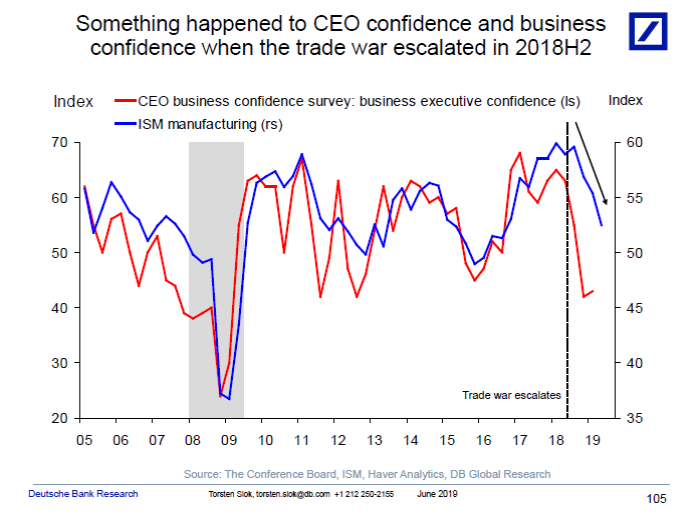

Or, Trumpian Winning, edition 3,010,524. From Torsten Sløk/Deutsche Bank today:

Category Archives: financial markets

Seven (Business) Days in May

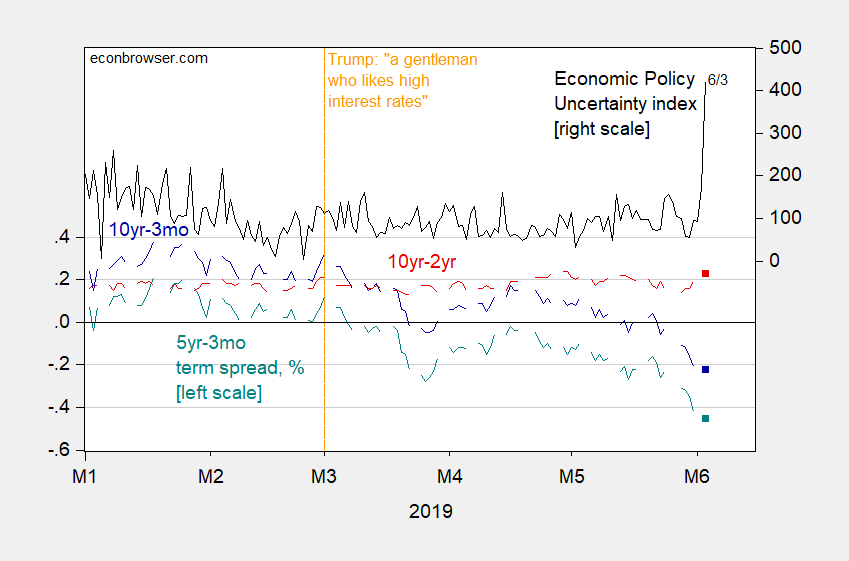

[updated 6/3] Undervalued currencies as countervailable subsidies, tariffs on Mexico, flash mfg PMI drops, Drumpf again insists China pays US tariffs…so the yield curve inverts!

Figure 1: [Updated 6/3) Treasury 10yr-3mo spread (blue, left scale), 10yr-2yr (red, left scale), 5yr-3mo (teal, left scale), in %; 6/3 interest rates on-the-run at 1:30PM EST, and Economic Policy Uncertainty index (black, right scale). Source: Fed via FRED, US Treasury, and policyuncertainty.com, accessed 6/3/2019.

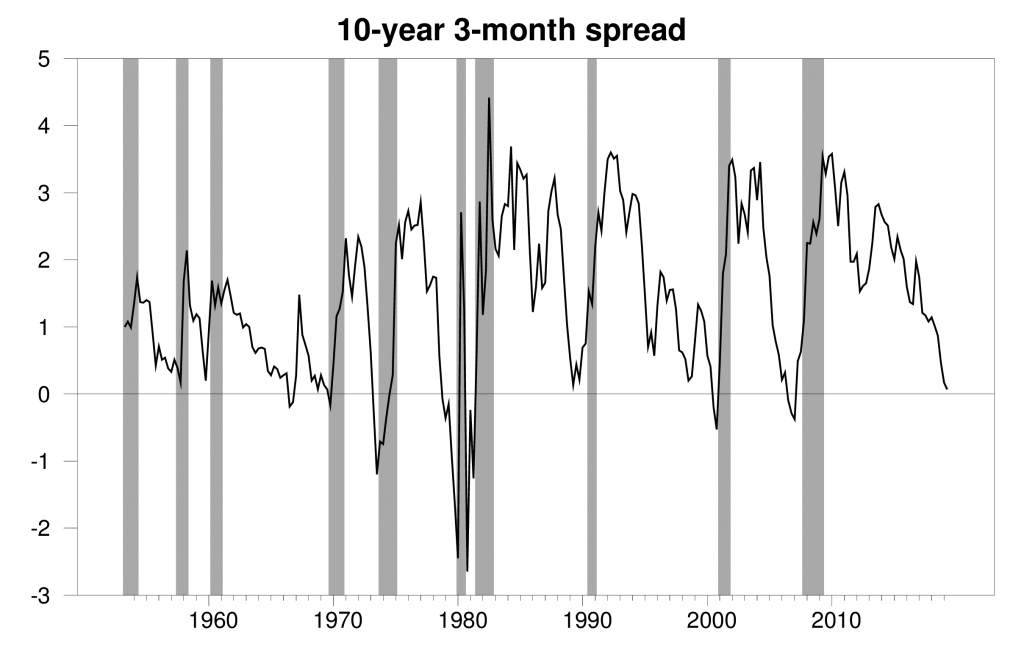

Yield curve inversion

The gap between long-term and short-term interest rates has narrowed sharply over the last year and is now dipping into negative territory. Historically that’s often been a signal that slower economic growth or even an economic recession could lie ahead.

Gap between average interest rate on 10-year Treasury bond and 3-month Treasury bill during the last month of the quarter (1953:Q2 to 2019:Q1) and May 1-24 for 2019:Q2. NBER dates for U.S. recessions shown as shaded regions.

Continue reading

Inversion! Close-of-Trading 5/13/2019

According to constant maturity rates reported by US Treasury, the 10 year-3 month yield curve was inverted as of today’s close (-0.01%). The 10 year-2 year spread is -0.22%, and the 5 year-3 month spread favored by Cam Harvey is -0.23%.

“White House Considers Economist Judy Shelton for Fed Board”

That’s the title of an article in Bloomberg:

Shelton, who’s served as an informal adviser to Trump, holds a Ph.D. in business administration with an emphasis on finance and international economics from the University of Utah.

If Campbell Harvey’s Specification Is Right, We’re (Still) in Trouble

Robust GDP growth, employment rising on pace, perceived recession risk declining… as in this headline. The latest issue of the Economist has an article entitled Fears of recession have faded. But I’m reminded that Campbell Harvey, who wrote early papers on the subject of yield curve predictors, relies on the 5yr-3mo spread (for growth, not recession). And that implied specification signals 44% probability of recession in 2020M04.

The Risk Adjusted Real Long Term Real Rate

One argument against the secular stagnation thesis is that the risk-adjusted real rate is not particularly low. I’m dubious.

Thoughts on the Next Recession

CEA Chair Kevin Hassett has stated a recession by next summer is impossible. I’m wary of such definitive statements.

Inversion!

Of the 10yr-3mo spread.

MMT for the ADD

I’ve written up a draft set of notes for my undergraduate macro students. Here is my interpretation of Modern Monetary Theory for them. Comments welcome. [Revised version incorporating comments now available here (3/26).]