How does a tariff work? A tariff is a tax on imported goods, so if a Chinese good is sold to an American, the American literally has to pay the tax.

Continue reading

Category Archives: international

Guest Contribution: “Fall in US Trade Balance, Led by Ag. Exports”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers.

Guest Contribution: “Trump Renews Charges of Chinese Currency Manipulation”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared in Project Syndicate.

Who Could’ve Known “Crash Brexit” Would Be Problematic?

In the aftermath of the Salzburg summit, where the Chequers plan was dismissed by the EU, and PM May demanded “respect”, the pound has plunged.

The Long Run Elasticity of Farm Product Prices and the US Dollar

Expansionary fiscal policy combined with Taylor-rule induced monetary tightening has resulted in a strong dollar. That strong dollar is driving US agricultural prices.

New Tariffs on Chinese Imports

As part of the United States’ continuing response to China’s theft of American intellectual property and forced transfer of American technology, the Office of the United States Trade Representative (USTR) today released a list of approximately $200 billion worth of Chinese imports that will be subject to additional tariffs. In accordance with the direction of President Trump, the additional tariffs will be effective starting September 24, 2018, and initially will be in the amount of 10 percent. Starting January 1, 2019, the level of the additional tariffs will increase to 25 percent.

The list contains 5,745 full or partial lines of the original 6,031 tariff lines that were on a proposed list of Chinese imports announced on July 10, 2018. …

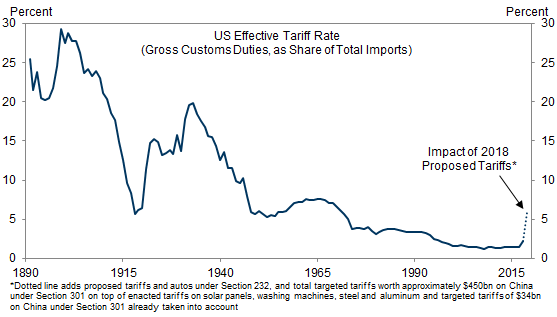

Implied US tariff overall tariff rates, from GS:

Source: Hatzius et al., “The Trade War: An Update,” Goldman Sachs June 25 2018.

Haven’t seen the Chinese back down so far, as some sanctions enthusiasts have predicted. If the demand is for China to give up on Made in China 2025, I’m guessing the Chinese are not going to back down in effect.

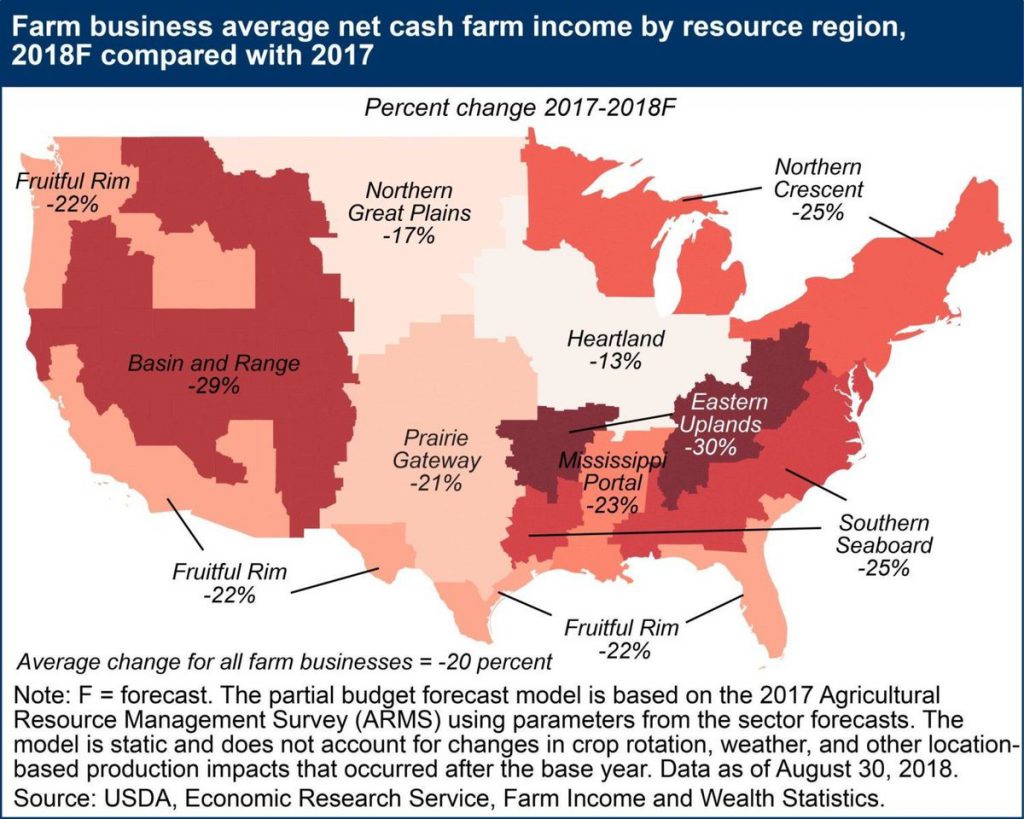

Farm Country Gets What It Voted For

From Yahoo Finance:

Tariffs imposed as retaliation for US tariffs worsen the US terms of trade (i.e., lower ag export prices), and a strong dollar lowers US ag prices. Rising interest rates due to the collision of monetary and fiscal policies worsens the debt service load of the ag sector, while reducing farmland prices.

Thanks, Trump!

Guest Contribution: “International Macroeconomics in the wake of the Global Financial Crisis”

Today, we are pleased to present a guest contribution written by Laurent Ferrara (Banque de France), Ignacio Hernando (Banco de España) and Daniela Marconi (Banca d’Italia), summarizing the introductory chapter of their book International Macroeconomics in the wake of the Global Financial Crisis. The views expressed here are those solely of the author and do not reflect those of their respective institutions.

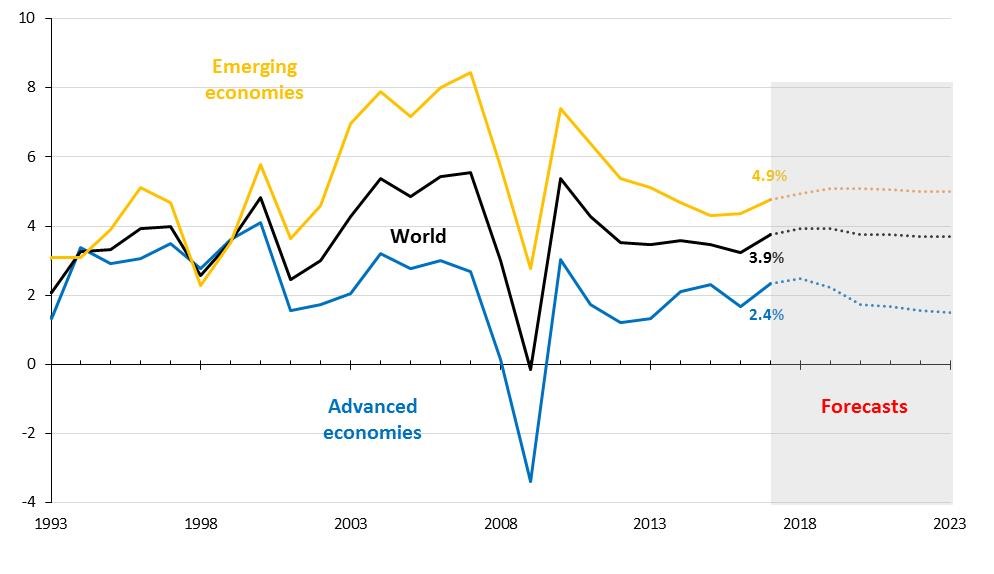

A decade after the eruption of the Global Financial Crisis (GFC), the world economy has finally returned to a more sustained pace of expansion (see Fig. 1).

Figure 1: World GDP annual growth (in %, constant prices). Source: IMF, World Economic Outlook, April 2018 and July 2018 update

Continue reading

The Term Spread and Dollar Diverge

With the election, and anticipation of a large fiscal impulse (tax cut, infrastructure spending), the dollar rose and the term spread increased. As expectations of the latter disippated, both the dollar and spread shrank. But recently, the comovement has broken down.

The CBO on Trade Policy Uncertainty

The CBO’s Budget and Economic Outlook is a must read. In addition to the widening budget deficit (no supply side miracle here), and the downward revision in projected 2018 growth, there is this commentary in the section blandly titled “Some Uncertainties in the Economic Outlook” (page 14 onward):

A sizable uncertainty in the U.S. trade and inflation forecast stems from recent changes to U.S. import tariffs and the retaliation of the country’s key trading partners.