Back at the beginning of this year, Mr. Steven Kopits asserted that the Philadelphia Fed’s early preliminary benchmark supported a recession in 2022H1, to wit:

You, Menzie, held the Est Survey was more likely right. You wrote: So: (1) I put more weight on the establishment series, and (2) the gap between the two series is more likely due to increasing, and biased, measurement error in the household series, rather than, for instance, primarily increases in multiple-job holders. https://econbrowser.com/archives/2022/12/the-household-establishment-job-creation-conundrum

Dead wrong, as it turned. And predictably so.

You were wrong because you did not consider the statistics more holistically. That’s the learning point for your students. Cross check your indicators if you have dials which are telling you different things. If jobs are increasingly rapidly, then GDP should also be up. If jobs are increasing rapidly, then mobility and gasoline consumption should also be up, because so many people need to drive to work in this country. Finally, if productivity is imploding when jobs are up, you really need to take a pause and put together some sort of narrative as to why that might be happening. It suggests something anomalous in the data which requires closer inspection.

Had you done that, Menzie, you might have concluded as did the Philly Fed…

With newly released QCEW data (which is used by the Philly Fed to generate its early benchmark), what do we now think happened in the labor market in 2022H1?

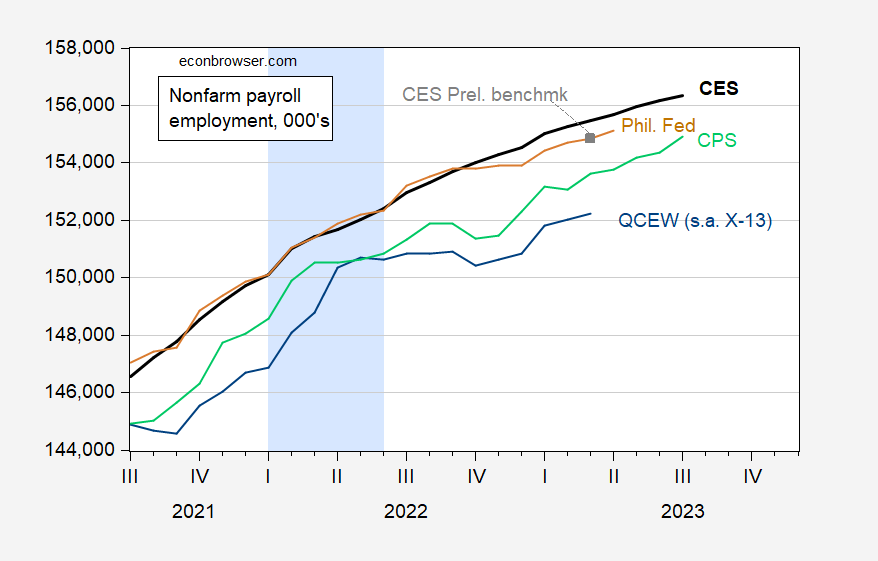

Figure 1: Nonfarm payroll employment, FRED series PAYEMS (bold black), preliminary benchmark (gray square), sum of states early benchmark by Philadelphia Fed (tan), civilian employment over age 16 adjusted to NFP concept (light green), Quarterly Census of Employment and Wages total covered employment, adjusted by log Census X-13 by author (blue), all in thousands, seasonally adjusted. Light blue shading denotes hypothesized (by Mr. Steven Kopits) 2022H1 recession. Source: PAYEMS from BLS via FRED, civilian employment adjusted to NFP concept from BLS, QCEW from BLS, BLS, sum of states early benchmark data from Philadelphia Fed.

Note that the preliminary benchmark revision did not alter qualitatively the trajectory of nonfarm payroll employment.

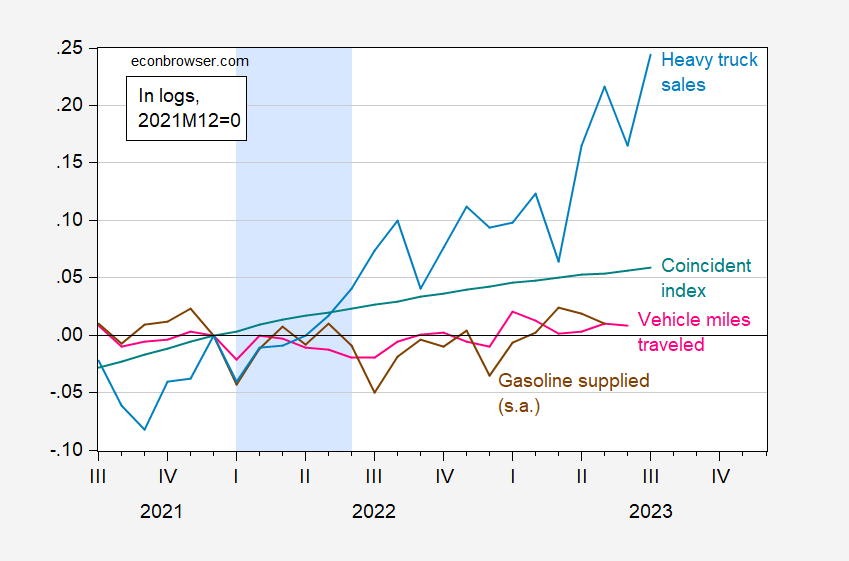

What about other indicators Mr. Kopits signalled as being important predictors? Figure 2 presents vehicle miles traveled as well as gasoline product supplied (consumption is highly correlated, regression coefficient of one, so it’s a proxy for that as well).

Figure 2: Vehicle miles traveled (pink), motor gasoline supplied (brown), heavy truck sales (light blue), coincident index for US (teal), all in logs, seasonally adjusted. Gasoline supplied seasonally adjusted using multiplicative moving averages. Light blue shading denotes hypothesized (by Mr. Steven Kopits) 2022H1 recession. Source: VMT, heavy truck sales, via FRED, motor gasoline (n.s.a.) from EIA, coincident index from Philadelphia Fed via FRED.

Notice that every index in Figure 1 was rising from 2021M12 to 2022M06. VMT provided I think a false signal (presuming NBER does not declare a recession in 2022H1). Gasoline supplied also seems to have indicated a lackluster growth in the past year. On the other hand, conventional indicators such as the Philadelphia Fed’s coincident index continued its rise. Heavy truck sales were nearly 5% higher at mid-2022 than at end-2021.

The high and rising value of the heavy truck sales index suggests to me a recession had not occurred as of June 2023. But no guarantees on 2023H2.

Has Stevie ever gotten something regarding the labor market right? His latest is to suggest the latest employment news is troubling. His source? A Bill McBride post that Stevie did not understand.

I have always admired McBride for his ability to take complicated economic data and present it so even a fifth grader could understand it. But I guess that against willful ignorance even McBride found his match.

Leaving the question of recession forecasting aside, why would heavy truck sales be growing so quickly going into 2023?

Would that be a function of economic recovery from the pandemic and the lingering fiscal stimulus associated with pandemic policies?

I’m guessing/assuming that expected real borrowing costs would impact heavy truck sales.

Fleet age is apparently a big factor. As of last September, the average age of class 8 trucks registered for use in the U.S. was 4.4 years. Before the supply hiccup, that figure was more like 4.0 years. Strongs sales were expected this year, after a strong 2022.

https://www.ccjdigital.com/economic-trends/article/15297068/fleets-in-search-of-new-units-as-truck-age-grows

Same story here:

https://www.automotive-fleet.com/10193281/survey-average-truck-age-exceeds-normal-cycle#:~:text=NTEA%20recently%20published%20its%2011th,exceeding%20their%20normal%20replacement%20cycle.&text=According%20to%20the%20survey%2C%2029,is%20increasing%20beyond%2010%20years.

There is also a very high level of goods consumption which supports demand for delivery services, so for trucks.

“ Would that be a function of economic recovery from the pandemic?”

Yes, I believe that is very correct. The same applies to cars, SUVs, and pickups. Pandemic related supply bottlenecks held back production. People Heldon to older models in the face of skyrocketing prices as well as shortages. Now the industry is playing catch-up.

Interestingly, though, truck shipments are down almost 10% YoY, and hiring of drivers has also turned down.this big discrepancy isn’t totally unique (it happened in 1998 as well), but in the past such a downturn in shipments has led to a decline in new truck orders with roughly a 12 month lag.

let me be preemptive here and predict that econned will now chime in that prof chinn is being mean for pointing out that a commenter on this blog is wrong. rather than focus on the fact that kopits is wrong, econned will focus on how mean prof chinn must be for pointing out the error of kopits. it happens every time prof chinn makes a post that corrects a commenter.

I bet Econned is preoccupied coming up with his own definition of “broad money” where his measure confirms the Quantity “Theory” of “Money”.

Let me be preemptive and say “stalker”.

Interesting numbers from BEA: corporate profit margins ROSE from 15.7% to 16.1% in the second quarter. It is the fifth highest profit margin ever reported.

https://fred.stlouisfed.org/series/A466RD3Q052SBEA

Real GDI rose by a very paltry 0.1%, but just enough for Biden partisans here to trumpet the fact that the economy is not in recession.

https://fred.stlouisfed.org/series/a261rx1q020sbea

It will be interesting to see how Realtime Inequality reports the distribution of GDI.

After all pgl’s bleating about how much Corporate America has been suffering, it looks like they are still making out like bandits, despite high interest rates and real wage gains.

Johnny, you worm, you! How many times have we told you – NBER decides when there is a recession. Not thtroll choir. Not GDP and not, for goodness sake, GDI.

Enough with the weak provocations.

My, my, my!!! How piggly and his doppelgänger Ducky do bleat…they hope that if they throw enough BS, snarks, and insults up against the wall, some of it will stick!

Hey moron – Kevin Drum did the hard work you cannot be bothered with. And real profits fell last quarter. I guess facts are snarks in your little world.

Nice try, boy. I won’t speak for pgl; you pretend to speak for him plenty already.

For myself, I’m performing a public service. You pretend to knowledge you don’t have. You pretend to ideals you don’t possess. You lie incessantly. You serve the interests of Putin and occasionally Xi, while pretending to be a concerned progressive. I point out the dispicableness that is you because casual readers of this blog may not realize what you are up to. You are a chihuahua-sized Russian Influence agent, as described here:

https://www.npr.org/2023/08/29/1196117574/meta-says-chinese-russian-influence-operations-are-among-the-biggest-its-taken-d

As a public service, I let people know own whoand what you are.

johnnie, thanks,

your antagonists make for fun reading here

make this old codger smile!

Yea – you are a waste of time too.

I grow bored with pointing out that Johnny is lying, butJohnny is lying.

pgl has not said that Corporate America is suffering. Johnny,feel free to show where he has, but you’ll have to distort any example you might try to provide. You’re simply lying.

gpl took Menzie’s sstimate of corporate profits as the basis for discussion. Menzie’s estimate was the same-sized drop as last time. Not “bleating”, you lying scum – accepting for the sake of discussion.

“After all pgl’s bleating about how much Corporate America has been suffering”

I never did that and you know it. I guess Jonny boy did not get his Kremlin dog food this week so he’s off on another emotional rant.

Now even the New Yorker has become one of Putin’s Poodles: “The Case for Negotiating with Russia”

https://www.newyorker.com/news/essay/the-case-for-negotiating-with-russia

Questions about the wisdom of the Ukrainian misadventure and its mismanagement are appearing everywhere…all Russian influence operations, if your believe piggly and his doppelgänger Ducky.

“There are dissenting voices within Ukraine, but they are seldom heard from in public. One former official, who asked that we disguise his identity, told me, “’The dialogue is not just toxic. If you are not jumping up and down with the mainstream, then you are an enemy.’” The same could be said for the “dialogue” here in the US and at this blog…dissent must be demonized and suppressed, even if the commentary and questions being raised come for well regarded mainstream sources, like Jeffrey Sachs or reporters at the NY Times, Washington Post, BBC, and Wall Street Journal. And now Tucker Carlson gets 50 million views of his interview with Victor Orban about Ukraine.

It looks like Americans might finally be getting a debate about getting involved in yet another pointless and futile war, a debate that citizens of a democracy should have been entitled to long before getting involved in such a war.

JohnH: Unlike others, I do not think you are part of the paid disinformation campaign. Any entity trying to spread disinformation would hire a more adept agent. I just think that you are hideously ill informed (from economics, where you think a median income is being kept secret by the government, to balance of forces — do you remember your mocking almost exactly a year ago, the Ukrainian “stealth counteroffensive”?)

I am, however, quite impressed with your readiness to continue to highlight your stupidity and ignorance, after repeated corrections (which you never seem to acknowledge).

One last point. One can admire Jeffrey Sachs’s economic analyses without agreeing with his analyses of international relations. (I would venture to say I have more acquaintance with Professor Sachs than you do.)

Our host has taken you down but let me ask – WTF does this have to do with your false claim that real profits rose. They fell moron. Learn to do basic research.

“despite high interest rates and real wage gains.”

Wait. Jonny boy claims national income barely gained but real wages rose (true) and somehow corporate profits soared. This is like adding 2 plus 2 and getting 16. No wonder Jonny boy’s firm went bankrupt. Jonny boy flunked accounting 101!

“corporate profit margins ROSE from 15.7% to 16.1% in the second quarter.”

Did Jonny not notice his own link had this margin at 16.9% as of 2022Q3. Another edition of Jonny boy lying in the most transparent way.

Jonny boy notes the BEA released the latest on real GDI but Jonny boy does not provide the link:

https://www.bea.gov/news/2023/gross-domestic-product-second-quarter-2023-second-estimate-and-corporate-profits

I wonder why he did not provide the link. Oh yea the reported increase was 0.5% (annualized of course) but Jonny boy reports it as 0.1% (not annualized). Now maybe Jonny boy is not lying. Maybe it is because Jonny boy sucks at all forms of communication (reading and writing). But everyone knew that already.

I get that little Jonny boy is incapable of basic research so I looked at the BEA’s

Table 1.10. Gross Domestic Income by Type of Income

Line 15: Corporate profits with inventory valuation and capital consumption adjustments, domestic industries

In nominal terms, this fell from $2359.1 billion in 2023QI to $2328.3 billion. Now unless we have deflation, real profits FELL. But Jonny boy wants us to believe they rose. Yea – Jonny boy is a lying idiot.

“It will be interesting to see how Realtime Inequality reports the distribution of GDI.”

Yep – Jonny boy does not realize that NIPA table 1.10 from the BEA reports these figures. I do have one mentally retarded stalker.

Holding RUDY to account!

https://www.msn.com/en-us/news/national/judge-finds-giuliani-defamed-georgia-election-workers-orders-sanctions/ar-AA1fZIwK?ocid=msedgntp&cvid=7fcf68605e0547f7aa6c0b51e94e588c&ei=6

Judge finds Giuliani defamed Georgia election workers, orders sanctions

A federal judge has found former New York City mayor and Trump attorney Rudy Giuliani liable for defaming two Georgia election workers who he falsely accused of tampering with the 2020 election results. Giuliani will still go to trial in D.C. federal court on the amount of monetary damages he owes to Ruby Freeman and Wandrea Shaye Moss for defaming them. But Judge Beryl A. Howell has already ordered Giuliani to pay roughly $132,000 in sanctions between his personal and business assets for failures to hand over relevant information to the plaintiffs.

RICO allows evidence like defamation to be used as evidence. RICO allows findings in other jurisdictions to be used as evidence. Defaming pole workers looks like part of an effort to overturn election results.

So it may be that this finding can be admitted as evidence, without re-litigating in a Georgia courtroom, of a conspiracy to overturn the election.

Plus he has to pay their legal fees, currently around $90K.

I was also glad to see the odious Peter Navarro has to go to trial (expected to be a short one!) His defense of “I’m innocent! I have an alibi! None of the people who could support that alibi are willing to do so, but my word should be good enough, so I shouldn’t have to go to trial!” didn’t cut it, for some reason.

Navarro, he of the belief that old white man speaking with authority should not be questioned or challenged, but accepted as truth, no matter how ridiculous the words are coming out of his mouth. privilege and entitlement, all wrapped up in one big turd. that is navarro.

Harkening back to https://econbrowser.com/archives/2023/08/the-problems-with-chinas-economy:

Donald Low writes in the SCMP:

“Policymaking in the mainland has, in recent years, become characterised less by pragmatism, experimentation and improvisation, and more by ideology, morality and security (in which policies are increasingly seen through the lens of national security, often at the expense of economic growth).”

Low’s description, in “recent years” timing and less pragmatic, more ideological character, fits the Xi regime.

I am right that finding a link which suits one’s taste is the whole point of comments in Johnny World, yes?

https://jabberwocking.com/corporate-profits-remained-elevated-in-q2/

‘The pandemic turned out to be great for corporations, if for no one else, but the last few quarters have shown a slow decline since profits peaked in mid-2022. I wouldn’t be surprised to see a further decline in Q3.’

Kevin Drum reports on inflation adjusted corporate profits. As usual – Kevin strives to inform in an honest way. Something JohnH refuses to do.

Kevin’s post pointed to:

Gross Domestic Product, Second Quarter 2023 (Second Estimate) and Corporate Profits (Preliminary)

https://www.bea.gov/news/2023/gross-domestic-product-second-quarter-2023-second-estimate-and-corporate-profits

Of course Jonny boy cannot be bothered to check out what BEA noted:

Profits from current production (corporate profits with inventory valuation and capital consumption adjustments) decreased $10.6 billion in the second quarter, compared with a decrease of $121.5 billion in the first quarter (table 10). Profits of domestic financial corporations decreased $47.8 billion in the second quarter, compared with a decrease of $9.4 billion in the first quarter. Profits of domestic nonfinancial corporations increased $17.1 billion in the second quarter, in contrast to a decrease of $102.9 billion in the first quarter. Rest-of-the-world profits increased $20.2 billion in the second quarter, in contrast to a decrease of $9.2 billion in the first quarter. In the second quarter, receipts increased $18.2 billion and payments decreased $2.0 billion.

I noted the decrease in overall nominal profits. But Kevin broke out the rise in nominal profits for nonfinancial companies showing there was no real increase. With the sizeable decline in real bank profits (and we know how Jonny boy hates those bankers) overall profits also fell in real terms.

Yea it was all there but Jonny boy missed it. No he is waiting for some folks at Berkeley to tell him what the rest already know.

Mitch had another lapse:

https://thehill.com/homenews/senate/4179341-mcconnell-freezes-for-second-time-during-press-conference/

I have no guess to make about his continuing as Majority Leader.

How does this play out if mcconnell keels over? Does the democratic governor appoint a replacement for his entire term? Does that replacement get onnhis committee assignments? I think his days are jumbered in the senate. He will soon be in worse condition than feinstein. Age is a problem in both parties.

Does the democratic governor appoint a replacement for his entire term?

The Republicans in the Kentucky legislature has passed some law that would prevent this. The Governor says he can challenge that law.

So good question but the answer is complicated.