From Jason Stein in today’s Milwaukee Journal Sentinel:

The state law requires that Wisconsin’s minimum wage “shall not be less than a living wage.” …

A living wage is defined under the law as “reasonable comfort, reasonable physical well-being, decency and moral well-being.”

…”The department has determined that there is no reasonable cause to believe that the wages paid to the complainants are not a living wage,” Robert Rodriguez, administrator of DWD’s Equal Rights Division, wrote in the denial letter.

The letter, released yesterday, is here. Interestingly, I have not been able to locate this document on the DWD website. In addition, I have not been able to locate any statistical or other quantitative analysis justifying this assessment (as of 10PM Central, on 10/7).

The standard critique — that there would be substantial job loss as a consequence of the a minimum wage hike, as argued by the Wisconsin Restaurant Association [1] — were trotted out. As I have noted before, the theoretical effects can go either way, and there is some evidence that the minimum wage increase effects are either small negative, or even possibly positive, on employment. [2]

Note that the Federal poverty threshold in 2014 for a two person household is $15730/year. If one were to work 40 hours/week for 52 weeks/year at the Wisconsin minimum wage, then gross income would equal $15080.

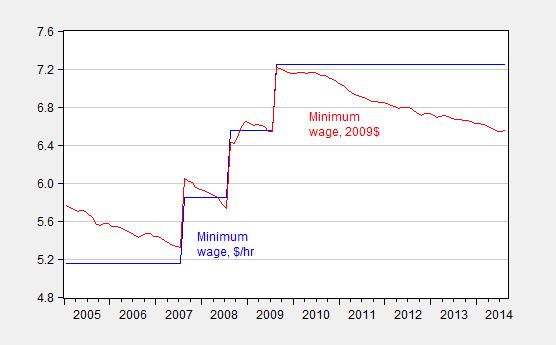

Update, 10/8 1:40PM Pacific: The irrepressible Rick Stryker observes that the Doyle administration determined $7.25 minimum wage as consistent with a living wage in July 2009. Well, lots has changed since 2009, including the fact that the price level has risen — a fact judiciously omitted by Mr. Stryker. Here is the minimum wage in 2009$ (and keep in mind, the CPI is plutocratic, so that it applies to upper income households). For instance, the CPI for food and beverages, which would be higher weighted for lower income households, has risen 11.9% vs. 10.9% for CPI.

Figure 3: Minimum wage in $/hour (blue) and in 2009$ (red). Deflation uses CPI-All.

Update: Here is the the 2009 Wisconsin Legislative Council Informational Memo regarding how DWD raised the minimum wage:

The Department of Workforce Development (DWD) is authorized by state statute to change the

state minimum wage through the rule promulgation process.

Despite some people’s assertions, the legislature did not pass legislation to effect this change.

You can also read more of the history of DWD’s decisionmaking here.

Update, 10/10, 9:25AM Pacific: The Legislative Council has provided a memo which outlines the authority granted to agencies to promulgate rules, including those relating to the minimum wage. The relevant portion:

The Wisconsin Constitution delegates to the legislative branch the power to make laws and assigns to the executive branch the power to enforce and execute laws. Although the legislature is highly capable of adopting public policies and setting the agenda for the state, it does not

always have the administrative expertise or resources to implement public policies. Also, the implementation and enforcement of the laws may require consideration of details and the adoption of procedures that cannot be foreseen when legislation is enacted. For these reasons the legislature has delegated to the executive branch the power to promulgate—to make known and put into effect—administrative rules.Administrative rules have the effect of law and, as stated in the Wisconsin Statutes, are “issued by an agency to implement, interpret, or make specific legislation enforced or administered by the agency or to govern the organization or procedure of the agency.” State agencies are granted rule-making power to actualize the legislature’s public policy decisions. The administrative rules are compiled in the

Wisconsin Administrative Code…

As the history of minimum wage changes in Wisconsin makes clear, DWD can make the changes on its own, subject to clearance by the Legislature. Hence, assertions that the legislature must on its own initiate minimum wage changes, or change the determination of what constitutes a living wage, are incorrect. Authority is delegated by the Legislature to DWD (and the Legislature can override DWD).

Sorry Menzie, but once again you are completely wrong on the facts. The Walker Administration did not determine that $7.25 is a living wage in Wisconsin. The determination that $7.25 per hour is a living wage was made under Jim Doyle, the Democratic governor, 2 years before Walker came into office.

Chapter DWD272 of the Wisconsin Administration Code ,which was established in 2009, defines the living wage that is required to be consistent with Chapters104.01-12 of the Wisconsin Statutes. Section 104.1 defines a living wage as “compensation for labor paid, whether by time, piecework, or otherwise, sufficient to enable the employee receiving the compensation to maintain himself or herself under conditions consistent with his or her welfare” and welfare as “reasonable comfort, reasonable physical well-being, decency, and moral well-being.” Chapter DWD272 operationalizes that definition of the living wage as follows:

“The rates adopted in this chapter reflect compensation that has been determined to be adequate to permit any employee to maintain herself or himself in minimum comfort, decency, physical and moral well-being. The department has also considered the effect that an increase in the living-wage might have on the economy of the state, including the effect of a living-wage increase on job creation, retention and expansion, on the availability of entry-level jobs and on regional economic conditions within the state. ”

And what is that living wage rate? $7.25 per hour. Defined in 2009. Under Democratic governor Jim Doyle. 2 years before Walker assumed office.

Thus, the letter that Robert Rodriguez, Administrator of Equal Rights, wrote which asserted that “there is no reasonable cause to believe that the wages paid to the complainants are not a living wage” is completely correct, since as long as the complainants are paid at least $7.25 per hour, that is a living wage under DWD272.

rick, your propaganda is wrong.

“And what is that living wage rate? $7.25 per hour. Defined in 2009. Under Democratic governor Jim Doyle. 2 years before Walker assumed office.”

as you clearly state, that living wage was defined in 2009. five years ago. walker was asked to reassess the standard, today, in year 2014. he chose not to change it. so he defined the living wage rate in 2014 as $7.25 per hour. take ownership of your beliefs, don’t pass them off on somebody else. or do you believe the living wage is not variable in time? perhaps all salaries should be rolled back to 1950 levels?

Rick Stryker: The fact that Governor Doyle made a determination in 2009 does not mean that Governor Walker couldn’t make a separate determination in 2014. After all, the Governor has determined matters have changed over time in all sorts of other areas (otherwise we would have a gloriously effective WEDC).

One relevant point is that as of August 2014 the CPI is 10.6% higher than in July 2009, and since we know the CPI has a plutocratic bias, use of this deflator understates the cost-of-living increase for low income households. The food and beverage component has risen 11.9%. If Governor Doyle were in charge now and yet again determined $7.25 was a living wage in 2014, I would express the same amount of disbelief.

The fact that you omit these relevant factors makes this comment equal on par for disingenuousness as your defense of Governor Romney’s assertion that 500,000/month net job creation was typical in recoveries. Keep up the good work — somebody has to keep on shoveling out the stuff so we sane people can come after you and clean up.

Sorry Menzie, but you are wrong on the facts yet again. Your premise is that “The fact that Governor Doyle made a determination in 2009 does not mean that Governor Walker couldn’t make a separate determination in 2014.” Since you believe that Walker could have made a different determination in 2014, you believe he could have adjusted for inflation and other factors. But that’s just wrong.

The problem with your premise is that the living wage was defined to be $7.25 per hour in the Wisconsin Administration Code. The rules in the Administration code are not suggestions that can be changed willy-nilly by governors. They are the result of a well-defined process whose ultimate authority comes from the Wisconsin State Legislature.

Because all laws have to be interpreted by the executive branch, the Wisconsin State Legislature confers rule making authority by statute to State Agencies. However, the Legislature oversees the process by means of the Legislative Council’s Administrative Rule Clearinghouse, by means of standing committees in both houses, and by means of the Joint Committee for Review of Administrative Rules (JCRAR).

A State Agency must follow a process to make a rule. First, it must put together a statement that outlines the reason for the rule, the statutory authority for making the rule, the objective of the rule, and the rule’s effects. That statement must be be submitted to the Governor (in this case Democratic Governor Jim Doyle) in writing for approval. Upon that approval, the agency may then write a draft of the rule. The agency must also prepare economic impact analysis for proposed rules. Then the rule must be reviewed by the Legislative Rules Clearinghouse. After that, there has to be an Agency Public hearing on the rule. Then the agency must submit the final draft to the governor for written approval (that would be Democratic governor Jim Doyle signing that).

Once the governor has signed off (that would Democratic governor Jim Doyle), then the rule must be submitted to the Chief Clerk of each house of the Legislature and reviewed by the standing committees in each House. After that, there is JCRAR review. Of course, in America, there is also Judicial Review.

After a rule has gone through this process, it has the force of law. Subsequent governors are not free to change these rules just because they don’t agree with them. If you want to change a rule, you have to go back through the legislative process. Walker can’t just arbitrarily decide to redefine the definition of a living wage. The living wage was defined through the legislative process to be $7.25 per hour.

Thus, my original point that you are completely wrong on the facts remains valid. The Walker Administration did not define the living wage in Wisconsin to be $7.25 per hour. Previous Democratic governor Jim Doyle along with the legislature decided that the living wage is $7.25 per hour. The Walker Administration was just following the law when it asserted that “there is no reasonable cause to believe that the wages paid to the complainants are not a living wage”, since as long as the complainants Sorry Menzie, but you are wrong on the facts yet again. Your premise is that “The fact that Governor Doyle made a determination in 2009 does not mean that Governor Walker couldn’t make a separate determination in 2014.” Since you believe that Walker could have made a different determination in 2014, you believe he could have adjusted for inflation and other factors. But that’s just wrong.

The problem with your premise is that the living wage was defined to be $7.25 per hour in the Wisconsin Administration Code. The rules in the Administration code are not suggestions that can be changed willy-nilly by governors. They are the result of a well-defined process whose ultimate authority comes from the Wisconsin State Legislature.

Because all laws have to be interpreted by the executive branch, the Wisconsin State Legislature confers rule making authority by statute to State Agencies. However, the Legislature oversees the process by means of the Legislative Council’s Administrative Rule Clearinghouse, by means of standing committees in both houses, and by means of the Joint Committee for Review of Administrative Rules (JCRAR).

A State Agency must follow a process to make a rule. First, it must put together a statement that outlines the reason for the rule, the statutory authority for making the rule, the objective of the rule, and the rule’s effects. That statement must be be submitted to the Governor (in this case Democratic Governor Jim Doyle) in writing for approval. Upon that approval, the agency may then write a draft of the rule. The agency must also prepare economic impact analysis for proposed rules. Then the rule must be reviewed by the Legislative Rules Clearinghouse. After that, there has to be an Agency Public hearing on the rule. Then the agency must submit the final draft to the governor for written approval (that would be Democratic governor Jim Doyle signing that).

Once the governor has signed off (that would Democratic governor Jim Doyle), then the rule must be submitted to the Chief Clerk of each house of the Legislature and reviewed by the standing committees in each House. After that, there is JCRAR review. Of course, in America, there is also Judicial Review.

After a rule has gone through this process, it has the force of law. Subsequent governors are not free to change these rules just because they don’t agree with them. If you want to change a rule, you have to go back through the legislative process. Walker can’t just arbitrarily decide to redefine the definition of a living wage. The living wage was defined through the legislative process to be $7.25 per hour.

Thus, my original point that you are completely wrong on the facts remains valid. The Walker Administration did not define the living wage in Wisconsin to be $7.25 per hour. Previous Democratic governor Jim Doyle along with the legislature decided that the living wage is $7.25 per hour. The Walker Administration was just following the law when it asserted that “there is no reasonable cause to believe that the wages paid to the complainants are not a living wage”, since as long as the complainants Sorry Menzie, but you are wrong on the facts yet again. Your premise is that “The fact that Governor Doyle made a determination in 2009 does not mean that Governor Walker couldn’t make a separate determination in 2014.” Since you believe that Walker could have made a different determination in 2014, you believe he could have adjusted for inflation and other factors. But that’s just wrong.

The problem with your premise is that the living wage was defined to be $7.25 per hour in the Wisconsin Administration Code. The rules in the Administration code are not suggestions that can be changed willy-nilly by governors. They are the result of a well-defined process whose ultimate authority comes from the Wisconsin State Legislature.

Because all laws have to be interpreted by the executive branch, the Wisconsin State Legislature confers rule making authority by statute to State Agencies. However, the Legislature oversees the process by means of the Legislative Council’s Administrative Rule Clearinghouse, by means of standing committees in both houses, and by means of the Joint Committee for Review of Administrative Rules (JCRAR).

A State Agency must follow a process to make a rule. First, it must put together a statement that outlines the reason for the rule, the statutory authority for making the rule, the objective of the rule, and the rule’s effects. That statement must be be submitted to the Governor (in this case Democratic Governor Jim Doyle) in writing for approval. Upon that approval, the agency may then write a draft of the rule. The agency must also prepare economic impact analysis for proposed rules. Then the rule must be reviewed by the Legislative Rules Clearinghouse. After that, there has to be an Agency Public hearing on the rule. Then the agency must submit the final draft to the governor for written approval (that would be Democratic governor Jim Doyle signing that).

Once the governor has signed off (that would Democratic governor Jim Doyle), then the rule must be submitted to the Chief Clerk of each house of the Legislature and reviewed by the standing committees in each House. After that, there is JCRAR review. Of course, in America, there is also Judicial Review.

After a rule has gone through this process, it has the force of law. Subsequent governors are not free to change these rules just because they don’t agree with them. If you want to change a rule, you have to go back through the legislative process. Walker can’t just arbitrarily decide to redefine the definition of a living wage. The living wage was defined through the legislative process to be $7.25 per hour.

Thus, my original point that you are completely wrong on the facts remains valid. The Walker Administration did not define the living wage in Wisconsin to be $7.25 per hour. Previous Democratic governor Jim Doyle along with the legislature decided that the living wage is $7.25 per hour. The Walker Administration was just following the law when it asserted that “there is no reasonable cause to believe that the wages paid to the complainants are not a living wage”, since as long as the complainants are paid at least $7.25 per hour that is a living wage under DWD 272.

Comment above got jumbled somehow. I’m repeating it below.

———————————————————————————–

Sorry Menzie, but you are wrong on the facts yet again. Your premise is that “The fact that Governor Doyle made a determination in 2009 does not mean that Governor Walker couldn’t make a separate determination in 2014.” Since you believe that Walker could have made a different determination in 2014, you believe he could have adjusted for inflation and other factors. But that’s just wrong.

The problem with your premise is that the living wage was defined to be $7.25 per hour in the Wisconsin Administration Code. The rules in the Administration code are not suggestions that can be changed willy-nilly by governors. They are the result of a well-defined process whose ultimate authority comes from the Wisconsin State Legislature.

Because all laws have to be interpreted by the executive branch, the Wisconsin State Legislature confers rule making authority by statute to State Agencies. However, the Legislature oversees the process by means of the Legislative Council’s Administrative Rule Clearinghouse, by means of standing committees in both houses, and by means of the Joint Committee for Review of Administrative Rules (JCRAR).

A State Agency must follow a process to make a rule. First, it must put together a statement that outlines the reason for the rule, the statutory authority for making the rule, the objective of the rule, and the rule’s effects. That statement must be be submitted to the Governor (in this case Democratic Governor Jim Doyle) in writing for approval. Upon that approval, the agency may then write a draft of the rule. The agency must also prepare economic impact analysis for proposed rules. Then the rule must be reviewed by the Legislative Rules Clearinghouse. After that, there has to be an Agency Public hearing on the rule. Then the agency must submit the final draft to the governor for written approval (that would be Democratic governor Jim Doyle signing that).

Once the governor has signed off (that would Democratic governor Jim Doyle), then the rule must be submitted to the Chief Clerk of each house of the Legislature and reviewed by the standing committees in each House. After that, there is JCRAR review. Of course, in America, there is also Judicial Review.

After a rule has gone through this process, it has the force of law. Subsequent governors are not free to change these rules just because they don’t agree with them. If you want to change a rule, you have to go back through the legislative process. Walker can’t just arbitrarily decide to redefine the definition of a living wage. The living wage was defined through the legislative process to be $7.25 per hour.

Thus, my original point that you are completely wrong on the facts remains valid. The Walker Administration did not define the living wage in Wisconsin to be $7.25 per hour. Previous Democratic governor Jim Doyle along with the legislature decided that the living wage is $7.25 per hour. The Walker Administration was just following the law when it asserted that “there is no reasonable cause to believe that the wages paid to the complainants are not a living wage”, since as long as the complainants are paid at least $7.25 per hour that is a living wage under DWD 272.

Not sure why my comment got repeated 3 times and cut off at the end. Oh well–repetition can be useful in getting a point across.

The Irrepressible Rick Stryker: Nice try at obfuscation with long-winded gobblygook. See this 2009 Wisconsin Legislative Council Informational Memo:

As is clear from this memo, there was no legislation involved. You are right: The rule has to be run by the legislature via the Legislative Council, but DWD could have found $7.25 was not a living wage, at which point the Legislature could have stopped it — but by not submitting the rule change, DWD was determining $7.25 was still a living wage.

Now, do you want to return to your equally specious claim that normal job creation rates in a recovery are 500,000/month?

Thanks again!!! – your comments are endlessly entertaining (and quite useful for examples in teaching how not to do policy analysis and debate).

When the real minimum wage was above $8 an hour, roughly between 1960 and 1980, the teen labor force participation rate rose from below 45% to about 60%.

However, a general decline in the teen labor force participation rate took place when the real minimum wage fell and stayed below $8 an hour, after roughly 1980.

Raising the minimum wage, e.g. to at least $10 an hour, may begin to raise the teen labor force participation rate.

Chart – Teen Labor Force Participation Rate

http://research.stlouisfed.org/fred2/series/LNS11300012?cid=32449

The decline in the real minimum wage isn’t the only factor that caused the teen labor force participation rate to collapse. However, it may be a major factor.

Why should teens work for less than $8 an hour, when they can stay at home, live off their parents (e.g. in a nice house, thanks to the homebuilding boom from 1995-06), and play with electronic gadgets all day, which became increasingly cheaper over the past 30 years.

Or, they can go to college, collect free money, e.g. grants and scholarships, or run-up debt in easy to get student loans.

The opportunity cost of giving all that up for a low-paying job isn’t worth it to many teens.

In the early 2000s, before the latest round of minimum wag hikes more that 90%

of employed teenagers earned more than the minimum wage.

% OF TEENS

AT OR BELOW

MINIMUN WAGE

AT ABOVE

2002 10.4%

2003 9.9% 90.1%

2004 9.1% 90.9%

2005 8.9% 91.1%

2006 7.7% 92.3%

2007 6.9% 93.1%

2008 10.6% 89.4%

2009 18.6% 81.4%

2010 24.9% 75.1%

2011 22.8% 77.2%

2012 21.1% 78.9%

2013 19.5% 80.5%

SOURCE:BLS CHARACTERISTICS

OF MINIMUN WORKERS:

The “living wage” argument encourages the public to view minimum wage increases as a first order benefit for the lowest income groups. Almost every non-economist liberal conflates those who directly beneficiaries with the poor in general. That conflation is vulnerable to arguments that SHOULD be trivial, like “Then why don’t just increase the minimum wage to $X a year?” Living wage is a good rhetorical strategy, but it would be more honest to phrase minimum wage increases as a bargain in which one low-income subset is initially protected from wage competition for long-run mutual benefit.

I would like to meet the person that can manage to keep warm during a Wisconsin winter and buy food for $15,000.

If the minimum wage hike has no affect on employment then it is not binding. Increase the minimum wage to $100 / hour (or $1000, etc.) and let’s see if “the theoretical effects can go either way”. And if you can fine-tune an aggregate minimum wage for all jobs, ages, educational backgrounds, geographic locations, cost of living, etc. then I’d like to see that model. If it is not binding, then why add this layer of complexity to employment decisions? The economic argument seems to boil down to “it won’t hurt the economy too much” and “it’s more likely to help those that need it than critics say, but let’s ignore alternative more efficient wealth redistribution schemes”.

Yeah, well. There’s a certain “trust factor” to other wealth redistribution schemes.

That is to say, the Dems have to trust that the Reps won’t reduce it Just Because, and the Reps

have to trust that “indigent bums” will not be given too much (as opposed to worthy veterans

who happen to be homeless).

Besides, the actual cost of raising the minimum wage comes in the form of fewer jobs for everyone.

Because Automation. We still have a huge, huge manufacturing sector in America, it just doesn’t

employ as many people. Truck drivers are next.

Please try to understand the difference between “affect” and “effect “

There are no 40 hour weeks at minimum wage. The most frustrating “fact” trotted out by economists, reporters and columnists is the yearly or monthly income of people working minimum wage jobs. Almost nobody gets 40 hours, except in an emergency or when there is a rush season, such as Christmas in retail. There ought to be government data on how many hours minimum wage earners actually work, if that was used in articles such as this the arguments would at least be anchored in reality.

Aside from stopping wage theft, the best boost minimum wage workers could get would be a $1 premium on schedules under 35 hours a week, to get employers to stop their cut-throat pitting of worker against worker for the plum of a regular schedule or a consistant 35 hours a week. The fear of paying overtime, along with the absolute power granted by inconsistant scheduling has led to a great change in working conditions for minimum wage workers during the last 20 years. Even writers with minimum wage experience usually left that work before the recent “improvements”

Perhaps some writers with minimum wage experience could look up their old employers and find out how these jobs have changed since they left their old jobs.

What is seldom discused in the minimum wage debate is under-employment. We see college grads with tens of thousands of debt coming out of college working minimum wage jobs. So why not increase the minimum wage to $20/hr so that these under-employed grands can make at least $40K/ year? The truth is that increased minimum wage advocates don’t want to give you enough poison to kill you, they only want to make you a little sick.

It may be that a minimum wage can have no effect if the wages in an area are higher than the minimum wage but there are two concerns. First, not all areas are unaffected and second if a recession hits wages are artifically high and the result is structural unemployment. It is not rocket science. Catallatically government intervention leads to structural unemployment.

…the EPI finds that a total of 16.8 percent of new grads are “underemployed,” meaning they’re either jobless and hunting for work; working part-time because they can’t find a full-time job; or want a job, have looked within the past year, but have now given up on searching.

…The bad news is that these recent B.A.s, working in jobs that don’t require a college degree, are in occupations that pay far less than in the past. It used to be that more than half of these overeducated young workers would find themselves in “good” jobs—meaning that they’d pay at least $45,000 in today’s market. Today, less than 40 percent do. Meanwhile, more than a fifth of this group were in low-wage jobs, meaning they paid $25,000 a year or less.

Well since raising the minimum wage will destroy all life as we know it in the state according to conservatives, I’m certain that the state GOP will soon be pushing: The Maximum Wage. The maximum wage is a ceiling on wages by employment classification and is designed to free, to unbind, to unleash the free market by removing uncertainty over how high wages could rise. I can hear the WMC ads even now touting the benefits: think how many more jobs would be created when employers need not worry that hourly wages they pay will go beyond those in say, Bangladesh. Think of the rocket-ship of job creation (I wonder where that image came from?) that would occur when employers, freed of concerns over labor price input, could simply grab increased market share from IL and MN producers through low prices.

Then once that’s done, on to the next item on the GOP agenda: establishment of Droit de Seigneur for in-state employers.

Dr Morbius, look what your friends did to Detroit in thirty years.

Detroit’s problems did not have ONE cause. Please do a little research and back up your statement with data.

The classical liberal view states that wages should be voluntarily agreed between a buyer and a seller, and that this will both clear markets and assure maximum economic efficiency. Menzie teaches this very point in his econ classes. For the minimum wage, he is trying to make the case that the general rule does not apply, but other than digging out statistical correlations, he has no reason to believe this is true.

If Menzie did believe this were true, he would lay out the case for the optimum minimum wage, because this should be possible to calculate using Menzie’s philosophy. Menzie should be able to tell us the optimal value in Wisconsin. He should be able to demonstrate where the curve leans back on itself. But he won’t do that, because it might be well nigh impossible to demonstrate that, and Menzie knows it.

If you want to help lower income or minority folks, this is the wrong horse to ride. It is bad policy.

Steven Kopits: I do teach supply and demand in intro micro, but even in the intro course, I talked about asymmetric information. Not surprising, as one of my teachers was George Akerlof, who won the Nobel (with Stiglitz and Spence) for information economics.

In addition, the sticky price macro models I teach could be consistent with simple full-information supply-demand, but not necessarily.

In my finance course, I definitely do not teach that price fully equilibrates financial markets. I do not believe inside finance costs equal outside finance costs, as in the neoclassical model of capital investment.

Hence, I regret your characterization of what I teach is partial and essentially incorrect. If you would like to see what I teach, instead of what you think I teach, you can see my syllabi/course websites here

Then you are saving that low income wages are too low because of asymmetric information? What is that asymmetric information? How does a minimum wage address the issue of asymmetric information? Why would use not use information, rather than a minimum wage, to solve that? I am hard pressed to understand how price controls overcome asymmetric information. But go ahead, I’m all ears.

I don’t believe the state should be in the business of defining “a living wage”. Here’s why.

As Peak above notes, a higher minimum wage draws in a higher proportion of teenagers who, by definition, should not require a living wage. Therefore, a wage floor will displace from the workforce those who need a job to survive in favor of those who would like some pocket change.

Further, about half of population growth in the US in good years comes from immigration. As we discussed earlier, the average wage of a maid in Mexico is $5 / day; thus, $5 / hour is not a living wage, it is a princely sum. (If it weren’t, I can assure you we wouldn’t need the fence at the border.)

Thus, a minimum wage law, substantively, is intended to favor white, middle class teenagers at the expense of inner city blacks, Mexican immigrants, and low productivity adults. Why this would constitute a policy goal for Progressives is simply beyond me.

Steven Kopits, do we want U.S. teens playing video games, taking poor classes, or smoking marijuana all day?

Or, do we want them to do some work, to raise household income, or income in general, and therefore, raise consumption, saving, and employment?

A work ethic might do them some good.

I agree. A work ethic is a good thing.

Now, do suburban teens lack a work ethic? Well, I can’t speak to other communities, but in Princeton, they do not. Kids are much more serious than we were at a similar age (albeit, I grew up in Baltimore, not the Princeton hothouse).

The issue is whether you want my very disciplined, very intelligent daughter competing against kids from the inner city in Trenton. If there’s a head to head competition she and her peers will win 95% of the time. The more you raise the minimum wage, the higher the proportion of highly qualified applicants—this is exactly what the experience of SeaTac tells us. Thus, a higher min wage is prejudiced–and I mean this literally–prejudiced against lower income applicants, and most particularly, young black and Latino men.

Discipline would influence the their lives perhaps 100 to 1000 times more than it would the lives of the children of upper middle class households. A minimum wage law will encourage indolence and crime in our weakest communities. Period.

steven, first your high achieving princeton daughter will not be competing for jobs in the inner city trenton area-so your idea of competition is flawed. second, you are assuming that by raising the standards, the minority groups will do nothing in response. it is rather unfortunate that an economist would not realize that by raising the expectations with the higher minimum wage, would not a proportion of those in that minority group you targeted respond to the challenge? so many conservatives believe in the idea of incentives, and yet your view basically says those incentives will not work on a poor minority population. and i disagree.

If you’re going to argue that the poor can rise to a challenge, then you’re making Scott Sumner’s point. Take away the welfare state, and people will learn to cope on their own. I personally agree with that insight, with the proviso that you will have some Type I errors (ie, people you should have helped, whom you didn’t). But read Kevin Erdmann, and you’ll see that the absolute error is probably not bigger than it is now. http://idiosyncraticwhisk.blogspot.com/2014/08/the-absurdity-of-blaming-capitalism-for_14.html

Also, look at Germany on this graph. http://www.prienga.com/blog/2014/10/6/employment-to-population-ratios

It’s just incredible. Germany increased employment to population ratios straight through the recession. That’s the Hartz IV reforms of 2005. Policy is incredibly, incredibly important in labor force participation. Create barriers to working, and people will respond–by not working.

Also, this from Kevin on the min wage: http://idiosyncraticwhisk.blogspot.com/2014/08/minimum-wages-crime-and-unemployment.html

Baffs –

A higher minimum wage will a) reduce the demand for min wage labor and b) increase the supply of more qualified labor competing for those jobs. Thus, unless you have a backward bending demand curve for labor, you will have fewer jobs for those at the bottom of the labor pool, which as a statistical matter, will be young black and Latino men. Now, because of DMUWI, the loss of welfare to those losing their jobs will be greater than the gain in aggregate welfare to those obtaining jobs. We’re not struggling for a living wage in this labor pool. We’re struggling to keep them out of prison.

Don’t get me wrong. I am happy to underwrite policies which might help. But, unless Menzie can conjure up a credible market failure in the min wage sector, an increased minimum wage is dead wrong policy for the weakest members of society.

Steven Kopits, it seems, you didn’t understand my statement.

Raising the minimum wage, e.g. to $10 an hour, may put your daughter to work.

So, she’ll have income to spend, e.g. at a restaurant, to help the “young black and Latino men.”

The (positive) income and multiplier effects may be stronger than the (negative) employment effect, perhaps up to $15 an hour.

Also, a higher minimum wage shifts idle capital (earning enough for capital preservation), in the saving glut, into capital equipment (because labor becomes relatively more expensive).

So, better jobs are created, because workers are needed to create, build, ship, install, improve, maintain, operate, and manage those machines.

Currently, in the U.S., there’s an overabundance of capital and an education boom.

There are too many overeducated Americans working at low-skilled jobs, and too much (idle) capital kept in unproductive assets.

Another view from labor economists:

“An alternate view of the labor market has low-wage labor markets characterized as monopsonistic competition wherein buyers (employers) have significantly more market power than do sellers (workers)…Such a case is a type of market failure and results in workers being paid less than their marginal value.

Under the monopsonistic assumption, an appropriately set minimum wage could increase both wages and employment, with the optimal level being equal to the marginal productivity of labor.”

There is so much wrong with your logic, Peak.

Education: Enrollment in post-secondary education will be down 1.4% this year, after a fall of 1.7% last year. (Did I suggest you look at my demographics spreadsheet?)

Factory utilization is at 79%, versus 80-81% pre-Recession. http://research.stlouisfed.org/fred2/series/TCU/

Increased wage costs at a restaurant will lead to reduced demand and reduced need for employment. If demand for labor is price elastic ((dq/q)/(dp/p) < -1), then total wages to restaurant labor may actually fall. Thus, my daughter would earn a higher hourly wage, but may earn less in total. Therefore, her wages may not rise; although she will displace a less qualified person in that job.

To suggest that there is monopsonistic competition in minimum wage employment is utterly absurd. We've already had this debate. As I noted at the time, there are at least 100 minimum wage employers in Princeton alone, a town of 40,000.

Steven Kopits, you neither contradicted nor disproved any of my statements.

“Note that the Federal poverty threshold in 2014 for a two person household is $15,730/year. If one were to work 40 hours/week for 52 weeks/year at the Wisconsin minimum wage, then gross income would equal $15080.”

Duly noted.

I also noted that the federal poverty level for a single person (that is, the wage earner in this case, working 40 hours per week throughout the year would be above the federal poverty level of $11,670 per the link Menzie supplied. Why the switch from the poverty level for a single person (the wage earner) to the poverty level for a two-person household? It’s not clear that “living wage” is (or should be) the same as the definition of the federal poverty level, but since Menzie seems to have set this up as a test, if not the test, a $7.25 per hour minimum wage in 2014 would pass that standard of “reasonableness” for a single worker. Did the Wisconsin legislature assume that a “living wage” was meant to support more than the wage earner? It appears not, based on the language quoted by Stryker:

“Section 104.1 defines a living wage as “compensation for labor paid, whether by time, piecework, or otherwise, sufficient to enable *the employee* receiving the compensation to maintain *himself or herself* under conditions consistent with *his or her welfare* and welfare as “reasonable comfort, reasonable physical well-being, decency, and moral well-being.” (emphases added).

Now, if we want to disregard the language of the statute and assume that it means “to enable the employee and his or her household, etc” and this is a two-person household, that two-person household referenced by Menzie might consist of 1) two adults: or 2) an adult and a dependent child (other possibilities may exist for dependents, but this pretty much covers 99 percent of the cases.

In the case of two adults and no dependents, is it reasonable to assume that one of the adults would not work at all (this may well be the original thought behind the wording of the statute)? It would take about 100 hours per year of minimum work at $7.25 per hour to meet Menzie’s test. Is there some legislative history to suggest that the “living wage” for a two-person adult household would have only one full=time wage earner? Is it reasonable to assume that most persons who earn the minimum wage are adults supporting at least one other household member?

If it is reasonable that one adult in that household should not work at all (and presumably would not collect unemployment benefits, etc) then that two-person household would be entitled to an refundable earned income tax credit of about $352 (assuming AGI is the same as gross wages). Thus, that *household* (not the employee) would fall short of a “living wage” as defined by the poverty level by about $400 per year. Should Wisconsin ignore the refundable credits directly linked to wages in setting its “living wage”?

If the household is one adult and one dependent child, the EITC would be about $3,250. Thus, total wages including the refundable wage supplement would exceed Menzie’s poverty level test for a “living wage”.

There are some debatable questions here, particularly whether the Wisconsin statute should be amended to re-define “living wage” as something to support more than just the wage earner, but that’s another question. Even for a two-person household almost all cases would pass Menzie’s poverty level test. It is not clear to me that a $7.25 per hour minimum wage would not result in higher overall employment than a higher amount and ensure full-time workers are above the poverty level *even assuming* that they don’t receive benefits other than specific wage supplements, such as SNAP, etc.

Vivian,

When you look at how vague the definition of the living wage is and all the outs the DWD has in defining it, it’s clear that the living wage is exactly equivalent to whatever the Wisconsin governor and legislature decide the minimum wage will be during the rule-making process. It really has no independent meaning.

It has to be that way really. If they really tried to define the living wage as a wage that would give a family of four a reasonable, albeit parsimonious, living standard, that wage would have to be so high as to cause serious economic damage. Both Republicans and Democrats know this. The living wage language is just political window dressing that doesn’t really mean anything.

I wouldn’t to so far as to say it could mean anything. First of all, as I indicated in my prior comment, it appears to me that it means the level of wages sufficient for a single person (i.e., the wage earner) to achieve a certain minimal standard of living. Beyond that, I agree there is a considerable amount of latitude in interpreting ” “reasonable comfort, reasonable physical well-being, decency and moral well-being.”. I certainly don’t think the “living wage” was meant as a wage sufficient to support a family of two with only one person working full-time. Why did Menzie choose a two-person household for his comparison to the “poverty level” given the language of the statute and regulations?. Because he looked at the required non-poverty level income for a single person and didn’t like that answer? If one is going to take those kind of liberties, why not choose a family of four and throw in a dog and a cat to boot? Why stop there? Why not just say that the wage a person is required to be paid should be sufficient to support himself or herself as a single earner and whatever family size he or she happens to have? When part of a definition contained in a statute or regulation is open to interpretation, that doesn’t mean that you are entitled to take any liberty you want with other aspects that are not.

The only thing sillier than this vague and unenforceable ‘law’; ‘A living wage is defined under the law as “reasonable comfort, reasonable physical well-being, decency and moral well-being.” ‘, is that there are people with economics degrees who take it seriously.

Patrick R. Sullivan: I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

For those who might have just come in, here’s the context that Menzie is dishonestly deleting in his continuing tantrum. I wrote;

—————-quote———-

Well, Menzie links to Krugman saying;

‘But Canada has its own currency, which means that its government can’t run out of money, that it can bail out its own banks if necessary, and more. An independent Scotland wouldn’t. And that makes a huge difference.’

Canada didn’t have a central bank until sometime in the 1930s, and had a less severe depression than the USA. As far as I know Canadian banks have never been bailed out by their central bank (because they don’t have crises). Their banks more or less regulate themselves, as could Scotland’s, whatever currency unit they choose to use.

True, Scotland would not be able to inflate its way out of a recession, but that might have a sobering effect on its politicians. Or maybe not, but Zimbabwe did put an end to some of its miseries by eliminating its currency a few yaars ago. The Rand, Euro, Pound and USD circulate there now.

———-endquote———-

I can be as stubborn as you, Menzie.

Patrick R. Sullivan: I’ve not deleted anything. I provide a link at all times I note your error and ask for your retraction.

Hence, I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong. It is still wrong even if you add your “context”. Can you provide data that Canada’s depression was less severe than that in the US?

I will keep on asking as long as you keep on posting here without a response. I am sure you are more stubborn than I, but I will persevere.

pat

“As far as I know Canadian banks have never been bailed out by their central bank (because they don’t have crises). ”

this is not true. canadian banks received support during the financial crisis a few years ago. if you receive support to keep from facing a crisis, you have been bailed out by the government.

Menzie,

Now you are being really obtuse. I guess the comment 3 times repeated didn’t get through to you.

Of course I know that the DWD has the statutory power to change the minimum wage law through the rule-making policy. I never claimed otherwise. The statutory authority to do so is in chapter 104.04 of the Wisconsin code that I linked to in my first comment. That rule-making power is subject to the process and oversight in chapter 227, which I described in my second comment, and which you called “gobbledygook.” But indeed Democrat Jim Doyle’s rule change went through that process. But all that is irrelevant to the point I’m making.

The issue we are talking about is that Wisconsin Jobs Now, Wisconsin Working Families, and a group of low-wage workers in the state submitted something like 100 complaints to the Walker Administration saying that the current $7.25 per hour is not a living wage.

Section 104.05 governs complaints and investigations and reads as follows:

“Complaints; investigation. The department shall, within 20 days after the filing of a verified complaint of any person setting forth that the wages paid to any employee in any occupation are not sufficient to enable the employee to maintain himself or herself under conditions consistent with his or her welfare, investigate and determine whether there isreasonable cause to believe that the wage paid to any employee is not a living wage.”

If after the investigation it is determined that there is a violation of the living wage statute, section 104.06 prescribes the remedy:

“Wage council; determination. If, upon investigation, the department finds that there is reasonable cause to believe that the wages paid to any employee are not a living wage, the department shall appoint a wage council, selected so as fairly to represent employers, employees, and the public, to assist in its investigations and determinations. The living wage so determined upon shall be the living wage for all employees within the same class as established by the classification of the department.”

Now here’s the problem for Robert Rodriguez, Administrator of Equal Rights. Under section 104.05 he is obligated to investigate the complaints he received and under section 104.06 obligated to take action if he finds that there is reasonable cause to believe that the wages paid to any employee are not a living wage. However, Democratic governor Jim Doyle made this investigation really easy, since DWD272 defines the living wage to be at least $7.25 per hour. Therefore, unless the complainants show evidence that they are being paid less than $7.25 per hour, Rodriguez must conclude, as he did in his letter that, “there is no reasonable cause to believe that the wages paid to the complainants are not a living wage”

It’s that simple. The Walker Administration was just following the law. It was Democratic governor Jim Doyle, not Walker, who defined the living wage to be $7.25 per hour. This is the third time I’ve made this point.

In your latest reply, you shifted your claim to be that since the Walker Administration did not promulgate a rule change in the minimum wage in response to the complaints, then that implies that they are asserting by inaction that $7.25 is still a living wage, despite the increase in prices and other factors. But that is a huge leap of illogic. The Walker Administration might well believe that $7.25 per hour is not a living wage for someone trying to support a family (while it might be fine for a teenager.) But they could still be opposed to raising the minimum wage because they believe the costs outweigh the benefits.

Again, your facts are completely wrong. I must say that I take a certain sadistic pleasure watching a Leftist writhing in the fires of reason and evidence, thrashing one way and then another to make the logic go away. And you’ve given me a bonus. I always know when you think you are losing because you’ll bring up that 500K per month. That’s your “tell.”

stryker,

the walker administration had the opportunity to address the living wage issue, and they punted. period. trying to pass that err in judgment off on the previous administration is “gobbledygook”. the only type of person who would even consider your argument as valid would be another ideologue like yourself.

Rick Stryker: Not a single journalistic account, including those by the very knowledgeable Jason Stein (the Milwaukee Journal Sentinel capitol reporter), makes the argument you make; and indeed the DWD didn’t make reference to the point you make. I would have thought it expedient of them to deflect blame by appealing to the Doyle administration – yet they did not. In fact, there is not even a statement on the DWD website.

My reading and understanding of how the rule making process works here in Wisconsin is therefore at variance with what you have written (and indeed apparently at variance what reporters here in Wisconsin understand). But heck, we should listen to an anonymous poster who might or might not be in Wisconsin — and by the way believes in 500K jobs/mo job creation and Heritage Foundation provides “fair and balanced” analysis (I will dig up the quote from you if you wish) — or the reporters on the ground here?

But you do remind me, I need to compile all the howlers you have written over the past couple years for a “Greatest Hits from Rick Stryker” in anticipation of the day we finally figure out who you are.

Menzie,

Actually, I never thought about making a list of your Howlers. But since you are getting your list ready, I should probably start on mine now, since it’s going to be a very long list. Fortunately, your current comment has lots of great material to work with. Let’s get the list started:

Howler 1: Since not a single journalistic account makes the argument that Rick Stryker makes, Rick Stryker’s argument can’t be correct, even though he supported his argument with links and quotes from the relevant law

Howler 2: Since the Walker Administration has an incentive to make the argument that Rick Stryker made but did not, Rick Stryker’s argument must be incorrect

Howler 3: Menzie’s understanding of the rule making process is at variance with Rick Stryker’s, since Menzie has derived his knowledge by reading the Wisconsin press, which has necessarily provided a true and complete account. Rick Stryker’s understanding is defective, since he derived his knowledge by reading the actual laws.

Howler 4: Since Rick Stryker made his comment anonymously, his comment must be incorrect

Howler 5: Since Rick Stryker has made some comments in the past that Menzie disagrees with, Rick Stryker’s current argument is incorrect

By the way, your statement that ends “we finally figure out who you are” is a bit ominous. Who is this “we?” Besides, why does your shadowy secret society care who I am? I’ve got nothing to hide. I’m an academic like you–the Ludwig von Mises Distinguished Service Professor of Free Market Economics at Wossamotta University where I teach economics from a free market point of view.

Rick Stryker: Please refer to this document from the Wisconsin Legislative Council, a nonpartisan arm of the Legislature.

As the document further observers, the Legislature reviews to see if the rule is consistent with statutory authority and existing laws. But as is obvious (to anyone who understands what’s going on in Wisconsin), DWD never got to the stage of submitting for review to Leg. Council. It made its own determination. And that was my point — DWD made a determination that –for the claimants who earned $7.25/hour — $7.25/hour was a living wage.

I didn’t say that was wrong; nor did I say it was right. I just indicated there was no analysis I could find.

Menzie,

OK, to try and make some progress here suppose I grant you that the DWD made a determination that $7.25 was “living wage.” That fact implies nothing more than what we already know, which is that the Walker Administration is not favoring an increase in the minimum wage. “Living wage” has a very specific meaning in the Wisconsin code. It does not necessarily mean the $7.25 is enough to maintain some pre-defined standard of living. The legislators left the term purposefully vague, defining it as the wage that is supposed to be sufficient to maintain yourself “consistent with your own welfare.” But at the same time, DWD is allowed to also consider the effect of the minimum wage on the state’s economy, the regional economy, and the effect on employment. In other words, the DWD is allowed to conduct its analysis on the effects of a particular minimum wage, balancing the costs and benefits. Thus, the “living wage” is the wage that is sufficient to maintain yourself consistent with your own welfare balanced against the economic effects of raising the wage above the market level. DWD came down on one side of that debate. You come down on the other. But they got elected and have no statutory requirement to report or justify their decision. So, I’m not sure what your complaint is here.

Rick Stryker: You should only consider your inevitable unmasking “ominous” if you consider your views of arming teachers to prevent school mass-shootings as embarrassing. If you think that’s a fine view, you should have the courage of your convictions to present those views under your own name.

Menzie,

The econbrowser comment policy allows anonymous comments with virtually no censorship (other than for profanity, etc). Those characteristics go together. Anonymous comments by their nature will be more controversial and the no censorship policy will insure that those comments are heard. I’ve chosen to remain anonymous under this policy as have most commenters. When you have an anonymous comment policy, you are saying to people that they can comment on your blog and you will respect their privacy. It therefore seems to me unethical to say you have an anonymous comment policy and at the same time to talk about the “inevitable unmasking” of specific commenters you disagree with. If you don’t want commenters to be anonymous, then set a policy of attributed comments and apply it fairly to everyone. If you do that though, you won’t need the no censorship policy since the comments will be few and bland.

Rick Stryker: I don’t follow your logic. I allow anonymous postings because it’s too hard to ensure posters are who they say they are, not because of any particular policy regarding privacy. But thanks for telling me what my ethics should be (!!!).

Moreover, I’m not working to find out who you are; it’s just an observation that few things anonymous forever. Remember – even Deep Throat’s identity was eventually revealed.

While we are piling on, let’s not forget this howler about the ACA that was so egregious that it required the combined innumeracy of Steven Kopits and Rick Stryker:

“So it costs us $140 bn per year to insure an incremental 3 million people. Only $35,000 per head. What a bargain!”

I haven’t heard them acknowledge their computational errors in that whopper.

Joseph,

Yes, I have been having trouble with my math lately. Maybe you can help me with a problem I’m wrestling with.

As you are not doubt aware, the Chebyshev counting function ph(x) = sum(log(p)) for p^k <= x so the the function gives each prime number p raised to the power of k the weight log(p). Riemann gave a formula for this function which is equivalent to

ph(x) = x – sum(over rho) x^rho/rho + sum(over all n) x^(-2n)/2n – log(2*pi) where rho are all the non-trivial zeros of the Riemann zeta function.

How can I use this formula to show that the non-trivial zeros generate a series of waveforms that spike at all primes and powers of primes? I'd appreciate any help you can give on this question.

rick your problem is quite simple. all you need to do is provide a proof for all the nontrivial zeros of the riemann zeta function. once you have that you are home free. you can’t do that?

Baffling,

What is a proof for all the nontrivial zeros of the zeta function? Proof of what?

proof of their existence in a systematic way. what you can’t do that?

Patience, Grasshopper. One must crawl before they can walk. First you must learn the ancient art of elementary school multiplication.

Apparently you are not able to help.

Robert Hurley, one problem Detroit did have is one party rule for decades and each decade got worse and worse. There may be other reasons Detroit failed but there is no doubt that the party in power didn’t solve them.

Updated demographics file. There’s lots more interesting things to discuss than minimum wage.

https://www.dropbox.com/sh/zrj4m2h8k5i4wud/AACkuYIvbY5v_wmlFLJyL2LUa/Demographics%20-%20US.xlsx?dl=0

Baffling,

I don’t know why you continue to pretend to know things that you don’t know.

It’s been well known for some time that not only do the zeros of the zeta function exist, but that there are an infinite number of them, and that the lie on the critical strip between 0 and 1 on the real axis and are symmetric about the line with real part 1/2, the critical line. Moreover, Hardy proved that an infinite number of the zeros of the zeta function are on the critical line (with real part equal to 1/2.) It’s also well known how to calculate the zeros. There is a function in mathematica to do so.

The question I asked here is part of the machinery of the Riemann hypothesis, which is the most famous and important unsolved problem in pure mathematics. The Riemann hypothesis asserts that all the zeros of the zeta function have real part 1/2. Fame and fortune awaits anyone who can solve it. My question was not to prove the Riemann hypothesis.

The question I asked does have a solution and is a result in analytic number theory that shows how the prime numbers are built up from the zeros of the zeta function. It was just a joke really.

rick, why do you feel so threatened when somebody challenges you? of course i know about the reimann problem, that is why i responded in a way to make the solution appear trivial. you pretended to act smart, so i pretend the solution is trivial. but what is funny is how you respond to such situations. classic.

Baffles,

You continue to pretend to know that things that you don’t. I can see why AS got so annoyed. Why don’t you solve the problem I posed if you really do know about this.

wall street journal says the same thing i did, so you guys got your feathers in a ruffle for no reason. but your apology is accepted rick.

http://online.wsj.com/articles/washington-scrutiny-of-supersize-iras-1412956814

Baffles,

No, the WSJ article did not say the same thing you did. What you said was

” i simply stated how you could undervalue assets and place them into tax advantaged accounts, where the profits are no longer taxed the way they were in a regular account. this is what romney did.”

The WSJ article did not say Romney did that. And it did not say someone could put undervalued assets in an IRA. As AS tried to explain to you, assets must be valued at fair market value. There is no “strategy” of putting undervalued assets into an IRA. The IRS will justifiably go after you if you try to do that. No one every accused Romney of this, but taxpayers who have attempted to undervalue assets in a traditional IRA which they then converted to a Roth IRA to avoid income taxes on withdrawal have been sued by the IRS and those taxpayers have lost, paying huge taxes and fines. At age 70.5, Romney will have to make large mandatory withdrawals on his IRA, and will pay taxes at the highest marginal tax rates.

The WSJ article is reporting some old news. Last November, the IRS announced that it will require additional reporting requirements for IRA custodians for assets that are hard to value. The article does not mention that the IRS will also impose those reporting requirements on 1099-R forms for distributions. This could be important for people who have overpaid taxes. You like to harp on assets going up. But they do down too. Some taxpayers have put hard to value assets in IRAs, such as real estate partnerships, only to have them become worthless. However, if the custodian does not update the fair market value and puts out a distribution with the wrong value, courts have held that taxpayers will have to pay on the phantom profits. The new reporting requirements might help with this situation.

rick, why would you bring up such a problem on an economics blog to begin with?

Baffles,

I think the more interesting question is why you would choose to comment on it.

ricky, a person asks a question on prime number theory on an ECONOMICS blog and then gets disgruntled when the question is ridiculed? really? somebody challenged your ability to do simple arithmetic, and you responded with a statement about reimann zeta functions? really? keep digging that hole…

Baffles,

I was in no way disgruntled. I was just pointing out yet again that you pretend to know things you don’t. The question is why you would choose to comment on it when you obviously know nothing about it. Why do you continue to think you can bluff your way through?

ricky, from the article

“Such moves include using account assets to buy nontraded stock or partnership interests that could balloon in value once inside the account, experts say.”

these are undervalued assets, especially if they are ownership stake in a distressed business in which you know a private equity firm is going to invest millions to rebuild the firm. i guess you and i simply disagree on what an undervalued asset is. but once again, your kind apology is accepted.

Baffles,

No they are not “undervalued assets.” They may be hard to value but they still have fair market value reporting requirements. And they can go to zero just as they can increase substantially. AS already provided the example of stock options so the article is not saying anything that he didn’t already explain to you. Either you won’t understand or you can’t understand.

ricky,

so you do not understand the concepts of undervalued assets, distressed assets, and illiquid assets with respect to fair market values. and you do not understand the silliness of posing problems of prime number theory on an economics blog. please continue to expose your deficiencies, they make me chuckle.