Because, they’re pretty good predictors of future prices (at least at the 3 and 12 month horizons) — better than a random walk, and better than a time series model. For empirics on corn, wheat and soybeans, see Chinn and Coibion, Journal of Futures Markets (2014).

Category Archives: commodities

Meanwhile, Back in Iowa

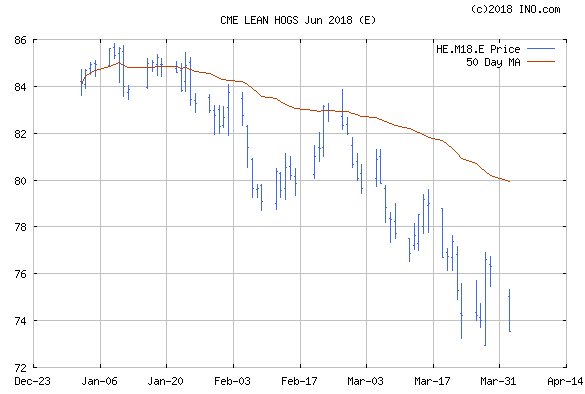

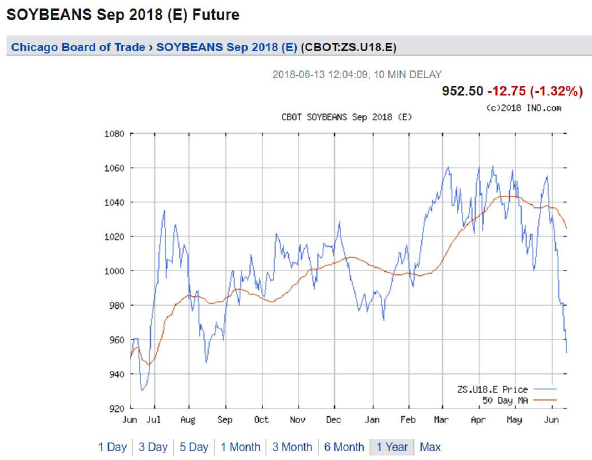

Soybean prices continue to collapse…

Source: ino.com, accessed 6/13.

Note that the peak was in early March, just as Mr. Trump hinted at Section 232 tariffs on aluminum and steel. This additional pain is unwelcome, given that even as of March, soybean prices were some 40% below their mid-2012 peaks.

From Progressive Farmer – Washington Insider today:

Anxiety Rising In US Farm Circles On China Trade

The U.S. has signaled it will make its intentions known by Friday on duties on some $50 billion in Chinese goods over intellectual property issues.U.S. ag interests like the American Soybean Association (ASA) are planning a full-court press to try and convince the administration to not take actions that would negatively impact U.S. soybean and other ag trade as China has threatened to respond with retaliatory trade actions against U.S. products like soybeans and other ag goods.

It’s not clear whether the U.S.-North Korea summit was enough to have the U.S. willing to hold off on imposing sanctions against China. But there are also still likely other steps in the process before U.S. sanctions go into place.

The U.S. has to publish a formal determination on the duties in the Federal Register, with up to 30 days after that point for the duties to come into effect. Plus, indications are the Trump administration is studying taking up to another 180 days before putting the duties in place.

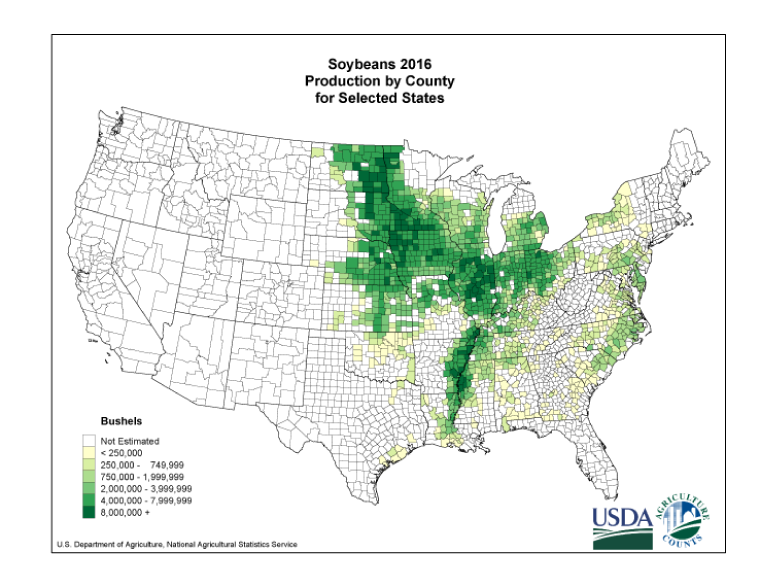

As a reminder, here is a map of soybean production.

Source: USDA.

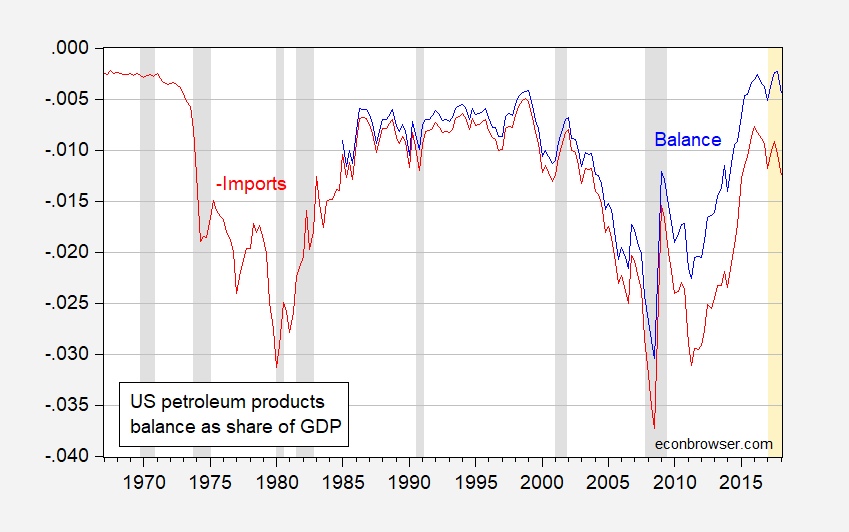

The US Petroleum Trade Balance

As oil prices start heading up, the usual questions arise regarding the macro implications. One view is that with the revolution in tight oil production, the US will experience less of a negative impact than before. This conclusion relies on a set of assumptions, possibly including the US being substantially less dependent on oil imports. Is this true?

Figure 1: US petroleum trade balance (blue), and negative of US petroleum imports (red). NBER defined recession dates shaded gray. Source: BEA, 2018Q1 advance release, NBER, author’s calculations.

As you sow…

Another Event Study: Hogs

Source: ino.com.

Thanks, Trump: Wisconsin Cheese Edition

Mr. Trump has stated his intention of raising tariffs on steel and aluminum, based on national security grounds. See this post on the specious aspects of this argument, and this recent EconoFact column on the hits to the economy that would result from steel tariffs. The EU has hinted at striking at Wisconsin cheese in retaliation (Wisconsin is the second largest state exporter). This makes perfect sense from a strategic perspective – agriculture is America’s comparative advantage, and Wisconsin’s Representative Paul Ryan is Speaker.

EconoFact: “Threats to U.S. Agriculture from U.S. Trade Policies”

Or, Does Mr. Trump feel lucky?

From EconoFact:

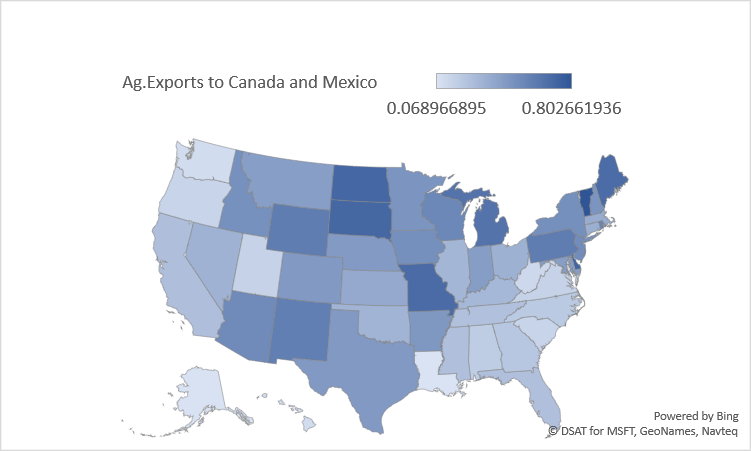

The agriculture sector in the United States depends upon exports for its vitality. Sales of U.S. agricultural products abroad are responsible for 20 percent of U.S. farm income, supporting more than one million American jobs on and off the farm, according to the U.S. Department of Agriculture. The three biggest buyers of American agricultural products are China, Canada, and Mexico. Yet trade with these three countries faces heightened uncertainty. The Trump Administration initiated a process of renegotiating the North American Free Trade Agreement (NAFTA) with Canada and Mexico, which includes the option of exiting the deal altogether. In addition, the United States has started a series of investigations of unfair practices leveled against China, some of which have already resulted in the imposition of new tariffs. These trade policy initiatives threaten agricultural exports both because of the potential increase of tariffs on exports to Canada and Mexico that would result from a withdrawal from NAFTA as well as the very real threat of retaliation in response to other proposed policies.

Figure 1: Share of total agricultural exports going to Mexico and Canada, by state. Agricultural exports defined as NAICS 111+112+311 (crops, livestock, and processed food). Source: Census via ITA and author’s calculations.

The entire article is here. More on agricultural sector fortunes here.

Guest Contribution: “The Sugar Swamp”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared on June 22nd in Project Syndicate.

EconoFact: “The Agricultural Implications of Mr. Trump’s Policies”

That’s the title of a new EconoFact memo written by me:

Nearly 70 percent of rural votes cast in the 2016 election went to Donald Trump. This phenomenon has been attributed in part to the declining fortunes of farmers. But rather than helping reverse this trend, several of the Trump administration’s policy proposals would negatively affect the fortunes of the agricultural sector by depressing the prices received by farmers, reducing the demand for American agricultural exports, and raising production costs. Moreover, that portion of the agriculture budget aimed at supporting farm prices and incomes is likely to be squeezed to accommodate the increase in defense spending.

Implications for the Agricultural Economy of Fiscal Policies Proposed by President Elect-Trump

In short: Rural areas will not like what they get from a combination of expansionary fiscal/counter-cyclical monetary policy.