Economists’ expectations rise, while household measures trend sideways.

Category Archives: inflation

Market Expectations and the CPI Release

Nominal and real yields rise, as do inflation breakevens, while yield curve flattens.

Alternative Inflation Measures for January 2022

As promised, month on month for CP chained, sticky price (posted 50 min ago), trimmed and PCE deflator.

Inflation in January 2022

Headline and core both surprise on upside, 0.6% m/m vs. 0.5% Bloomberg consensus. You’ll hear lots about “records”, which are accurate, but focus on y/y inflation. Here’s some context:

Guest Contribution: “Inflation, Fed policy and emerging markets”

Today, we are pleased to present a guest contribution by Steven Kamin (AEI), formerly Director of the Division of International Finance at the Federal Reserve Board. The views presented represent those of the authors, and not necessarily those of the institutions the authors are affiliated with.

Inflation: US vs. Euro Area and UK

We hear a lot about how expansionary US policy has led to accelerated inflation. Is that inflation much faster than what occurred in other regions? Consider the US, Euro Area and UK 3 month annualized consumer inflation rates (calculated as log differences).

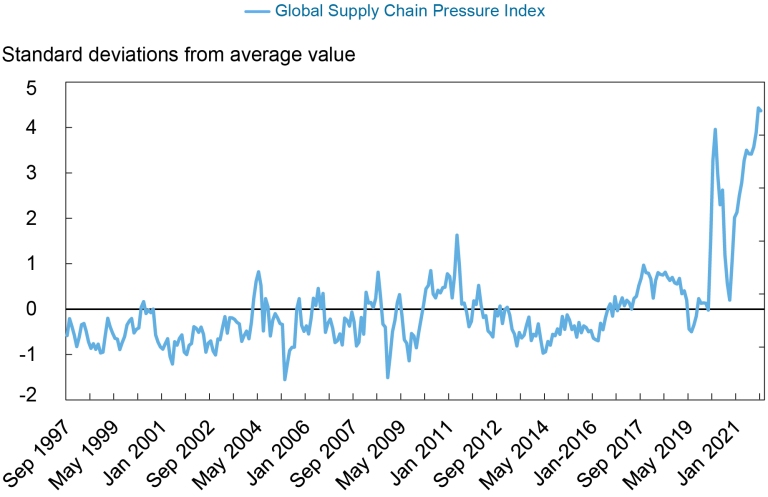

US Inflation and Chinese Imports

One reason why inflation exceeded my estimates from earlier this year is the price of imports. Since 2020M02, goods import prices from China have risen 5.3%, after declining 5.8% over the preceding six years. The dollar depreciated by 9.4% over the same period, implying a exchange rate pass-through coefficient of 0.56.

Market Responses to the CPI: Inflation Breakeven, Term Spread, Dollar

The CPI surprised on the upside by 10 bps relative to Bloomberg consensus (also higher vs. Cleveland Fed nowcasts). How did financial markets respond?

Sectoral Divergences and Real Wages

With yesterday’s employment situation release (discussed in this post), we have data employment by sectors, as well as corresponding average hourly earnings. We don’t have the CPI for that month, but using nowcasts, we can guess what is likely to be happening to real wages.