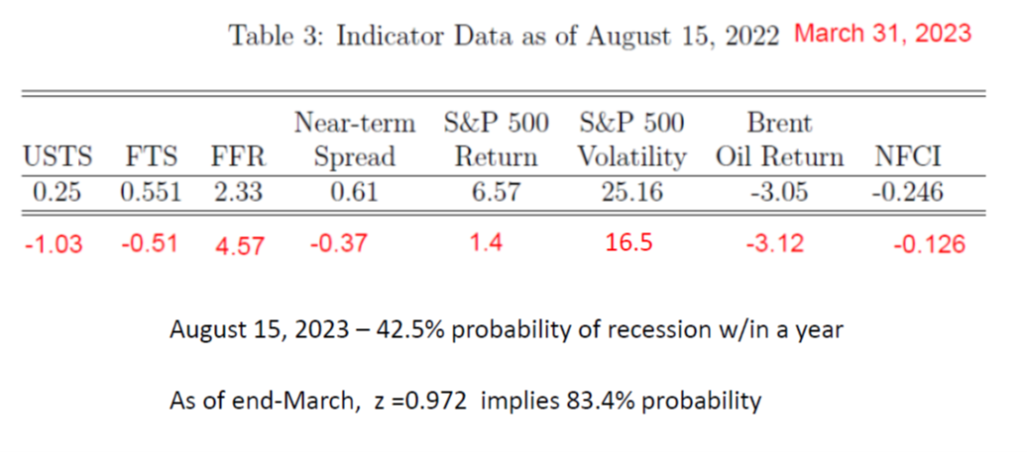

About 83% probabiity within a year: Here’s the edited version of Table 3 of Ahmed-Chinn (2022), plugging in March 31, 2023 values (in red), which I prsented in a UW Milwaukee Department of Economics seminar today (thanks to my gracious hosts, who provided tons of great comments/criticisms).

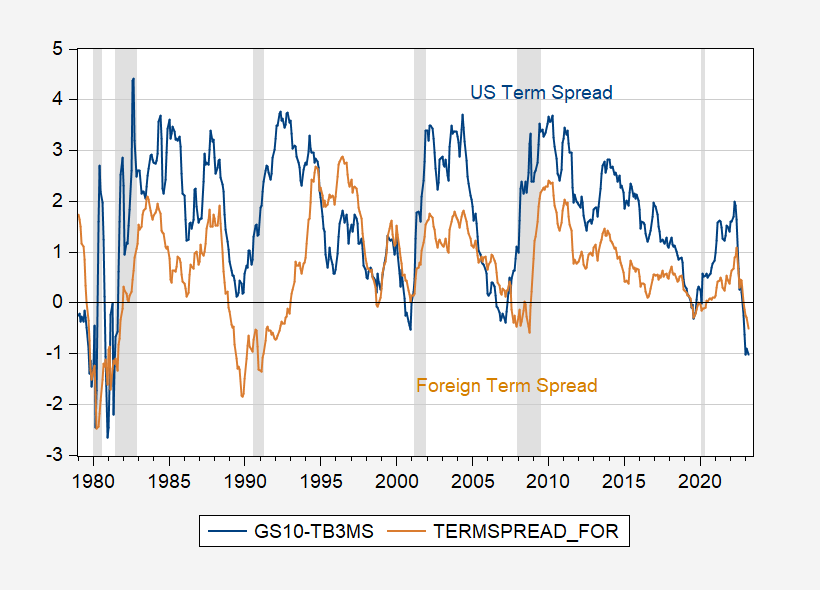

The US and Foreign 10yr-3mo — as is the near term — inversion are now deeper while the current Fed funds rate is higher.

Figure 1: US 10 yr-3 mo term spread (blue), GDP weighted foreign (Canada, Germany, Japan, UK) 10 yr-3 mo term spread (tan), and NBER defined peak-to-trough recession dates shaded gray. Source: Fed via FRED, OECD, NBER, and author’s calculations.

So???? This equation is a illusion based on central banking messing with the short end of the curve. Nothing more or less. In the past, long term rates would decline with looming recession in face of years long path of central banks lifting rates. I see nothing now. Long term rates have declined back to trend while central banks have tried to raise the short end. Of course your 83% nonsense is a false flag. It’s a fiction.

GREGORY BOTT: The estimates are an empirical observation; you can take issue with (1) the estimation procedure, or (2) the robustness of the results, or (3) the causal interpretation. However, to argue the results are irrelevant because you don’t agree with the causal interpretation is plain stupid and unscientific.

“Of course your 83% nonsense is a false flag. It’s a fiction.”

The point was not to disagree, but to insult and demean:

https://en.wikipedia.org/wiki/False_flag

A false flag operation is an act committed with the intent of disguising the actual source of responsibility and pinning blame on another party.

Exactly.

Menzie, I was remembering just now, how when I was a “pretend” teacher, when I went over to northeast China, (I didn;’t have great teaching credentials like you and your UW colleagues, but my father had his Master’s in education and drilled it into my sister and me how Education was nearly a religion…….. Do you know why all your UW friends gave their “comments and criticisms”??? Like My northeast China colleagues, they criticized you because they had affection towards you.

Both U.S. and foreign term spreads went negative in 2019, prior to the Covid recession. There were other signs of financial stress at the same time. The Fed spooked, ended its tightening and then cut rates. It was the second time the Fed saw evidence that unwinding a prolonged period of ultra-easy monetary policy would be fraught with problems. The taper tantrum was the first. The current tightening round, for all its aggression, has had relatively few financial blow-ups. So far, anyhow.

There is alway the risk that financial plumbing will break. The Fed has learned a good bit about dealing with plumbing problems since Continental Illinois failed. I’m wondering when insurance failure will become a problem. Don’t think the Fed’s bag of tricks would work on insurance failure.

Russia has broken through the Oil Price Cap

https://www.princetonpolicy.com/ppa-blog/2023/4/15/russia-has-broken-through-the-oil-price-cap

“I have criticized the price cap and the EU embargo as the wrong policy from the start — a year ago now. I have not changed my views.”

Get a clue little Stevie – no one gives a damn about your “views” or the kind of babbling displayed in your latest worthless post.

Let’s see – the price of oil in the North Sea is $84 a barrel so if Russia is getting only $66 a barrel, it would seem to anyone with a brain that sanctions are having the desired effect. Except Stevie got an extra dose of ego when God was passing out brains.

Yea – congrats on another completely idiotic post.

I think we all realize by now NEVER to trust a word little Stevie says. Matt Phillips (Axios Markets) pens

The price cap on Russian oil seems to be working

https://www.axios.com/2023/04/11/russian-oil-price-cap-working-treasury

Russia is still shipping crude, but its oil revenues have plunged, fulfilling the twin goals of the energy price cap the U.S. government devised last year.

Why it matters: After it launched its war on Ukraine in 2022, Russia’s position as a major oil supplier to global markets was seen as a constraint on the West’s ability to punish Moscow.

Now, the price cap may be helping to solve that problem.

The latest: There are fresh signs that Russia’s finances are in trouble.

Russian oil and gas revenues dove by 45% in the first quarter, as its deficit exploded due to the costs of the war.

The average price for Russia’s Urals grade crude oil was $47.85 a barrel in March, down from $89.05 last March.

In a sign of the economic stress Russia faces, the ruble just suffered its worst week of the year, hitting its lowest level against the dollar since April 2022.

Background: Last year global oil prices were soaring — $5 gasoline! — amid widespread uncertainty about access to supplies.

Effectively, Russia was benefiting from a surge in prices that its own illegal invasion had set off.

What they did: In December, the European Union — long Russia’s largest buyer — imposed an embargo on Russian oil (the U.S. did so back in March 2022)

Simultaneously, the G7 group of advanced economies, along with allies, agreed to a never-before-attempted plan to impose a price cap of $60 on Russian crude oil that the U.S. Treasury Department had spearheaded.

How it works: In practice, the plan is actually a series of rules and restrictions on companies like shipping giants and insurance providers — almost all based in the West — that are the backbone of the global oil market.

Basically, shippers and insurers are required to get those buying and moving the oil to officially promise — in signed “attestations” — that the petroleum was sold below $60.

Violations would open companies to potential criminal and civil penalties.

The big picture: Given the obvious potential loopholes in the plan — for instance, people simply lying about paying less than $60 for Russian oil — there was a fair amount of skepticism that this price cap plan would work.

But the early evidence suggests that the cap, in conjunction with other sanctions, has been pretty successful at keeping Russian oil flowing — while reducing the amount of money Russia reaps from its sale (predominantly to China, India and Turkey).

What they’re saying: “Most people would say it’s probably helped reduce revenues,” says Robert McNally, president of consulting firm Rapidan Energy Group, who served as an energy advisor in the administration of President George W. Bush. “It does give some leverage to India and China when they’re negotiating with Russia.”

On the other hand: Kevin Book, who heads up energy research at consulting firm ClearView Energy Partners, emphasizes that it remains to be seen how well the cap would operate if energy demand from China — where the economy has struggled to recover from the COVID crisis — fully bounced back.

“On the surface, it looks like both goals are being met,” Book says. But “it’s hard to see below the surface,” he adds.

The bottom line: There are always a number of factors at play in market prices, making it essentially impossible to prove something is “the reason” a price is moving one way or the other. But the red ink in Russia’s budget suggests this policy is performing pretty well.

Evidence little Stevie failed to mention in his latest blog rant. Of course little Stevie in other comments has not how Russia’s oil revenues have fallen as Stevie tries to tell us how enormous the Russian deficit has become. Of course Stevie tends to grossly overstate that issue.

But come on Stevie – you can’t have it both ways. Either oil revenues have dropped a lot which means your last blog post was dishonest or they haven’t – which undermines your deficit cheerleading. Princeton Stevie pooh – a flip flop artist to the core.

This is Stevie’s evidence that the Price Cap has been a failure?

The collapse of the Price Cap is also evident in the Urals discount, the difference between the Brent and Urals oil prices. Historically, the Urals oil price has averaged about $1.50 / barrel less than Brent. This gap widened to more than $35 / barrel in the early days of the war, but narrowed to around $23 / barrel last fall. The Price Cap re-opened the gap to near $30 / barrel. In the last two weeks, however, the gap has once again closed, now back to $20 / barrel, the smallest since early September.

Wait – under normal markets, this discount is a mere $1.50 but now it ranges from $20 to $35? If that is a failure – WTF is success?

Come on Stevie – we get the fact that you write the dumbest things ever.

Exactly. The purpose of the cap was to ensure that Russia had to sell at a drastic discount (that was and still is a huge success) and make sure that Russian government lost substantial oil/gas incomes (that was and still is a huge success). The idiocies from Steven tries to move the goal post and pretend that the $ price cap in itself was the purpose. The Biden team are not idiots so they expected that there would be some work arounds on the price cap. They also understand that an effective blocking of almost all Russian oil would increase world oil prices way too much to be worth it. Nobody with just a minimal amount of knowledge would expect that we could put a death grip stranglehold on Russia – and that would be an insane goal against a country with the largest nuclear arsenal in the world. Biden is playing this exactly as it should be and with great success.

Anyway, Russia’s main problem on the battlefield cannot be solved by more money, nor are they caused by a lack of money. They have already wasted a large fraction of their best soldiers, and currently are decimating the remaining Wagner professional soldiers in an insane offensive to take over Bakhmut (which has no strategic value). By the time they have to defend against a Ukrainian offensive they will have to man their defensive trenches with poorly trained and unwilling soldiers. Russian stocks of weaponry are severely reduced and their domestic production severely hampered by supplies (not lack of money). Purchases of high quality weapons from the few potential foreign sellers are not limited by money, but by lack of stock and export capacity. Any additional severe degradation of Russias economy would provide limited strategic military gains but have large political risks. We don’t want Russia to collapse, we want them to be slowly degraded.

It is not a huge success. Not today. The Urals discount — the difference between Brent and the Russian western Urals price — was $35 / barrel at the start of the war. Today it is $20 / barrel, the smallest since September and almost the smallest since the start of the war. At the start of the war, I would note, there was no EU embargo and no Price Cap. The Urals discount is now smaller with both the embargo and Price Cap in place.

Indeed, Russia can now bank $10 / barrel more in revenues than it did in the 2015-2021 period on average. This suggests the Price Cap is no smashing success. And that’s at current Brent oil prices. If the Cap has been broken, and we would expect this development over time, then imagine Russian revenues if Brent starts heading towards $140 / barrel, as Pierre Andurand forecasts.

The Price Cap as designed by Treasury is yet another example of disastrously bad policy analysis and structuring under Yellen leadership.

Steven Kopits: Welcome back. I was wondering what your view was about (1) the 2022H1 recession thesis, in the wake of recently released data on monthly GDP, GDP+, coincident index and (2) what your view on likely employment trajectory in 2022H1 given the new preliminary benchmark released by Philadelphia Fed.

It is not a huge success? According to who? Stevie – no one trust your judgment or even your integrity. A $20 per barrel is rather substantial.

Now in another line of discussion you keep telling us how a lack of tax revenues (driven in part by this) will bankrupt the Putin government.

So yea – you have contradicted yourself massively here. Then again – no one really cares what you think.

Not back. Just visiting. The US economy is hanging in. Don’t know for how long. Clearly there is some sort of correction coming at some point, but don’t know when. US oil consumption has been up lately, and that’s generally a positive sign (or at least non-negative.)

Here’s the post from today:

Russian Oil Production: A Full Recovery in Sight

https://www.princetonpolicy.com/ppa-blog/2023/4/16/april-russian-oil-production-a-full-recovery-in-sight

Kudos to the Chinese, by the way. They are outplaying us diplomatically at the moment. Nice if they didn’t destroy the world as we know it.

Steven Kopits: But you hung your hat on the Philadelphia Fed’s (not the “Fed’s” as you incorrectly wrote) assessment using QCEW data that there was a recession in 2022H1. Where do you now stand on that declaration?

Dont be such a moron and don’t insult us as we were. You babbeling may sound smart to you, but nobody here is going to be fooled by your selective comparison dates and focus on things that are irrelevant. Here is the relevant chart:

https://www.iea.org/data-and-statistics/charts/prices-for-brent-urals-crude-and-diesel-in-northwest-europe-2021-2022

Ural and North Sea Brent are supposed to sell at the same price and were until the war created uncertainty in delivery. They are not at this time. If you don’t understand how that is connected to the current policies that is either be because you are willfully ignorant or outright stupid – none of which I can help you with.

Given how much I loathe Mike Jabba the Hut Pompeo, this is good news:

https://www.msn.com/en-us/news/politics/mike-pompeo-won-t-run-for-president-in-2024-says-future-run-possible/ar-AA19SCsL?bncnt=BroadcastNews_TopStories&ocid=msedgdhp&FORM=BNC001&pc=U531&cvid=4d0df0ff1e234d709a8fee7bad86825a&ei=26

Mike Pompeo will not run for president in 2024 because of “personal” reasons, the former secretary of state and CIA director announced Friday.

Personal reasons? As I Mikey could not stay on that diet of his. He’ll have six Big Macs and three large fries please.

And there’s this:

https://www.kansas.com/news/politics-government/article264963724.html

Snowball, meet Hell.

It seems to the Richie Rich rightwing crowd Clarence Thomas can do whatever he wants:

https://www.msn.com/en-us/news/opinion/the-conservative-movement-is-a-giant-exercise-in-plutocrat-financed-astroturfing/ar-AA19TS3C?ocid=msedgdhp&pc=U531&cvid=3a1b447026ac41a082a6c5388b26044b&ei=19

The “Conservative Movement” Is a Giant Exercise in Plutocrat-Financed Astroturfing

The scandal of Clarence Thomas accepting enormous gifts from billionaire Harlan Crow is a reminder of just how little mass support the Right has. Take away the rich financiers and there’s not much of a conservative movement to speak of.

In the wake of ProPublica’s reporting on Supreme Court justice Clarence Thomas and the decades’ worth of undisclosed gifts he has received from billionaire Harlan Crow, a cadre of conservative pundits and operatives have rushed to play defense. Early out of the gate was the Manhattan Institute’s Ilya Shapiro, who declared just after the story was published, “Unless Harlan Crow has some business before the Court, the @propublica report about Justice Thomas is a big breathless nothingburger.” Responding to the revelation that Crow maintains a bizarre collection of Nazi memorabilia — including, among other things, two paintings by Adolf Hitler and a signed copy of Mein Kampf — conservative editor Jonah Goldberg commented: “Harlan Crow is a deeply honorable, decent, and patriotic person,” adding that the “garden of evil” on his property represents “an attempt [to] commemorate the horrors of the 20th century in the spirit of ‘never again’” (a defense that elided the absence of Nazis from said “garden”). Sounding like a man trying to reassure himself, Goldberg later added: “My conscience is clear. Harlan Crow is a good man and the farthest thing from a Nazi.” The chorus of tortured Harlan Crow apologism was soon joined by the likes of former National Review editor David French and racist pseudoscientist Charles Murray. As Andrew Perez reports, such defenses are not exactly incidental. Crow’s wife sits on the board of the Manhattan Institute, which just so happens to lobby the Supreme Court. Crow is an investor in Goldberg’s outlet the Dispatch, and Goldberg is a senior fellow at the American Enterprise Institute (AEI), where Crow sits on the board of trustees. Both (like French) have a relationship with the National Review, while Murray has long been affiliated with the AEI and has dedicated several of his books to Crow.

Continue reading

Menzie Chinn,

I’ve been told of similar approaches utilized by analysts and traders in fixed income markets some number of decades ago. My understanding was firms were simply expanding the work of Estrella & Mishkin by analyzing foreign yield curves. I think it was all fairly quickly abandoned by the few firms using such techniques during those times as the dot com bubble provided a shift back towards – for lack of a better phrase – ‘real’ analysis.

Difference between Urals and and Brent oil price from December 31, 2021 to April 10, 2023(in U.S. dollars per barrel)

https://www.statista.com/statistics/1298092/urals-brent-price-difference-daily/

I have provided this chart since every here knows that whatever Princeton Steve writes in not to be trusted.

https://econbrowser.com/archives/2023/04/48498#comment-297294

April 14, 2023

Deep in the bowels of ancient Chinese philosophy there is something missing: the notion that an idea belongs to one person, and not to anyone else.

Copying, counterfeiting, or stealing intellectual property, simply do not fall into the category of Things One Should Not Do.

Until, and unless, that changes – which is highly unlikely – there will be problems in trade relations with the West….

[ These remarks are severely prejudiced, false and malicious. ]

https://www.nytimes.com/1982/04/18/books/the-china-the-west-knew-nothing-about.html

April 18, 1982

The China The West Knew Nothing About

By Jonathan Spence

SCIENCE IN TRADITIONAL CHINA: A Comparative Perspective.

By Joseph Needham.

ESSAYS ON CHINESE CIVILIZATION.

By Derk Bodde.

Edited and Introduced by Charles Le Blanc and Dorothy Borei.

JOSEPH NEEDHAM’S immense work, ”Science and Civilization in China,” which will probably total some 20 separate volumes when completed, * is the most ambitious undertaking in Chinese studies during this century. Ranging across the fields of chemistry and mathematics, navigation and medicine, botany and mechanics among many others, the work covers each scientific discipline from the earliest periods of Chinese history up until the middle of the 17th century, when China joined in the general dialogue of world science.

So huge is the work, and so complex and varied the topics, that few except specialists can have read through all that has appeared to date. And though an abbreviated version of the whole is currently being produced by Colin Ronan, that too remains technical in focus and intent. For those who want a taste of Mr. Needham without too much effort, this short volume entitled ”Science in Traditional China,” which is drawn from his recent Ch’ien Mu lectures in Hong Kong, will prove the perfect introduction….

* Twenty-seven books (1954-2008)

Jonathan Spence teaches modern Chinese history at Yale.

https://www.nytimes.com/1971/06/20/archives/joseph-needham-the-real-thing.html

June 20, 1971

Joseph Needham, the Real Thing

By Richard Boston

Our vocabulary for describing what is great has been so impoverished by the misuse of Hollywood publicists (Stupendous!!! Colossal!!!) that it is hard to find suitable words to describe the real thing. And Joseph Needham is the real thing: he is one of the great intellects of our time. Merely to call him a polymath gives no idea of his achievement: a fellow scholar at Cambridge University, a man who is not given to making rash judgments and who is well‐versed in the British art of understatement, recently commented to me that you have to go back to Leonardo before you can find anyone with such a grasp of the whole of human knowledge. History, philosophy, religion, mathematics, astronomy, geography, geology, seismology, physics, mechanical and civil engineering, chemistry and chemical technology, biology, medicine, sociology, economics…. just to list the topics covered in his massive “Science and Civilisation in China” would take more than the space of this article (the summary of contents in the publisher’s prospectus covers more than 12 closely printed pages.) And, at the same time as dealing with China, throughout the work Needham compares and contrasts with what was going on all over the rest of the world. In spite of Hollywood, it is stupendous, it is colossal.

Joseph Needham, Fellow of the Royal Society and holder of the Brilliant Star of China, was born in 1900, the son of a doctor. He took his degree at Cambridge, and in 1924 became a Fellow of Gonville and Caius College, of which he is now the Master. In the same year he married a fellow‐student and fellow‐biochemist, and later Joseph and Dorothy Needham became the first husband and wife both to be made Fellows of the Royal Society….

https://www.nytimes.com/1995/03/27/obituaries/joseph-needham-china-scholar-from-britain-dies-at-94.html

March 27, 1995

Joseph Needham, China Scholar From Britain

By Sarah Lyall

Joseph Needham, an extraordinarily prolific British biochemist and scientific historian who spent decades researching, writing and editing a monumental history of scientific development in China, died on Friday. He was 94 years old and lived in Cambridge.

His death was announced yesterday by Gonville and Caius College at Cambridge University, with which he was associated for 70 years. The cause of death was not announced.

Dr. Needham was a lecturer, professor and author of more than a dozen books on a broad range of topics. The crowning achievement in his long and achievement-rich life was “Science and Civilization in China,” which was conceived in the 1940’s as a short book but which grew so extensive that he and dozens of associates worked on it for the next five decades.

“Science and Civilization in China” so far comprises more than 16 published books * extending to tens of thousands of pages. The project, which is not expected to be completed until at least the year 2000, covers every possible facet of its subject, including chemistry, mathematics, navigation, medicine, botany, mechanics, civil engineering and agriculture.

Students of China consider the work a singular achievement and have compared Dr. Needham’s work to that of Darwin and Gibbon in its size and scope. …

* Twenty-seven books (1954-2008)

Watch how Trumpian traitors react to criminal behavior these days. Yes Jack Teixeira committed serious crimes but Tucker Carlson praises him was some sort of whistleblower:

https://www.msn.com/en-us/news/world/russian-host-praises-colleague-tucker-carlson-over-jack-teixeira-stance/ar-AA19U6Ml?ocid=msedgntp&cvid=d3e38ffa7e5d447f9fcd2dbeb481f24f&ei=9

A Russian state television host has praised Fox News anchor Tucker Carlson over his stance on Jack Teixeira’s arrest.

Oh oh – who else can play this game? Marjorie Taylor Greene and JohnH!

Per pgl, citizens have no right to know what the government is doing in their name…particularly when the government is lying about its involvement in a proxy war with a nuclear armed enemy. And pgl has the chutzpah to pose as a Democrat!

Ahhh – Putin’s little pet poodle was left out of this traitor’s little chat group. Come on Jonny – admit it. You were hoping they had pictures of old Ukrainian ladies getting beheaded.

“no right to know what the government is doing in their name”

Are we talking about what Putin is doing in the name of Russian citizens? Oh wait – Russians have no rights at all and Ukrainians deserve to die in Jonny boy’s little world. For a little pet poodle – Jonny boy is one disgusting piece of garbage.’

Classic misread from Russia. Though considering Putin’s regime is collapsing……neocons will be in trouble.