As of Monday, 12/27, from EIA via FRED:

Category Archives: inflation

Regional Inflation Rates

A recent article (N. Brophy, Appleton Post-Crescent) outlined some of the causes and implications of heightened inflation. The article lays out some of Wisconsin-specific effects. The discussion is somewhat constrained since BLS only reports limited region-specific CPI data, and none limited to Wisconsin, so the author makes some inferences linked to housing prices, energy and wage costs. Nonetheless, there are some interesting regional differences.

More on Market Indicators pre- & post-Manchin

Following up on the previous post on expectations responses from the market to Manchin, Just putting together all the pieces of betting odds on the size of the reconciliation package, and the impact on implied expected inflation, real rates, and future economic activity. I plot on a 7 day frequency so as to include the odds from PredictIt, which do not stay constant over the weekend.

Five Year Expected Inflation Now, Five Years from Now

From the markets:

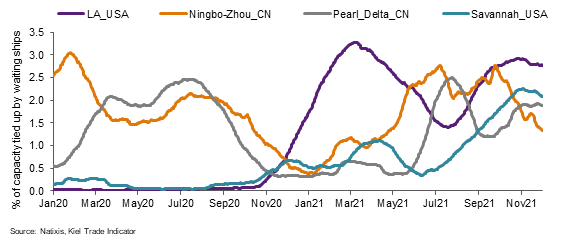

The Ports Tie-Up, Illustrated

A Backgrounder on the Current Inflation Episode

Some CPI Component Movements and Their Implications

Dean Baker has an interesting article conjecturing about future declines in the CPI, being driven by gasoline, cars, and food. The argument seems plausible, depending on what happens in the supply chains and the oil markets. I want to consider what might happen, depending on other components.

Inflation Expectations

Before and after the November CPI release.

CPI Inflation in November

Month-on-month down, even if up year-on-year. Trimmed and sticky price inflation (m/m) are also down.