The structural, or cyclically adjusted, budget balance has been deteriorating. In accounting terms, what’re the drivers?

Category Archives: taxes

What Did $1.4 Billion Buy in Manufacturing Employment?

Not much…Wisconsin manufacturing employment up to February; January revised down…

Jindal-nomics Illustrated

In response to my graph of Louisiana GDP, Manfred asks:

Continue readingAnd Back in Fiscal-Land

The FY2019 projected deficit balloons, as the estimated “dynamic” effects of the Tax Cuts and Jobs Act prove minor (quelle suprise!)

Continue reading

Political Calculations on Soda Tax Concludes: No Externalities Internalized

Finally, Ironman at Political Calculations understands what an externality is. Instead of this:

If a deadweight loss exists, it represents the amount of economic activity that has been directly lost because of the imposition of the tax, which tells us the degree to which the city’s economy may have shrunk as a result.

Guest Contribution: “An Economic Platform for the Democrats”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. An earlier version appeared in Project Syndicate.

The Reagan Tax Cuts and Defense Buildup: Supply-Side Miracle or Keynesian Stimulus?

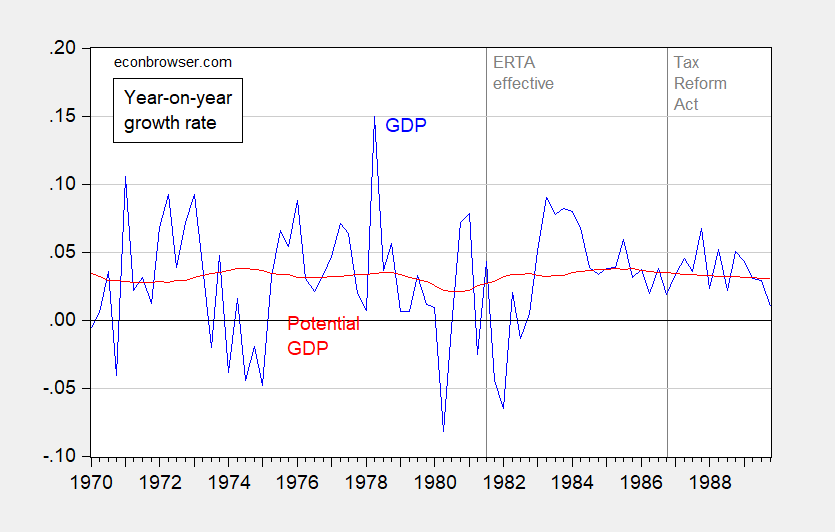

I keep on hearing about the supply-side miracle associated with the the Reagan era tax cuts. What do changes in estimated potential versus actual output suggest?

Figure 1: Year-on-year growth rate of real GDP (blue), and of potential GDP (red), calculated as 4th differences of logged values. Dashed lines at effective dates for Economic Recovery Tax Act of 1981 and Tax Reform Act of 1986. Source: BEA, CBO.

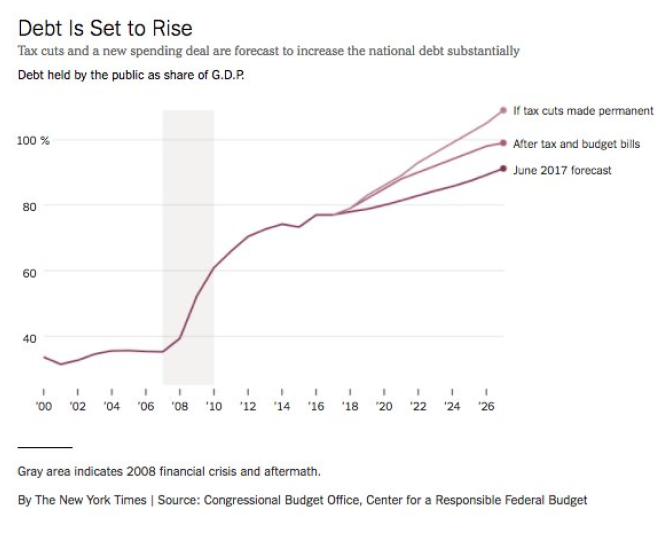

The Cyclically Adjusted Primary Balance Post-Tax Cut/Spending Bill

Not good. From GS Sunday.

And nary a peep from purported conservative deficit hawks and/or Tea Party folk.

Austerity, What’s It Good For?

With apologies to Seinfeld. It seems like a long time ago that conservatives argued for cutting taxes and cutting spending so as to spur expansion — but the Brownback and Walker experiments in Kansas and Wisconsin are in some sense just being completed now, some five years after Governor Brownback’s “shot of adrenaline” forecast.

More on Portfolio Crowding Out in the Context of Normalized Fed Policy

The algebra and graphical analysis (from my undergrad course) is here. If you don’t understand it, don’t bother commenting.

Source: Irwin, NYT, 9 Feb 2018.