Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared in Project Syndicate.

Category Archives: deficits

Federal Spending Implications of the House GOP Tax Plan: $25 bn Off of Medicare …

As noted in this earlier post, the distributional consequences of the House Tax Cuts and Jobs Act should include the spending cuts. According to CBO, there will be a $25 billion cut to Medicare unless independent legislation is passed. From TPM:

…automatic cuts spring into action anytime Congress passes a bill that balloons the federal deficit, as the tax bill would. The approximately $136 billion in cuts spurred by the GOP tax bill would hit a number of government programs—including farm subsidies and the Border Patrol—but would cut most deeply into Medicare. Medicaid, Social Security, and food stamps are protected.

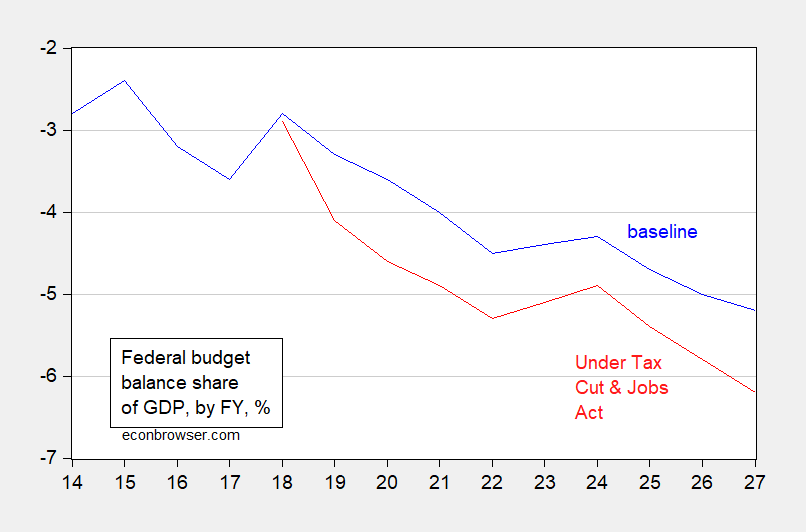

CBO/JCT on Deficits and Debt under the Tax Cuts and Jobs Act

And resulting impending cuts to Medicare.

Per CBO letter released yesterday.

Figure 1: Federal budget balance to GDP, by FY, baseline (blue), and under Tax Cut and Jobs Act (red). Source: CBO.

Defining Crowding Out in an Open Economy

Gavin Ekins argues that it’s Time to Shoulder Aside “Crowding Out” As an Excuse Not to Do Tax Reform. From the introduction:

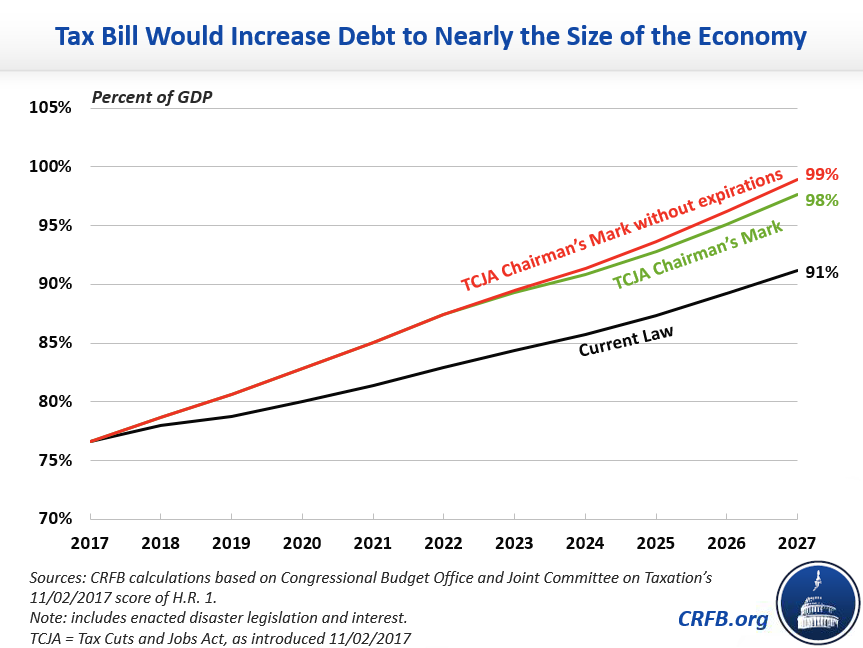

Federal Debt under the Tax Cut and Jobs Act

It (the debt picture under the Tax Cut and Jobs Act, H.R.1) is not pretty, especially after taking into account the accounting gimmicks (that change the “reported” number but not the actual numbers).

Source: Committee for a Responsible Federal Budget (Nov. 3, 2017).

Note that plausible dynamic scoring is unlikely to change the trajectory of debt-to-GDP substantially.

So Much For Fiscal Probity

The budget will allow Republicans to pass a tax overhaul that adds up to $1.5 trillion to the deficit through a process known as reconciliation, which only requires 51 votes to pass in the Senate.

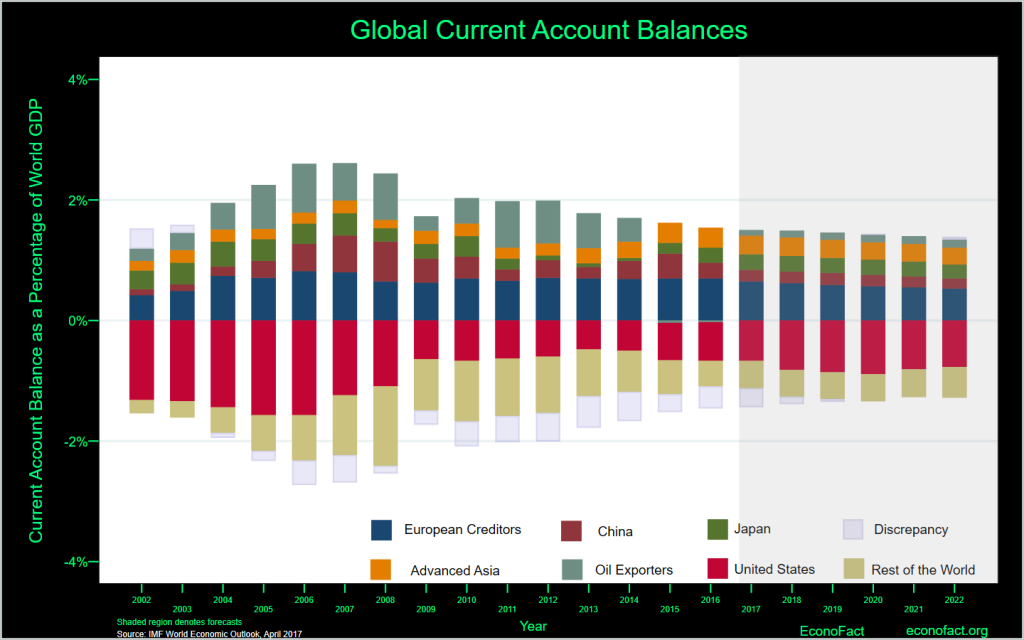

EconoFact: “Are Global Imbalances a Source of Concern?”

That’s the title of a new EconoFact piece. Here is the key depiction of some key current account balances, past and (possibly) future.

Return of the Tooth Fairies

(as referenced by Larry Summers, quoted in this post).

As I watched Secretary Mnuchin on Meet the Press (before discussing his taxpayer funded trip to view the recent eclipse) state :

…the president is not going to sign something that he believes is going to increase the deficit.

I was struck by an overwhelming sense of déjà vu. Of course, the caveat “he believes” is important. Mnuchin mentions “dynamic scoring”, but most economists agree that it is not plausible that the tax cuts as currently sketched out would lead to a revenue neutral outcome.

Asymmetries in Fiscal Policy, Again

One of the most interesting papers presented at the Jackson Hole conference was written by Alan Auerbach and Yuriy Gorodnichenko, entitled Fiscal Stimulus and Fiscal Sustainability.

So You Want to Fix the Trade Deficit?

Well, I don’t think a few tariffs and quotas, plus “tweaking” Nafta, are going to do it. And blowing a hole in the Federal deficit ain’t likely to help.