The conventionally reported trade balance (or “net exports”) for the United States from the National Income and Product Accounts (NIPA) is net exports of goods and services, in nominal terms. (There are also trade balance measures on a Census basis and Balance of Payments basis, which differ in coverage and definitions.) The inflation adjusted trade balance is hard to calculate correctly, given the use of chain weighted measures of exports and imports. Here I plot a (Törnqvist) approximation to the real trade balance.

John Bolton on Tariffs on Imports of Chinese Goods

From The Hill:

President Trump’s incoming national security adviser John Bolton said Sunday he hopes impending economic tariffs against China could be “a little shock therapy” for the country.

Guest Contribution: “Can Technology Hurt Productivity?”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. This is an extended version of a column that appeared at Project Syndicate on March 19.

Some Thoughts on the Art of (Trade) War

夫未戰而庙算胜者,得算多也;未戰而庙算不勝者,得算少也。

The general who wins the battle makes many calculations in his temple before the battle is fought. The general who loses makes but few calculations beforehand. — Sun Tzu

Guess which sentence applies to which side in the incipient struggle?

Springtime for Social Scientists, Winter for Markets and Exporters

I’ve got new event study examples for my finance course! Trade policy measures that are evaluated to hurt profitability of major US listed firms have definitive effects on the Dow Jones index.

Figure 1: Dow Jones Industrial Average index. Red bold lines at announcement of impending Section 232 national security based trade restrictions on steel, and Section 301 trade sanctions aimed at China. Source: TradingEconomics.

Continue reading

A Declaration of Trade War on China?

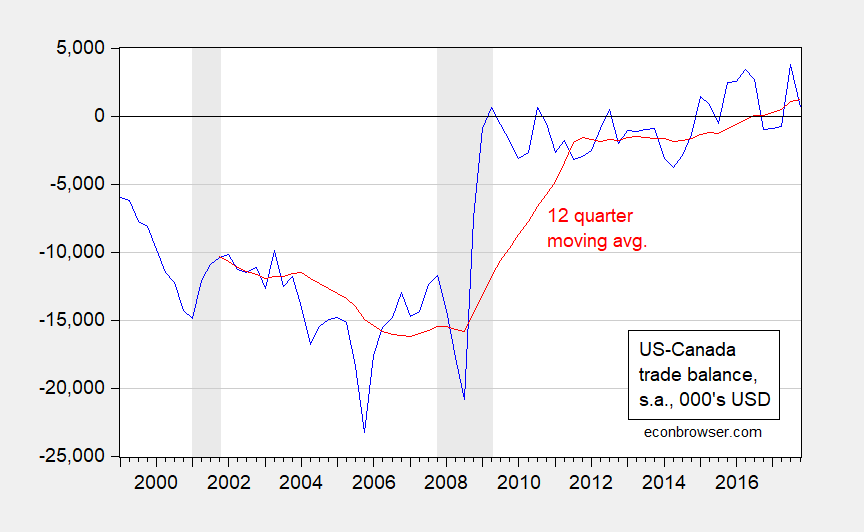

US-Canada Bilateral Trade Balance in Goods and Services at Quarterly Frequency

Is the trend more important than if there is actually a surplus or deficit, as one commenter suggests? On a bilateral basis, I don’t think either is particularly important, but as a matter of fact I think we need to verify that the US-Canada bilateral trade balance in goods and services is (barely) positive in 2017, and trending upward on a quarterly basis.

Figure 1: US-Canada trade balance in 000’s US$, s.a. (blue), and 12 quarter trailing moving average (red). NBER defined recession dates shaded gray. Source: BEA, NBER, author’s calculations.

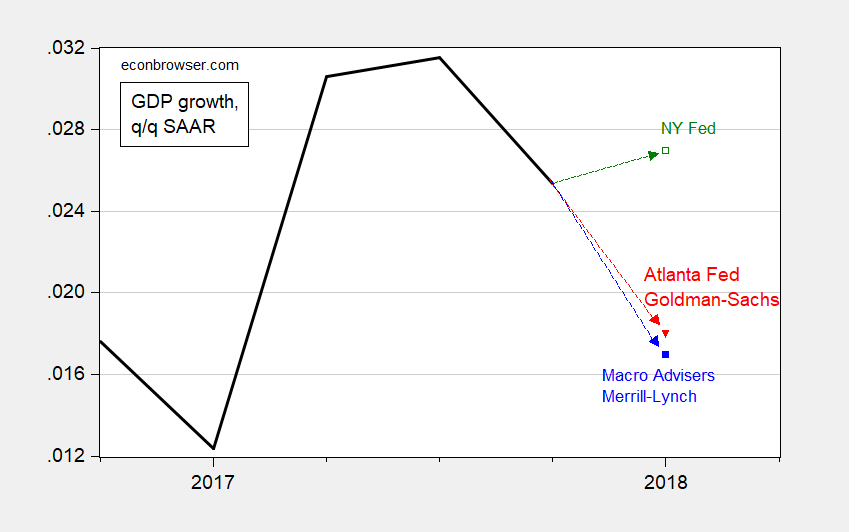

Some GDP Nowcasts

Figure 1: Real GDP growth, actual (bold black), forecast of NY Fed Nowcast 3/16 (green), Atlanta Fed GDPNow 3/16 (red), Goldman-Sachs 3/19 (red), Macroeconomic Advisers 3/16 (blue), Merrill Lynch 3/19 (blue), q/q SAAR. Source: CR, Macro Advisers, Goldman-Sachs.

GDP growth in Q1 has been lower in the past years, few consistent with residual seasonality.

Comparative Employment Growth in California and Wisconsin

Both Governors Brown and Walker are coming to the end of their second terms. Time to appraise how their respective economies have fared, in terms of employment.

Nearly Two Decades of US-Canada Trade Balance Data

There seems to be some confusion regarding the distinction between trade balance in goods and services (a typical macro variable of interest) and trade balance in goods (more commonly reported, but less and less relevant on its own as countries become more service intenstive). In order help remedy this confusion, I plot below freely and easily accessible data, for those willing to expend a few calories to click.