That’s the title of a symposium in The International Economy, with Anders Åslund, Scott K.H. Bessent, Lorenzo Bini Smaghi, Jill Carlson, Stephen G. Cecchetti, Menzie D. Chinn, Lorenzo Codogno, Tim Congdon, Marek Dabrowski, Mohamed A. El-Erian, Heiner Flassbeck, Takeshi Fujimaki, Joseph E. Gagnon, James K. Galbraith, James E. Glassman, Michael Hüther, Richard Jerram, Gary N. Kleiman, Anne O. Krueger, Mickey D. Levy, Thomas Mayer, Jim O’Neill, Adam S. Posen, Holger Schmieding, Derek Scissors, Mark Sobel, Makoto Utsumi, and Chen Zhao.

Category Archives: exchange rates

The Strong Dollar Debate, Yet Again

(Somewhat repetitive of a 2007 post…)

Some Asset Market Reactions

Stock, currency and bond markets respond (up, up, yield up) on news of likely Democratic control of the Senate

Treasury’s FX Report – Currency Manipulation versus Currency Misalignment

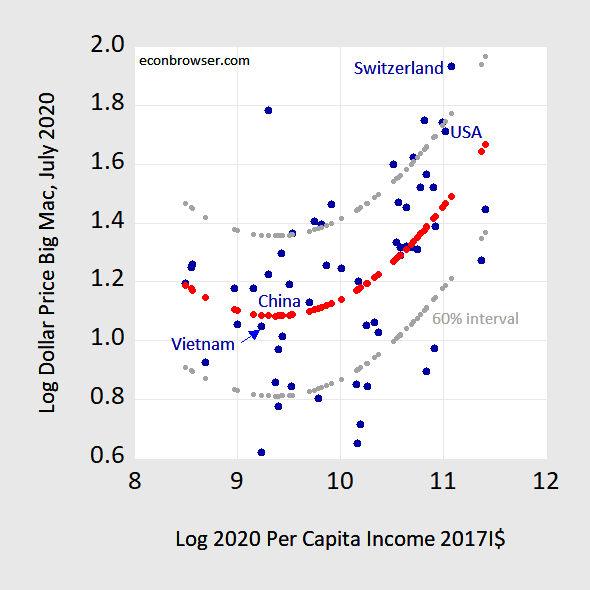

The Treasury’s semi-annual report designated Switzerland and Vietnam as currency manipulators. Without taking a definitive stand on currency manipulation, I do want to highlight where Vietnam (and Switzerland) stand if evaluated by the Big Mac Parity/Penn Effect:

Figure 1: Log Big Mac dollar price in July 2020 plotted against log 2020 per capita income in 2017 I$. Penn Effect line estimated using regression (red) and 60% prediction interval (gray). Source: Economist, IMF World Economic Outlook October 2020 database, author’s calculations.

Treasury’s Semi-annual Foreign Exchange Report

Debasing the Dollar? (Or Inflation Looming, Again?)

Worried about currency debasement? Do we find out anything from the nominal exchange rate? In a flexible price monetary model (sometimes called the monetarist model of the exchange rate), changes in the money supply should be immediately reflected in the exchange rate.

Stop the Uncertainty!

The economic policy uncertainty, that is (With apologies to Susan Powter). Regardless of where you are on the econo-political spectrum, you should want economic policy uncertainty to be reduced. Remember all those conservative voices in the post-Global Financial Crisis saying policy uncertainty was slowing the economic recovery? Well, today is an opportunity to return considered, coherent, economic policymaking and trade negotiations.

The Net International Investment Position of the US

Since 2016Q4, the Net International Inestment Position of the US has become more negative.

The Dollar’s Value under Pressure

The dollar’s value has come under pressure recently. Does this mean the dollar’s role as a key international currency is at threat?

“The US and China in the global order: the role of the dollar and tensions with China”

Yesterday, I had the pleasure of joining a virtual panel sponsored by the Official Monetary and Financial Institutions Forum (OMFIF), is think tank covering central banking, economic policy and public investment.