No succor from the QCEW series that the Walker Administration previously touted [1]

DWD released QCEW figures for first quarter 2014. Since the QCEW figures are not seasonally adjusted, I have estimated a series consistent with the BLS private nonfarm payroll employment series based on the QCEW data.

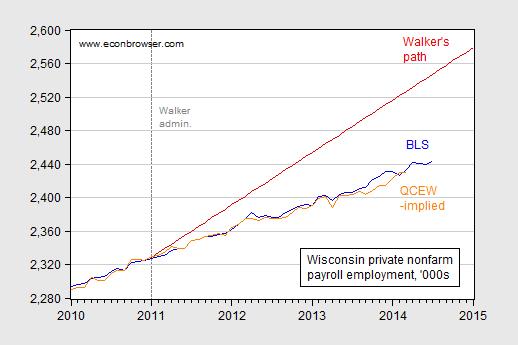

Figure 1: Wisconsin private nonfarm payroll employment (blue), path implied by Governor Walker’s August 2013 pledge (red), and employment implied by QCEW series (orange), all in thousands, seasonally adjusted. Source: BLS, DWD, and author’s calculations.

Figure 1 includes an estimate of the private nonfarm payroll series using the QCEW figures as input. By March 2014, the BLS series and the estimated are close, although the BLS establishment survey was higher for much of the preceding months.

This result confirms Wisconsin’s lackluster employment growth. As noted in this post, in order to hit the January 2015 target laid out by Governor Walker, the Wisconsin economy will need to generate 22.6 thousand net new jobs in each of every month until January. Mean job creation over Governor Walker’s term thus far has been 2.7 thousand per month. This suggests that it is unlikely that the goal will be achieved.

The implied employment level is obtained by regressing the log BLS series on the log QCEW series, along with a constant and monthly seasonal dummies, over the 2001M01-2014M03 sample. The elasticity is 0.96, the adjusted-R2 = 0.99, and SER = 0.0019 (much as in the earlier case, suggesting stability in the relationship).

In other news, “… tax collections were $281 million less than anticipated for the fiscal year that ended in June. That puts the two-year budget on pace to be at a $115 million shortfall by June 30.” In other words, the hit to tax revenues was $81 million more than I assumed in this post. See this for additional information regarding the full enormity of the shortfall.

Meanwhile, attitudes are being readjusted in the land where they take cheese,–as well as Menzie’s prejudices–even more seriously than in Wisconsin ;

http://www.france24.com/en/20140828-france-businesses-hoping-new-thatcher-economy-medef-valls/

————-quote————

The choice to replace Montebourg was telling. The veteran left-wing firebrand has made way for 36-year-old former banker Emmanuel Macron, another move aimed at sending out a clear pro-business message.

Xavier Galezowski, a senior consultant at Ernst and Young, believes the government’s change of heart is a “clear signal that the left is reconsidering the fact that they have to be pragmatic” when it comes to businesses and the economy.

“There is too much ideology,” he says. “French people have had enough of ideology. We just hope it’s not only words.”

Even if the government does follow through on its promises, it may not be enough, Galezowski believes.

“Cutting taxes, for example, is a good sign, but my only worry is that we won’t go fast enough, or far enough.”

“I think that in many ways we are hoping to have someone like Margaret Thatcher in France,” he says, referring to the Britain’s “Iron Lady” Prime Minister famous for her policies of economic deregulation, privatisation and decreasing the power of trade unions.

———–endquote———-

Patrick R. Sullivan: Yeah, and some people in American business wanted Romney. Did they get what they wanted? And maybe France isn’t doing so badly as you’d like to think [1].

In any case, I know in your ADHD-addled statistics-challenged mind, it is hard to stick to a topic, but I was writing about Wisconsin…

Maybe Wisconsin should cutback on its excessive government spending;

http://www.nasbo.org/sites/default/files/State%20Expenditure%20Report%20%28Fiscal%202011-2013%20Data%29.pdf

Wisconsin, according to NASBO, spent $42.3B in 2012, while the Wonderland that is Minnesota only spent $31.3B.

You ignore the population difference. On purpose, of course.

Patrick R. Sullivan: I see you continue your campaign of misinformation. Do you even read the documents you link to, or do you deliberately ignore the documentation. The report notes it covers only state spending, and omits local, and the localities have different responsibilities in different states. Moreover, as Phil notes, Wisconsin has a larger population — 6% larger in 2013. That might be another reason why WI spending is a somewhat higher.

Try again…

A six percent greater population explains the 35% greater spending?

You have to read the report thoroughly rather than look at a single chart. And some is hard to figure, as in the chart Patrick refers to shows MN spending much more from its general fund than WI (by over 40%), and less from federal sources (which are part of total state spending) than WI, but more from “Other State Funds”, which isn’t defined. As in WI, spends $6B less from general funds, spends $2B more from federal funds and a whopping $11+B from “Other”. The note about that isn’t particularly detailed: it means targeted state funds like a gas tax to be used only for roads (or maybe a cigarette tax to be used for x). The note then says, “For Medicaid, other state funds include provider taxes, fees, donations, assessments, and local funds.” Is Medicaid the difference? All I can say is that the money isn’t from income or sales taxes or other broad-based taxes for the general fund. They don’t go through what their accounting is for revenue, mostly because the report is about how spending breaks down.

I wonder if it’s Medicaid because other sources list state spending differently, probably reflecting different accounting treatments. I see, for example, one “official” set of numbers that shows WI’s spending relates quite closely to the population difference.

‘The report notes it covers only state spending, and omits local, and the localities have different responsibilities in different states.’

You might want to give a little more thought to that, Menzie.

The budget shortfall in Wisconsin is actually $472 million for this fiscal year and $1.3 BILLION in the 2015-17 budget. This is based on the 3.5% revenue growth the LFB forecast for FY2015, and using the new (lower) 2014 revenue numbers .

The “$115 million” figure thrown around assumes revenues grow back to the 2015 projected level, but that assumes revenue growth of 5.6% instead of 3.5%

Expenditures are not known, but are likely to be if anything higher, as Medicaid has a major shortfall due to Walker’s dumb decision not to follow the ACA’s expanded Medicaid.

It’s all very Bush-like, don’t ya think?

Jake, you should also know that as the Manufacturer’s and Agricultural credit keeps expanding, more and more tax dodges are being put in place to manipulate income reporting, maximizing manufacturing and agricultural income that will generate higher levels of pass-through credits. I should know, I’ve come up with a few. One involves a standard international tax minimization strategy–transfer pricing. Set up a distributing company either in-state, or to be super safe, out-of-state. Sell the products of your manufacturing company to the separately-organized distribution company at extremely high transfer prices, leading to large profits in the manufacturing firm and losses in the distribution company. Since the choice of a transfer price is a business decision you have to show that the pricing was absolutely out of all bounds (very hard in international transfer pricing) and with the diminished capacity of the Wis DoR after years of budget cuts, the chances are near zero of being challenged. There are several other strategies: LLP holding of real estate with above-market charge-backs; transfer of intangible assets to separate entities, spin-off of administrative/executive functions with charge-backs–all will be at work shifting profits from non-pass through entities to manufacturing and agricultural ones. In fact one of the largest executive management firms in the state exists, of all places, in Eau Claire. I wonder who can that be?

My prediction is that that the state should lose between 12 and 18% of its total income tax revenues over the next three years.

According to this article, Wisconsin’s funded ratio of state pension funds is the highest in the nation. The same article shows that Wisconsin’s change in non-farm employment is typical or better than other Great Lakes manufacturing states while Minnesota is at the lower end of north central states. Once again, what’s the problem with Wisconsin? Well, it could be that expectations of a general regional recovery just didn’t pan out, but Wisconsin has managed its finances well and the overall recovery is middle of the road. Certainly not something that the people in Michigan and Illinois and Ohio can boast.

http://www.aei-ideas.org/2014/08/when-economists-talk-about-mismanaged-us-states-one-gets-special-mention/

Bruce Hall: Do you think the state of WI pension funding is fully determined by policies adopted in the past three years? I don’t think so, given WI pensions were already adequately funded. So Governor Walker decided to embark upon a contractionary fiscal policy (that hit the poorer more than the rich) to top off already healthy pension funds during a period of economic slack. I do wonder about Pethoukas’s use of growth since 2007M12. Shouldn’t we use a longer span of data if we are concerned about structural — as opposed to cyclical — factors?

Well, I agree with you. Certain a base of 2011 is hardly appropriate.

Bruce Hall: But 2011 would be just fine if one wanted to focus in on, say, the pro-cyclical aspects of a particular fiscal policy implemented in 2011. Duh.

There is no doubt that the statistics for Wisconsin could be better since 2011. As it is, Wisconsin appears to be doing so-so in comparison to the rest of the states during that time. For example, Michigan has statistically come roaring back… from the depths of a depression… which is why I referenced the information with a 2007 base which was a more “normal” period. Michigan has done many of the things that Walker implemented, including right-to-work, reduction of taxes, and changes to government spending. Michigan will also implement a reduction in business taxes related to “personal property.” So, why has Michigan done so well since 2011 versus Wisconsin? Two words: automotive industry. That doesn’t mean it is back to 2007 levels as Wisconsin is. It just means the ride on the roller coaster was more severe.

Here’s another look… with 2011 as the base since that seems to be the fixation point: http://host.madison.com/news/local/interactive/economic-growth-how-wisconsin-compares/html_f508b48e-a48f-11e3-a965-0019bb2963f4.html

Wisconsin is sort of middling which is to be expected since the fall from grace wasn’t as bad as other states.

Bruce Hall: Since you commented on this post, I am surprised that you brought up again the “bounce back” conjecture. After all, in that post, I documented the fact that the downturns were of comparable magnitude in Minnesota and Wisconsin, and yet Wisconsin lags by employment, coincident index, and Gross State Product metrics, particularly since 2011M01. What gives?

Menzie, I was comparing a Great Lakes industrial state to another Great Lakes industrial state: Wisconsin to Michigan. I chose Michigan because the rate of recovery is so great since 2011 when compared to Wisconsin, but the rate is a meaningless measure because Michigan still lags so far behind. As you might have picked up in other comments I made, I consider Wisconsin to be more closely aligned economically with Michigan than Minnesota, not because of population, but because of dependency on heavy/old tech industry which has been dragging down most of the Great Lakes states. Having lived in Wisconsin, Michigan, and North Dakota, I can say first hand… my opinion based on observation, of course… that Minnesota does not relate economically as much to Wisconsin as it does to other North Central states. But it’s your blog so you can choose the comparisons.

There have been a lot of comparisons of Wisconsin vs. Minnesota vs. Kansas vs. California. Here’s another.

The BEA puts out real per capita income adjusted for state specific price levels. This is where the rubber meets the road for most voters–voters are interested in what their income is given the real prices they must pay in their state.

Although these numbers are only available until 2012, they don’t necessarily show the same divergence that the state coincident indices showed starting in 2011 when Republican governors took over in Wisconsin and Kansas. The two year growth rates of real per capital income from 2010 to 2012 are (% change from 2010 to 2012):

California: 3.58%

Kansas: 7.68%

Minnesota: 4.15%

Wisconsin: 3.61%

Wisconsin real per capital growth of income was on par with California. Minnesota did a little better than both Kansas and California. And Kansas led the pack by a lot.

Sorry, meant to say that Minnesota did a little better than Wisconsin and California.

Rick Stryker: With quarterly GDP, one can calculate with greater precision, rather than mid-year to mid-year. To end 2013, MN, CA, and WI per capita income growth are 5%, 4.9% and 3.7%, respectively.

Menzie,

I’m not sure what calculation you’ve done–perhaps you could elaborate? But it appears that you have just done a different calculation rather than a more accurate one. Some further points on my numbers:

1) I am reporting real state personal income, not real state GDP. Personal income is the sum of all income received through wages, tips, dividends, etc.

2) The real personal income I’m reporting is adjusted for state variations in prices. State real GDP is not adjusted for state variation in prices. When you adjust for state prices, real personal income in California is 39K per year, on par with Alabama at 38.5K. Wisconsin is 43K while Kansas and Minnesota are on par at about 45K. People make more in California but then things are much more expensive, particularly housing. Growth rates matter, yes, but so do levels.

3) The numbers I reported include the full year of income–it’s not mid-year. What is mid-year is the population estimate, but that’s because the census department reports population figures as of July 1 each year.

Rick Stryker You might want to check the components of personal income. What you’ll find is that comparing MN, KS and WI from 2011Q1 thru 2013Q4, wages and salaries (which is actually what people care about) increased the most in MN. KS was somewhat behind. What brings up the personal income growth for WI is a shocking 14% increase in the receipts of transfer payments. This is way out of line with either MN or KS. When people talk about economic growth they usually don’t have in mind an expansion in retiree pensions and Social Security receipts. In this category MN was slightly better than KS, but only slightly.

Where KS shows the biggest growth is in non-farm proprietors’ income…up a whopping 21.45%. OTOH, KS shows a 40% drop in farm proprietors’ income. When you look at the income components what you’ll find is that MN has much more balanced growth overall. Not out of line either way in any category.

Rick Stryker: The annual difference in inflation between Wisconsin and Minnesota is 0.2 ppts. This merits you looking at annual data ending in 2012?

The midyear point I made refers to the fact that year-on-year annual changes are in effect measuring 4 quarter growth rates measured from mid-year (post to follow).

Mises – HUMAN ACTION

The Historical School and the Institutionalists want to outlaw the study of praxeology and economics and to occupy themselves merely with the registration of the data or, as they call them nowadays, the institutions. But no statement concerning these data can be made without reference to a definite set of economic theorems. When an institutionalist ascribes a definite event to a definite cause, e.g., mass unemployment to the alleged deficiencies of the capitalist mode of production, he resorts to an economic theorem. In objecting to the closer examination of the theorem tacitly implied in his conclusions, he merely wants to avoid the exposure of the fallacies of his argument.

Ricardo,

Have you read Charles Koch’s The Science of Success: How Market Based Management Built the World’s Largest Private Company? In this book, Koch explains how he developed his management philosophy, “Market Based Management,” which is grounded in the “science of human action.” Koch based his management methodology explicitly on ideas found in Mises’ “Human Action” and on other free market thinkers. It’s a fascinating book which I’d recommend if you haven’t seen it.

Rick,

No I haven’t read it but on your recommendation it is next on my reading list.

Rick,

I have started the book and realized something. Every book I have read with a supply side base has included how proper economic theories lead to a moral business climate. This is all the way back to Adam Smith’s THE THEORY OF MORAL SENTIMENTS, which is actually longer than his WEALTH OF NATIONS. I have never read a demand side book that speaks of their economic theory leading to morality. As a matter of fact, Keynes GENERAL THEORY actually proposes deception and suberfuge especially when it comes to inflation and wages. What a stark difference in perspective!

ricardo,

I would assume a proper economic theory, based on mathematics, should be indifferent to a moral business climate. how we choose to interpret that theory may be biased, but that is not the basis of the theory itself. and obviously interpretation is not fact, and is subject to debate.

Ricardo,

Yes, that is an insight of the free market theorists that is often overlooked. Limited government and free markets leads not only to an economically more efficient society, but also to a more just society in which its citizens are more virtuous . And the opposite move towards the welfare state leads to a less just society and worse behavior. In the extreme case, when a society moves from the welfare state to socialism, whether of the of Nazi or Communist variety, we have seen the rise of very evil people who commit appalling crimes, often with the complicity of the people.

Unfortunately, modern economists on the Left take as a given that the welfare state is morally justified, with the only constraint to its unbridled growth being inefficiency. For them, it’s a question of positive economics as to how high taxes can be raised or how high the minimum wage can go without affecting growth too much. They feel that if they can demonstrate empirically that marginal tax rates of 70% don’t affect growth much, then the case for raising marginal tax rates to 70% has been established.

The underlying political philosophy of the Left needs to be challenged just as vigorously as the economics. I think one reason for the hostility towards MIses is that he was uncompromising in his assault on the moral legitimacy of the welfare state.

stryker, since you are against any social programs , i imagine you have returned all of your social security checks and opted out of medicare? i wouldn’t want you to be considered a hypocrite and collect from a social welfare program-i don’t think you could sleep at night. i want you to live in your “economically more efficient society, but also to a more just society in which its citizens are more virtuous . “

Baffles,

Well, if the government returned all funds I’ve already put into both programs, with interest, and deregulated the health care markets so that alternatives to medicare exist, then sign me up.

rick, sorry can’t do those are taxes, not investments. but if you want to consider them investments, i will bet they return more to you dollar for dollar than any other investment you have made in your life. just consider what your insurance premium would be without medicare. and you want it deregulated? you really think any private insurance company would provide seniors with insurance? only if they could deny you coverage once you are terminally ill. you live in a fantasy land rick. but by all means live our your libertarian dream by not using your government subsidized health care and retirement benefits. again i really don’t want you to live the life of a hypocrite.

Ah, yes. Libertarian Paradise. Our Future Destiny, now and forever.

I think history shows that it’s not our destiny. Too many people want to use the coercive power of the state to force people to do things that they can’t be convinced to do voluntarily.

Rick Stryker: Yeah, absolutely — I should’ve burned my selective service card!

I’m certainly not in favor of the draft. But then I never would havevoted for Jimmy Carter, although I bet you did.