That’s the title of a fascinating new paper with important policy implications.

Continue readingCategory Archives: financial markets

“A Third of a Century of Currency Expectations Data: The Carry Trade and the Risk Premium”

That’s the title of a new paper, coauthored with Jeffrey Frankel, using data extending back to August 1986.

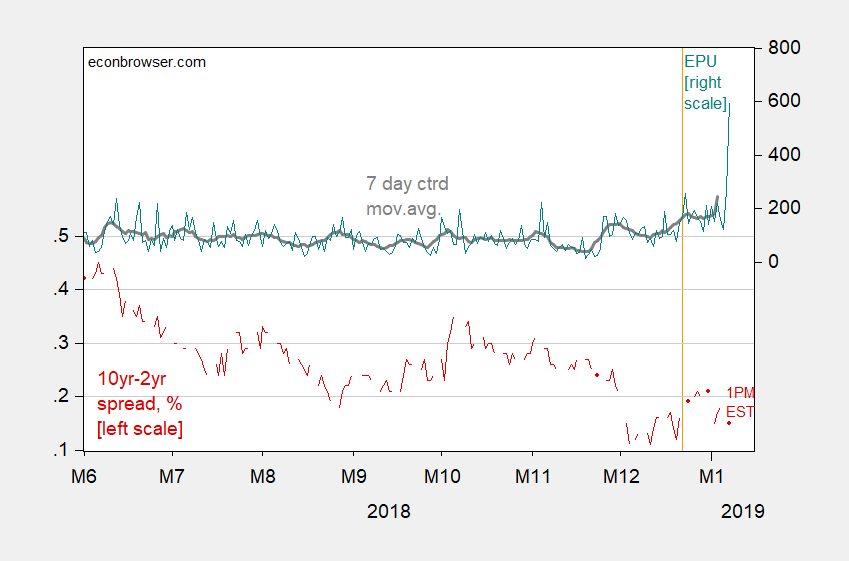

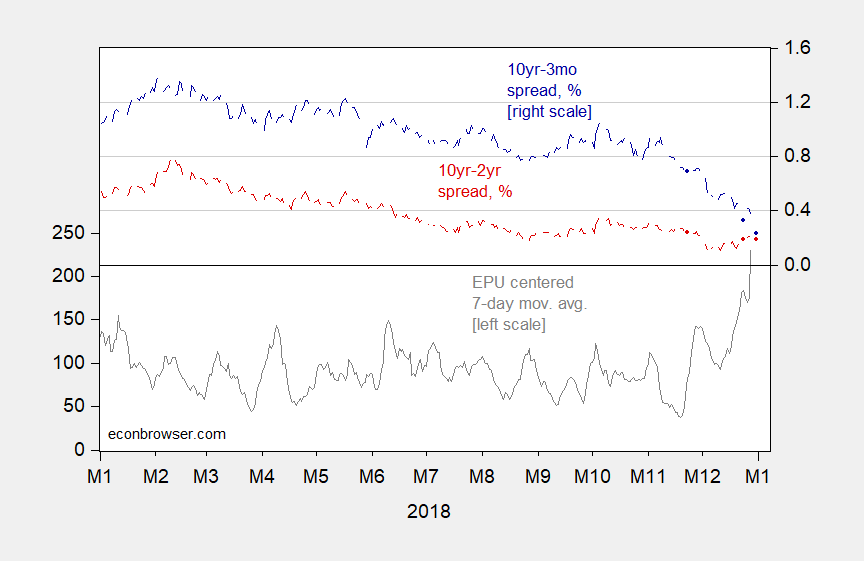

Continue readingMeasured Uncertainty and Treasury Spreads, 1/7/19

Treasury Spreads and Measured Policy Uncertainty

Do they matter?

Continue readingHappy New Year!

Figure 1: Baker Bloom and Davis Economic Policy Uncertainty index, centered 7 day moving average (gray, left scale), and ten year – three month Treasury spread, % (blue, right scale) and ten year – two year spread, % (red, right scale). Source: policyuncertainty.com, FRED and author’s calculations.

Perspective on the stock market

Some people are getting a little spooked by recent stock market movements. Here I offer a few thoughts.

Continue reading

US Treasury Yield Curve Website, Today…

Is it just me? I’ve tried 3 browsers and my iphone…

Continue reading

Who Could’ve Known “Crash Brexit” Would Be Problematic?

In the aftermath of the Salzburg summit, where the Chequers plan was dismissed by the EU, and PM May demanded “respect”, the pound has plunged.

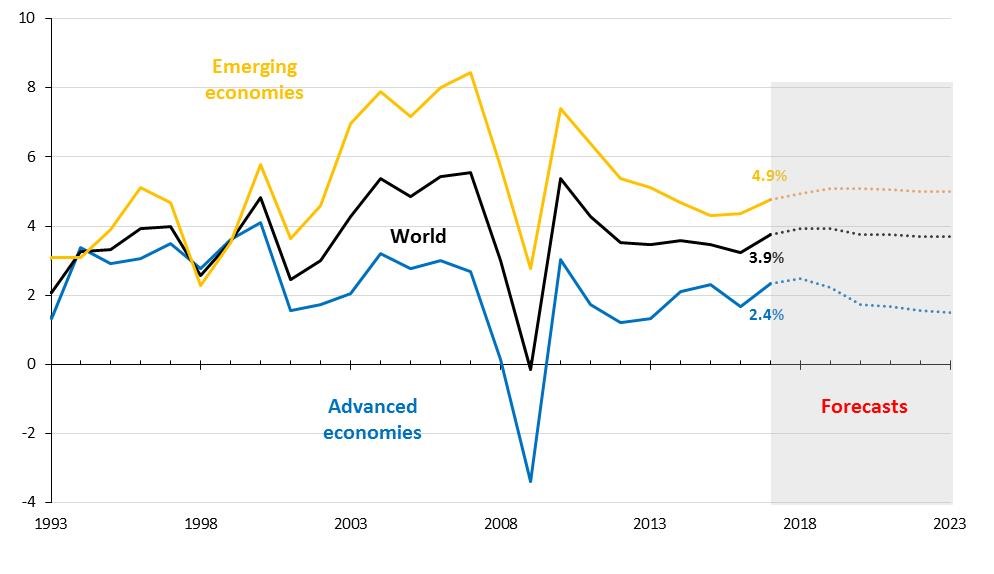

Guest Contribution: “International Macroeconomics in the wake of the Global Financial Crisis”

Today, we are pleased to present a guest contribution written by Laurent Ferrara (Banque de France), Ignacio Hernando (Banco de España) and Daniela Marconi (Banca d’Italia), summarizing the introductory chapter of their book International Macroeconomics in the wake of the Global Financial Crisis. The views expressed here are those solely of the author and do not reflect those of their respective institutions.

A decade after the eruption of the Global Financial Crisis (GFC), the world economy has finally returned to a more sustained pace of expansion (see Fig. 1).

Figure 1: World GDP annual growth (in %, constant prices). Source: IMF, World Economic Outlook, April 2018 and July 2018 update

Continue reading

Recalling the Beginning of the Lost Decades

Lehman Brothers, the global financial crisis and ensuing great recession, plus ten.

Continue reading