Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared in Project Syndicate on November 26th.

Category Archives: inflation

“Inflation in Emerging and Developing Economies”

That’s the title of a new volume released today, edited by Jongrim Ha, M. Ayhan Kose, and Franziska Ohnsorge.

Continue reading

Guest Contribution: “Modeling Time-Variation Over the Business Cycle (1960-2017): An International Perspective”

Today, we are pleased to present a guest contribution written by Enrique Martínez-García (Federal Reserve Bank of Dallas), based on his forthcoming article in Studies in Nonlinear Dynamics and Econometrics. The views expressed here are those solely of the author and do not reflect those of the Federal Reserve Bank of Dallas or the Federal Reserve System.

Guest Contribution: “The European Central Bank’s Lack of Accountability Has Consequences”

Today, we are fortunate to present a guest contribution written by Ashoka Mody, Charles and Marie Visiting Professor in International Economic Policy, Woodrow Wilson School, Princeton University. Previously, he was Deputy Director in the International Monetary Fund’s Research and European Departments.

The European Central Bank (ECB) was set up as the most independent of all central banks. Its independence also made it unaccountable. Freed from public accountability, the ECB’s decisions have been swayed by its management’s ideological preferences and by national interests. The consequence is that some eurozone countries are now subject to long-term deflation risk and are locked into a currency that is too strong for their economies.

A Fisherian Decomposition of the Recent Interest Rate Increase

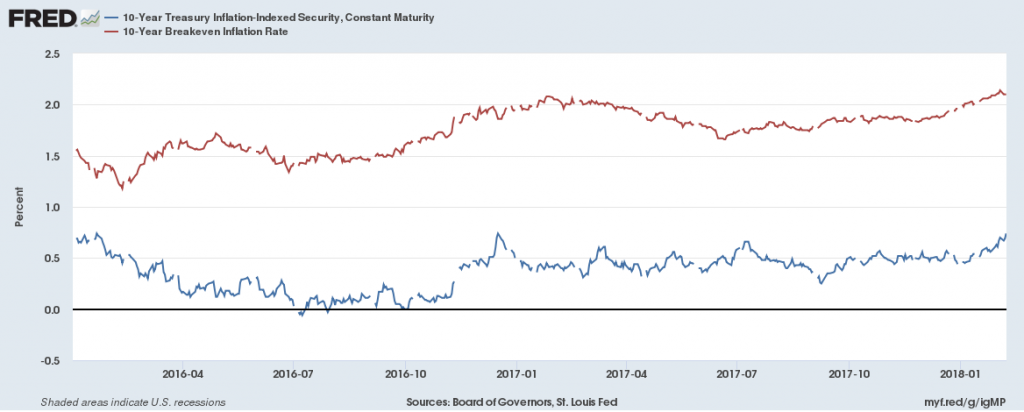

How much of the increase in the 10 year constant maturity Treasury yield is from higher real rates, and from higher expected inflation?

Source: Federal Reserve Board via FRED.

Recalling the Fisherian identity:

it = rt + πet

One can take the total differential:

Δit = Δrt + Δπet

Hence, of the 0.49 percentage point change from December 15 to February 7 in ten year Treasury yields, 0.27 percentage points is accounted for by a real interest rate increase, and 0.22 percentage point by inflation expectations boost (abstracting from liquidity premia, etc.).

Over the five year horizon, of the 0.41 percentage point change, 0.28 percentage points is accounted for by the real rate change, and 0.21 percentage point from higher expected inflation.

All about why nominal rates are rising, in interview with Marketplace (Stan Collender comments too). We talk about the standard things — tax cuts, spending increases, Fed QE unwinding and rate increases, and (my contribution) the deceleration of foreign central bank Treasury purchases (graphical depiction here on page 6). Discussion of the last point with respect to China here.

“What’s the Problem with Low Inflation?”

That’s the title of a new EconoFact article by Michael Klein.

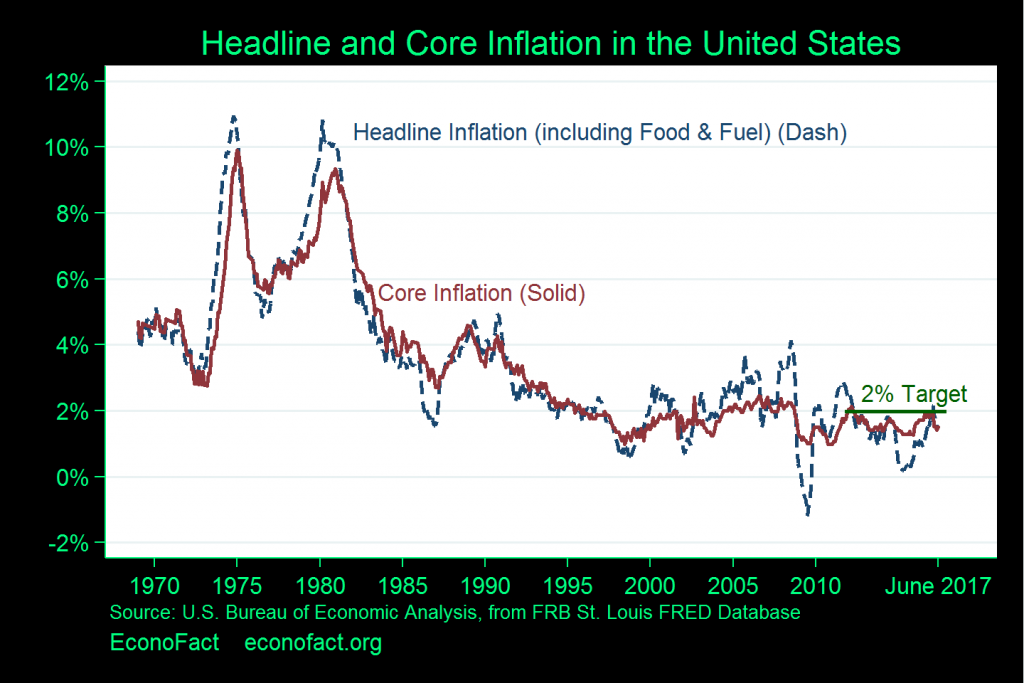

Today’s low inflation has some economists puzzled. The Federal Reserve has persistently undershot its inflation target of 2 percent since 2012, when it established this level of inflation as one of its policy goals.

…

Low inflation can be a signal of economic problems because it may be associated with weakness in the economy. When unemployment is high or consumer confidence low, people and businesses may be less willing to make investments and spend on consumption, and this lower demand keeps them from bidding up prices.…

There have been calls for the Federal Reserve to raise interest rates because the ongoing recovery from the Great Recession represents the third-longest recovery on record and the current low unemployment rate would usually lead the Federal Reserve to set its policy course towards preventing the economy from overheating. It is striking, however, that this recovery has not been accompanied by increasing inflation, even with unemployment rates of 4.3 percent in June and July, the lowest string of two-month unemployment rates in more than 15 years.

This figure from the article highlights the anomalous nature of recent inflation behavior.

Source: Klein.

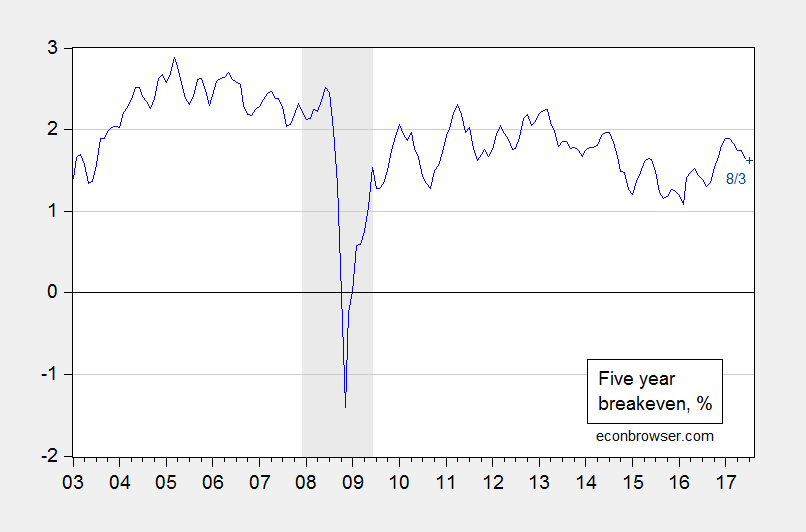

What are the prospects for accelerated inflation? The market’s expectation inferred from Treasury spreads is shown below:

Figure 1: Five year nominal Treasury yield minus five year TIPS yield, % (blue). July 2017 observation (dark blue +). Source: Federal Reserve Board.

As noted, such quiescent current and expected inflation at (what is widely acknowledged to be) near full employment does pose something of a mystery.

In the past, I’ve argued that the inflation target should be higher than the current 2%. [1] [2] I still believe that’s the case.

Are we in a new inflation regime?

Federal Reserve Bank of Chicago President Charles Evans got some attention recently with the following statement:

In a world of global competition and new technology, I think competition is coming from new places. New partners are choosing to merge and sort of changing the marketplace and [bringing] more competitive pressures on price margins…If that’s the case, and I think that’s just speculative at this point, then it means that we need even more accommodation to get inflation up.

Fed tightening cycles

Last December the Fed began what it thought at the time was a new cycle of tightening. Fed Chair Janet Yellen’s statements last week suggest the Fed still sees this plan as underway. A comparison with historical tightening cycles sheds some light on why so far the Fed hasn’t followed through.

Continue reading

Guest Contribution: “The Effects of Unconventional and Conventional U.S. Monetary Policy: The Role of Expected Inflation”

Today we are pleased to present a guest contribution by Yi Zhang, Ph.D. candidate at the University of Wisconsin-Madison. This post draws upon this paper.

Thinking about Wages, Inflation and Productivity… and Capital’s Share

On the release of the Productivity and Costs release, the WSJ reports “Weak Productivity, Rising Wages Putting Pressure on U.S. Companies: Economists fret how trends may affect inflation and broader growth”.