That’s what Governor Walker said today about Wisconsin’s economy, quoting from a 1980’s song. This was apparently spurred by DWD’s release “Wisconsin Employment Reaches All-Time High in November”. This statement is true, when referring to the relatively imprecisely measured household survey figures [1]. It is not true when referring the (more precisely measured) establishment series.

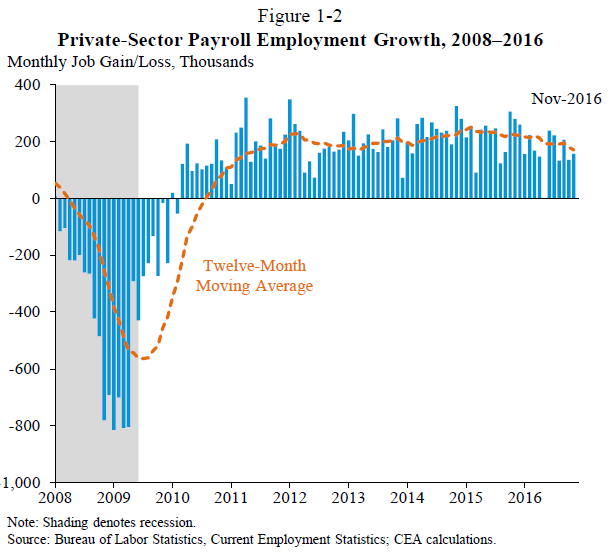

Economic Report of the President, 2017

When Tax Cuts Meet Mass Deportations

As we get more clarity on the nature of fiscal and mass deportation policies under a Trump Administration, it seems useful to consider what happens to the output gap.

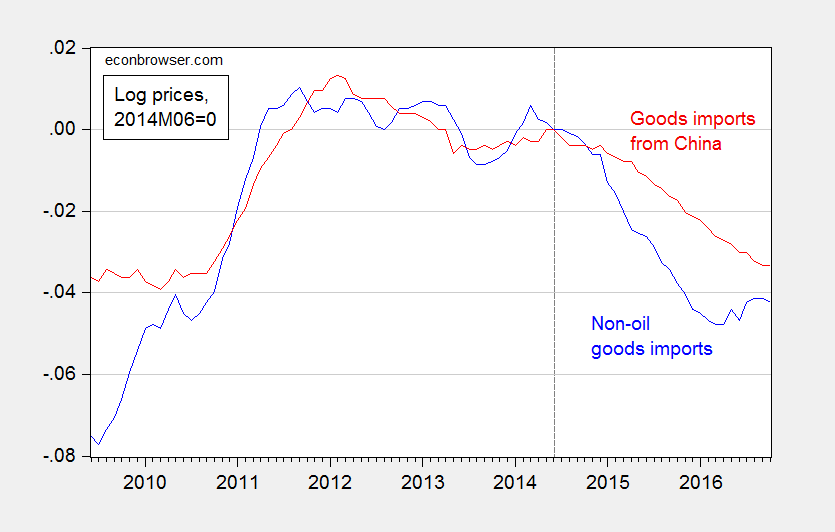

Prices of Imports from China Are Falling

US Financial Conditions and Emerging Market Stress: The Outlook

From NYT:

…around the globe, the surge in the dollar is provoking financial jitters.

Emerging market countries and corporations that have been binging on cheap dollar debt for more than a decade now face a spike in servicing costs and elevated debt burdens.

Wisconsin GDP Trending Sideways

Quarterly state GDP figures for the second quarter were released yesterday. Estimated Wisconsin GDP is flat relative to 2015Q4; 2016Q1 GDP was revised down by 1.7%.

Raise the Yuan! Implications for the Treasury Spread

Some back-of-the-envelope calculations: If we get what President Elect Trump says he wants — no depreciation of the yuan — what happens to the Treasury 10 year-3 month spread?

Guest Contribution: “The Yellen Rules”

Today, we are pleased to present a guest contribution written by Alex Nikolsko-Rzhevskyy, Associate Professor of Economics at Lehigh University, David Papell and Ruxandra Prodan, respectively Professor and Clinical Associate Professor of Economics at the University of Houston.

Manufacturing Employment and Three Episodes of Dollar Appreciation

Mark Thoma comments on the impact of the likely dollar appreciation:

A stronger dollar will make imports cheaper for American consumers…The U.S. economy is now strengthening and approaching full employment, but it’s not quite there yet. So I expect the stronger dollar to have some employment effects, but I don’t expect them to be substantial…

President Elect Trump Hints at Bretton Woods III

Via Twitter, yesterday afternoon: