I tire of hearing people who had one (or no) class in economics saying “the magic of the marketplace” will lead to the optimal outcome. What teaching finance has made me realize is that information problems are rife in many economic interactions. And one can’t be a student of currency crises without being even more convinced. The paper by Stijn Claessens and Ayhan Kose, “Macroeconomic Implications of Financial Frictions: A Survey” is a must-read for those who want to keep up with the literature. It has this fantastic schematic:

Views on Fiscal Stimulus Then and Now

Remember when critics wailed about the high cost/per job saved and low multipliers likely under the American Recovery and Reinvestment Act? The same set of people do not seem very bothered at all by the relatively small implied output impact of the TCJA produced by any of the reasonable modelers.

What Constitutes “an Economist”?

What prompted this question was seeing this release from Senator Portman (as well as this tweet) extolling the Tax Cuts and Jobs Act, appealing to the opinion of “137 economist”. Here’s the list:

Leontiev Lives! In Wisconsin

The MacIver Institute has released new projections of the impact of the Tax Cuts and Jobs Act on Wisconsin:

Continue reading

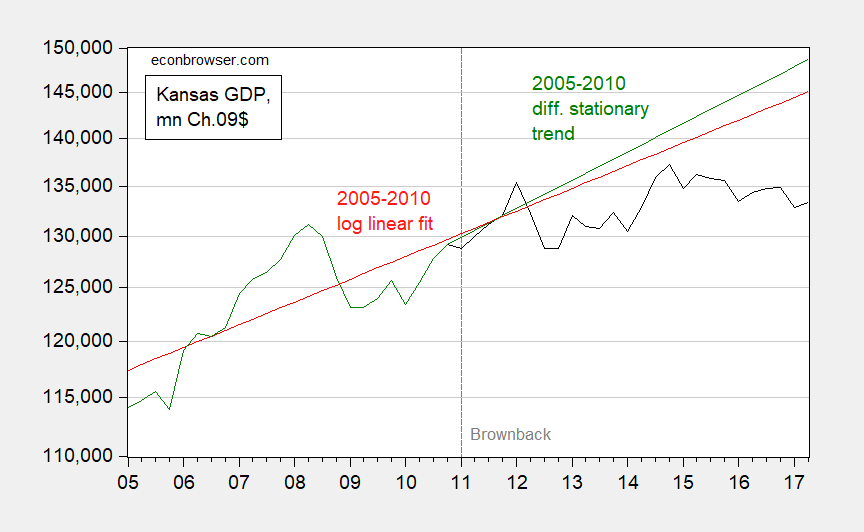

Brownback’s Regime in Long Term Context

It looks even worse than shown in this post.

Term Papers Due this Friday

Kansas and Missouri GDP Trends since Brownback

“Financial Spillovers and Macroprudential Policies”

That’s the title of a new paper by Joshua Aizenman, Hiro Ito and me.

Wisconsin Output since Implementation of the MAC

The Manufacturing and Agriculture Credit, that is.

Continue reading

Wildfires: Acres Burned to Date

Not a record year yet, but still devastating. The upward trend in acres burned is shown below.

Continue reading