Today, students in my Master’s level Public Affairs course in macroeconomics had the good fortune to receive a guest lecture from Steven Kamin, resident scholar at AEI, formerly Director of the International Finance Division of the Federal Reserve Board (sponsored by UW’s International Division). In his lecture, he covered the centrality of the dollar in the global financial system, monetary “spillovers” of Fed policy to other economies with special reference to the pandemic response, the macro challenges posed by the most recent fiscal relief package, and implications for emerging market economies. The entire lecture is here.

Category Archives: international

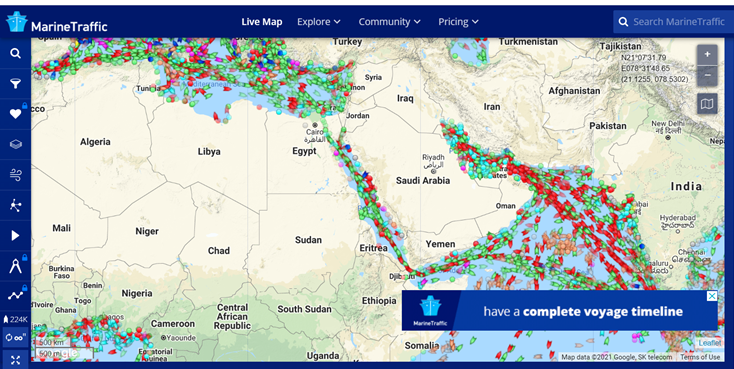

Visualizing the Suez Canal Blockage

From marinetraffic.com (accessed 3/26/21, 8:16pm Central):

Some additional details: S&P Global/Platts, WSJ, NikkeiAsia.

Macroeconomic Competitiveness

Competitiveness is often appealed to in popular discourse, but seldom defined. In macroeconomics, competitiveness is usually interpreted as cost competitiveness. Chinn and Johnston (JPAM, 1994) discuss the topic at length. Here is the OECD’s measure of cost competitiveness since 1999, along with the Fed’s CPI deflated measure of the dollar against a broad basket of currencies.

“Is a Dollar Crash Coming?”

That’s the title of a symposium in The International Economy, with Anders Åslund, Scott K.H. Bessent, Lorenzo Bini Smaghi, Jill Carlson, Stephen G. Cecchetti, Menzie D. Chinn, Lorenzo Codogno, Tim Congdon, Marek Dabrowski, Mohamed A. El-Erian, Heiner Flassbeck, Takeshi Fujimaki, Joseph E. Gagnon, James K. Galbraith, James E. Glassman, Michael Hüther, Richard Jerram, Gary N. Kleiman, Anne O. Krueger, Mickey D. Levy, Thomas Mayer, Jim O’Neill, Adam S. Posen, Holger Schmieding, Derek Scissors, Mark Sobel, Makoto Utsumi, and Chen Zhao.

Guest Contribution: “The Impact of COVID-19 on Emerging Financial Markets”

Today, we are pleased to present a guest contribution by Steven Kamin (AEI), formerly Director of the Division of International Finance at the Federal Reserve Board. The views presented represent those of the authors, and not necessarily those of the institutions the authors are affiliated with.

The Strong Dollar Debate, Yet Again

(Somewhat repetitive of a 2007 post…)

“Richard Cooper, cutting-edge economist”

That’s from the title of a Harvard Gazette article today:

Most economists live in the world of theory, using careful calculations to predict the future. But Richard N. Cooper believed theory couldn’t tell the whole story when it came to solving real-world problems, particularly when they involve the whole world — which he amply demonstrated after a global recession in the 1970s.

Guest Contribution: “You don’t miss international cooperation until it’s gone”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared at Project Syndicate .

Trade Deficit Surges During the Recession

The trade balance hit -$63.6 billion (monthly, seasonally adjusted) in July. The trade balance has been deteriorating since the recession began, in contrast to what usually happens — an improvement in the trade balance, as imports decline with a decline in domestic economic activity.

The Net International Investment Position of the US

Since 2016Q4, the Net International Inestment Position of the US has become more negative.