Literally.

Category Archives: exchange rates

Elections and Asset Prices

One interesting correlation, as pointed out by Clines in the NYT, is between the Mexican peso’s value against the USD and the probability that Donald J. Trump will win, as judged by the markets.

The Dollar, Tradables, and Monetary Policy

One argument for tightening monetary policy is derived from the argument the Fed needs to raise rates to close a “confidence gap”. Instead of psycho-analyzing the markets, I think it better to focus on data.

“Exchange Rate Prediction Redux: New Models, New Data, New Currencies”

That’s the title of a new paper, coauthored with Yin-Wong Cheung, Antonio Garcia Pascual, and Yi Zhang.

“Policy Challenges in a Diverging Global Economy”

That’s the title of the volume of proceedings of the 2015 Asia Economic Policy Conference, edited Reuven Glick and Mark M. Spiegel.

Currency Casus Belli?

Is a current undervaluation of the Chinese yuan plausible?

Guest Contribution: “Importer and Exporter Market Share in Exchange Rate Pass-Through”

Today we are pleased to present a guest contribution written by Michael Devereux at the University of British Columbia and Wei Dong and Ben Tomlin at the Bank of Canada. The views expressed below are those of the authors and do not represent those of the Bank of Canada. This post is based on a revised version of this paper.

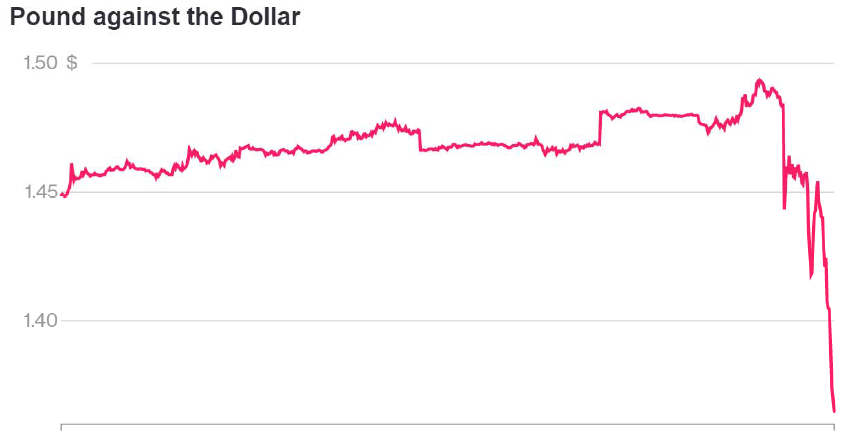

The Pound, 4AM London Time

Guest Contribution: “The Effects of Unconventional and Conventional U.S. Monetary Policy: The Role of Expected Inflation”

Today we are pleased to present a guest contribution by Yi Zhang, Ph.D. candidate at the University of Wisconsin-Madison. This post draws upon this paper.

Currency Misalignment, 2016: FEER vs. Penn Effect

The Peterson Institute for International Economics’ William Cline has just published estimates of equilibrium exchange rates for May 2016; the USD is 7% overvalued, while the Chinese yuan (CNY) is at its “FEER level”.