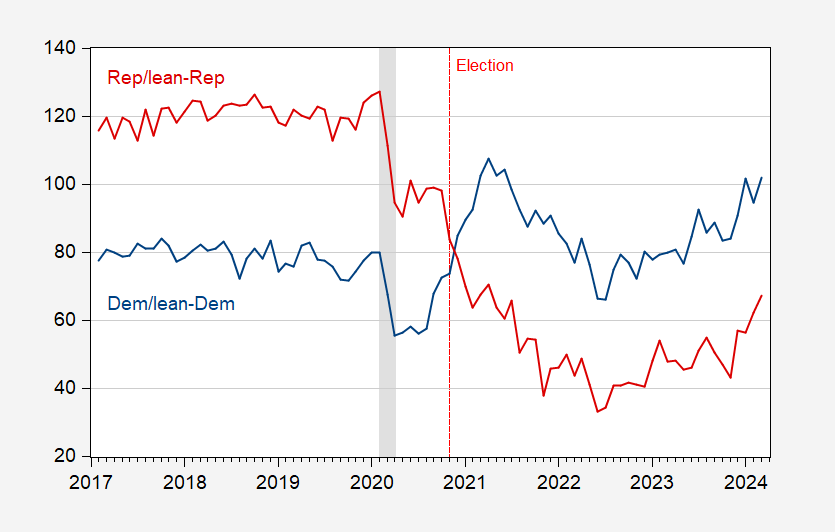

Here’s a plot to economic sentiment as recorded by the University of Michigan Survey of Consumers, by political affiliation:

Figure 1: University of Michigan Economic Sentiment index for Democrat/lean-Democrat (blue), and for Republican/lean-Republican (red). NBER defined peak-to-trough recession dates shaded gray. Source: University of Michigan Survey of Consumers, and NBER.

While sentiment shifts as control of the presidency shifts, it’s interesting to investigate the size of the shifts, and how respondents vary in the importance accorded various factors.

If one got the impression that Republican/lean-Republican respondents really, really ascribe a big negative to Biden’s presidency, one would be correct. This can be seen by running a regression of economic sentiment on unemployment, inflation, a Biden dummy variable and the SF Fed’s news sentiment index, over the 2017M02-2024M02 period (for which we have continuous time series for sentiment broken down by partisan affiliation).

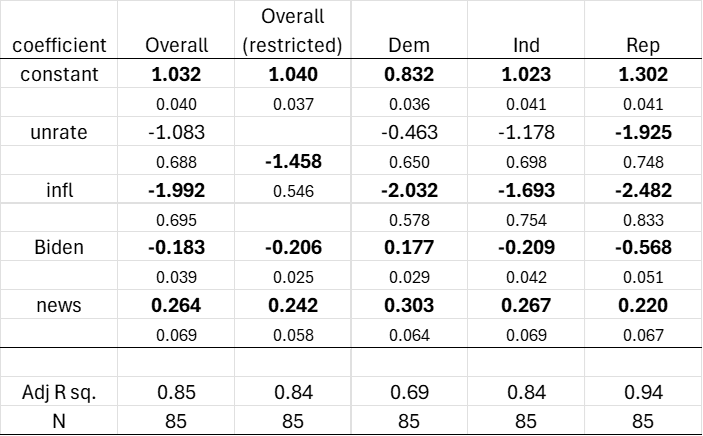

Table 1. Regression coefficients with HAC robust standard errors. Bold denotes significance at the 5% msl. Sentiment, unemployment, inflation all expressed in decimal form.

Column (1) reports the results of running the Michigan survey series on these variables, while column (2) reports the same results, constraining the coefficients on unemployment and inflation to be the same (i.e., running the regression on the “misery index”).

Inflation and unemployment for the aggregate index have the expected sign, while the Biden dummy variable coefficient is significantly negative. The news sentiment index has the expected positive sign as well. A F-test does not reject the null hypothesis that the unemployment and inflation coefficients are of equal size. “Misery” then has a statistically significant coefficient.

The interesting findings pertain the the disaggregated responses. Democrat/lean-Democrat respondents as well as Independents have a smaller (in absolute value) weight on unemployment than on inflation. For Dem/lean-Dem, an F-test on whether the coefficients are the same rejects at the 5% msl. Hence, for this group, unemployment has a relatively lower weight. Republican/lean-Republican on the other hand have about equal weight on unemployment and inflation. They also have — relative to Dem/lean-Dem — a larger effect ascribed to inflation (2.5 vs. 2.0).

In contrast, Dem/lean-Dem are more affected by news sentiment than Rep/lean-Rep (0.30 vs. 0.22). This suggests that, regardless of whatever bias there is in the news reporting as suggested by Harris and Sojourner (2024), Rep/lean-Rep respondents are more impervious to information regarding the economy than Dem/lean-Dem.

The most interesting finding pertains to the coefficient on the Biden variable. For Dem/lean-Dem, the coefficient is +0.18, while that for Rep/lean-Rep the coefficient is -0.58, which is over three times as large (in absolute value). Another way to view the relative impact is to look at standard deviation normalized coefficients (sometimes called beta coefficients). For Rep/lean-Rep, the beta coefficients for Biden vs. inflation (the next most impactful variable) is 0.83 vs 0.18. For Dem/lean-Dem, Biden vs. news sentiment is 0.87 vs 0.57.

While the larger relative impact for Rep/lean-Rep for which party controls the presidency shows up in earlier data (we don’t have nearly as much for 2006-2016), the impact, to the extent to which we can measure it, seems larger for Biden than for Democratic presidents in general. (Not sure an F-test would confirm, but the coefficient is larger (in absolute value) in the last 7 years).

This distinction buttresses the findings in this post. For results not incorporating the news sentiment variable, see this post.

I think the information about where people get their news (not just whether things are in the news) would be important. A lot of republicans get their news from highly biased and fact-free sources. Furthermore, they have been primed to reject facts that they don’t like and simply hook on to an authority figure as their source of “truth”. Critical and scientific thinking is not something they master or even want to learn. Scientific data as a whole has been demonize, to ensure that Fox and its right wing masters can manipulate republicans and MAGA cult members.

That would be a really interesting study- and I’d be interested to see how much of the “Republican” effect would be attributed to the “News source” effect. I’m sure there’d be some left, but it would allow for an analysis of propaganda vs. party loyalty effects.

Off topic- cars:

Trade-ins are part of the structure of automobile purchases. In much the same way the housing market runs on a combination of home equity and credit, new car purchases rely on trade-in value and credit. Edmunds reports that there has been an increase in negative equity in the auto market, as a resultof used-car values dropping:

https://www.edmunds.com/industry/press/negative-equity-on-vehicle-trade-ins-pick-up-steam-as-used-car-values-dwindle-according-to-edmunds-q4-used-vehicle-report.html

That suggests a slowdown in auto sales, as owners have to come up with cash to settle car loans before they can trade up to a new car.

While I’m all for utting way back on travel by and ownership of family vehicles, the auto sector is a big deal for the U.S. economy. Here are light vehicle sales and capacity use in the sector:

https://fred.stlouisfed.org/graph/?g=1inO5

The news had a survey of voters asking them if Biden is too old. The retarded voters who wore MAGA hats said yes by 90% (hey Bruce Hall – these are your people).

The ones with brains still left in their heads said no overwhelmingly.

This is a distinction that pollsters need to make routinely. If the answer to “Is Biden too old?” or “Is the economy doing well?” depends largely on political affiliation, then the results, not differentiated by political affiliation, don’t tell us much. Broken-record me really wants that information from undecided voters in swing states.

If we’re going to treat the choice of president as a horse race, let’s at least do a good job handicapping the race.

Menzie – a little bit of good bipartisan news: Wisconsin legislature/Gov Evers put into law Wisconsin Act 96, which “provides necessary funding to leverage federal funding for the development of Wisconsin’s biohealth and technology sectors.” This puts up $7.5 million which will go to support existing biohealth and tech firms in Wisconsin. Wisconsin was designated as a Regional Technology Hub (RTH) by the U.S. Economic Development Administration (EDA), and this money is part of the bid so Wisconsin can compete for up to $75 million in funding under the federal CHIPS and Science Act of 2022. This was supported by WIGOP/Dems and WEDC IMO, this will give Madison/Waukesha/Milwaukee and other areas of the state a real boost https://www.wispolitics.com/2024/gov-evers-signs-bill-providing-grant-to-support-wisconsins-regional-biohealth-tech-hub/

Also as a member of the Madison Chamber of Commerce – I had a chance to visit the new Elements Lab https://universityresearchpark.org/introducing-element-labs/ the growth in University Research Park has been amazing in the last five years https://universityresearchpark.org/

Folks these are existing companies and current jobs – not an empty field like the Trump/Walker Foxconn boondoggle I guess the photo of Trump, Walker and Paul Ryan trying to handle a shovel for the first time in their lives was worth millions in WI taxpayer dollars https://www.thebulwark.com/the-foxconn-boondoggle-was-even-worse-than-we-thought/

“Bradford DeLong asks why is the American long-term real safe interest rate so far above the neutral level?…The near-consensus since the start of the pandemic has been that there are powerful fundamental factors keeping the neutral interest rate very low, and that there have been no major changes to those fundamentals. The neutral rate therefore should still be very low, implying that the high policy rate is inappropriate to an economy at full employment with inflation near its target.

But if there is one lesson that I have learned in more than 40 years of trying to understand the business cycle, it is that there is no empirical regularity in the macroeconomy that can be trusted not to crumble beneath our feet in a remarkably short time.”

https://www.interest.co.nz/economy/126868/bradford-delong-asks-why-american-long-term-real-safe-interest-rate-so-far-above

Shorter DeLong – interest rate policy is most likely inappropriately tight, but maybe not.

Johnny must be running out of people to mumble about, since DeLong’s basic view is that Johnny is wrong about unterest rates.

DeLong is at least willing to entertain the real possibility that group-thinking economists are wrong about the neutral rate…but Ducky’s low rate/high asset values bias blocks him from seeing it.

JohnH: In this post, I plotted multiple versions of the natural rate (r*) which implies by adding 2.5 ppts different versions of the neutral rate. I think many economists, including Macroduck, are aware that there are multiple ways of estimating a natural rate.

Yes indeed, there are multiple ways of estimating a natural rate, something the rate cannot be measured or observed directly…which begs the question of why what is essentially an academic exercise has become is the object of such intense speculation and debate.

Usually when something as fuzzy and intangible as the neutral rate gets such intense attention, there is money lurking behind it–in this case the Wall Street ecosystem, which stands to make a lot of money if it correctly guesses which way the winds are blowing at the Fed…and possibly even being able to shift the winds in a favorable direction.

To the extent that the debate is fueled by money interests, those participating in it would do the public a big favor by disclosing that that is what is motivating their economic research and opinions.

JohnH

March 17, 2024 at 3:55 pm

Here he goes again. Jonny boy does not even get this concept, has said who cares about this topic, and now any disagreement must be politically motivated. It never stops with this troll.

For all of DeLong’s openness about the natural rate, he never said it was the 4% figure Jonny boy is touting. Yea – Jonny boy misrepresents what everyone has said.

More scepticism from St. Louis Fed, Kevin L. Kliesen, “Has the U.S. Economy Transitioned to a Higher Long-run Real Interest Rate Regime? …The evidence presented in this blog post suggests that the long-run real market interest rate has increased over the past two years, nearly returning to the levels that prevailed from 2004 to 2012. The higher market real rate could reflect a higher long-run neutral real interest rate or the expectation of “looser” monetary policy in the future that results in an inflation rate above the 2% target set by the FOMC. That said, two years is probably not a sufficiently long enough time to declare with much confidence that the U.S. economy has shifted to a higher real interest rate regime. Indeed, as noted by Bullard, regime switches are generally not forecastable. Still, a higher long-run neutral real interest rate, if it has occurred, has important implications for monetary policy in the long run, as noted above.”

https://www.stlouisfed.org/on-the-economy/2024/mar/has-economy-transitioned-higher-long-run-real-rate-regime#authorbox

This discussion was a pretty good one – too bad little Jonny boy has no clue what he wrote. Yea – this is a nice close:

“The evidence presented in this blog post suggests that the long-run real market interest rate has increased over the past two years, nearly returning to the levels that prevailed from 2004 to 2012.”

Except everyone who gets this issue (which excludes Jonny boy) knows that this level (2004 to 2012) was around 2% – not the bogus 4% figure Jonny boy thinks is gospel.

A little advice for Jonny boy – until you understand what this issue is about STOP making comments as all they do is to embarrass your poor mother.

DeLong goes through 3 different scenarios and Jonny boy asserts he only discussed one? I would ask if you could be more dishonest but then we know you lie 24/7. Now I liked his reference to Wily E. Coyote as that cartoon character is little Jonny boy all over.

Off topic – You know I like to gripe, yes?

So McKinsey has released a report on Europe’s economic structure and risks to growth:

https://www.mckinsey.com/mgi/our-research/accelerating-europe-competitiveness-for-a-new-era#/

The gist, in the McKinsey view of the world, is that Europe is falling behind the U.S. because of a lack of innovation and investment. This is particularly consequential, argues McK, because we have entered a period of change, in which innovation is more important than…well, than before.

Grist for the mill, I suppose, but much of the broad argument is embarrassingly thin. We’re entering a period of change? Could the framing be more trite? But leave that aside.

McK gives Europe high marks for inclusion and sustainability, recognizing that the European economy is structured for stability. The focus of the article, however, is growth. The unstated argument here is that one of the richest regions of the world, which has done a better job than other rich regions at translating wealth into general welfare, should worry more about getting richer, less about fairness and sustainability. That, I should think, is a matter for voters to decide.

McK lists seven areas of weakness –

Innovation: “Disruption” is sprinkled through the text here. Such is the quality of thought at McK – sell that cliche’.

Energy: Didn’t we already know that? McK suggests no remedies. Thanks.

Capital: Europe’s lower returns on capital are exacerbated by higher borrowing costs. True. The big consultant brains at McK don’t mention that this is a problem which sorts itself out, either by firms seeking higher-return investments, by cutting back on investment, or both. McK doesn’t even bother to address this simple implication, even though it’s the whole ballgame.

Supply Chains: Economic openness is a bad thing.

Talent: Here, read “talent” as worker protections. This is a very old song. Again, the unstated implication is that fairness and quality of life should be sacrificed to growth.

Size: Bigger is better. Really? One of the stronger arguments regarding the declining trend in U.S. productivity growth is that industrial concentration inhibits productivity growth. And creates monopsony power. And corrupts politics. And distorts incentives…

Competition and markets: Trade barriers are good. Not in so many words, but it’s hard to read the text any other way, unless this is just a restatement of the supply chain point, which argues that openness is bad.

The details are worth reading. The structure of corporate finance, the extent of reliance on overseas supply chains, the level of industrial concentration – all very educational. The broad strokes, though, are shabby pro-corporate hand-wringing.

I shall now step down from my soapbox.

https://www.digitimes.com/news/a20240219PD206/china-auto-components-mexico-us-market.html#:~:text=Chinese%20automotive%20suppliers%20establish%20plants%20in%20Mexico%2C%20aiming%20for%20US%20market,-Jerry%20Yang%2C%20Taipei&text=China%2Dbased%20car%20component%20suppliers,future%20Gigafactory%20in%20Nuevo%20Leon

Telsa and China building EVs in Mexico – maquiladora done Xi style! Oh wait – Trump sees a “bloodbath” so raise those stinking tariffs. Here we go again!