Literally.

Category Archives: financial markets

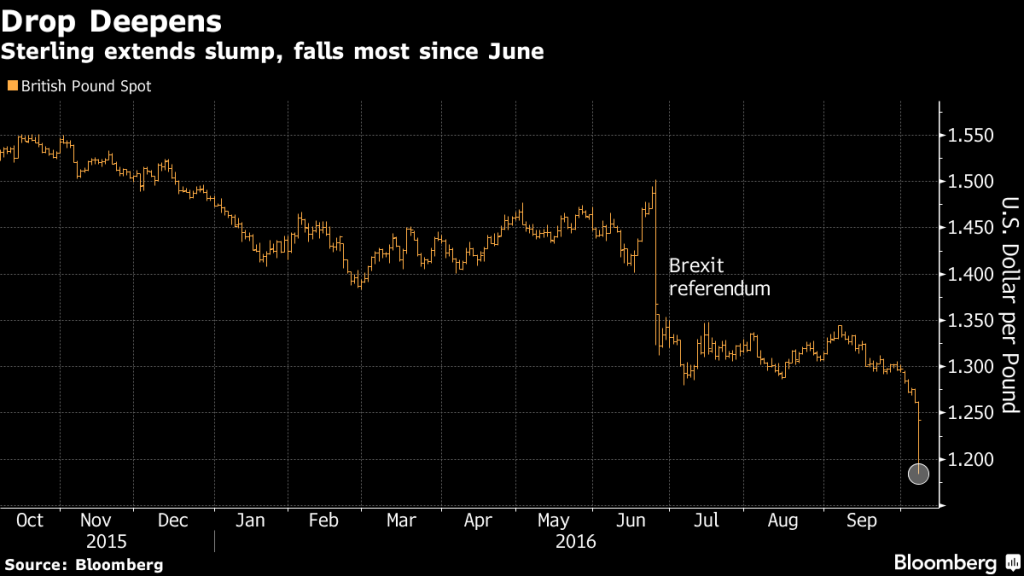

No Kidding: “Hard Brexit has haunted the sterling.”

Ron Alquist brings my attention to this ongoing story:

Source: Bloomberg 10/6/2016.

Term Spreads Today

A couple months ago, we were worrying about a yield curve inversion signalling recession. Now there are anxieties about surging long yields, as — apparently — inflation fears loom. It seems to me a little perspective is necessary.

“Exchange Rate Prediction Redux: New Models, New Data, New Currencies”

That’s the title of a new paper, coauthored with Yin-Wong Cheung, Antonio Garcia Pascual, and Yi Zhang.

Donald J. Trump: “The interest rates are kept down by President Obama.”

The entire quote is here.

“Policy Challenges in a Diverging Global Economy”

That’s the title of the volume of proceedings of the 2015 Asia Economic Policy Conference, edited Reuven Glick and Mark M. Spiegel.

Fed tightening cycles

Last December the Fed began what it thought at the time was a new cycle of tightening. Fed Chair Janet Yellen’s statements last week suggest the Fed still sees this plan as underway. A comparison with historical tightening cycles sheds some light on why so far the Fed hasn’t followed through.

Continue reading

Too systemic to fail

Bryan Kelly at the University of Chicago, Hanno Lustig at Stanford and Stijn van Nieuwerburgh at NYU had an interesting paper in the June issue of American Economic Review that used option prices to measure the magnitude of the implicit U.S. government guarantee of the financial sector during 2007-2009.

Continue reading

“Balance Sheet Effects on Monetary and Financial Spillovers: The East Asian Crisis Plus 20”

That’s the title of a new paper written by me, Joshua Aizenman and Hiro Ito: