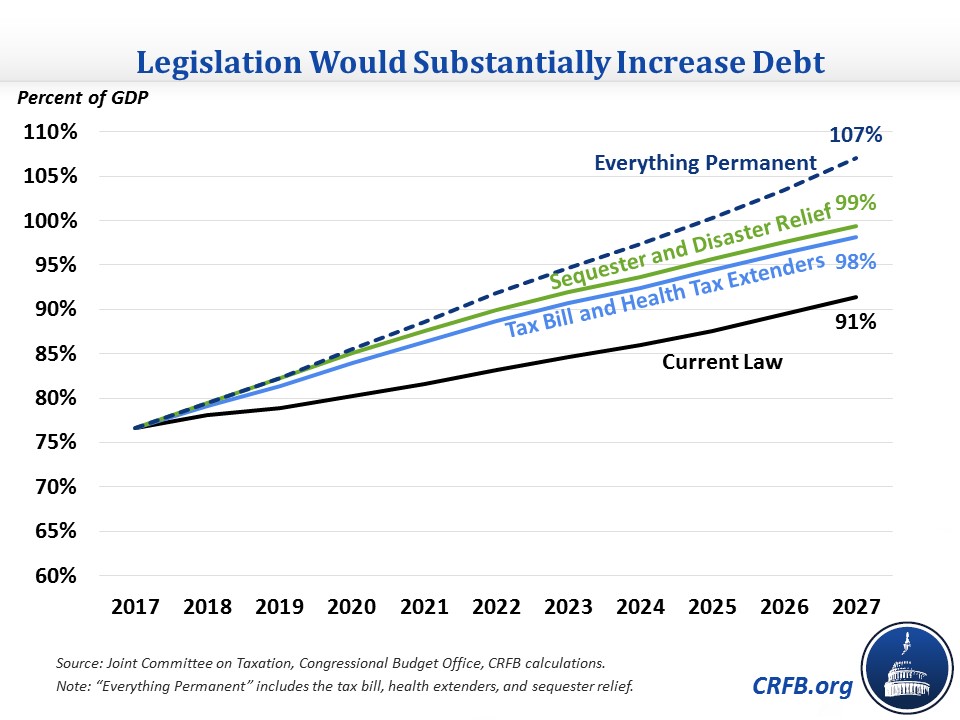

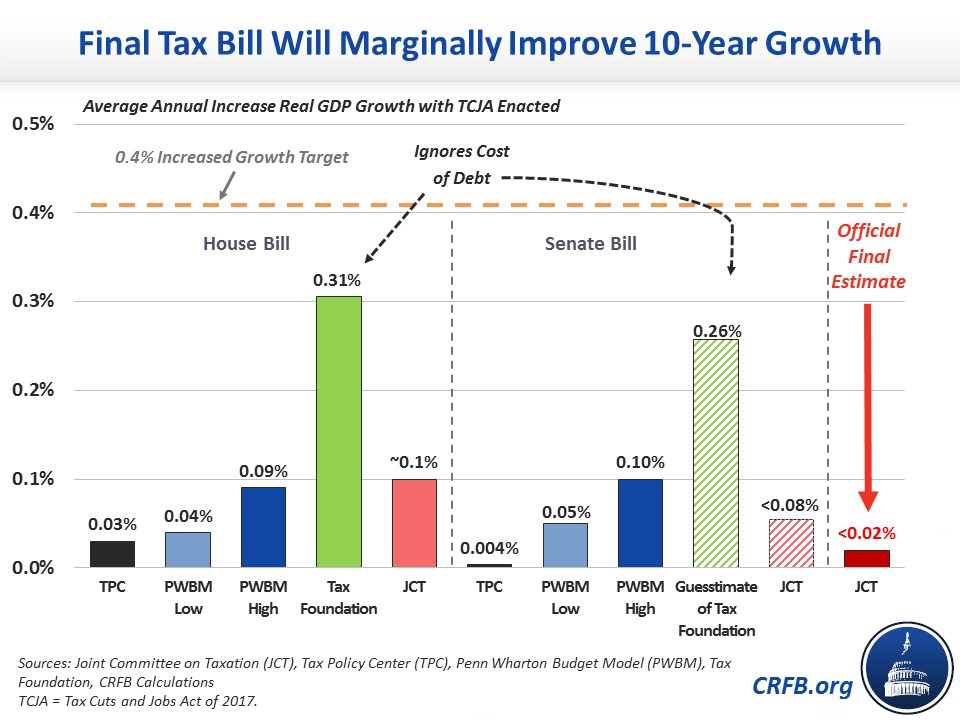

In response to my quote of CRFB’s assertion that average growth acceleration under the Tax Cuts and Jobs Act relative to baseline will be only between 0.01-0.02 percent (shown below),

Source: Committee for a Responsible Federal Budget (Jan. 3, 2018).

Reader Vivian Darkbloom writes:

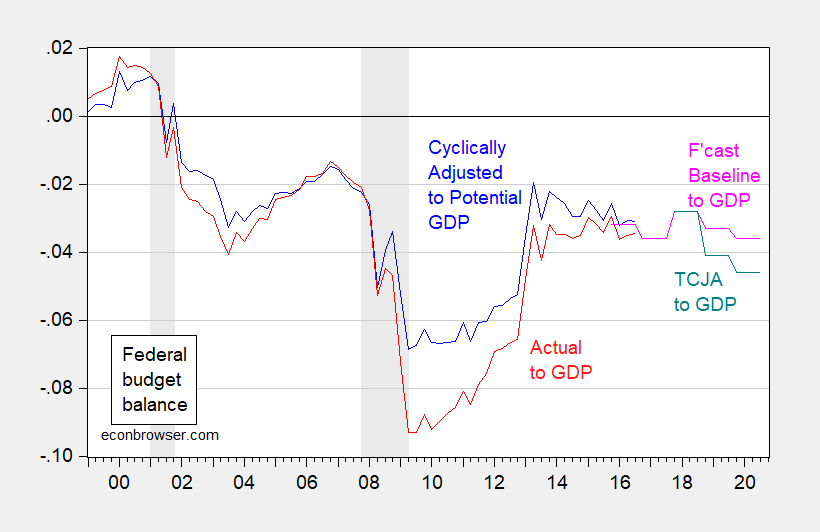

I’m asking myself how an average increase of only 0.01 percent to 0.02 percent in GDP growth over a decade could result in an average of increase in the level of GDP output of 0.7 percent of that same ten-year period as reported by the CFRB and Menzie.

and continues:

Either you need to justify it (and the related text regarding the assertion that it is 1/20th to 1/40th of the McConnell estimate), or retract it.