Well, given the trilemma, and limits to capital control efficacy, it’ll mean more PBoC decumulation of US Treasurys, and holding all else constant, higher long term interest rates.

Category Archives: international

Guest Contribution: “On the Global Financial Market Integration “Swoosh” and the Trilemma”

Today we are pleased to present a guest contribution written by Geert Bekaert (Columbia University) and Arnaud Mehl (ECB). This post is based on the paper by of the same title. The views expressed are those of the authors and do not necessarily reflect those of the ECB or the Eurosystem.

The “Unsustainable” US-Mexico Trade Deficit

From CNNMoney, President Trump:

“With Mexico we have $70 billion in deficit. … It’s unsustainable. … We’re not going to let it happen, can’t let it happen,”

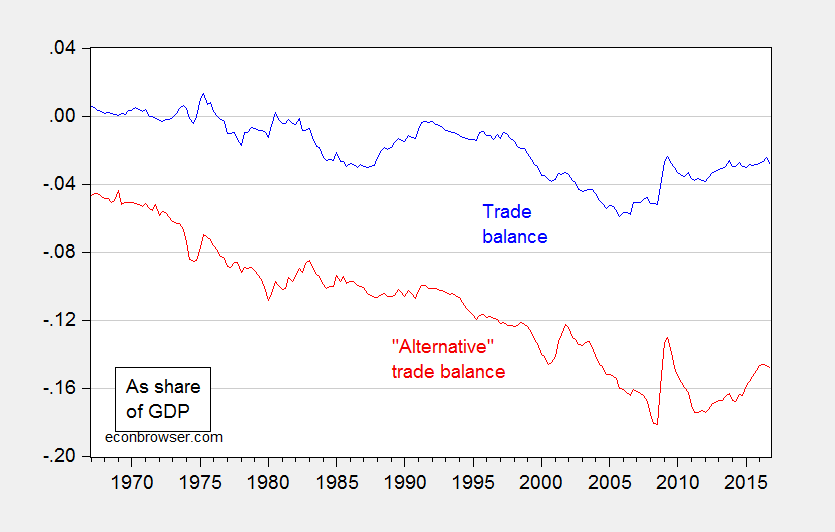

The Trade Deficit Is Nearly 15% of GDP (“Alternatively Defined”)!

If we count only the import side and not the export side of re-exports, as some in the Administration have suggested, we might as well go “whole hog” and redefine the trade balance completely: Let’s count imports, but not exports.

Figure 1: The trade balance defined as net exports/GDP (blue), and the trade balance excluding exports (red). Source: GDP advance release for 2016Q4, and author’s calculations.

Would a Gold Standard Result in Fast Adjustment to Parity?

Judy Shelton argues that “Free trade needs sound money”:

…[T]he time has come to develop a comprehensive approach to international monetary reform compatible with genuine free trade under free-market conditions. If markets are to function properly, money needs to convey accurate price signals; that won’t happen as long as governments can manipulate exchange rates.

A New Approach to Tackling Chinese Currency Manipulation That I Do Not Understand

From Bloomberg:

President Donald Trump’s administration is considering a new tactic to discourage China from undervaluing its currency that falls short of a direct confrontation…

“Who Will Pay for the Wall?”

That’s the title of a new post written by me, on Econofact. Short answer to the question posed: not likely just the Mexicans…

WaPo: Federal agents conduct immigration enforcement raids in at least six states

From the article:

Officials said the raids targeted known criminals, but they also netted some immigrants without criminal records, an apparent departure from similar enforcement waves during the Obama administration. Last month, Trump substantially broadened the scope of who the Department of Homeland Security can target to include those with minor offenses or no convictions at all.

Exchange Rate Prediction Redux

That’s the title of a new European Central Bank working paper (coauthored with Yin-Wong Cheung (City U HK), Antonio Garcia Pascual (Barclay’s), and Yi Zhang (U. Wisc.)) just released.

Paying for the Wall/Fence: Tariff Edition

Tax reform (DBCFT) will not pay for the wall. A remittances tax will not yield sufficient revenues, except perhaps over many years. What about a tariff?