(Somewhat repetitive of a 2007 post…)

Steven Englander of Standard Charter writes several weeks ago (not online):

“From the Treasury’s perspective, the purpose of a strong dollar policy is less a strong dollar itself than to encourage foreigners to lend to the US on favourable terms even when the dollar is under pressure. The success of a strong dollar policy is reflected in the absence of USD risk premium on US assets when the USD is weak. In fact, the preferred asset market outcome is probably for the US to gain an export advantage via a weak dollar without paying a price on the financing side. But to be clear, the negative correlation between the USD and US yields over a period of decades suggests that neither an overtly strong nor an overtly weak USD policy affects borrowing costs significantly”

Is there a link between the interest rate and the currency’s value, in theory or in practice? At this point, it’s important to distinguish between the level of the currency’s value and the rate of change in the currency’s value.

The overshooting model of the exchange rate due to Dornbusch and Frankel says the real interest differential determines the value of the currency (higher relative real interest rates induce a stronger currency), while interest rate parity (a building block of the overshooting model) indicates currency depreciation must equal nominal interest differential, ignoring risk premia. Even if real interest rates only explain a small proportion of exchange rate levels, they are about the only one that works empirically.

Regarding the concern about higher US long term interest rates (short rates discussed here), the question is whether longer term interest rates — which are more relevant to financing costs of the Federal government — do indeed hold to uncovered interest parity. Actually, there’s a second question if the answer to the first is “yes” – that is whether it’s US interest rates or foreign interest rates that move in response to expected depreciation. (On this, I’m not aware of much research, aside from Bruneau and Jondeau (1998). Chinn and Frankel (2006) find a role for US government bond yields on for foreign government bond yields, but not vice versa).

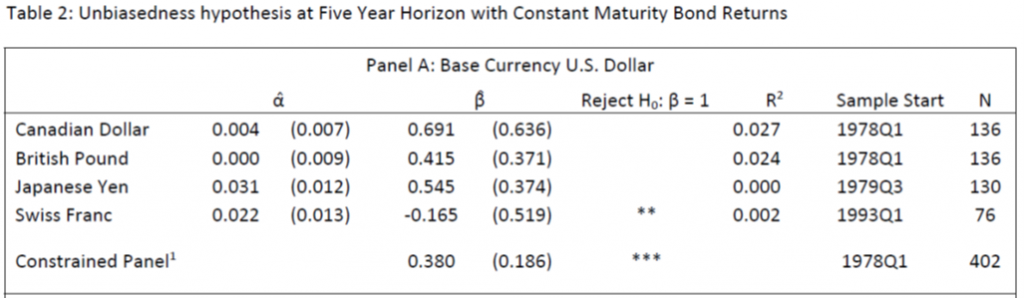

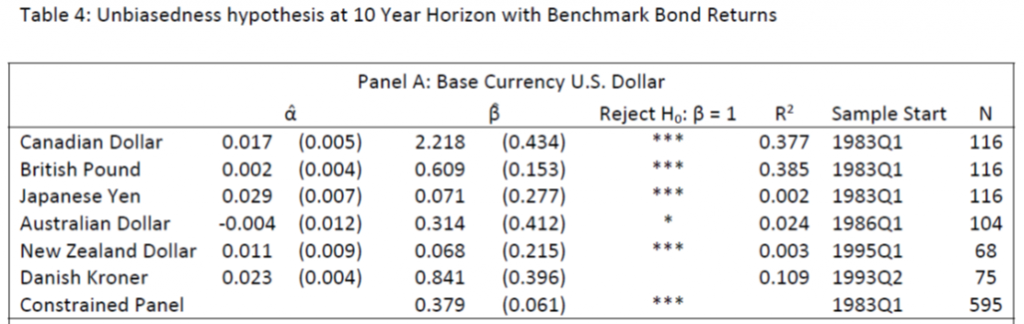

On the first, we have some evidence, from Chinn and Quayyum (2013) following up on Chinn and Meredith (2004). They find that there is some evidence for US based exchange rates that the unbiasedness hypothesis – the joint hypothesis of uncovered interest parity and rational expectations – holds at the 10 year horizon, a bit less clear for 5 year horizon. (Here I’m not taking into account the liquidity premium associated US Treasurys that Engel has demonstrated is important; accounting for them would probably make the unbiasedness hypothesis hold more strongly.)

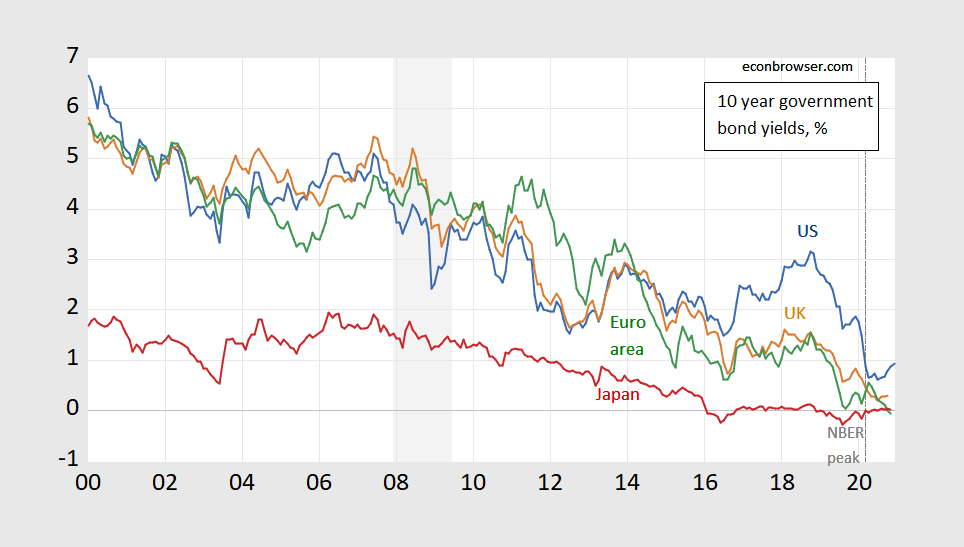

So, there is a tendency for ex post exchange rate changes to compensate for interest differentials at maturities of five to ten years. Of course, there is still the question whether foreign interest rates, US interest rates or both would move in response to increasing expected depreciation (or indeed if expected depreciation moves — a no arbitrage profits conditions doesn’t tell us what causes what…). So, here’s the current configuration of interest rates in some major economies.

Figure 1: Ten year government bond yields for US (blue), UK (brown), Euro area (green) and Japan (red). NBER defined recession dates, peak, shaded/dashed gray. Source: FRED, NBER.

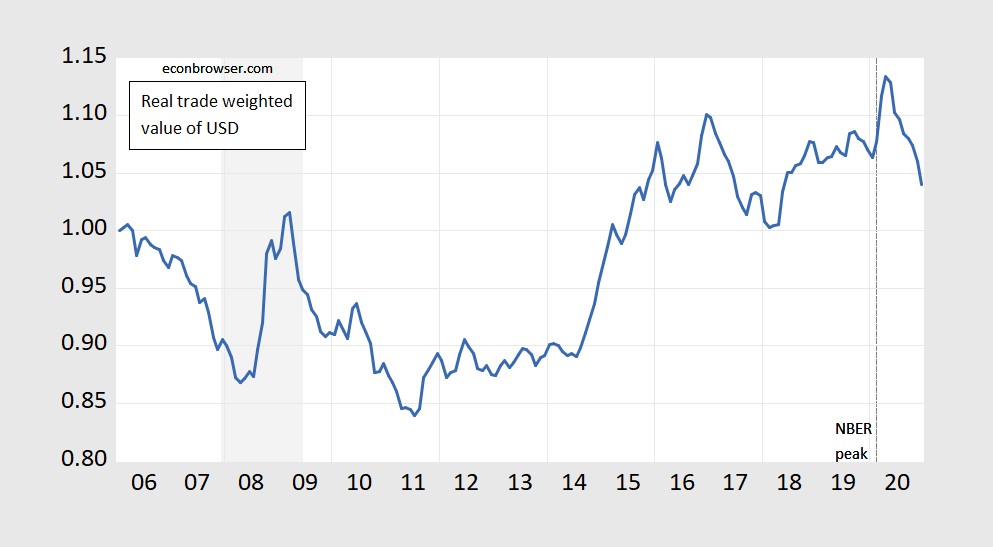

For those of us who believe a weak dollar is desirable on expenditure switching grounds, but don’t want a weakening dollar to induce higher US government financing costs, it’s possible to square the circle by having a discrete dollar depreciation to a long term equilibrium that is associated with no further depreciation. To get there, though, or to get to say 2014 levels will take some more depreciation.

Figure 2: Real value of the US dollar against broad basket of currencies, trade weighted, 2006M01=1. NBER defined recession dates, peak, shaded/dashed gray. Source: FRED, NBER.

https://fred.stlouisfed.org/graph/?g=lv0w

January 15, 2018

Real Broad Effective Exchange Rate for China, United States, India, Japan and Germany, 2007-2020

(Indexed to 2007)

https://fred.stlouisfed.org/graph/?g=yeYT

January 15, 2018

Real Broad Effective Exchange Rate for China, United States, India, Japan and Germany, 1994-2020

(Indexed to 1994)

FRED provides another series on these real broad exchange rates that start in 1973 but stop as of 2019. I’m not sure why this newer series could not continue back to 1973.

pgl: Because they don’t have sufficiently good data on bilateral *services* trade to get the appropriate trade weights for earlier years.

Thanks. I guess I could have checked the footnotes but as always your explanation was clear.

Some observations:

1) The value of the dollar has been historically tied to oil prices, even if the dollar-interest rate correlation is less clear. This makes a lot of sense:

“Crude oil is quoted in U.S. dollars (USD). So, each uptick and downtick in the dollar or in the price of the commodity generates an immediate realignment between the greenback and numerous forex crosses. “ Shouldn’t oil prices be factored into dollar-interest rate analyses and any policy development related to the dollar??

https://www.investopedia.com/articles/forex/092415/oil-currencies-understanding-their-correlation.asp

2) Why is the trade weighted dollar considered a significant measure when it is financial transactions, not trade, that account for almost all dollar forex transactions?

JohnH: (1) Empirically, oil prices have not shown up as empirically relevant in terms of causality going from oil to dollar; at least in the literature I’m aware of. It has shown up as important for certain currencies, e.g., Canadian dollar. On (2), see Primer…, and one example here Lane and Shambaugh (2010).

From your primer:

Several alternative measures of “effective’’ exchange rates are discussed in the context of their theoretical underpinnings and construction. Focusing on contemporary indices and recently developed econometric methods, the empirical characteristics of these differing series are examined for the U.S., the euro area, and several East Asian countries. The issues that confront the applied economist or policymaker in using the measures of real effective exchange rates available are illustrated in several case studies from current interest: (i) evaluating exchange rate misalignment; (ii) testing the Balassa-Samuelson effect; (iii) estimating the price responsiveness of trade flows; and (iv) assessing the potential impact of competitive devaluations.

This is definitely a paper JohnH should read instead of that weird Investopedia rant he linked to.

“ There is strong evidence that oil prices and exchange rates are related over the long-run. There is also a fair amount of evidence for various short-run linkages and spillovers between both markets at daily and monthly frequencies. The inverse causality from US dollar depreciations to increases in the price of oil often materializes at a daily frequency or over a few months.

A fair conclusion is that exchange rate movements are not a silver bullet for understanding or forecasting the price of oil—and vice versa—and neither is a substitute for supply or demand factors. However, each contains potentially useful information for forecasting the other and should be taken into account, particularly over the short-run…”

https://www.eia.gov/workingpapers/pdf/oil_exchangerates_61317.pdf#page27

Naturally this relationship has changed over the years as the US changed from being a net oil importer to an exporter.

Nonetheless, substantial economic theory research has been focused on the interest rates-exchange rate nexus. Meanwhile any effects of oil and commodities prices on exchange rates are routinely disregarded. Certainly, if reduction of fracking could contribute to the depreciation of the dollar via a reduction in oil exports, and an increase of oil prices, it could only help other exports generally and potentially have positive environmental benefits by speeding a decline in carbon usage, adoption of green technology, along with a reduction of environmentally destructive fracking.

“Dutch disease is the apparent causal relationship between the increase in the economic development of a specific sector ….and a decline in other sectors (like the manufacturing sector or agriculture). The putative mechanism is that as revenues increase in the growing sector …, the given nation’s currency becomes stronger (appreciates) compared to currencies of other nations (manifest in an exchange rate). This results in the nation’s other exports becoming more expensive for other countries to buy, and imports becoming cheaper, making those sectors less competitive.”

https://en.wikipedia.org/wiki/Dutch_disease

In the US FIRE is by far the largest sector of the economy, comparable in importance to the oil industry in Venezuela.

Why wouldn’t the finance industry cause a Dutch disease effect on the US economy? (A related data point is the fact that trade in goods represent an almost negligible percentage of forex transactions, overwhelmed by financial transactions.)

JohnH: Most of the forex forecasting literature applies to months/quarters while Dutch Disease is typically along run phenomenon, operating at horizons of years — not unlike Harrod-Balassa-Samuelson.

Agreed. The Dutch disease suggests that a currency can be chronically overvalued, disadvantaging sectors that are not the pre-eminent one.

If this is the condition, policies that produce marginal changes won’t have much effect on the broad range of industries not pre-eminent.

JohnH: One has to be a bit careful about “overvaluation”. Not sure Dutch Disease implies “overvaluation” in some objective sense, but rather normative.

So would it be fair to say that having a pre-eminent sector overvalues the currency for other sectors?

For example, a pre-eminent oil industry results in a currency that is overvalued for manufacturing and agricultural sectors, making them generally uncompetitive internationally? This would seem to be what happens in countries with classic Dutch disease.

Likewise, a pre-eminent financial sector overvalues the currency for traded goods, resulting in a large, persistent trade deficit? That would help explain the need for perpetual government subsidies for the highly efficient US agriculture industry.

JohnH,

Oh dear. Some of the points you are trying to make are not completely ridiculous. But you keep undermining even those with arguments that fall apart or contradict themselves. An unfortunate example is your example about how a “pre-eminent financial sector overvalues the currency for traded goods, resulting in a large persistent trade deficit.”

Oooops! You can argue that financial services are not “traded goods,” but exports of such services, which is what must be going on in order for them to “overvalue the currency” do enter into the trade balance. It may be that the society in question (UK?) might prefer to have more exports of manufactured goods, but having services, or for that matter any good, driving up the value of a currency because of exports of it does not at all lead to a trade deficit. Heck, a lot of those oil exporting nations that suffer from “Dutch disease” have chronic trade surpluses, not chronic trade deficits.

I would grant that over time one should expect that if a nation has a single good or service that is the overwhelming constituent of the nations export, whether it is oil in Rjussia or copper in Chile or peanuts in a West Aftican nation, sudden large changes in the price of that good are likely to be reflected in some changes in the same direction of the value of that nation’s currency. But I also agree with Menzie that strong arguments that commodity price to exchange rate relations do not seem very robust in general, and the non-publication of that paper you cited is a sign of that, quite aside from evidence appearing in other papers, such as the one he cited.

Good grief – someone is 40 years behind the times. I remember Peter Neary and Max Corden discussing their idea back in 1982. The original Dutch disease had to do with the discovery of natural – not your strange oil price volatility. But yea high oil prices did lead to a boom in North Dakota fracking. Funny I do not recall a Dutch disease for the US.

A few years later in Ireland Peter was musing about the UK Big Bang which did attract a lot of people into the financial sector. Now are you telling me all those big shots on Wall Street used to manufacture cars? After all – the US is a lot bigger than the Netherlands and Wall Street is such a tiny little place.

Please take a course in international economics and stop relying exclusively on Wikipedia or Investopedia as there are entire literatures you should read.

Your quoting of Wikipedia on the Dutch Disease clearly has you confused. If you read the seminal Corden-Neary paper, you might note the causal link of high the growing Dutch natural gas sector lead to less manufacturing goes like this. The former sector started attracting workers by bidding up wage. It was an increase in wages that led to less people choosing to work for the manufacturing companies. Now a lot of people like you complain about low real wages which I admit is a policy issue but it is not the kind of thing Corden-Neary was noting about the Netherlands economy some 60 years ago. Again – learn a little economics from a real source and not some bizarre Wikipedia post.

Our host has addressed your 1st really dumb comment so let me address (2). Look if the only thing you care about is Wall Street speculators – whatever. But the relative price of goods is a rather important issue if one works either for the import competing sector or the export sector. I guess it seems JohnH either could care less for workers or he is dumber than I gave him credit for.

Dollar tied to oil? Maybe.

Dollar tied to gold? Maybe.

Dollar tied to any commodity quoted in dollars? What’s the point of this …?

Maybe JohnH is trying to get Judy Shelton on the FED!

Dollar tied to interest rates? Maybe. But other factors provide relevant information on exchange rate dynamics.

Yet it is interest rates that receive almost all of the attention, except from f-x traders? Why?

It seems you do not get his snark. Then again you often babble on topics where you are completely clueless.

Happy snarking! You might enjoy this:

“We find that commodity prices predict exchange rate movements of commodity exporters up to two months ahead when the analysis is based on in-sample panel regressions. Out-of-sample estimations also show that simple linear predictive models based on our commodity price indices tend to have superior predictive performance for exchange rates when compared to random walk benchmarks. These findings hold true for the three advanced economies and eight emerging markets in our sample. They hold for bilateral variations against the US dollar and the Japanese yen, as well as for the nominal effective exchange rate variations.”

https://www.bis.org/publ/work551.pdf

Is I it the case that when your only tool is a hammer, then the solution to every problem has to look like a nail—a change in interest rates?

JohnH: Interesting paper. I do wonder (1) why the paper is not published, and (2) why there aren’t more out-of-sample reservation periods, and (3) why they don’t have more windows, and (4) why they don’t discuss the Chen, Rogoff and Rossi (QJE, 2010). The fact that the paper is not published is suggestive that the results were probably not robust.

Ungated 2010 paper: https://scholar.harvard.edu/files/rogoff/files/125-3-1145.pdf

The year begins with a new trade union in Asia and in Africa, both including China, directly and through the Belt and Road Initiative in Asia and through the BRI in 46 African nations.

As for the forming and opening of the African Continental Free Trade Area (AfCFTA), I consider this a profoundly important development spur and opportunity, a chance for a Namibia to become a Denmark or as Nelson Mandela envisioned a Singapore. An African trade union along with the Belt and Road program that includes 46 African nations, should mean sorely needed infrastructure formation. Look to Ethiopia and find what infrastructure formation is allowing in the way of growth.

Imagine a vast, populous Ethiopia being land-locked, having no rail line to the east coast or rail line to Ghana. Then imagine the trade that becomes possible and necessary with such rail lines. AfCFTA and the BRI could be and should be as developmentally important as the European Union has been.

You already posted this, or something essentially the same, area days ago. In neither case was it germain to the topic.

https://fred.stlouisfed.org/series/TWEXBPA

Real Trade Weighted U.S. Dollar Index: Broad, Goods

The dollar appreciated substantially during Reagan’s 1st term leading to a large trade deficit, which lowered US employment especially in the manufacturing sector.

During Clinton’s 2nd term we had a boom in the internet, telecommunications, and computer sector which again led to a strong dollar. The current account deficit grew and manufacturing employment growth was limited.

But the series I just linked to is considered unimportant from someone who thinks Investopedia is the way to learn about international economics? WTF?

https://fred.stlouisfed.org/graph/?g=xdT5

January 15, 2018

Real Narrow Effective Exchange Rate for United States, 1992-2020

(Indexed to 1992)

https://fred.stlouisfed.org/graph/?g=xcH8

January 15, 2018

Real Narrow Effective Exchange Rate for United States, 1964-2020

(Indexed to 1964)

I’m curious, if the value of the dollar is going down (at least since the dollar’s high, shortly after the NBER peak date), would this assist in increasing the volume of trade between countries outside of the U.S., if we exclude the effects of the global downturn??

Moses Herzog: Yes, although the extent depends on how much the March-April peak was viewed as persistent.

Menzie,

Last time we discussed determinants of long term forex rates you seemed to argue that the fundamental was PPP, which emphasizes the role of trade. Now you seem to be saying that it is the financial side, relative real interest rates. Now in a super duper full blown global general equilibrium, these should lead to the same result. But in the real world we know that they pretty much never do, as I have been aware of for the last half century since I took the grad international sequence at UW-Madison from the late Bob Baldwin.

If indeed, as I am sure is the case, the PPP-implied USD value differs from the relative real interest rate-implied value, then if you are going to hold to your recommendation of making a discrete change of the value of the USD to that long-run equilibrium, which is it? Or do you want to play a game of halfway between the two, if you can even figure out reasonably well what each of them are?

Barkley Rosser: Real interest differentials at short horizons seem to have explanatory power; you can see it happen, i.e. surprise upward movements in nominal rates are associated with currency strengthening in event studies. In regression studies, PPP at longer horizons seems to do best.

Thanks, Menzie, although that still does not answer the question of if you are recommending a discrete change in USD forex rate, do you go for the shorter term financial fundamental or the longer term trade fundamental?

I’m very befuddled at pronouncements like these.

https://www.marketwatch.com/story/feds-bullard-says-inflation-may-be-higher-that-were-used-to-this-year-11610046685?mod=bnbh

What on Earth could Bullard be talking about?? “Inflation”??? Really?? Unless he’s talking about supply side induced inflation I haven’t the faintest idea what he could be talking about?? Unless the man, Bullard, just loves hearing the sound of his own voice or reading his own laughable quotes in print, whose interest does it serve to con the common working man, that inflation is just around the corner?? When I read garbage like this, I think that all the paranoid baloney the Fed Res get from ZH blog, Republican talk radio, and the Ron Pauls of the world is very well earned. If Bullard, et al of the Fed Res want to lie about inflation happening in 2021 then let the talk radio psychos and ZH psychos lie about them. It’s their just due.

Moses,

He may be wrong, but Jim Bullard is probably the smartest person on the FOMC, the only one who was an intellectual match for Yellen when she was there, and has for quite some time led the way in changes of views held in the FOMC. His argument is that growth may be faster than expected and that there are supply blockages, along with some uptick in some interest rates, although some still seem to be reaching new lows, such as mortgage rates. So, he may be wrong about that and the rest of it. But for me the uncertainties are too large to make any solid forecasts. I leave that to you with your dart throwing. Maybe you will prove right and Bullard wrong. But he is not remotely a dummy, not remotely.

From the Harrisonburg dummy….. to another dummy, I’m sure Bullard is touched if he’s reading.

Do you think Bullard knows the difference between GDP and GNP?? Do you think he knows that all of the Fed’s regional banks and BEA’s headline GDP are always SAAR?? If so that’s apparently two things he’s got over you Junior.

I don’t generally “throw darts”. ” Throw darts” implies something totally random. “Educated guestimate” might be a fair description of what I do. If I did “throw darts” I’d run around insulting respected forecasters GDP numbers and then get it 30%+ wrong like the blowhard of Shenandoah Mountains. I didn’t see you give an NFP number (admittedly on the night prior to announcement) that was just 8k over-pessimistic and beat both Goldman’s and the consensus number. My ADP number was closer than the consensus, and my 2nd Quarter GDP missing the mark 2.52% wasn’t terribly shabby either. Were all 3 “just luck”. The gentle reader may decide. I’ll concede luck was a factor, but I also feel not a lot of people could get 3 numbers of the nature that near in vicinity on “luck alone”~~so people can take it for whatever it’s worth. I don’t plan on selling a macro newsletter anytime soon. But I will jump in the deep end of the swimming pool if I feel I have a rough gauge on the depth.

But you are running around right here “insulting respected forecasters.” You may think Jim Bullard is a “dummy,” but he is an extremely respected forecaster. Go read what you wrote. It is far more insulting than anything I wrote when I disagreed with Jeffrey Frankel. I have no doubt that both Jim H. and Menzie have lots of respect for Jim B. as I am sure they are acquainted with at least some of his work, which is very high quality, and I suspect that they both know him also, as do I. although I am not about to try to drag them into this discussion where you are just making an a** of yourself.

Here is a small slice of Barkley Junior’s thoughts about other forecasters and/or colleagues:

“As it is, yes, Frankel is indeed on the list of ‘authorities’ I am challenging regarding these projections of a massive GDP decline in second quarter.”

https://econbrowser.com/archives/2020/06/gdp-nowcasts-june-26th#comment-237929

I like how Junior put quotation marks around the word authorities, referring to a PhD holding colleague, I thought that was a real “touch of class”.

“Moses, As a matter of fact, Krugman did claim credit for something done before him by somebody else, indeed it was half his Nobel Prize, the new economic geography part. He published a paper in 1991 applying the Dixit-Stiglitz model to economic geography/regional economics (Dixit has not received a Nobel). But Masahisa Fujita did it before him in 1988, but in the more obscure journa, [sic] Urban Economics and Regional Science, with Fujita’s English being poor, although his math skills are outstanding, better than Krugman’s by a mile. Fujita was never recognized by Krugman, certainly not in his Nobel speech, although he did later coauthor with him.”

https://econbrowser.com/archives/2020/05/guest-contribution-history-warns-us-how-to-avoid-a-w#comment-236590

Readers may note, Fujita is in fact mentioned on page 342 in the verbatim copy of Krugman’s Nobel Speech (the speech isn’t that long, that’s how the pages are marked in the Nobel PDF (as were Dixit-Stiglitz mentioned by Krugman in his Nobel Speech on page 338). So this is easily verifiable and one of many lies Barkley Junior has told here:

https://www.nobelprize.org/uploads/2018/06/krugman_lecture.pdf

From commenter “AS” June 26th:

“Hi Moses,

As I recall, Barkley was the first and perhaps the only economist to say that we may have a positive 2020Q2 GDP, so I was trying to give credit to his comments which are far different from what the average of the forecasts by the various NowCasts.”

https://econbrowser.com/archives/2020/06/imf-world-economic-outlook-june-update-forecast#comment-237756

Notice this following quote I link, Barkley Junior recognizes the headline GDP number is annualized. This is before he would later claim he “didn’t know” headline GDP was annualized after he got caught with his pants down on a horrible 2nd Quarter forecast number around July 31. So here, he was basically dissing all the other regional banks Nowcasts and GDP numbers:

“I do not know what that becomes annualized, but it is certainly not as negattive [sic] as a -20% annualized rate. Probably closer to the teen decline projected by the New York Fed on its Nowcast.”

https://econbrowser.com/archives/2020/07/continued-recovery-in-june#comment-237996

“Anything worse than a decline in the high teens ‘must be wrong’.”~~~Right?? It was later shown to be over a 30% decline.

Of course, the above list excludes the time Barkley saw it fitting to lecture a a PhD Professor with way better economic credentials like he was a grade school child on what the definition of black swan is, which of course can “only” be defined in the very singular way Barkley Junior views it~~and no other way~~~because “God” has spoken.

Moses,

I did “challenge” Jeffrey Frankel on a prediction he made. That is not a personal attack like the drivel you spouted above against Jim Bullard I shall not repeat.

Regarding Krugman, I have indeed called him out on failing to cite Masa Fujita, and I was completely right on that matter. He did not and he got a Nobel at least partly for what Fujita beat him to the punch on publishing. This is simply a matter of historical record. However, in pointing this clearly factual matter out, I did not use language on Krugman of the sort you used above on Jim Bullard, who is, again, a very smart guy.

Oh, I see you think that because Krugman mentioned Fujita once in his Nobel Prize speech that gets him off the hook. The problem is that he ignored him earlier, especially when he was running around bragging about having “invented” the new economic geography to a press that just repeated it. Once he got his prize all by himself, well, OK to sort of mention Fujita, although he even there sort of tried to minimize Fujita’s contribution. This was very bad conduct by Krugman and lots of people know it. If you want to defend this, then you are just a creeep. This was awful conduct by Krugman, and I have definitely been on the public record saying so.

For that matter I never suggested that either Frankel or Krugman were not smart guys. They are clearly both smart and well-informed guys. That people are smart and well-informed does not mean that they are necessarily alwaya right. Heck, Moses, I am a smart and well-informed guy, but I have certainly made mistakes, as you like to repeatedly remind people of here.

Again, you slimy creep, go read what you wrote Bullard. Just totakl slime and without any justification. I do not know if he is right, but he may well be. Again, I am sure both of the people who run this blog take him very seriousl, even if you do not.

BTW, throwing a dart is not totally random. One does usually see the dartboard and try to aim at it.

Moses,

I appreciate that you now accept that you overdid it on dumping on Bullard. I note that last year he was the first at the Fed, I think starting in February, to call that the economy was going to crash very hard as a result of the pandemic, and he pushed the Fed to act quickly to substantially loosen policy, which it did. I suspect you would agree that this was an excellent call on his part, and that it is a good thing that people at the Fed take him pretty seriously. Things could easily have been a lot worse.

On the matter of me and Frankel, I think you are way overstating conflict/disagreement. I have massive respect for him. If you go read Chap. 15 of my 1991 book (still my most heavily cited one) on “Instability and Volatility of Foreign Exchange Rates” you will find me extensively and favorably citing numerous papers by him, many of them with his frequent coauthor, Kenneth Froot, about speculative behavior in the USD forex market. I think they were more on top of that than anybody else. And he has written lots of other important and influential papers and has performed very capably when in policy positions. It is not surprising at all that he is at Harvard, and he was certainly a superb person to serve as Menzie’s major prof.

His post that I commented on essentially assumed a view of black swans that is widely and popularly held, so it was not unreasonable of him to use that terminology in what was basically a popular discussion. Which is why I thought it was appropriate to make it clear that this popular view is not the view of black swans as expounded by Nassim Taleb himself, and on that matter I am simply correct. I do not know if Frankel was aware or not of that when he used the popular but inaccurate view of what they are. But it is the case, near as I can tell, that this is not a topic on which he has professionally published, although he has published on many topics and some not too far off, such as speculation and bubbles in forex markets. I have, quite aside from knowing Taleb well. So I was and remain in a position to comment on the matter knowledgeably. None of us know everything about everything, and he may well have relied upon this popular view of what “black swans” are even as he knew this was not quite what Taleb meant. This is not at all any personal disparagement of him in any way. He is clearly widely knowledgeable and extremely accomplished. Indeed, my view of him is a lot like my stated view here of Richard Cooper, whom he has commented on: I have never met Jeffrey Frankel, but I highly respect both his academic intellectual accomplishments as well as his policy achievements.

Bullard tends to introduce innovation to the FOMC policy regime. If you squint hard at the Fed’s recent announcement of inflation averaging, it looks like Bullard’s inflation regime policy rule from four (?) years ago; once inflation has been above 2% long enough to think the change is persistent (that the inflation regime has shifted), it will be time to raise rates.

Moses Herzog: Dr. Bullard may very well turn out to be wrong, but he is not completely unequipped to comment: https://scholar.google.com/citations?user=CYCwSHcAAAAJ&hl=en&oi=sra

That was an unfair and out of bounds comment on my part as far as Mr. Bullard is concerned, and I regret making it, and I apologize. The statement on inflation is still asinine in my personal opinion. He’s not alone, I noticed El-Erian was making similar comments, who I have a modicum of respect for.

@ Menzie

2 notes here. I don’t think we actually disagree, but I presume you were just wanting me to “tone down” my comments on Bullard, which is fair enough. I “swiped” both of these from another blog, maybe someone here can guess where.

Note 1: Richard Clarida’s public notes on inflation are quite different than Bullard’s.

Note 2: Lael Brainard will be making a public speech on Wednesday. I have made no secret of the fact I am a Lael Brainard fanboy. She is one of the very few people who could make me rethink my thoughts on 2021 inflation. I see it as a complete non-issue. Whether she says she takes 2021 inflation serious on a personal level, in her own mind (not just boilerplate filler “long bond yields indicate blablablabla”) or is semi-fluffing it off would be a big wind shift for me. But Brainard would have to state it pretty vociferously for me to change my thoughts on it, as a nearly zero threat for 2021.

Make up yry. So inflation over 3% is pretty likely, especially as we are seeing peaks now in Covid, likely to fall off rapidly in the spring as these cycles usually do(you can see it in south america right now).

Found on FT Alphaville:

https://www.omfif.org/wp-content/uploads/2020/10/11-Art-collections.pdf

What was the old blog host lingo?? “hat tip” to…..

January 10, 2021

Coronavirus

US

Cases ( 22,917,334)

Deaths ( 383,275)

India

Cases ( 10,467,431)

Deaths ( 151,198)

UK

Cases ( 3,072,349)

Deaths ( 81,431)

France

Cases ( 2,783,256)

Deaths ( 67,750)

Germany

Cases ( 1,929,353)

Deaths ( 41,434)

Mexico

Cases ( 1,524,036)

Deaths ( 133,204)

Canada

Cases ( 660,289)

Deaths ( 16,950)

China

Cases ( 87,433)

Deaths ( 4,634)

January 10, 2021

Coronavirus (Deaths per million)

UK ( 1,196)

US ( 1,154)

France ( 1,037)

Mexico ( 1,027)

Germany ( 494)

Canada ( 447)

India ( 109)

China ( 3)

Notice the ratios of deaths to coronavirus cases are 8.7%, 2.7% and 2.4% for Mexico, the United Kingdom and France respectively.

https://www.brookings.edu/experts/nellie-liang/ <<—–WSJ reporting she has a strong chance of getting a "senior" Treasury post with Biden's team.

No word yet from "Princeton"Kopits on whether or not she is an evil spy. Kopits also has to check her against paint color codes to see if she died if her death certificate counts as real or not. Stay tuned to OANN, it's going to be tight if her skin tone is above or below hexadecimal code A9957B. If below, then she becomes immortal and or non-existent. Cross your fingers and stay tuned for Kopits' updates on OANN.

https://news.cgtn.com/news/2021-01-11/Chinese-mainland-reports-103-new-COVID-19-cases-WXjIehzmsE/index.html

January 11, 2021

Chinese mainland reports 103 new COVID-19 cases

The Chinese mainland on Sunday recorded 103 new COVID-19 cases – 85 of local transmission and 18 from overseas, the National Health Commission said on Monday.

The domestic cases were reported in north and northeast China: 82 in Hebei Province, 2 in Liaoning Province and 1 in Beijing.

Seventy-six new asymptomatic COVID-19 cases were recorded, while 506 asymptomatic patients remain under medical observation. No deaths related to COVID-19 were registered on Sunday, while 18 patients were discharged from hospitals.

The total number of confirmed COVID-19 cases on the Chinese mainland has reached 87,536, and the death toll stands at 4,634.

Chinese mainland new imported cases

https://news.cgtn.com/news/2021-01-11/Chinese-mainland-reports-103-new-COVID-19-cases-WXjIehzmsE/img/8492cde5b2a3472bae14211c45365a97/8492cde5b2a3472bae14211c45365a97.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2021-01-11/Chinese-mainland-reports-103-new-COVID-19-cases-WXjIehzmsE/img/4b2c4799d6ab47f0adac54a61e452cdd/4b2c4799d6ab47f0adac54a61e452cdd.jpeg

[ There has been no coronavirus death on the Chinese mainland since the beginning of last May. Since the beginning of last June there have been only limited community clusters of infections, each of which was an immediate focus of mass testing, contact tracing and quarantine, with each outbreak having been contained. Symptomatic and asymptomatic cases are all contact traced and quarantined.

Imported coronavirus cases are caught at entry points with required testing and immediate quarantine. Cold-chain imported food products are all checked and tracked through distribution. The flow of imported cases to China is low, but has been persistent.

There are now 673 active coronavirus cases in all on the Chinese mainland, 20 of which cases are classed as serious or critical. ]

I think right now, in this “period” or “phase” America is going through it’s very easy to get discouraged and to go into a kind of tunnel vision that feels dark. It’s hard to find things that are “heartening” and maybe give you some faith in humanity. I found listening to these 4 women talk about their experiences covering the U.S. Capitol and the orange abomination’s enflaming of illiterate people living in a non-reality. All 4 of these women are courageous in their own way and to stick it out in a dangerous situation and “not leave their posts” like some of the Capitol police did etc. I think they earned their stripes (if they hadn’t already) and them talking can give Americans some “sustenance” in a space where things are hard to mentally metabolize for lack of a better way to describe it. Just press the play button in the lower left of the video box. You can click either the top one “America Interrupted” or where it says “the day the capitol was attacked”, either one.

https://www.pbs.org/newshour/podcasts/special-series

Interesting to look at both the five-year and ten-year TIPS vs. GS5 and GS10 nominal breakeven rates. The breakeven rates using daily data are 2.07% for the five-year breakeven inflation rate and 2.06% for the ten-year inflation breakeven rate.

https://fred.stlouisfed.org/series/T5YIE/

https://fred.stlouisfed.org/series/T10YIE

What the ending of poverty in China has meant:

http://www.xinhuanet.com/english/2021-01/11/c_139659451.htm

January 11, 2020

People vs. poverty: A Zimbabwean’s experience of rural China

By Albert Mhangami

BEIJING — I am certain I will remember that building for as long as I live. It looked like a fortress, or more like a gem, a bright orange-yellow one, wooden beams neatly spaced underneath a roof of traditional dark grey tiles. Six ruby lanterns sat on golden tassels at its gate, crowning the elegant backdrop of grey and white buildings that had become a cultural trait of Anhui’s architectural landscape.

I am by no means an expert on poverty alleviation, but like many in my field of policy, I found it hard not to become deeply invested when I read the statistics and frameworks of China’s poverty alleviation strategy over the last two decades.

Trillions of yuan in infrastructure alone, hundreds of provincial and municipal experiments, the restructuring of domestic social and economic policy, incalculable hours of debate and dialogue — these numbers, dates, methods and results formed the documents the world had been blown away with; that I had been blown away with.

I would chant them like a prayer when speaking on panels or in everyday conversation. I would count them like beads, speak them out like hopes and dreams as the numbers increased with each passing year.

But as a policy scholar, it’s hard to see these numbers without seeing them as an intangible, distant possibility.

And then one day, those numbers were standing in front of me.

I was doing field research at Tsinghua University, my home and place of learning for two years. I had been sent with a small team of young scholars to Chongqing so that we could see the numbers for ourselves.

It was phenomenal, a feeling so simple yet so difficult to put into words that I left with more questions than I had the time or the language skills to ask.

So, when the university allowed me to join another small team to visit a village in Anhui, I was determined to interact more deeply with these numbers.

Our first stop was a classroom. After some games and laughs had allowed me access to the students’ unconditional openness, I was able to ask them a number of questions.

It started very basically: what they wanted to be when they grew up, what they liked about their school, and so on. But without warning, the team shifted gears and moved to more complex questions.

I was surprised. It’s so easy to forget just how aware children are of the world around them, and it’s equally easy to take for granted how skilled journalists are at asking the right questions.

“Have you noticed any changes in the village?”

I almost couldn’t keep up with them after that. The children covered everything from the physical infrastructure of the entire village to their subsidized meals at school.

Two moments really struck me more than I thought they would. I couldn’t think of the words for medical insurance when a boy with his arm in a sling entered the conversation. With the help of a translator, I tried not to overreact when he detailed how the cost of an injury he had sustained while playing had been shared with the government. He knew shocking amounts of detail and for good reason.

Subsidies and insurance were guardians of the millions of jobs and assets the government had created for the people. A costly and unplanned trip to the hospital anywhere in the world can strip aid, micro-financing, and all sorts of other projects of their roles in poverty alleviation, so this little boy’s experience really meant more than he could ever know.

The second moment was when another boy almost floored me when he said, “I want to study abroad.”

I remember talking with a member of the team about this boy’s statement for the entire car journey to our next site.

Poverty is ultimately about options. A child who only five years prior would have seen the provincial capital as a goal was speaking of the international community as a space for his dreams — poverty was truly being alleviated….

Bullard is one of the reasons that many working people consider economists to be their enemies. Bullard has been absolutely wrong every single time, over and over and over, about imminent inflation and his obsession with raising interest rates. He has a pathological bias in judgement toward putting his foot on the neck of wage earners to stamp out non-existent inflation.

And still he is treated with respect for his scholarship by the fraternity.

joseph: I can respect Fama for his contributions to finance and international finance without letting him off the hook when he talks about fiscal policy (which is outside his area of expertise).

Correct me if I have this wrong. Charles Upton co-authored with the great Merton Miller the seminal paper on leasing. I have quoted it many times. But as I understand Upton’s macroeconomics it is died in the wool the kind of New Classical silliness that Franco Modigliani (Miller’s best known co-author) would tear to shreds.

Look I respect financial economics but to be good at macroeconomics requires a wee bit more thinking that the Efficient Markets Theorem.

pgl: Don’t know about the Upton book – must not have been popular at UC Berkeley, UCSC, or UW-Madison…

I agree, one needs more than the EMH to be a good macroeconomist. That’s why I cited Fama as an example. See also Summers’s analogy – financial economists talk about whether different types of ketchup can have different prices, while economists talk about why the price of ketchup relative to everything else is what it is.

I like Summers analogy. Will have to Google and see if I can find the quote in full.

https://krugman.blogs.nytimes.com/2009/07/19/ketchup-and-the-housing-bubble/

Krugman provides a double bonus. He links to Summers ketchup paper AND he has a lot of fun with Fama over the housing market.

The Summers ketchup economics paper:

On Economics and Finance

Lawrence H. Summers

The Journal of Finance

Vol. 40, No. 3, Papers and Proceedings of the Forty-Third Annual Meeting American Finance Association, Dallas, Texas, December 28-30, 1984 (Jul., 1985), pp. 633-635 (3 pages)

Menzie Chinn: “I can respect Fama for his contributions to finance and international finance without letting him off the hook when he talks about fiscal policy (which is outside his area of expertise).”

But you have to admit it’s a bit different when Fama embarrassingly opines on subjects outside his wheelhouse between rounds of golf in Chicago and when Bullard, who self-claims expertise on monetary policy, has control over those very issues affecting people’s lives.

Hey – we should give Fama a break. After all Stephen Moore is running around pretending to be not only an expert on fiscal policy but also someone who is highly qualified to be on the Federal Reserve. That is almost as dumb as some criminal law type (Alan Dershowitz) practicing Constitutional Law since he teaches at HARVARD.

@ pgl

I think commenter Joseph’s argument here is, that Fama has the excuse of ignorance on things outside of his bailiwick. Whereas Bullard does not have that excuse, which actually makes Bullard’s crime worse. If I’m misstating and misrepresenting Joseph’s arguments I hope joseph will correct me.

pgl: Yes, I think that’s it. I’d say that I don’t agree with Bullard’s view, but I don’t think it’s a crazy view. Here’s what I saw in Reuters:

Given massive money supply (not just money base) increase, and the Fed’s new monetary strategy focusing on price level targeting, this seems like a noncrazy viewpoint to me.

joseph,

Like Menzie I am not sure I agree with Bullard right now, but your dissing him as some super hawk suggests you have no idea what you are talking about. Go back to Feb. and March last year, and it was Bullard who before anybody else at the Fed, and pretty much ahead of most other observers as well, called that the economy was going to plunge very hard as a result of the pandemic and pushed hard for the massive loosening of Fed policy that did indeed take place. This is a sign both of his brains and his influence, because indeed the Fed did move hard and fast not too long after Bullard pushed on this. This was the exact opposite of anti-inflationary hawkishness and was an absolutely excellent call. I was wondering at the time when he first came out with this in Feb. if he was not overdoing it, but he was not. He was on the money well ahead of the rest of them.

In this he resembles Yellen, to whom I compared him. She was the first at the Fed to call the housing bubble. He was the first to call how hard the pandemic-induced crash would be. He was right, and this is part of the reason why he is taken very seriously by his fellow policymakers at the Fed.

John B. Taylor is just as guilty on these absurd predictions. And at one time – he was a highly regarded macroeconomist. I guess he drank too much Bush43 Kool Aid.

You are seriously wrong here, joseph. You do not know what you are talking about. It was Bullard who last year at the Fed was the first to call how hard the economy would plunge due to the pandemic and he was the main force behind the major loosening of Fed policy that was carried out, which in hindsight looks to have been exactly what was called for. He deserves major kudos, not this misguided nonsense coming out of you.

January 10, 2021

Coronavirus

Massachusetts

Cases ( 432,791)

Deaths ( 13,151)

Deaths per million ( 1,908)

————————————

January 10, 2021

Coronavirus

New York

Cases ( 1,167,149)

Deaths ( 39,592)

Deaths per million ( 2,035)

[ We apparently have failing public health systems, and need to understand why. ]

Menzie,

I have a WAG about the drivers of FX rates, based in an analogy with tax rates. Here goes:

The argument that tax rates influence investment, productivity and thus the pace of economic growth makes theoretical sense, by it is obvious that at lower tax rates, the effect of changes in rates should weaken. In fact, it is hard to find any evidence that lowering tax rates generally has led to increased investment or faster growth in the past hal century.

With interest rates low and differentials narrowing, is it not reasonable to expect that the impact of rate differentials on FX rates would also weaken? Liquidity and risk considerations would come to matter more as interest-rate pick-up is reduced.

Of course, that may no make sense when investors are induced to squeeze out every basis long they can in a low-yield market. Still, it’s a testable proposition that rate differentials lose power in a lower rate environment.

“Basis point”

I gotta lay off the midday ouzo.

@ macroduck

I’ve always found (YES an orthodox and widely accepted concept) the idea the high marginal tax rates “disincentivize” work and productivity to be asinine. If a wolf or polar bear has to trot through 6 feet of snow or 12 feet of snow, or hunt longer distances of terrain, is the wolf going to pass on the effort needed to eat 3 seals vs eating 1 seal?? I kind of doubt it. If you look at 1950s America:

https://slate.com/business/2017/08/the-history-of-tax-rates-for-the-rich.html

https://web.stanford.edu/class/polisci120a/immigration/Federal%20Tax%20Brackets.pdf

So if we eliminate progression in technology and efficiency between 1955 and 2020 from the equation, are we saying people work harder in 2020 than they did in 1955 because tax rates are lower?? Other people might buy that one, but it’s a very hard sell for me.

BTW, just because taxes are taking away from private sector investment does not mean they aren’t still going into investment and future productivity. If we look at the years of FDR and LBJ, I can certainly make arguments that the governments investments in future civilian productivity were higher than has ever been achieved by the private sector. Would we have non-violent BLM protests and the amounts of literate African American writers we have today, and a segment of an affluent African Americans now, if not for LBJ’s injections into public education for minorities?? How many Black Americans went to 4-university (think of guys like Susan Rice’s father) because of the GI Bill??? Very few ever stop to ask that question. I doubt General Motors, Coca-Cola, and IBM were much interested in it at the time.

* I meant to type 4 -year university in the 2nd to last sentence.

January 11, 2021

Coronavirus

Israel

Cases ( 499,362)

Deaths ( 3,695)

Deaths per million ( 402)

———————————–

July 4, 2020

Coronavirus

Israel

Cases ( 29,170)

Deaths ( 330)

Deaths per million ( 36)

Having apparently approached a containment of the coronavirus in June, the Israeli government incautiously opened schools and businesses, and the result has been a persistent community infection spread contributing to what are now 499,362 cases in the small country as compared to 87,536 in all through all of mainland China. Israel unfortunately has more than 5 and a half times the number of coronavirus cases in mainland China. Paul Krugman noticed the Israeli “disaster” on September 14 when there were 160,000 coronavirus cases.

“Basis points”