The IMF blog (Andrea Pescatori, Martin Stuermer, and Nico Valckx) predicts: “Surging Energy Prices May Not Ease Until Next Year”.

Category Archives: energy

Guest Contribution: “Global financial markets and oil price shocks in real time”

Today, we are pleased to present a guest contribution written by Fabrizio Venditti (European Central Bank) and Giovanni Veronese (Banca d’Italia). The views expressed in this paper belong to the authors and are not necessarily shared by the Banca d’Italia and the European Central Bank.

Negative oil prices

First negative interest rates, and now negative oil prices. Is the world coming to an end?

Continue reading

Comparing shipping costs and industrial production as measures of world economic activity

That’s the title of my latest contribution at Vox CEPR Policy Portal.

The US Petroleum Trade Balance

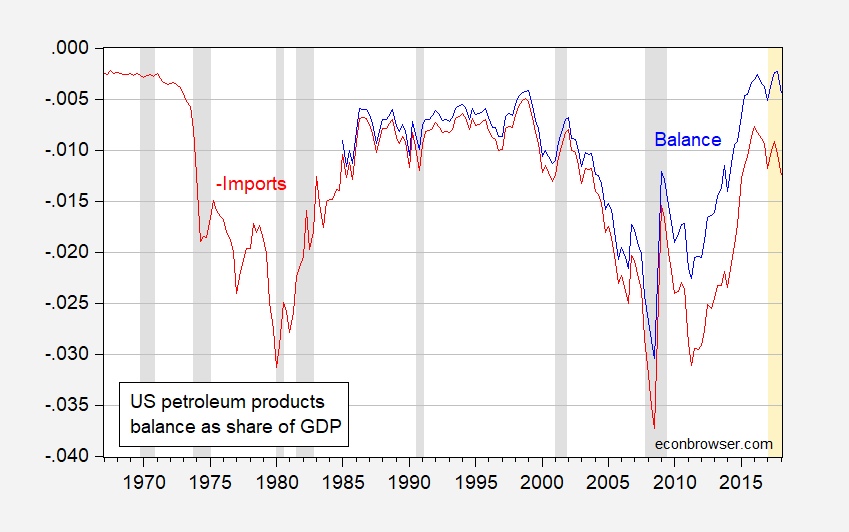

As oil prices start heading up, the usual questions arise regarding the macro implications. One view is that with the revolution in tight oil production, the US will experience less of a negative impact than before. This conclusion relies on a set of assumptions, possibly including the US being substantially less dependent on oil imports. Is this true?

Figure 1: US petroleum trade balance (blue), and negative of US petroleum imports (red). NBER defined recession dates shaded gray. Source: BEA, 2018Q1 advance release, NBER, author’s calculations.

Podcast on econometrics, oil shocks, and monetary policy

I had an interesting discussion on a range of topics with David Beckworth which you can

listen to as a podcast from Macro Musings.

Stephen Moore: “When It Comes To Electric Power, Coal Is No. 1”

That’s a title of a July 28 piece in IBD. He writes:

According to the Energy Information Administration, which tracks energy use in production on a monthly basis, the single largest source of electric power for the first half of 2017 was…coal.

U.S. begins ninth year of economic expansion

The Bureau of Economic Analysis announced today that U.S. real GDP grew at a 2.6% annual rate in the second quarter. That is below the long-term historical average of 3.1%, but better than the 2.1% we’ve seen on average since the Great Recession ended in 2009.

Continue reading

New data sources for economic research

One of the exciting implications for economists of the digitization of everything is the ability to study economic relations and behavior at a level of detail far beyond anything that could have been attempted a decade ago. I’ve earlier called attention here to new measures of inflation obtained from millions of prices posted on the web, new insights into pricing behavior coming from scanner data on individual store transactions, and understanding of consumer behavior based on debit and credit transactions of 25 million Americans. Here I discuss another new study based on smart-phone apps.

Continue reading

OPEC production cut

The Wall Street Journal reported on Thursday:

OPEC said its members agreed that they need to cut crude output to reduce the world’s supply glut, a shift for the 14-member group that was enough to send oil prices higher, even though reaching a deal remains far from certain.

Members of the Organization of the Petroleum Exporting Countries said they reached an understanding after a six-hour gathering in the Algerian capital, but deferred until November the fraught task of finalizing a plan to make those cuts. OPEC officials said a committee would be formed to determine how much each country would have to cut and then report to the group at its next meeting on Nov. 30 in Vienna.