Case-Shiller indices came out today. August prices for the 20 city index declined m/m, and Zillow’s forecast for the CS 20 city index in September was for another decline. This is shown in Figure 1:

Exactly How Much Does the Mainstream Literature Ignore Demographics?

Reader Steven Kopits writes about the economics profession:

MMT in (Relatively) Plain English

Guest Contribution: “Weaponization of the Dollar May Backfire”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared in Project Syndicate.

Growth Deceleration?

The nowcasts indicate slowdown.

Real Home Prices

Case-Shiller August prices come out next week. For now, we have Zillow prices through September, and Zillow forecast. Here are the CPI deflated prices.

Where Did All the Stimulus Go?

By April 2018, the Tax Cut and Jobs Act and the Bipartisan Budget Act of 2018 had been put into law. The CBO projected a bump in GDP growth, relative to counterfactual. (According to the CBO, the TCJA alone should have pushed output 0.6 percentage points above baseline in 2019.) However, the actual record has been fairly plodding, as shown in the below figure.

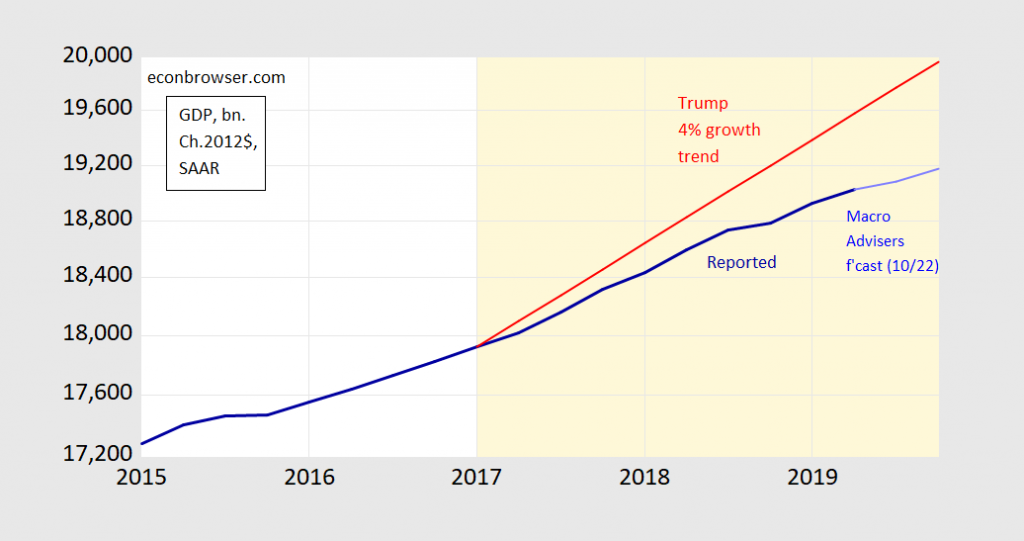

Where’s That 4% Growth Trump Promised (or For That Matter, 5%)?

We have two and a half years of observations on GDP, and a couple quarters of nowcasts, to consider. (And if you’re planning to pull a “Mick Mulvaney” and say Trump never predicted 4% or 5%, see here.)

Figure 1: GDP in bn. Ch.2012$, SAAR (dark bold blue), Macroeconomic Advisers nowcasts (light blue), and 4% trend (red), all on log scale. Light orange shading denotes Trump administration. Source: BEA, 2019Q2 3rd release, Macroeconomic Advisers (10/22), and author’s calculations.

Well, I’ll file this prediction with “The Kurds are happy” and “phoney emoluments” clause.

Presentation: “The Economic Consequences of Trump’s War on Multilateralism”

Here is a link to my October 18th Global Hot Spots talk, sponsored by the Wisconsin Foundation and Alumni Association.

What Does It Mean to Say Futures Contracts Forecast?

Despite repeated explanations, some readers still don’t understand futures contracts and forecasting exercises. One point of Chinn-Coibion (2014) is that at the one year horizon, the best predictor of future soybean prices at a one year horizon is the futures contract expiring one year ahead.