Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared in Project Syndicate on November 26th.

Category Archives: Federal Reserve

Origins and Challenges of a Strong Dollar

That’s the title of an op-ed appearing in Nikkei newspaper (日本経済新聞):

Corey Lewandowski: “Fed is … a rogue agency”

That’s from a remarkable op-ed in The Hill by Corey Lewandowski. He also writes:

The effectiveness of large-scale asset purchases

That’s the topic of a piece I put up at VoxEU, which draws on my comments at a recent conference at the Brookings Institution.

Guest Contribution: “International Macroeconomics in the wake of the Global Financial Crisis”

Today, we are pleased to present a guest contribution written by Laurent Ferrara (Banque de France), Ignacio Hernando (Banco de España) and Daniela Marconi (Banca d’Italia), summarizing the introductory chapter of their book International Macroeconomics in the wake of the Global Financial Crisis. The views expressed here are those solely of the author and do not reflect those of their respective institutions.

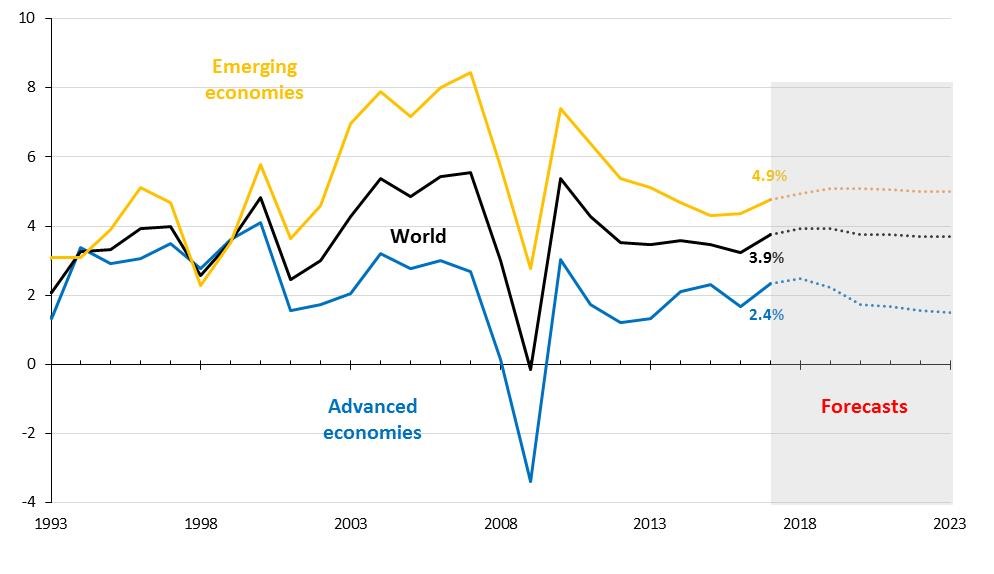

A decade after the eruption of the Global Financial Crisis (GFC), the world economy has finally returned to a more sustained pace of expansion (see Fig. 1).

Figure 1: World GDP annual growth (in %, constant prices). Source: IMF, World Economic Outlook, April 2018 and July 2018 update

Continue reading

Manufacturing Employment and Output

Today’s employment situation release depicted a picture of continuing recovery in the labor market. One interesting aspect is what is happening to the tradables sector, which I proxy with the manufacturing sector. There, the advance data indicate a slight decline.

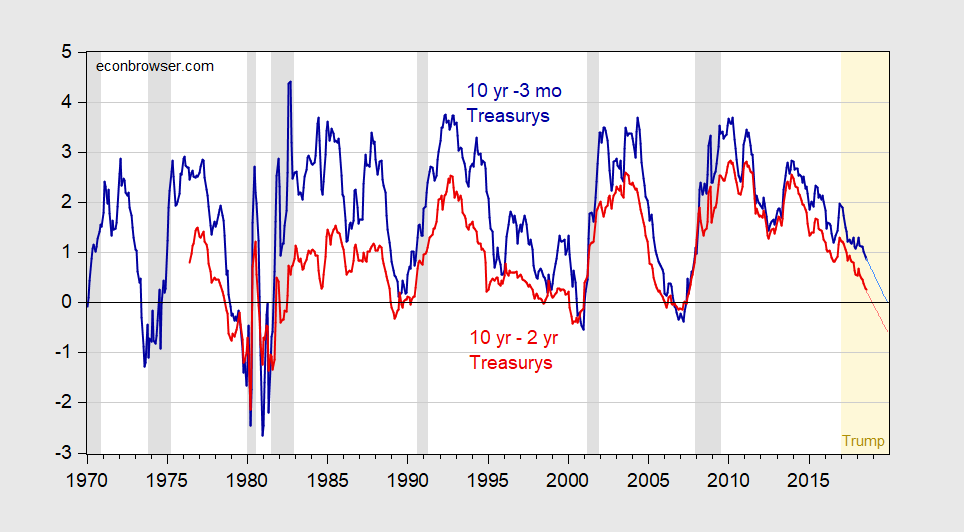

At the Current Pace, the 2-10 Will Invert in December

Holding to the Old Faith

Figure 1: Ten year-3 month Treasury yield spread (bold dark blue), and ten year-two year Treasury yield spread (bold dark red), and projections at current pace using 2017M01-18M08 sample (light blue and pink lines), in percentage points. August 2018 observation through August 27th. NBER defined recession dates shaded gray. Light orange denotes Trump administration. Source: Federal Reserve Board via FRED, Bloomberg, NBER, author’s calculations.

Continue reading

Guest Contribution: “Rising US Real Interest Rates Imply Falling Commodity Prices”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A version appeared earlier on his blog.

Taylor Rule Implied Rate, Trump-Annotated

“I don’t like all of this work that we’re putting into the economy and then I see rates going up.”

and a tweet on Saturday:

Tightening now hurts all that we have done.

Worries about the yield curve

Several people have asked me if the flattening yield curve is a warning of impending weak growth or even a recession. My answer is not yet. Here’s why.

Continue reading