The two neighboring states of Wisconsin and Minnesota share a similar economic structure and size; and yet their fortunes have diverged over the past three years. One correlate of Wisconsin’s growth deficit is state and local government spending.

First, let’s document Wisconsin’s lagging performance along three dimensions — gross state product, a high frequency indicator of economic activity from the Philadelphia Fed, and nonfarm payroll employment.

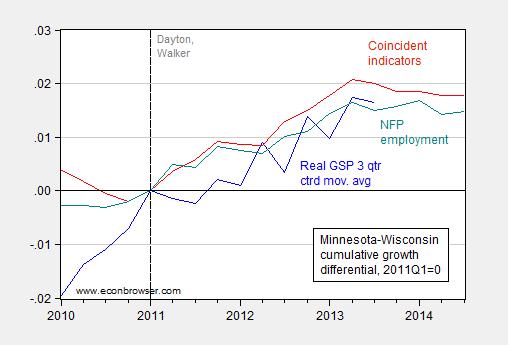

Figure 1: Minnesota-Wisconsin log gross state product cumulative growth differential (3 quarter centered moving average), in Ch.09$ (blue), log coincident indicators (red), and log nonfarm payroll employment (teal), all 2011Q1=0. 2014Q3 observations based on two months. Source: BEA, Philadelphia Fed, FRED, and author’s calculations.

Figure 1 highlights the fact that the growth gap peaked at between 1.6 ppts to 2.1 ppts in the middle of 2013. Interestingly, the gap has only barely diminished since then.

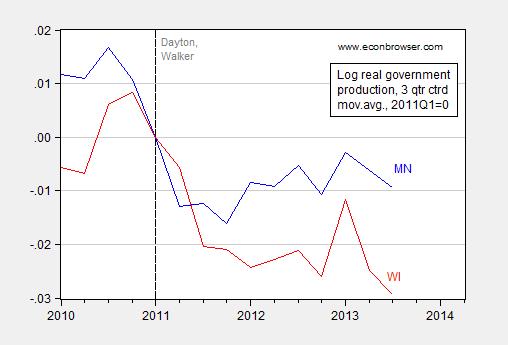

One of the correlates of the Wisconsin lag relative to Minnesota is government spending. Figure 2 illustrates relative cumulative growth in real government spending. Since 2011Q1, Wisconsin’s cumulative real government growth has been 2 percentage points more negative than Minnesota’s.

Figure 2: Log real government spending in Minnesota (3 quarter centered moving average) (blue), and in Wisconsin (red), both in bn. Ch.09$, 2011Q1=0. Source: BEA and author’s calculations.

This data ends in 2013Q4, so it’s not clear what’s happened recently. We can glean some information regarding more recent trends from state and local government employment.

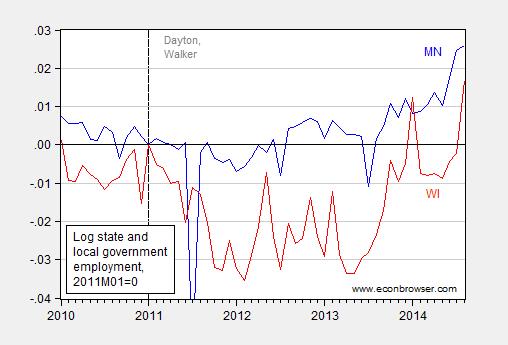

Figure 3: Log state and local employment in Minnesota (blue), and in Wisconsin (red), 2011M01=0. Source: WI DWD, MN DEED, and author’s calculations.

Two observations: (1) as the gap in cumulative government employment growth has closed, the gap in cumulative nonfarm payroll growth has fallen ever so slightly (so too has the private NFP); (2) Wisconsin fiscal policy has become less contractionary in the last year, as state-local employment has risen and the state has embarked on regressive tax cuts [1] [2].

On this last point, I would be tempted to say something about political business cycles, but I will demur. For now, I’ll merely note that lagging Wisconsin performance over the past three years was entirely predictable given standard theory [3] while supply side factors highlighted by Governor Walker were unlikely to have a noticeable effect at that time horizon, if ever.[4] Also entirely predictable, that the Governor’s August 2013 pledge to create 250,000 net new jobs by the end of his first term would not be met, [5] undershooting by over 100,000 according to forecasts from the Walker administration’s own March 2014 Wisconsin Economic Outlook.

“Political business cycles”, ouch! And not just for gubernatorial re-election, also has presidential ambitions…or at least he used to before the current election went south.

But if that is true, then they are tacitly admitting to the effectiveness of stimulus in a demand-constrained economy. Otherwise, tax cuts etc. should have already worked. And if they will do that now to win re-election, why not simply do that in 2011. Why the deep attachment to tax cuts?

The only answer that makes sense to me is that all the deficit scare mongering in 2010 was merely a ruse to gain conservative policy victories against the welfare state.

Oh Lord – after November 4 – please grant Professor Chinn a new obsession. Bass fishing? Lamping deer? Slam poetry? Anything that doesn’t involve WI politics?

Maybe he could take a course in map reading;

http://www.phil.frb.org/research-and-data/regional-economy/indexes/coincident/

Wisconsin and Minnesota are both included in the top performing 11 states, according to Menzie’s preferred source; the Philly Fed.

Patrick R. Sullivan: You do realize that map only pertains to the last three months? That is why for a more useful perspective, which includes levels, I refer to a longer time series (in the graph). Or do you only believe in relying on growth rates? If so, you must prefer to be an Indian with per capita income 1/10 US levels (at PPP terms, even less at market rates), but 5.7% growth rate (y/y), vs US per capita income and 2.6% growth rate.

I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

Patrick R. Sullivan: Apropos “levels”, you might be interested in this map:

http://www.bloomberg.com/infographics/2014-09-30/uneven-jobs-recover-instates-post-recession.html

In addition, I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

Gee Menzie, I can repeat just as often as you, that your fixation with that is still a change of subject away from the one I was addressing; whether or not Scotland had something to fear from using the Pound Sterling if they went independent. I didn’t even have to get a Phd to learn that.

So, again, what was the evidence you had in mind for Scotland’s dangerous liasson.

Patrick R. Sullivan: “liasson”???

The point was that even without a banking crisis, a monetary union without a fiscal union can lead to serious economic crisis. Hence, the issue of output declines is not peripheral, but central, to the issue.

Thus, I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

Government spending cuts, with smaller tax cuts, causing a fiscal surplus won’t stimulate growth.

However, Wisconsin has slow growth old industries and doesn’t seem to be a top destination for Information and Biotech firms.

Moreover, much of the state’s talent may be moving to other states, where there are more opportunities.

Nonetheless, I heard, Wisconsin cheese is doing very well 🙂

The Philadelphia Fed publishes their Coincident Economic Activity Index in level terms indexed to 100 at July 1992. For most of the history of up to 1995, Minnesota and Wisconsin appear to grow at the same rate. Since then, Minnesota has consistently been growing faster. From 1996-2000, this metric shows Minnesota growing 3.7% SAAR and Wisconsin growing 3.2%. From January 2002 to December 2007, Minnesota grew 1.6% SAAR and Wisconsin climbed 1.4% SAAR. And since July 2009, the Philadelphia FRB measure has Minnesota rising 2.7% annualized and Wisconsin up 2.3% annualized. So, what is particularly new here? Minnesota has been doing better than Wisconsin fairly consistently since the mid-1990s.

Neil: First, regarding coincident indices, if you do a diff-in-diffs type analysis, running a regression of log first difference of the coincident index Minnesota/Wisconsin ratio, you will find a dummy variable for 2011M01 onward is always positive; in the regressions I prefer using quantile regression (to take into account the non-normality of the ratio, as indicated by a Jarque-Bera test; and drop last two observations as preliminary), you will find low significance for the positive coefficient dummy, indicating acceleration of Minnesota relative to Wisconsin. The significance at conventional levels is there if using nonfarm payroll employment or private nonfarm payroll employment.

Second, I will also bring your attention to this post which uses real gross state product in Minnesota vs. Wisconsin. A structural break is detected using a n-step ahead recursive residuals test.

Hence, I respectfully disagree with your conclusion there is “nothing new here”. I think there is, and that change occurs roughly around 2011M01 or 2011Q1. You can interpret that break in any fashion you wish, but I think it is there.

Patrick,

Menzie is correct that you must take a longer view of the results to make any determinations of trends (I hope this change of heart is not just convenient statistics.). But that said we have not yet has sufficient time to honestly evaluate economic changes even though Menzie takes a longer view.

Also, Menzie believes that government employment is good for the economy though government employees only consume and do not create wealth. Those who have never started a business do not understand that it takes a number of years for an investment to pay. Most business investments do not turn a profit in the first year and most fail after 2 years so we still need to see what is beyond the horizon.

And as Neil just pointed out, that longer view shows that there’s nothing particularly comforting for the Scott Walkerphobes in the longer view.

Btw, some government employees do ‘create wealth’. I know that because I’ve been a government employee as well as having had government employees as customers of my businesses. The question has to be, for any particular or specific instance, are government employees more efficient creators than other employees. I.e., are USPS employees better at what they do than UPS or Fedex ones. To that, well, even with the Private Express Statutes protecting the USPS’s markets….

Patrick R. Sullivan: I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

ricardo

“But that said we have not yet has sufficient time to honestly evaluate economic changes even though Menzie takes a longer view.”

what is the appropriate length of time? until the results turn your way? just curious at what point should we pass judgement on the performance of wisconsin as it relates to walker’s economic policies? how long should we give him a pass? the simple reality is any politician owns the growth, or lack thereof, after a couple of years-fair or unfair. but that is why a governor gets 4 years rather than 2 years in office. by then his reelection campaign runs off of the success or failure of his own policies.

Many still echo the claim that governors don’t influence their state’s economy (but if that were true how is it that Mississippi remains in last place for nearly everything for decades on end?). I would state, however, that there are state-wide macroeconomic effects from state policies. In Wisconsin the GOP under Walker made the conscious decision to 1) cut income available to those whose marginal propensity to consume was the highest, through the 2012 restrictions on the EITC, the 2012 freezing of the the Homestead Credit, 2012 TANF restrictions, and the 2013 decision to forego Medicaid expansion–all of which siphoned money from the bottom two quintiles; 2) froze pay, instituted deductibles, higher health care premiums, and pension funding that significantly reduced compensation for nearly 300,000 individuals scattered across the length and breath of the state; and finally 3) reduced taxes in such a way that concentrated the benefits to those in the top 5% of Wisconsin taxpayers (whose out-of-state consumption is much higher, and whose MPC is far lower than those hit with benefit reductions, pay freezes, and benefits costs). Combine that with the multiplication effect and is it any wonder that Wisconsin’s recovery is sub-par? It is only compounded by the population out-migration occurring in the North, Southwest and Lakeshore areas, generalized population aging, and the unfortunate morbidity of the state’s legacy industries (don’t believe me? well those are from the Moody’s Reports). So if the GOP’s plan was to make Wisconsin “A Place for Old People”, I guess they’ve succeeded, but my point is that there are state level macroeconomic effects that must be anticipated from state policy decisions. The GOP of the Knowles Brothers, Jack Olsen, and Walt Kohler, was pragmatic conservative (the type of person called a liberal today) who worked to strengthen the state economy enjoyed by the broad masses, it’s a shame their legacy has vanished.

Patrick R. Sullivan,

I’ve got an idea for a game if you are willing to participate. On some upcoming Saturday night, you agree to keep posting on this blog. Your posts should be things like “Warm and fuzzy puppys are so cute,” or “I pray that I’ll see world peace in my lifetime.” Then, if Menzie responds with

“Patrick R. Sullivan: I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

Canada … had a less severe depression than the USA.

And this statement is wrong.”

Upon Menzie’s comment, all participants have to down 1 beer and then post their cumulative beer total.

The last participant who manages to post his cumulative beer total wins. I’ll pledge to donate $100 to either the National Rifle Association, The Heritage Foundation, or to Scott Walker’s campaign. The winner gets to choose which lucky organization gets the funds. Are you in?

Patrick and Rick,

Menzie has his own method of evaluation of whether Canada or the US had the more severe depression during the 1930s and 40s. I am sure Canadian banks don’t feel like they were worse than US banks. Rick I like your idea for the game but I watch football on Saturday nights.

Ricardo: If you don’t want to use GDP to assess economic activity, what measure would you use. I would be happy to consider your alternative. Is it the Ricardo/RicardoZ/DickF/Dick vapours/humours indicator?

Patrick,

Governments do not produce wealth. They consume. Whether it is the USPS or the Space Program the government consumes what others have. The government does not function as a wealth creator but as a wealth consumber. That is not a judgment of government as good or bad, the same could be said of security services but they perform a necessary function. Government has a purpose though it ususally fails in its purpose and to cover for its failure it engages in areas it should not. Two recent incidences give good examples of how disfunctional government is.

Ray Rice obviously committed an assault on camera and should be in jail, but the government did not like the possibility of negative political fallout so they gave him a slap on the hand. But then to cover themselves they attempted to shift the blame for their incompetence to the NFL. Enforcing the law is not the NFL’s responsibility.

The second incident is the beheading of an American worker. The crime was committed by a man with an extensive record and immediately before the incident his work had called the FBI because of his actions and words. I have heard many criticize the company. It was not the company’s job to enforce the law. It was the responsibility of the government and they should enforce the law. But what do they do. They call it workplace violence. It was not workplace violence. It was a crime and it is the responsibility of the government to enforce the law.

The government should not be forcing people to buy substandard health insurance. The government should be protecting the citizens.

“The government should not be forcing people to buy substandard health insurance. ”

the government is not doing this. they are simply keeping substandard health insurance off the market.