Currency manipulation or not? The Treasury’s semiannual foreign exchange report, released yesterday, says no, contra Mr. Trump’s statement a few months ago.

Category Archives: exchange rates

Guest Contribution: “How Are Uncertainty and the Uncovered Interest Parity Condition Related?”

Today, we are pleased to present a guest contribution written by N.R. Ramirez-Rondan and Marco E. Terrones (Universidad del Pacifico).

Guest Contribution: “The currency composition of foreign exchange reserves”

Today, we are pleased to present a guest contribution written Hiro Ito (Portland State University) and Robert N. McCauley (formerly Bank for International Settlements). The views presented represent those of the authors, and not necessarily those of the institutions the authors are or were affilliated with.

The Fama Puzzle at 40

Fama (JME, 1984) was published 35 years ago, but the earlier — perhaps the earliest — appearance of the Fama regression is in Tryon (1979). While the puzzle has largely persisted since then, it has seemingly disappeared since the global financial crisis.

As Long as Trump Tweets His Way Randomly through the Trade War, the Dollar Will Stay Strong

Modern asset-based models are based upon fundamentals such as money stocks, incomes, interest and inflation rates mattering. But the dollar — in which safe assets like Treasurys are denominated — is special in that risk also matters.

Back-of-the-Envelope Calculation of Trump Induced Dollar Appreciation

Undervaluation, Misalignment, and China in the 2019 IMF External Sector Report

Donald Trump’s pronouncements can typically be taken as contra-indicators. In other words, what he says is invariably wrong. So, you gotta wonder on China…

Continue reading

“Purchasing Power Parity and Real Exchange Rates”

That’s my new entry in the Oxford Research Encyclopedia of Economics and Finance.

The idea that prices and exchange rates adjust so as to equalize the common-currency price of identical bundles of goods—purchasing power parity (PPP)—is a topic of central importance in international finance. If PPP holds continuously, then nominal exchange rate changes do not influence trade flows. If PPP does not hold in the short run, but does in the long run, then monetary factors can affect the real exchange rate only temporarily. Substantial evidence has accumulated—with the advent of new statistical tests, alternative data sets, and longer spans of data—that purchasing power parity does not typically hold in the short run. One reason why PPP doesn’t hold in the short run might be due to sticky prices, in combination with other factors, such as trade barriers. The evidence is mixed for the longer run. Variations in the real exchange rate in the longer run can also be driven by shocks to demand, arising from changes in government spending, the terms of trade, as well as wealth and debt stocks. At time horizon of decades, trend movements in the real exchange rate—that is, systematically trending deviations in PPP—could be due to the presence of nontraded goods, combined with real factors such as differentials in productivity growth. The well-known positive association between the price level and income levels—also known as the “Penn Effect”—is consistent with this channel. Whether PPP holds then depends on the time period, the time horizon, and the currencies examined.

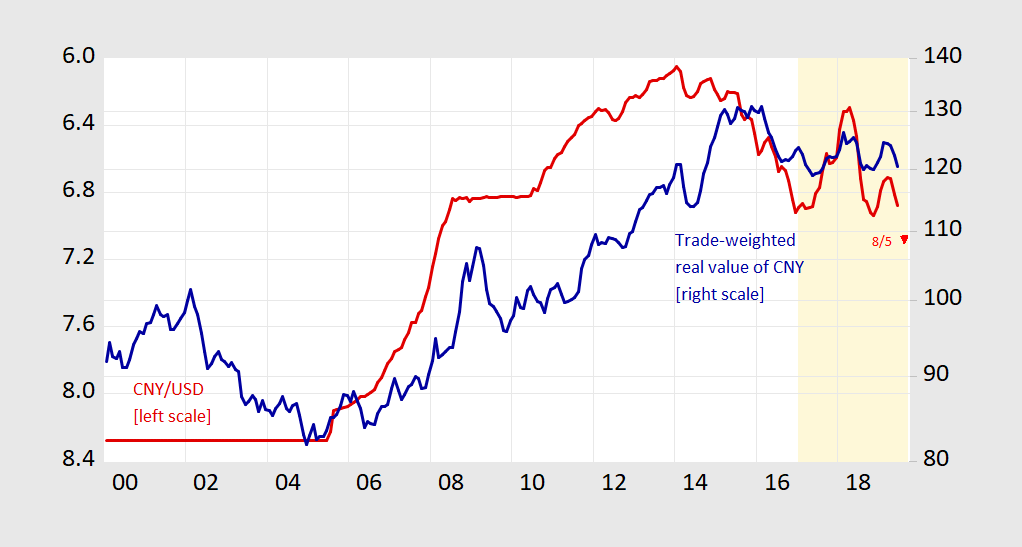

The Answer Is No (and No)

Figure 1: CNY/USD nominal exchange rate (red, left inverted scale), 8/5 value (red triangle, left inverted scale), trade weighted real value of CNY against broad basket of currencies (blue, right log scale). Up denotes appreciation. Light orange shading denotes Trump administration. Source: FRED, and BIS.

In a new (and extremely timely) EconoFact memo on Should the United States Try to Weaken the Dollar?, Michael Klein and Maury Obstfeld ask:

BdF/AMSE International Macro Workshop: Business Cycles, Uncertainty, China, Macro Policies, and Exchange Rates

Today, we are pleased to present a guest post written by Laurent Ferrara (Banque de France), Céline Poilly (AMSE) and Daniele Siena (Banque de France). The views presented represent those of the authors, and not necessarily those of the institutions the authors are affilliated with.