In Jim’s review of the Q3 advance release, he noted disappointments in residential investment. What is also worrying is the deceleration in real business fixed investment growth, and the decline in equipment investment.

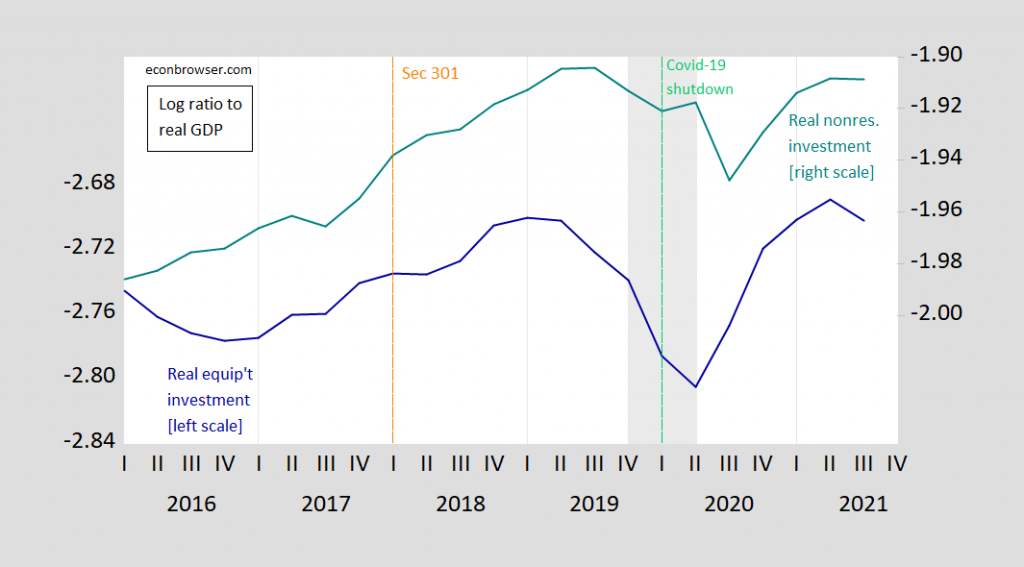

Figure 1: Gross equipment investment to GDP log-ratio (blue, left scale), and gross nonresidential investment investment to GDP log-ratio (teal, right scale), all in Ch.2012$, SAAR. NBER recession dates shaded gray. Orange dashed line at 2018Q1 for announcement of Section 301 action; green dashed line at 2020Q1 for imposition of public health measures. Source: BEA 2021Q3 advance release, NBER, and author’s calculations.

Both series, as a log-ratio of real GDP, are higher than they were at the last NBER peak (2019Q4) which occurred before the onset of the pandemic. Indeed, equipment investment was higher than in 2019Q3.

Why might we have observed this state of affairs, even as the economy was seemingly booming as of 2019Q4? Recalling that fixed investment is a forward looking variable, we know that it is sensitive to expectations and uncertainty. And as noted elsewhere, empirically investment does seem sensitive to policy uncertainty (see also here), as well as to other economic uncertainty.

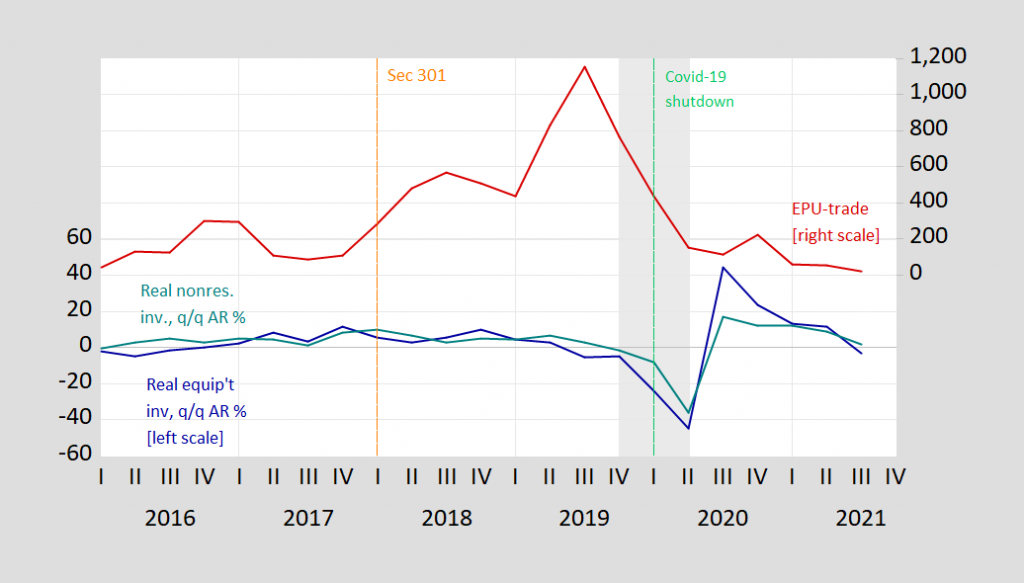

Figure 2: Annualized q/q growth rate of gross real equipment investment to GDP ratio (blue, left scale), and gross real nonresidential investment investment to GDP ratio (teal, left scale), SA, and Trade Policy Uncertainty (red, right scale) . NBER recession dates shaded gray. Orange dashed line at 2018Q1 for announcement of Section 301 action; green dashed line at 2020Q1 for imposition of public health measures. Source: BEA 2021Q3 advance release, policyuncertainty.com, NBER, and author’s calculations.

Investment growth went negative as trade policy uncertainty spiked. By the way, while nonresidential investment seems high as a ratio to GDP, it’s important to recall that this is gross investment being reported. The 2019 decline in net investment was more profound, from an already pretty low level, and given the trend shift toward faster depreciating equipment, it’s likely net investment to GDP looks quite a bit lower.

This makes me wonder whether — had we not had the Covid-19 pandemic strike — we would’ve still encountered a recession. After all, the 10yr-3mo spread has been a pretty reliable precursor of recessions over the past three-quarters of a century.

https://fred.stlouisfed.org/graph/?g=z21W

January 15, 2018

Shares of Gross Domestic Product for Private Fixed Nonresidential & Residential Investment Spending, Government Consumption & Gross Investment and Exports of Goods & Services, 2017-2021

https://fred.stlouisfed.org/graph/?g=z21I

January 15, 2018

Shares of Gross Domestic Product for Private Fixed Nonresidential & Residential Investment Spending, Government Consumption & Gross Investment and Exports of Goods & Services, 2017-2021

(Indexed to 2017)

https://fred.stlouisfed.org/graph/?g=AuPM

January 15, 2020

Shares of Gross Domestic Product for Private Fixed Nonresidential & Residential Investment Spending, Government Consumption & Gross Investment and Exports of Goods & Services, 2020-2021

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=lLwj

January 15, 2018

Shares of Gross Domestic Product for Private Fixed Nonresidential & Residential Investment Spending, Government Consumption & Gross Investment and Exports of Goods & Services, 2007-2021

(Indexed to 2007)

https://fred.stlouisfed.org/graph/?g=r4MU

January 4, 2018

Interest rates on 10-Year Treasury Bond minus 3-Month Treasury Bill, 2017-2021

Not to let the last guy off the hook, but policy uncertainty may well have been high because the new guy was likely to represent big changes, or not, depending on the outcome of Senate races. So not a binary choice, but a whole range of potential for change. And even seen as a binary choice, the Biden policy mix was less well understood than the nonsense pursued under the last guy.

Since investment is also not a binary choice, or even a continuum of “how much” choices, but a choice suited to policies not yet established, keeping powder dry makes sense. Then would come catch-up investment, were it not for other problems.

I doubt this little guess of mine could be demostrated to be a feature of the election cycle because so much else goes on in business cycles. But the odds of a big policy swing between the last guy and Biden were substantial. Holding back on investment made sense.

And isn’t fixed investment another of those unreliable recession indicators? If it were reliable, we’d have had recessions around 1987 and 2016.

And the Sahm Rule was benign in 2019.

macroduck: The 10yr-3mo spread first inverts on a monthly basis in 2019M06; typically, the spread predicts at about a 12 month horizon — or at least that is what is typically tested for. 12 months from 2019M06 is 2020M06…The Sahm Rule as I understand it is a concurrent, not leading, indicator.

Yep. I’m perfectly happy to believe we might have been on the way to recession in 2020. I’m just thinking back to the recent discussion of Blanchflower and friends recession claim. There are lots of data series which sometimes provide indications of coming recession, but aren’t reliable. Non-residential fixed investment seems to be one of them.

The curve is more reliable. I’d have greater faith in the curve if the Fed wasn’t busy flattening it. On the assumption that we will remain in a low-rate regime for another few cycles, we’ll eventually have information about the curve’s reliability when the Fed is flattening it.

md,

Yeah, indicaters sometimes indicate and sometimes they do not. Several decades ago the late Paul Samuelson famously wisecracked “The stock market has forecasted nine out of the last six recessions.”

Speaking of the stock market, while apparently Biden’s approval rating on the economy has dropped something like 20% in the last month, the stock market is again hitting all time highs, the measure Trump approves of the most. Heck, the Dow is at something like 35,913, just shy finally of that long-awaited Glassman-Hastett 36,000. But, hey, if it hits it tomorrow or in the next few days, count on the Trumpistas telling us about high gasoline prices, and that does seem to be what is on the minds of a lot of voters in Viriginia, gag.

I hope Menzie doesn’t feel like I’m subtracting from his blog by taking away from the focus or going off-topic all the time. I think Menzie himself has interest in these things, but probably would rather readers like me not “mess up” or, I don’t know how to say it, “finger paint” all over his blog when the main focus is economics and finance. Anyways….. he’s always been kind on it. But I thought this was interesting and worth keeping an eye on—specifically Harriet Hagemon and the race there, and that Wyoming Public radio might be one of the better places to “watch this space” or pony race or whatever:

https://www.wyomingpublicmedia.org/politics-government/2021-09-10/hageman-is-trumps-pick-to-face-cheney

I’m very sad to say my money is on Hagemon winning, but I hope my cynical outlook on human behavior proves to be wrong. I dream and fantasize everyone here telling me I am an idiot when the election is held, though expect to be depressingly correct.

Wasn’t that 2017 tax cut for rich people supposed to lead to a yuuuge surge in business investment? Oh well – the pretend economists on Faux News lied to us again!

Menzie

This comment is from just another frog living in the pond – i.e. I am not someone that pretends to understand the business cycle – but I always thought that the Trump economy was a sham fueled by tax cuts for rich people and stock buybacks. The rural economy and Trump’s rural voters got billions via a farm bailout via the Commodity Credit Corp (this was up and beyond the usual crop subsidizes and crop insurance and estimated at 40% of farm income in 2019 and 2020), (Also – note that Sonny Perdue was the worst USDA Sec in history – he destroyed the agencies he didn’t care to hear from Ag Econ and Climate Change by forcing them to move to Kansas City; got a sweetheart deal from ADM for himself; and gave out billions in taxpayer $$$ to large commodity producers – all forgotten by GOP now – https://www.nasdaq.com/articles/adm-sold-grain-plant-to-former-usda-head-for-fraction-of-estimated-value-report-2021-06-29)

Before it goes down the memory hole – we should also note that Trump never got an infrastructure bill despite having majorities in House and Senate and left a legacy of failed trade deals amidst the constant corruption and near bankruptcy of the U.S..

BTW – I hope some students from ag school wander over and take your classes – The only thing I can remember my ag econ teacher saying was “buy low and sell high and you will always make money.” This was not at UW and granted my young mind was seeking any nugget of information that I thought was important.

Thanks

“Archer Daniels Midland Co ADM.N sold a grain storage plant worth millions of dollars for $250,000 to Sonny Perdue weeks after then-President Donald Trump tapped him to lead the U.S. Department of Agriculture, the Washington Post reported on Tuesday. ADM, one of the world’s largest grain traders and food companies, had paid more than $5.5 million for the South Carolina property six years earlier, the Post said.”

That is quite the find there! And I thought Wilbur Ross was corrupt.

Keep up the excellent comments as we need someone here that actually gets ag econ (as opposed to our Usual Suspects who misrepresent these issues all too often).

Having worked on a few intercompany leasing issues, I will say estimating the rate of economic depreciation. Now I can see such a rapid decline in the market value of an asset if it were computer mainframes in the 1990’s. But rapid depreciation for a warehouse? Maybe CoRev and Sammy will mansplain how this is credible for us!

This Purdue ADM deal was covered in great detail by this WaPo discussions. Opinions of the value of the property may differ but the lowest appraisal came in at $2.4 million whereas one valuation put it at $5.7 million. Of course ADM tried to argue that the $0.25 million purchase price was perfectly legit. Then again ADM is notorious for shady business practices – so hey!

https://www.washingtonpost.com/climate-environment/interactive/2021/sonny-perdue-adm-land-deal/?wpmk=1&wpisrc=al_news__alert-politics–alert-national&utm_source=alert&utm_medium=email&utm_campaign=wp_news_alert_revere&location=alert&pwapi_token=eyJ0eXAiOiJKV1QiLCJhbGciOiJIUzI1NiJ9.eyJjb29raWVuYW1lIjoid3BfY3J0aWQiLCJpc3MiOiJDYXJ0YSIsImNvb2tpZXZhbHVlIjoiNTk2OTk2NTg5YmJjMGY2ZDcxYzRlYTNiIiwidGFnIjoid3BfbmV3c19hbGVydF9yZXZlcmUiLCJ1cmwiOiJodHRwczovL3d3dy53YXNoaW5ndG9ucG9zdC5jb20vY2xpbWF0ZS1lbnZpcm9ubWVudC9pbnRlcmFjdGl2ZS8yMDIxL3Nvbm55LXBlcmR1ZS1hZG0tbGFuZC1kZWFsLz93cG1rPTEmd3Bpc3JjPWFsX25ld3NfX2FsZXJ0LXBvbGl0aWNzLS1hbGVydC1uYXRpb25hbCZ1dG1fc291cmNlPWFsZXJ0JnV0bV9tZWRpdW09ZW1haWwmdXRtX2NhbXBhaWduPXdwX25ld3NfYWxlcnRfcmV2ZXJlJmxvY2F0aW9uPWFsZXJ0In0.GYrPKDFS6GbpF_zZWa-HhbNKJFW5Uw7XB5wsd2YCddQ

@ James

Sir, if this wisdom and information/links comes from a “frog in the pond”, I think we need many more blog comments here from the frogs in the pond, and I hope I am not stepping out of bounds when I say, I venture a guess Menzie feels the same way. More ribbit ribbit sounds please.

Poor Stephen Miller is having a bad day as he is scared that the Supreme Court will slash Texas’s little end run of the Constitution and Roe v. Wade:

https://www.foxnews.com/politics/abortion-activists-at-supreme-court-are-aiming-for-roe-v-wade-part-2-in-texas-stephen-miller-warns

Sotomayer in my view is the best justice there since the passing of RBG and she is convincing even Trump’s appointees that this little Texas scheme needs to be struck down.

all americans should be concerned about the game texas is playing with the law(s). this texas abortion law should have been reviewed and deemed unconstitutional immediately. texas is arguing that federal laws are not applicable if they only let citizens bring the complaints to court. it is ridiculous. as one court observer made, texas is arguing that it should be permitted to pass a law prohibiting the desegregation of schools, if the law is enforced by citizen lawsuits. federal law does not apply in texas according to the state. i imagine even rick stryker cannot contort himself in such a way as to actually defend the constitutionality of this law. it was simply meant to create a months long block on abortions in texas as it ran through the system. this is what i call abuse of the courts. and the supreme court fell for it.

The oral arguments this week seem to be suggesting a couple of Trump’s appointed judges are about to come down hard on this Texas canard.