My answer on Marketplace yesterday was essentially “why not”. On macro grounds, with prospects for economic activity softening, a bit of insurance isn’t too crazy.

Category Archives: Federal Reserve

Judy Shelton Confuses Me: On Interest Rates, Currency Manipulation

With Judy Shelton’s nomination to be a Fed governor, it behooves us to consider her views on the world. I will point out two salient (there are many) areas of confusion about her views: (1) interest rates and monetary policy easing, and (2) currency manipulation.

Libra: economics of Facebook’s cryptocurrency

Facebook last week announced plans for Libra, a new global cryptocurrency. The name seems to be a marriage of the words “livre”, the French currency throughout the Middle Ages based on a pound of silver, and “liber,” which is Latin for “free.” Facebook claims that Libra will give the freedom to easily transmit funds across borders to the 1.7 billion adults in the world without access to traditional banks.

Continue reading

Yield curve inversion

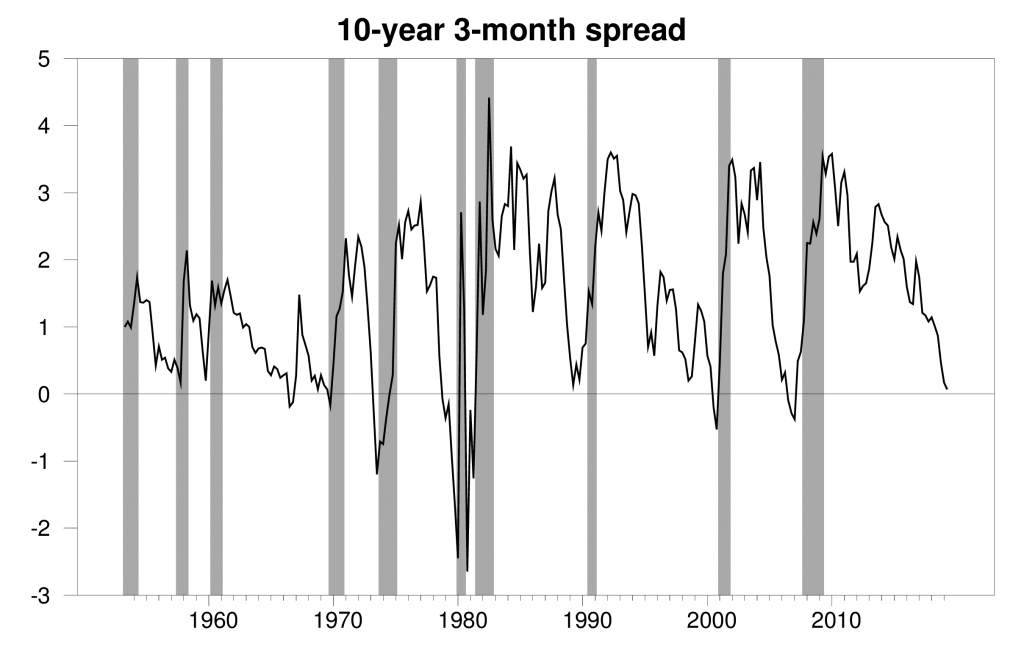

The gap between long-term and short-term interest rates has narrowed sharply over the last year and is now dipping into negative territory. Historically that’s often been a signal that slower economic growth or even an economic recession could lie ahead.

Gap between average interest rate on 10-year Treasury bond and 3-month Treasury bill during the last month of the quarter (1953:Q2 to 2019:Q1) and May 1-24 for 2019:Q2. NBER dates for U.S. recessions shown as shaded regions.

Continue reading

“White House Considers Economist Judy Shelton for Fed Board”

That’s the title of an article in Bloomberg:

Shelton, who’s served as an informal adviser to Trump, holds a Ph.D. in business administration with an emphasis on finance and international economics from the University of Utah.

Tools of monetary policy

I just finished a new paper on current U.S. monetary policy operating procedures. Here’s the abstract:

The Federal Reserve characterizes its current policy decisions in terms of targets for the fed funds rate and the size of its balance sheet. The fed funds rate today is essentially an administered rate that is heavily influenced by regulatory arbitrage and divorced from its traditional role as a signal of liquidity in the banking system. The size of the Fed’s balance sheet is at best a very blunt instrument for influencing interest rates. In this paper I compare the current operating system with the historical U.S. system and the procedures of other central banks. I then examine strategies for transitioning from the current system to one that would give the Federal Reserve better tools with which to achieve its strategic objective of influencing inflation and output.

Here’s a link to a video of my presentation of the paper at a conference at Stanford last week.

Guest Contribution: “Evaluating Central Banks’ Tool Kit: Past, Present, and Future”

Today, we are pleased to present a guest contribution written by Eric Sims and Jing Cynthia Wu (both from the University of Notre Dame), based on their paper of the same title.

Guest Contribution: “No Moore Golden Era for Monetary Policy”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared in Project Syndicate on April 27th.

Ramesh Ponnuru on the Conduct of Optimal Monetary Policy

I agree with

@realDonaldTrump: We need to keep interest rates low now to keep our economy growing.

Thoughts on the Next Recession

CEA Chair Kevin Hassett has stated a recession by next summer is impossible. I’m wary of such definitive statements.