EJ Antoni mangles the data:

Category Archives: Uncategorized

Business Cycle Indicators

NBER BCDC indicators and alternatives:

A Levels Perspective on the Employment Situation Release

From today’s release, +133K v +66K Bloomberg consensus on NFP:

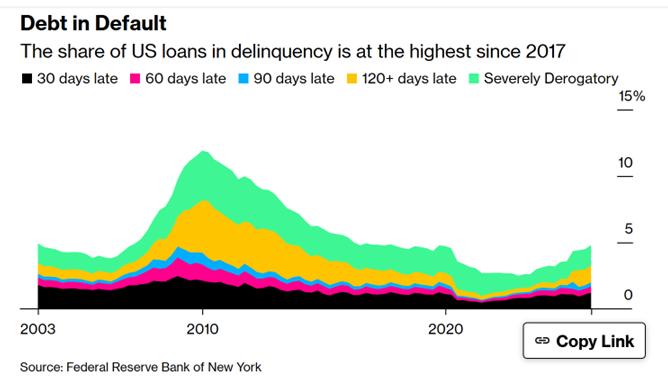

Households under Debt Stress: Two Pictures

Miran: No “…material inflation from tariffs.”

From CNBC:

If at 5pm ET, Trump Starts Posting about “Fake” Employment Numbers, Be Prepared

The White House receives embargoed BLS (and other) releases before the official release at 8:30am. If memory serves (and is still relevant), this is late afternoon the day before. So (if as before), Trump starts posting to get people to ignore the numbers, be prepared for a disappointing release.

Announced Job Layoffs Attributed to AI

In the Challenger, Gray and Christmas report for January is an interesting table, reporting the job losses attributed to each factor.

Is Accelerating Inflation Just around the Corner?

Households say yes (preliminary), while Wall Street economists says no:

0.68%: Truflation Y/Y CPI Inflation Rate as of 8 February 2026

The Cleveland Fed nowcast for February 2026 as of today is 2.34%.

What Could Go Wrong? The AI Asset Price and Investment Boom

Last semester, teaching the Financial System, I laid out three things that worried me: Crypto & stablecoins, private credit, and the AI boom. How’re things looking for the latter?