Stock, currency and bond markets respond (up, up, yield up) on news of likely Democratic control of the Senate

Category Archives: taxes

Guest Contribution: “How Might Biden’s Anticipated Tax Changes Affect The Market?”

Today, we are pleased to present a guest contribution written by Daniel Soques (University of North Carolina Wilmington). The views presented represent those of the authors alone and do not reflect the views of their respective institutions.

Macroeconomic Policy, Midterm 2 (Nov 18) – Revisiting the Tax Cut & Jobs Act

How would you answer Question 2?

Ma, Rogers, Zhou: “Global Economic and Financial Effects of 21st Century Pandemics and Epidemics”

Addendum, A new paper by Chang Ma, John H. Rogers and Sili Zhou:

We provide perspective on the possible global economic and financial effects from COVID-19 by examining the handful of similar major health crises in the 21st century. We estimate the effects of these disease shock episodes on GDP growth, fiscal policy, expectations, financial markets, and corporate activity. Simple time-series models of GDP growth indicate that real GDP is 2.57 % lower on average across 210 countries in the year of the official declaration of the outbreak and is still 2.96 % below its pre-shock level five years later. The negative effect on GDP is felt less in countries with more aggressive first-year responses in government spending. Consensus forecast data suggests a pessimistic view on real GDP initially that lasts for two months, an effect that is larger for emerging market economies. Stock market responses indicate an immediate negative reaction. Finally, using firm-level data, we find a fall in corporate profitability and employment, and an increase in debt, the last of which is further reflected in higher sovereign CDS spreads.

Addendum, 4/1:

Impact on GDP growth expectations are illustrated in Figure 3:

One interesting (among many) policy relevant findings:

In countries with large responses of government expenditures, real GDP initially falls by 2.68% but the effect dies out in the second year. For the low government expenditure response countries, real GDP initially falls by 2.84%, an effect that is very persistent. Meanwhile, responses in government tax revenues do not make much of a difference.

Wisconsin, Minnesota and US GDP over the Walker Years

State level GDP data for 2019Q3 are out today. If you were wondering, Wisconsin lagged both the US and Minnesota. Since 18Q4 (the last full Walker quarter), Wisconsin growth has matched Minnesota growth.

Guest Contribution: “Six Practical Proposals for Progressive Tax Policy”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared in Project Syndicate December 17th.

Foxconn as Case Study of Targeted Development Subsidy

Or, “Ready, fire, aim”. From Mitchell et al. “The Economics of a Targeted Economic Development Subsidy,” Mercatus Center:

Prebuttal: Fiscal Policy Can Be Effective

In my mind, absent a shooting war, the economy is headed for a slowdown, if not a recession. I am confident that, should the administration or anybody else propose countercyclical fiscal policy, a set of the usual suspects will deny the efficacy of discretionary policy. Hence, a prebuttal is called for.

Of Sugar Highs, Uncertainty, and Recession

Growth is already slated to decelerate, but in the absence of the Tax Cuts and Jobs Act, it might have decelerated even more; on the other hand in the absence of crazy high policy uncertainty, growth might have been faster…

Continue reading

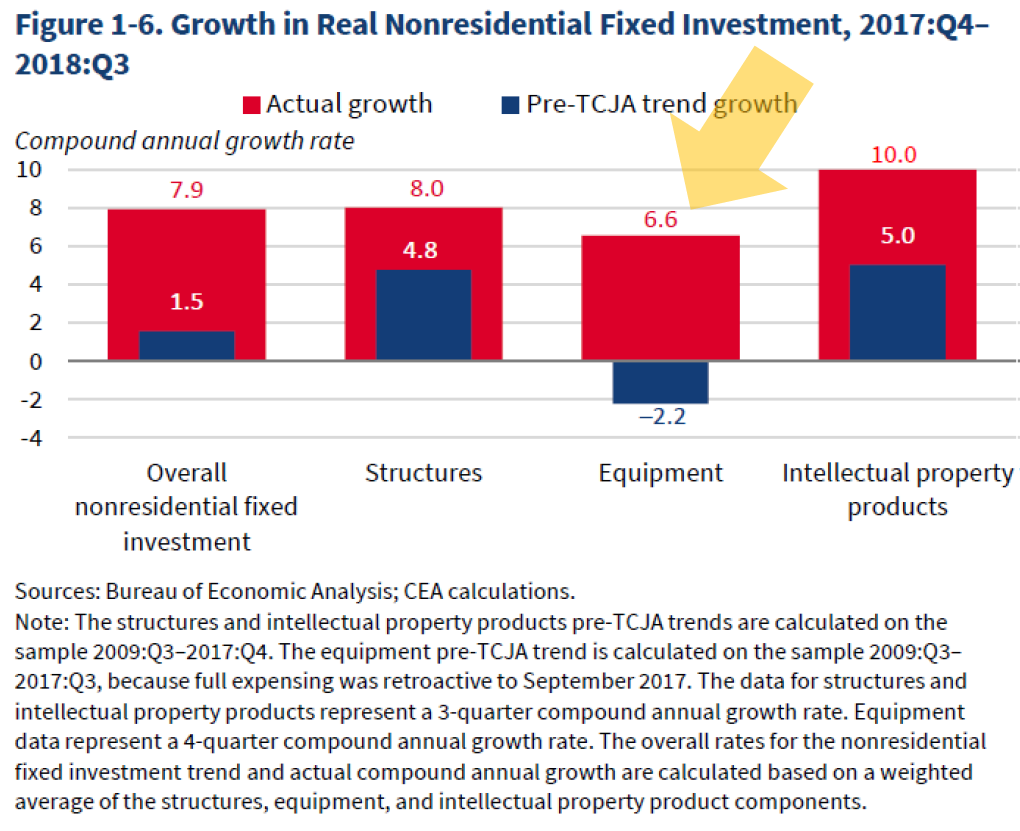

Deciphering Figure 1-6 in the 2019 Economic Report of the President

What the heck? Here’s what the Trump-Hassett CEA reports in February.

Source: ERP, 2019, as edited by MDC (orange arrow).