Inflation exceeds average hourly earnings in the aggregate (private sector) and for Leisure and Hospitality Services (production and nonsupervisory). But they are still ahead of 2020M02 levels.

Category Archives: inflation

Guesstimating the US-Euro Area Core Inflation Differential in April

April HICP numbers are out for the Euro Area. The US reports April CPI on Wednesday. Using the Cleveland Fed’s nowcast for April core (0.52% m/m vs. Bloomberg consensus 0.4%), we have the following picture.

US-Euro Area GDP Performance Pre/During Pandemic

We now have Q1 GDP for the US and Euro Area. While US inflation as measured by CPI/HICP is higher than Euro Area (US core accelerating relative to EA by 0.7 ppts since the pandemic), US GDP growth has also been higher.

Interpreting Growth Rate Changes and Deterministic vs. Stochastic Trends – An Application to Inflation Differentials

Two ways of calculating how prices have moved pre-pandemic and during pandemic, incorporating the ideas of stochastic vs. deterministic trends (e.g., this post, Stock and Watson, JEP, 1988).

Four Questions and Four Answers: US and Euro Area Core Inflation

Or why Jason Furman and I get different answers.

- Is US core inflation faster than Euro Area, during the pandemic? Yes.

- Was US core inflation faster than Euro Area, before the pandemic? Yes.

- Is US core m/m inflation faster than Euro Area during the pandemic period, with statistical significance? Yes.

- Did US core m/m inflation accelerate relative to Euro Area during the pandemic period, with statistical significance? No.

How Much Faster Has American Inflation Been Compared to Euro Area Inflation?

Since the pandemic struck, 0.4 percentage points (headline), 0.7 percentage points (core) [with additional results/graphs, 4/24]

Oil Prices, Price Surprises, and Forwards, Breakevens, and Term Spreads

First, what are current one month and 1 month forward 2 months doing?

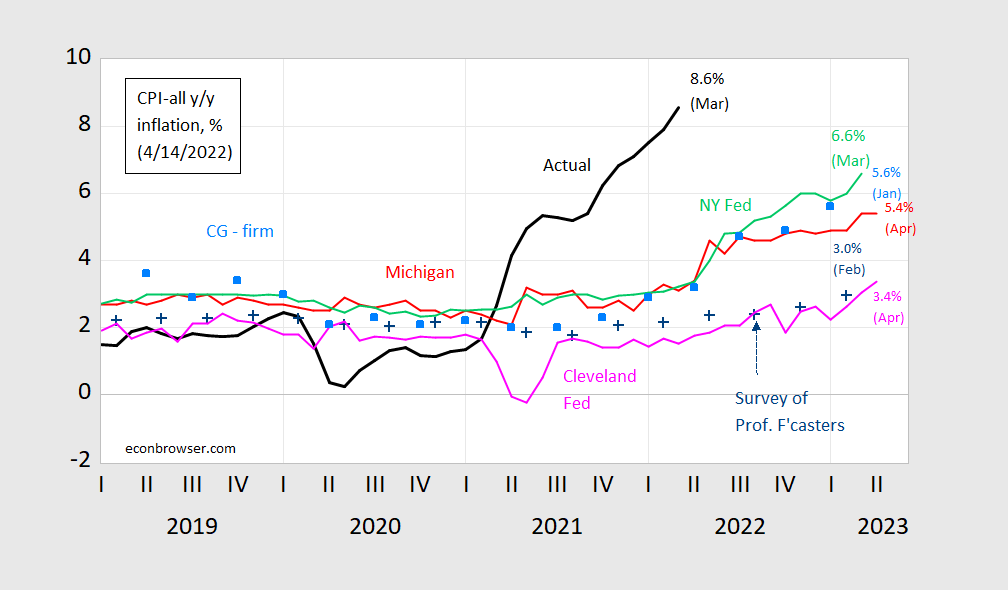

One Year Ahead Inflation Forecasts

Figure 1: CPI inflation year-on-year (black), median expected from Survey of Professional Forecasters (blue +), median expected (preliminary) from Michigan Survey of Consumers (red), median from NY Fed Survey of Consumer Expectations (light green), forecast from Cleveland Fed (pink), mean from Coibion-Gorodnichenko firm expectations survey [light blue squares]. Source: BLS, University of Michigan via FRED and Investing.com, Reuters, Philadelphia Fed Survey of Professional Forecasters, NY Fed, Cleveland Fed and Coibion and Gorodnichenko.

In terms of accuracy and bias, a new study by Bennett and Owyang (forthcoming) is very relevant.

Will the True PPI Stand Up?

PPI Inflation in March, with Implications for April CPI

Month-on-month PPI inflation surprised on the upside, 1.4% vs. Bloomberg consensus 1.1%, while core PPI was up 1% vs. 0.5% consensus.