Forty years ago, I was working for Bob Crandall as an RA at Brookings, on how much the voluntary export restraints (VERs) added to the costs of a typical Japanese imported car. He found that number to be about $820 (a Datsun Stanza was about $6700 in 1981), and a comparable domestically produced car by about $370 (since the VER puts up a wall that allows domestic producers to raise prices). Today, according to Wells Fargo, the 25% tariffs would result in a vehicle assembled in Mexico or Canada to go up in price by $8000-$10000, while the average over all cars using imported parts will go up about $2100 (average car price in March 2024 is about $47000; a Ford F150 STX is about $42000).

Category Archives: Trade Policy

Trump 25% Tariffs: Wisconsinites “to get it good and hard”?

President-elect Trump has mentioned a 25% tariff on Mexico and Canada. Time to think about how this would affect Wisconsin, a state that voted for Mr. Trump.

Further Dollar Appreciation: Implications

What else would one expect from expectations of expanded budget deficits, higher incipient inflation in the context of a Taylor rule reaction function, when the currency is a safe haven asset?

Trade War and Recession?

Former Senator Toomey (Politico):

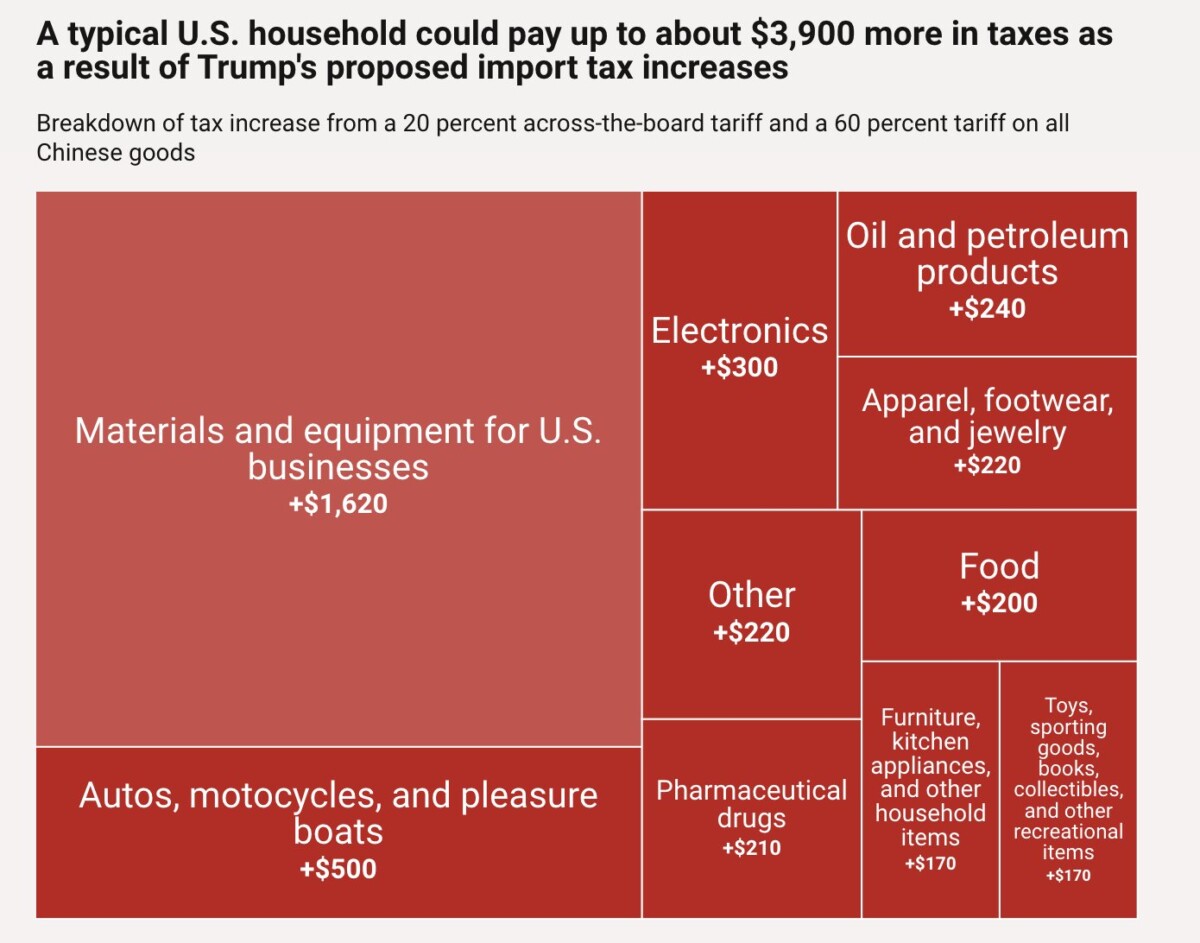

“We have a recession coming. That’s what the response would be from a full-blown trade war that [Trump] would precipitate,” Toomey said, referring to the president-elect’s trade proposals. Those include tariffs of up to 20 percent on all imports, tariffs of at least 60 percent on China and more radical positions such as swapping the income tax with tariffs.

Did the Trade Balance Improve with Tariffs? Did Imports Fall? Did Ag Exports Rise?

Answers: No. No. No.

Some Last Pictures: Trade War 2.0

Farmers of the Nation, Unite! You Have Nothing to Lose but Possible Retaliation against Soybeans and Corn

From the National Corn Growers Association:

U.S. soybeans and corn are prime targets for tariffs. As the top two export commodities for our country, together they account for about one-fourth of total U.S. agricultural export value. As such, a repeated tariff-based approach to addressing trade with China places a target on both U.S. soybeans and corn. Farmers and rural economies pay the price as a result.

“The Economy would grow under Harris. Under Trump, expect higher prices and debt.”

By Menzie Chinn and Mark Copelovitch

A Harris administration is far less likely to disrupt the ongoing and unprecedented American economic recovery of the last three years with stark policy reversals. This is an expanded version of an op-ed published in the Milwaukee Journal Sentinel.

Trump 2.0 Tariffs and Wisconsin

Be prepared. It doesn’t look good for Wisconsin (just like Trump 1.0 didn’t but this time there isn’t $18 billion on tap to bail out the soybean farmers).

Contextualizing the Inflationary Impact of the 10%/60% Trump Tariff Plan

I was trying to think about how to contextualize the impact of the Trump 10%/60% tariffs on inflation. McKibbin-Hogan-Noland (2024) trace out the impact of this measure (as well as mass deportation) on inflation using an updated version of the G-Cubed model. In 2025, they estimate inflation will be 0.6 percentage points above baseline. Goldman-Sachs also come up with similar implied effects (although in their scenario, they only assume a portion of the tariffs are implemented)