The headline number for nonfarm payroll employment was decent [1], and although there are worrisome aspects, I think the key take-away is the fact that manufacturing employment is slowing much more than overall. To the extent that manufactured goods proxies for tradables, I think caution is in order with respect to monetary tightening. And yet, I read headlines reporting that the “Fed is on track to raise rates…”[Sparshott/RTE WSJ].

Category Archives: financial markets

Interest Rate Parity and Exogeneity

One of the enduring puzzles of international finance is the fact that the joint hypothesis of uncovered interest parity and rational expectations is consistently rejected, as evidenced by the coefficient estimates in the Fama regression.

Exchange Rate Regimes and the Global Financial Cycle

Relevant or Irrelevant?

Divergences: Interest Rates, Nominal, Real, Short, and Long

I’ve been wrapping up some long term projects (not planned as long term — they just took longer than expected) on interest rate parity and term spreads, and that spurred me to look at current patterns in interest rates. Some quick observations: interest rates remain higher in emerging markets than in core industrial countries. So too are real rates are higher despite higher inflation rates. And term spreads are larger in the US than other countries.

How Much More Dollar Appreciation?

One important factor in the growth prospects for the US economy is the trajectory of the dollar. [1] If the dollar stabilizes at March levels, US economic growth might rebound. On the other hand, continued appreciation bodes ill. Based on history over the floating rate era, the expected duration of an appreciation is about 5 years (depreciations about 2 years). The current surge in the dollar has only been going on for only slightly over half a year, although when dated from the trough of 2011Q2, it’s been going on just a bit over 4 years. Either way, by this metric, it appears that there is still some additional way to go before the dollar peaks.

World interest rates

Ben Bernanke has joined the blogosphere, offering an invaluable resource for anyone wanting to understand recent economic developments. Last week he had a series of articles examining factors behind the very low real interest rates on long-term bonds.

Continue reading

Fed moves the markets

As widely expected, at Wednesday’s FOMC meeting the Federal Reserve dropped its statement that “the Committee judges that it can be patient in beginning to normalize the stance of monetary policy”, the magic formula that many observers had thought would open the way for a hike in interest rates at the Fed’s June meeting. But the yield on a 10-year U.S. Treasury bond dropped 10 basis points immediately following the FOMC release.

Continue reading

Guest Contribution: “Currency politics, debt politics”

Today, we’re fortunate to have a guest contribution by Jeffry Frieden, Stanfield Professor of International Peace at Harvard University, and author of the newly published Currency Politics: The Political Economy of Exchange Rate Policy (Princeton University Press, 2015). This post is based upon a portion of that book.

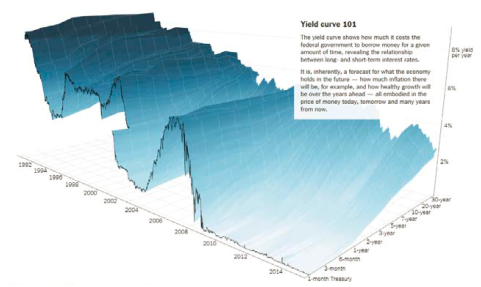

The Yield Curve and Economic Activity, Again

The New York Times has an article in The Upshot today, which shows the yield curve over time in a nifty map. They also show the topography for yields in Germany and Japan.

What is the new normal for the real interest rate?

The yield on a 10-year Treasury inflation protected security was negative through much of 2012 and 2013, and remains today below 0.25%. Have we entered a new era in which a real rate near zero is the new normal? That’s the subject of a new paper that I just completed with Ethan Harris, head of global economics research at Bank of America Merrill Lynch, Jan Hatzius chief economist of Goldman Sachs, and Kenneth West professor of economics at the University of Wisconsin, which we presented at the U.S. Monetary Policy Forum annual conference in New York on Friday.

Continue reading