The Survey of Professional Forecasters (SPF) February release and the January five year breakeven inflation rate suggest accelerating inflation – up to about 2.1%-2.2%

Category Archives: inflation

Inflation Looming? Phillips Curve vs. Quantity Theory

Look at this:

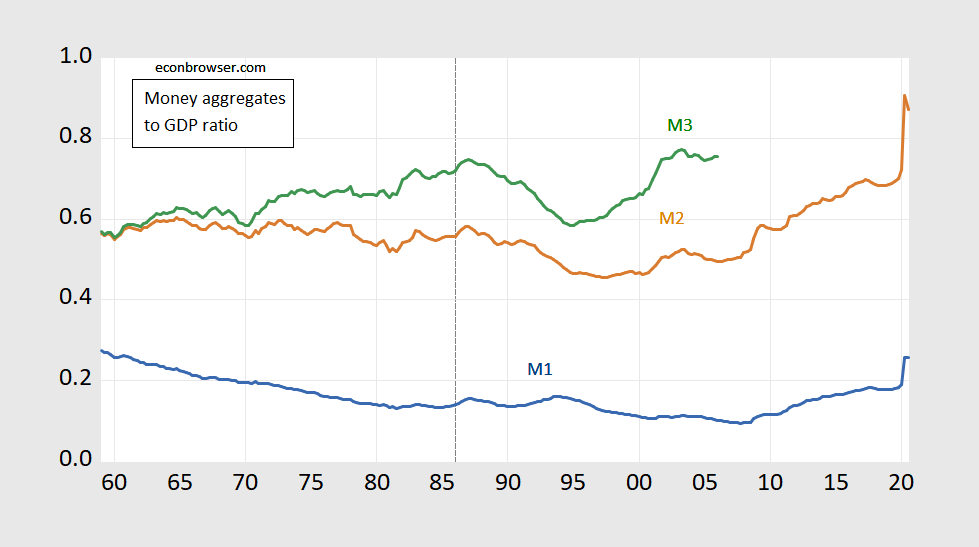

Figure 1: Ratio of M1 to real GDP (blue), of M2 to real GDP (brown), of M3 to real GDP (green), 1959Q1-2020Q3. Quarterly money data average of end of month data. Source: Federal Reserve via FRED, and BEA, 2020Q3 2nd release, and author’s calculations.

Inflation Sensitivity to Gaps and Shortfalls

Suppose maximal output evolves as a line between peaks in output, as discussed in this post updating the Delong-Summers approach. The is the “slack” thus defined (red line) a clearer determinant of inflation than the traditional output gap (black line)?

Guest Contribution: “The Significance of Gold’s Record $2,000 Price”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared in Project Syndicate.

Very Broad Money and the Price Level

I keep on getting missives from the IIMR. Here’s today’s, from a Tim Congdon:

Worried about Surging Inflation?

Periodically, I get emails from some guy named Tim Congdon of the Institute of International Monetary Research, bewailing the tendency “to shrug off the inflation risks that have in the past arisen from too much monetary financing of large budget deficits.” So…big increases in the Fed’s balance sheet: will they collide with reduced supply over the medium run to produce inflation? TIPS say no…

Guest Contribution: “Let’s Forget about 2% Inflation”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared in Project Syndicate on July 25th.

Judy Shelton Confuses Me (Part 2,432,671)

Fed Nominee-to-be Judy Shelton responds to her issues with government statistics (Long, Davies, WaPo):

In a series of e-mails, Shelton defended her views, saying that she remains “skeptical about the accurancy and consistency” of economic statistics because they do not always capture technological innovation accurately. She added that “we need to be sure that data used for policy-making decision is accurate and appropriate.”

However from the context of her 2015 talk (see tape, at 1:07:07) it’s pretty clear from how she responded to the question, she thought the government statistics were understating inflation. Yet her supposedly exculpatory statement regarding technological innovations is consistent with an enormous literature that addresses concerns that government price statistics overstate inflation (review, Boskin Commission; more recently in digital context, see here). In other words, I still get the impression that Dr. Shelton disbelieves the government statistics because, well, they’re government statistics, and not because of any deeply held convictions regarding hedonic adjustments for quality, etc. in the CPI or other price indices. (A Google Scholar search fails to detect any Shelton writing on quality/measurement issues and deflators and/or productivity statistics).

An interesting paper on the subject of incorporating digital products into the national accounts, by Brynjolfsson et al. (2019).

What Does Judy Shelton Believe GDP Growth and Inflation Are in 2019?

In a 2015 Cato Institute session, Fed Board Nominee Judy Shelton discusses whether to trust or not official GDP and inflation statistics (she says no — see 1:07:07) (h/t Sam Bell).

Is There a Relationship between Inflation and Unemployment?

Or, old fogey downloads data, finds a negative relationship, a.k.a. the Phillips Curve…