As widely expected, at Wednesday’s FOMC meeting the Federal Reserve dropped its statement that “the Committee judges that it can be patient in beginning to normalize the stance of monetary policy”, the magic formula that many observers had thought would open the way for a hike in interest rates at the Fed’s June meeting. But the yield on a 10-year U.S. Treasury bond dropped 10 basis points immediately following the FOMC release.

Continue reading

Category Archives: Federal Reserve

The Yield Curve and Economic Activity, Again

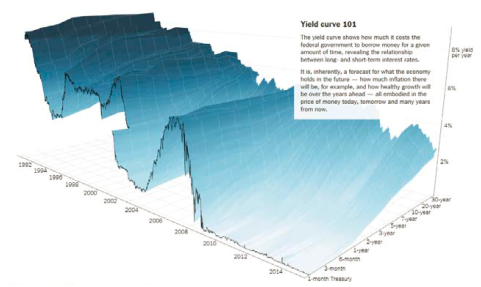

The New York Times has an article in The Upshot today, which shows the yield curve over time in a nifty map. They also show the topography for yields in Germany and Japan.

Some Implications of the Dollar’s Rise

Currency appreciation will be a drag; this implies a policy of slower monetary tightening is in order

What is the new normal for the real interest rate?

The yield on a 10-year Treasury inflation protected security was negative through much of 2012 and 2013, and remains today below 0.25%. Have we entered a new era in which a real rate near zero is the new normal? That’s the subject of a new paper that I just completed with Ethan Harris, head of global economics research at Bank of America Merrill Lynch, Jan Hatzius chief economist of Goldman Sachs, and Kenneth West professor of economics at the University of Wisconsin, which we presented at the U.S. Monetary Policy Forum annual conference in New York on Friday.

Continue reading

Audit the Fed

Senator Rand Paul (R-KY) has gathered significant bipartisan support for the Federal Reserve Transparency Act of 2015, his proposal for more audits of the Fed. I’ve been trying to understand why any sensible person would think this is a good idea.

Continue reading

Switzerland drops its currency peg

The Swiss National Bank stunned markets on Thursday with an abrupt decision to abandon its commitment since 2011 to hold the Swiss franc at 1.20 francs/euro, as a result of which the franc appreciated almost 20% within the space of a few minutes.

Do falling oil prices raise the threat of deflation?

The spectacular drop in oil prices means that inflation is going to fall even further below the Fed’s 2% target. Does that raise any new risks for the economy? I say no, and here’s why.

Guest Contribution: “Why Are So Many Commodity Prices Down in the US… Yet Up in Europe?”

Today we are fortunate to have a guest contribution written by Jeffrey Frankel, Harpel Professor of Capital Formation and Growth at Harvard University, and former Member of the Council of Economic Advisers, 1997-99.

Evaluation of quantitative easing

Last week the U.S. Federal Reserve closed a chapter on the experiment with quantitative easing, just as the Bank of Japan opened a new one. Seems like a good time to comment on some of what we’ve learned so far.

The Rising Dollar and Macroeconomic and Policy Prospects

From Buoyant Dollar Recovers Its Luster, Underlining Rebound in U.S. Economy in today’s NY Times:

The United States dollar, after one of its most prolonged weak spells ever, has now re-emerged as the preferred currency for global investors. Across trading desks in New York, London and elsewhere, analysts are rushing to raise their dollar forecasts based on the resurgence in the American economy.