Reader Steven Kopits writes:

Two down quarters in 2021. Typical definition of a recession. I don’t believe I have declared a recession since.

No negative quarters in 2021. I think Mr. Kopits meant 2022. No two consecutive quarters of growth in 2022 (which was Mr. Kopits’ assertion, as late as January 2023, after repeated declarations).

Here the data, as of 2024Q2 annual update.

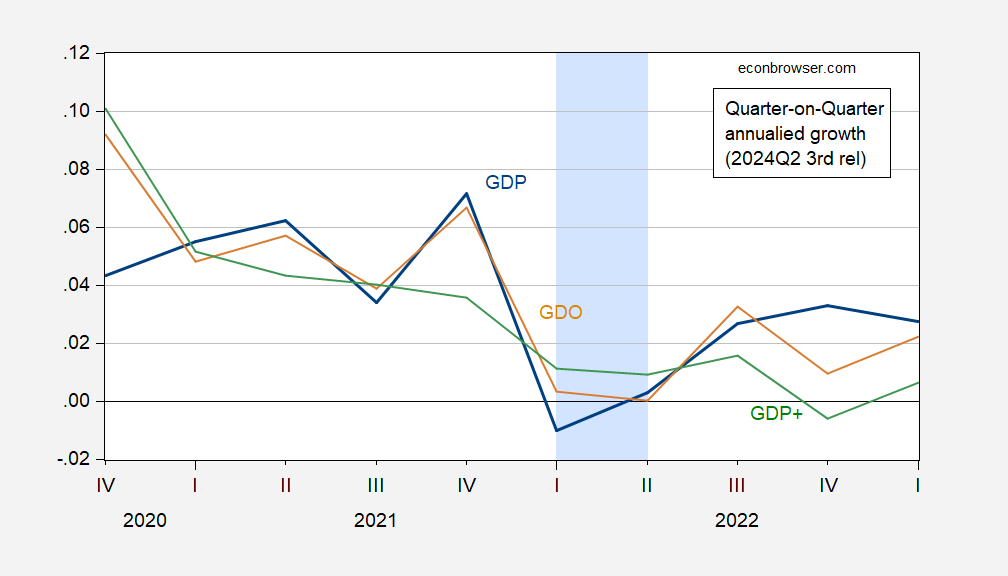

Figure 1: Quarter-on-Quarter annualized growth for real GDP (bold blue), GDO (tan), GDP+ (green), calculated at log first differences times four. Light blue shading denotes a purported recession. Source: BEA 2024Q2 3rd release/annual update, Philadelphia Fed, and author’s calculations.

This graph demonstrates why the NBER’s Business Cycle Dating Committee does not put primary reliance on GDP as an indicator of recession. (Note that as of the current vintage, there was no two-consecutive-quarter decline in real GDP; but there was a two quarter decline in the 1947 period, without a recession declaration.)

Antoni claims his naive approach is how business cycles have been presented in economic textbooks for a hundred years. Of course quarterly data on real GDP did not being until 1947. And then there is:

https://www.nber.org/books-and-chapters/measuring-business-cycles#:~:text=Chapter%204:%20Dating%20Specific%20and%20Business

Measuring Business Cycles

Arthur F. Burns & Wesley C. Mitchell,

Published Date January 1946

So the two economists who pioneered this work published their thoughts not 100 years ago but in 1946. Then again EJ Antoni is so incompetent that I doubt he even knows how Burns and Mitchell were.

“Note NBER does not date a recession to 1947, when there were two consecutive quarters of negative growth.”

What you noted in that earlier post. It is true that real GDP in 1947Q3 was lower than it was in 19471Q1. The decline was less than 0.5%. Steven Koptis declared this to be a recession because he is almost as dumb as EJ Antoni!

2022, yes.

To me, that was still a technical recession. Sorry if we disagree. (That’s suppression v recession.) On the other hand, if we use the same standard, it’s hard to argue that Q2 could be the start of a recession if Q3 is tracking 2.5-3.0% GDP growth.

https://www.calculatedriskblog.com/2024/10/q3-gdp-tracking-around-3.html#google_vignette

Steven Kopits: I thought the definition of a “technical recession” (I think “rule-of-thumb recession” is better) is “two consecutive quarters of negative GDP growth”. We now have data indicating there was no sequence of negative growth quarters. So what remains of the “technical recession”?

Clearly, neither the pandemic suppression nor the 2022 technical correction count as a traditional recession that we’d expect to see over a normal business cycle. These were historically unusual events. But to my mind, 2022 did have a technical recession, two months of declining GDP, which we would ordinarily consider some sort of anomalous event. But would we be surprised at a technical recession coming off the back of a monumental stimulus? I am not.

Now, a more interesting question is if we have to have another technical recession coming off the back of a budget deficit at 6% of GDP.

Steven Kopits: Do you understand you are using the term “technical recession” in a way nobody else uses it?

And we also got “pandemic suppression”! For Christmas, can we pool our funds and buy Stevie a competent version of ChatGPT?

https://www.jagranjosh.com/general-knowledge/recession-and-technical-recession-1605793610-1

What is the difference between Recession and Technical Recession?

Some dude named Jagran Josh from India must be Steven’s idea of a Nobel Prize winner in economics!

If you have a better term, let’s hear it. But I don’t think you have a term for it, do you?

Steven Kopits: I call one quarter of negative GDP growth, not accompanied by a downturn in nonfarm payroll employment, or consumption, is … one quarter of negative GDP growth.

2 months of declining real GDP? Not two quarters? BTW – the concept of a “normal business cycle” does not exist. Is that like your retarded understanding of the Real Business Cycle.

Dude – you need to stop as you clearly have no clue what you are babbling about.

Yes, quarters. But the covid recession, per the NBER, was two months.

I’m sorry. Let me distinguish a ‘technical recession’ from a rule of thumb recession. By ‘technical’ I mean ‘as opposed to fundamental’. A fundamental recession, in this parlance, would mean one related to an ordinary business cycle, typically preceded by asset, securities or commodities bubbles, which, when they pop, create unemployment and a reset of prices.

A technical recession, in this case, would mean two down quarters resulting from some one-off or unusual circumstance, for example, a contraction in government spending without the other accoutrements of a recession. That does represent a contraction of the economy, but for atypical reasons without broader systemic implications. The 2022 technical recession could be considered a kind of bookend to the covid recession, which, at two months, would not ordinarily qualify as a recession. So we’re talking about two atypical contractions of the economy. If you are stuck with the customary term ‘recession’ (or perhaps the lack thereof), then you really don’t have much of an analytical framework to discuss what’s happened. If, on the other hand, you distinguish a suppression from a recession, then you can treat the covid pandemic and its aftermath as a unique sort of economic event with its own dynamics.

This matters for policy. The Fed misinterpreted the covid suppression as the GFC Great Recession (again, better understood as a depression). As a result, they reprised the zero FFR policy of the Great Recession, but this time with disastrous consequences, exploding asset and housing values, a policy choice from which we are yet to fully recover.

Also, I saw our buddy EJ Antoni claims that real median weekly wages are down since the end of 2020 under Biden-Harris. But that conveniently ignores how unemployment was 6.7% and that much of that unemployment were in low-wage leisure and hospitality industries. Naturally when those lower-wage jobs came back as COVID vaccinations came in and tourism and leisure spending resumed, the median wage went down.

What’s not mentioned is that real weekly wages in Q3 2024 are up 3% since the end of 2019, and that most Americans have seen their wages beat inflation in their real jobs. That’s in addition to real consumer spending remaining decent even with the higher prices.

https://jakehasablog.blogspot.com/2024/10/nice-try-dweeb-but-wages-for-workers.html