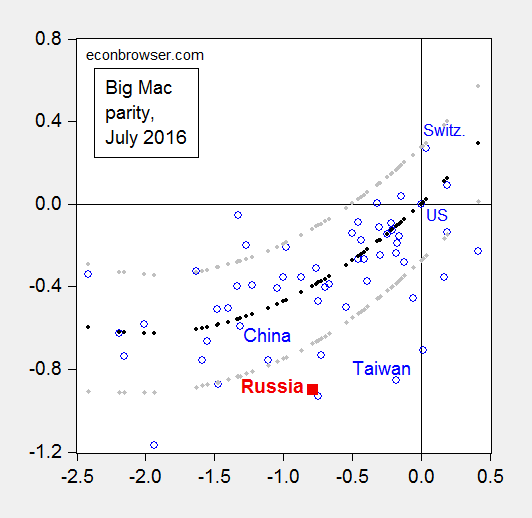

Those are estimated amounts of currency undervaluation, using the Big Mac index and the Penn Effect as of July 2016. Guess which currency is 3.7%, and which currency is 50.2%.

Category Archives: international

Paying for the Wall/Fence: Capital Controls Edition

Can we fund the partly see-through wall by taxing worker remittances?

More on the Trade Deficit and Economic Growth

In an EconoFact post from Saturday, Michael Klein and I noted that usually for the US, the trade deficit grows during times of robust economic growth.

What Explains the Trump Dollar?

Elevated real interest rates and policy uncertainty explain a dollar about 4% higher than election day.

Chinese Forex Reserves Continue Declining

Hard to argue the PBoC is manipulating the yuan to keep it weak, especially as capital controls are being tightened. But who listens to facts any more?

Guest Contribution: “The Impact of Real Exchange Rate Shocks on Manufacturing Workers: An Autopsy from the MORG”

Today we are pleased to present a guest contribution written by Douglas L. Campbell (New Economic School, Moscow) and Lester Lusher (UC Davis).

Guest Contribution: “China’s Growing Influence on Asian Financial Markets”

Today we are pleased to present a guest contribution written by Serkan Arslanalp, senior economist at the IMF. This post is based on the paper by the same title, coauthored with Wei Liao, Shi Piao, and Dulani Seneviratne (all of the IMF).

Trade Policy with China

Since President-elect Trump has nominated Peter Navarro* to direct the newly formed Trade Policy Council, now seems a good time to review some trade data.

Guest Contribution: “Five Key Factors for 2017”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers.

A Big MacParity Guide to Undervalued Currencies

China is not high on the list for “day one sanctions” if one were to look at this fast-food data.

Figure 1: Log relative dollar price of Big Mac against dollar price of US Big Mac (July 2016) versus log relative per capita income in PPP terms (2016 estimates); regression fit from quadratic specification (black dots), and 90% prediction interval (gray dots). Source: Economist, World Bank World Development Indicators, and author’s calculations. Data [XLSX]

Using the methodology outlined in this post, it’s clear that by the price criterion, Russia’s currency is much more undervalued (at 50% in log terms) than China’s.