As are all import prices.

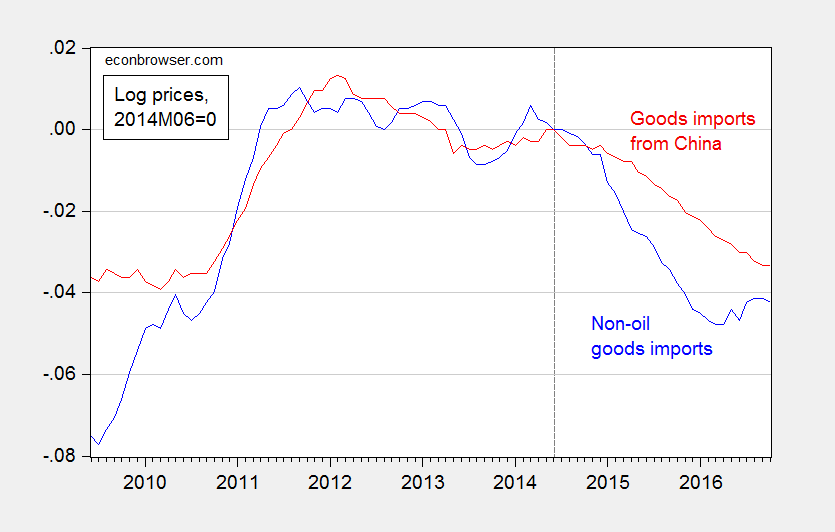

Figure 1: Log import prices of non-petroleum goods (blue), and of goods imports from China (red), all normalized to 2014M06=0. Source: BLS via FRED, author’s calculations.

From NYT:

…around the globe, the surge in the dollar is provoking financial jitters.

Emerging market countries and corporations that have been binging on cheap dollar debt for more than a decade now face a spike in servicing costs and elevated debt burdens.

Some back-of-the-envelope calculations: If we get what President Elect Trump says he wants — no depreciation of the yuan — what happens to the Treasury 10 year-3 month spread?

Via Twitter, yesterday afternoon:

The real return on long-term government bonds has dropped steadily over the last 30 years, falling from values around 4% to something closer to zero or even negative for many countries today. What accounts for this remarkable development, and what are the prospects for this situation to continue?

Continue reading

Today we are pleased to present a guest contribution by Yi Zhang, Ph.D. candidate at the University of Wisconsin-Madison. This post draws upon this paper.

From Donald J. Trump, March 14, 2016:

…under decades of failed leadership, the United States has gone from being the globe’s manufacturing powerhouse — the envy of the world — through a rapid deindustrialization…

Three papers of interest on the effects of U.S. trade policy on manufacturing employment, racial discrimination, and the Chinese real estate boom.

Continue reading

That’s the title of a newly released book written by Eswar Prasad, an authority on the Chinese economy (and international finance).

Today, we are fortunate to present a guest contribution written by Rasmus Fatum, at the University of Alberta. This post is based upon the Dallas Fed working paper by the same title.