transfer costs of increasing electricity prices across the entirety of the economy. Much of this due to Biden’s ill conceived GREEN policies.

What this study has show is the plateauing at increased prices and that the economy has yet to adjust to these new prices.

Another example of ignoring the policy impacts or the perception of social pay off from these policies. All this “feel good” virtue signalling while ignoring the economic PAIN.

What is missed by referencing this article is that the inflation didn’t need to happen! It canlt all be blamed on Russia, since it was wsell started before they attacked.

The transitory nature or BLIP as the authors claimed is well documented in their figures. What is not ment6ioned is the damage and pain will not be quite so transitory.

Your preferred policies in action. Way to go ignorant liberals.

CoRev wants to go back in time to Trumpland, where he can sit at home, picking the toe jam off his feet with his bare fingers while sipping on bleach, screaming at the TV anchor on his TV screen that “All the 400,000 deaths from Covid-19 under MAGA are all fiction!!!! It’s all make-believe!!!”

Welcome to the “mind” of a MAGA sycophant.

Ignorant liberals? Their theme runs contrary to what some liberals want to believe. And their article was well reasoned. But judging from your pointless barking disguised to be some sort of criticism, it strikes me you have no clue what the discussion even said. Then again how can I expected a loud retarded dog to grasp macroeconomics?

Corev has insisted that his little world is the real world, and then declared that a study he doesn’t seem to understand is “confused” because it doesn’t fit his little world. Same old Corev.

His follow-up comment amounts to “they didn’t study what I want themto study, so they’re wrong!” Science isn’t a performance of right-wing rage, so it must be wrong, Sad little man.

MD, who frequently points out debate tricks, also is a frequent user. You provided the article link, and made the quoted statement. Then failed to refute the comment.

Your common tactic: ” The Bait & Switch:: When a claim is made and your opponent refutes it, don’t try to respond, simply change the subject. ” Then debate the changed subject. As you just did, again.

Tell us CoRev – what is the trick to make you just go away. We all want to know since your comments are always nothing more than a total waste of time.

@ Ole Bark, bark 😉

MD claims: “Corev has insisted that his little world is the real world, and then declared that a study he doesn’t seem to understand is “confused” because it doesn’t fit his little world. Same old Corev. ”

MD, my world???? No, reality. Your referenced study is limited and mis-focused to fit your limited liberal view points and not reality.

I just pointed out its weaknesses, and Y’all have still to refute those weaknesses.

Interesting discussion. You have to forgive me for reading CoRev’s mindless barking before I read this discussion. Now as I read this:

One may object that gasoline price shocks have been the most visible manifestation of rising energy prices but by no means the only one. In this regard, we document that accounting for natural gas, electricity, diesel fuel, and jet fuel price shocks and their indirect effects on consumer prices – in addition to the effect of gasoline price shocks – does not fundamentally change this conclusion (Kilian and Zhou 2022b).

I was reminded of CoRev protesting that the authors allegedly excluded the cost of some forms of “energy”. Well yea – they forgot to include the massive amounts of whiskey CoRev had drunk before he started barking again.

In looking at the Phillips curve (as close a representation as I can manage at FRED), I was struck by the stediness of core inflation since 1995. It’s no wonder the authors had a hard time finding persistent pass-through effects from energy prices to core inflation in the past 27 years or so.

But back to the Phillies curve. Aside from the backward-looking focus on year-over-year inflation, the Fed’s main argument for hiking rates has lately been the strength of the labor market. Anybody see a reliable relationship between the unemployment rate’s divergence from NAIRU and core inflation’s divergence from 2% since 1995?

And Brainard’s departure from the Fed is now being unofficially confirmed in the press. Any guesses as to a replacement? Other than Rand Paul, of course.

I may haveleft out the link to core inflation and Professor Phillips:

https://fred.stlouisfed.org/graph/?g=101sS

“Another way to look at this is to think of $5.4 billion multiplied by 1.6 (Moody’s number for infrastructure, CBO range is 0.4-2.2) is about 0.6% of GDP for each of 5 years (where Wisconsin GDP was $303 billion in 2021).”

I guess you would argue that even some high schoolers could figure this out, but I am pretty sure you’re talking about the “fiscal multiplier” here, which is slightly different than the money multiplier?? I just thought some people might get lost there.

Off topic, coordinated state wealth taxes –

Or not:

https://www.washingtonpost.com/business/2023/01/17/wealth-taxes-state-level/

The idea is to impose wealth taxes in several states at once to avoid the whole cockroach-when-the-lights-go-on thing, but the Post casts doubt on passage of these bills.

I’m probably making too many comments in the same thread (like since when has that ever stopped me, aye??) Uhm, but I thought this was worth highlighting for idiots like CoRev, Sammy, Ed Hanson, Bruce Hall, and HIs Rick Strykerness that think that Professor Chinn “biases” his economic analysis with his political leanings:

“Then there are other non-actions. In particular, the Administration has retained the Section 232 aluminum and steel tariffs, as well as the Section 301 tariffs levied against China. Since Wisconsin is a user of steel and aluminum, as well as other intermediate inputs imported from abroad, on net the retention of these tariffs and restrictions is likely subtracting away from employment.”

Not exactly a ringing endorsement of President Biden’s trade policy with China.

Careful. It’s lime saying “Voldamort”, maybe.

The guy did have a cute nose though.

I been trying to recollect or call to the front of my mind, why does this FT article seemingly arbitrarily make me think of Steven Kopits?? Anyone with a wisp of an idea??

https://www.ft.com/content/fb1254dd-a011-44cc-bde9-a434e5a09fb4

“The Big Con of the book’s title is not a crime; it’s a confidence trick. Consultancies and outsourcers, Mazzucato argues, know less than they claim, cost more than they seem to, and — over the long term — prevent the public sector developing in-house capabilities.”

So well said. She has caused quite the stir with the usual idiots over at LinkedIn.

Now as far as Princeton Steve – didn’t he say he used to work for Deloitte Hungary. I bet they even found him so annoying that they had to fire him.

“The civil service can’t match the pay or training that private consultancies provide. But if it took more responsibility, and paid a little better, it might attract the brightest graduates.”

She got this right! One example – governments like ours lose a lot of big ticket transfer pricing disputes that they should easily win because multinationals pay big bucks for the smart but sleazy lawyers and buy out smart but dishonest expert witnesses while the government plays cheap with hiring its supposed experts. Penny wise pound foolish. Biden is trying to change this but the Republicans want to make the situation even worse.

A shake up at E&Y?

https://news.bloombergtax.com/transfer-pricing/ey-split-sets-stage-for-big-labor-shuffle-among-big-four

Ernst & Young’s plan to break out its consulting practice as a global advisory behemoth threatens to unleash a shakeup of the labor market for accountants and consultants at the Big Four firms and beyond.

EY staffers are already dipping their toes into the job market, reconsidering their own careers and the type of employers they want to work for as their firm’s top leaders set the stage for a historic restructuring.

Professionals on the partner track are particularly in demand as the firm’s competitors line up to nab top talent.

“You’ll see a wave of promotions, you’ll see departures from EY, and you’ll see hiring from EY because they’re going to be out there poaching as well,” said Tom Rodenhauser, managing director with Kennedy Research Reports, which analyzes the consulting industry. EY plans to spin off its advisory and tax strategy practice into a stand-alone public company in a combined debt and equity deal through which it expects to raise almost $30 billion. As the firm’s global partners prepare for a vote to advance the split, EY staffers are contemplating their next career moves. Their options include jumping to other firms or perhaps starting their own practices, said Geremy Cepin, a principal in the professional services practice at Korn Ferry.

So the greedy corrupt people doing tax evasion will become a publicly traded company? I don’t know – not buying shares of this group.

This “man”, Yevgeny Prigozhin, the leader of Wagner group, works for Putin. And Putin was the man donald trump stated he trusted more than American Intelligence agencies. All the while we have Republicans like U.S. Senator James Lankford of Oklahoma telling American citizens that January 6th was “patriotic”, and “we should all just work together”.

https://www.yahoo.com/lifestyle/wagner-group-release-another-sledgehammer-112608023.html

So I guess James Lankford is cool with calling Yevgeny Prigozhin Republicans’ friend and Lankford’s personal friend, because donald trump and Republicans making friends with mass murderers is just part of “being a team” and being part of the January 6th “patriotism”. Folks, one of these days “Christianists” (false Christians) will be incinerated in the flames of Hell. Until that day that Lankford burns in Hell, we get to watch him talk on cable TV about what “right and wrong” is and “Jesus and donald trump”. Good times……..

FYI for the general reader:

https://www.monmouth.edu/polling-institute/reports/monmouthpoll_us_020923/

Prepare for a ‘significant uptick’ in inflation this week, top economist Paul Krugman says

https://www.msn.com/en-us/money/markets/prepare-for-a-significant-uptick-in-inflation-this-week-top-economist-paul-krugman-says/ar-AA17r1zb

When I read this headline, I first thought Larry Summers took Paul Krugman out for too many beers and made Paul pick up the tab. Yea beer prices have recently gone up but their prices during that transitory period of high inflation did not rise much at all.

But then I read the story and it seems whoever wrote this misleading headline was drunk.

Exactly. The purpose of the headline is to make money, which mean it should make you click on it. All other purposes from the old days have been subjugated to the new purpose of headlines.

Huh – maybe I should gone drinking with Paul Krugman:

https://www.bls.gov/news.release/cpi.nr0.htm

ONSUMER PRICE INDEX – JANUARY 2023

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.5 percent in January on a seasonally adjusted basis, after increasing 0.1 percent in December, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 6.4 percent before seasonal adjustment.

The index for shelter was by far the largest contributor to the monthly all items increase, accounting for nearly half of the monthly all items increase, with the indexes for food, gasoline, and natural gas also contributing. The food index increased 0.5 percent over the month with the food at home index rising 0.4 percent. The energy index increased 2.0 percent over the month as all major energy component indexes rose over the month. The index for all items less food and energy rose 0.4 percent in January.

You really can do better than MSN you know. I mean you can read what you want, just saying the layers of garbage you have to go through to find real news are thicker on some sites. But then I occasionally use Yahoo, so maybe I should just shut up.

I need to change my browser. You’re right – the news feed it sends me is very annoying.

California natural gas price surge distorted cpi. BLS and their mythology is the problem though like OER’s lag. When something goes wrong, they struggle with it. BLS says natural gas rose 127% compared to December……..wrong.

Two good points! Kevin Drum had a few interesting discussions of this CALI natural gas price surge.

Says Menzie commenting on the economic effects of Biden policies:

“To the extent that Wisconsin, as a medium industry heavy state, is involved, the enhanced investment will spur further GDP and employment increases.”

“[t]o the extent that semiconductor chip supply is enhanced, this will reduce the cost of production for Wisconsin manufacturing firms.”

If this is all true, and all these policies are so beneficial and positive, why not just subsidize everything and every sector of GDP permanently? Why not print quatrillion dollars per year forever to subsidize all sectors of the economy? Because they way Menzie paints this, there are absolutely no consequences whatsoever to these Biden economic policies. Thus, there is a gigantic free lunch to be had. Is this the Econ taught in a school of public policy?

Considering Wisconsin gets most of its steal from US suppliers and Aluminum from Canada, your point is dead.

@ Manfred

I assume you’re talking about the “free lunch” fat-cats and corporations have, by paying ZERO taxed over multiple years on “deferred losses”??

https://www.nytimes.com/interactive/2020/09/27/us/donald-trump-taxes.html

https://www.nytimes.com/2021/04/02/business/economy/zero-corporate-tax.html

https://itep.org/55-profitable-corporations-zero-corporate-tax/

https://publicintegrity.org/inequality-poverty-opportunity/taxes/trumps-tax-cuts/you-paid-taxes-these-corporations-didnt/

According to poor Manfred’s logic, the government should take in zero revenues and people like Manfred, donald trump, and Amazon should not have to pay for the government infrastructure and services they use up every day of their lives, while the government operates on ZERO budget revenues. These are the “ethics” and “morality” the Manfred’s of the world teach. A free lunch for me, but not for thee

You’re apparently confusing the effect of policies which discourage activity, such as tariffs and numerical limits, with policies which encourage activity, such as subsidies. While subsidies will cause distortion, we already live in a world of distortions. It’s possible to improve outcomes by choosing our distortions well. Read up on “second best” policy.

Oh, and you might want to stop making your arguments through hyperbolic silliness and putting word in other people’s mouths. It makes you sound like JohnH, and sounding like Johnny isn’t something anyone should do.

I should probably mention that my first response to Manfred isn’t a defense of Menzie’s post. Menzie didn’t claim that industrial policy is beneficial on net. He claimed that a particular set of industrial policies is likely to benefit a particular state, because that state has a particular industrial base. Manfred then pretended that Menzie had made some other argument, and then pretended to rebut that pretend argument.

I pointed out weaknesses in Manfred’s pretend argument.

If you can’t make up stuff about your opponent’s discourse, aren’t you really taking all the fun out of it?? That’s what I got taught in my Alabama VoTech “Master E of Hyperbubbly and Digalog” off-campus internet class (endorsed by donald trump), damn it. You’re turning my world upside down now. A new paradigm of the world of debait. Or was it a new paralegal?? I forgot.

https://www.theguardian.com/us-news/2023/feb/13/trump-grand-jury-report-release-georgia-2020-election

Portions of a Georgia grand jury’s report on whether Donald Trump and allies committed crimes when they tried to overturn the 2020 election will be made public this week, but the entirety of the report will remain secret until the Fulton county prosecutor decides whether to bring charges, a judge ruled on Monday. The sections that will be made public are the report’s introduction, conclusion and a section discussing whether some of the witnesses who testified before the special purpose grand jury lied under oath. The section does not identify which witnesses may have lied.

Since we have a list of who had to testify – figuring out who lied to the grand jury should not be hard. After all there is docudrama on one of these witnesses entitled Truth Isn’t Truth.

Trump toadie Nikki Haley wants to be our next paragraph? Permit me to hand the microphone over to The View:

https://www.msn.com/en-us/tv/news/whoopi-goldberg-dresses-down-nikki-haley-over-trump-challenge-you-actually-used-to-have-some-sanity/ar-AA17tzee

Hey kids, it’s creepy Uncle Moses again!!!! You know, the one at Thanksgiving you continually avoid eye contact with that keeps haranguing on about how he misses Rainn Wilson as “Backstrom” on FOX?? Never let it be said Uncle Moses doesn’t try to keep you current on world goings-on.

https://meduza.io/en/news/2023/02/14/russian-government-has-built-secret-network-of-railroad-lines-and-train-stations-for-putin-s-exclusive-use-according-to-new-report

The gossip on “Maddow” is that he is using the train much more recently—i.e. he does feel traveling by air gives him enough assurance of personal security. Could tell us something…. or the early signs of something.

Break up into classroom groups of four students apiece and discuss. At the end of class, group leaders will be required to discuss Putin’s hair.

*he doesn’t feel traveling by air gives him enough assurance of personal security.

Durn it.

I wish I could remember the details but didn’t Gorby have his own lane for driving through the streets of Moscow? Putin is taking this to the next level.

It sounds right. I remember one time, the northeast city I lived in, in China, the leader of North Korea (It was Kim Jong Il still, the 2nd one of the line) And he did a lot of train travel then also, but while he was in the city he had a long cavalcade of cars and was staying in a hotel very near to my apartment. I never saw him in person, but it kinda gave you a weird feeling knowing that a murderer sicko was that nearby to you.

https://www.hrw.org/news/2021/12/16/north-korea-abusive-rule-10-years-after-kim-jong-il

Just like the MidEast Arabs who call America the “great Satan”, Kim Jong il couldn’t wait to send his children to school in Switzerland for a western education. Just like MidEast Arab economic elite, I guess they asked Kim Jong-il “Where you gonna send your children for their education??” and naturally he answered “With the Great Satan. Who else??”. Of course America is the one and only true “Great Satan” but a father does what he can for he son, so he settled for just, like, uhm, a Lieutenant demon in Switzerland. Oh well. Harvard vs Yale, what yeh gonna do?? “Great Satan” America vs “Demon Lieutenant” Switzerland. How many fake passports and bribes can a loving father give??