One of the problems in conducting cross-country analyses of infrequent macroeconomic episodes (such as financial crises) is absence of a comprehensive historical dataset. That has been partly remedied by the publication of the Macrohistory Database, assembled by Oscar Jordà, Moritz Schularick, and Alan Taylor (see the paper utilizing this database, discussed here by Jim).

Category Archives: international

Treasury Semiannual Report on International Economic and Exchange Rate Policies Released

On China, from the Report (page 4):

China has a significant bilateral trade surplus with the United States. The country’s current account surplus fell from 3.0 percent of GDP over the full year 2015 to 2.4 percent for the four quarters through June 2016, moving below the established threshold for that criterion. China’s intervention in foreign exchange markets has sought to prevent a rapid RMB depreciation that would have negative consequences for the Chinese and global economies. Treasury estimates that from August 2015 through August 2016, China sold more than $570 billion in foreign currency assets to prevent more rapid RMB depreciation. More transparency over exchange rate management and goals, and strong adherence to G‐20 commitments to refrain from competitive devaluation and not to target exchange rates for competitive purposes, will enhance the credibility of China’s exchange rate regime. At the same time, China has a very large bilateral goods trade surplus with the United States. This underscores the need for further implementation of reforms to rebalance the Chinese economy to household consumption. Fiscal policy can support structural reform and provide consumption‐friendly stimulus to support demand if growth slows more than expected.

Detailed discussion of China on pages 15-18.

Here is the most recent Econbrowser post on the Chinese currency misalignment. See a more general discussion of the Penn effect at VoxEU. And on misalignment generally, see here.

Note that the Peterson Institute’s William Cline has recently taken issue with the Cheung-Chinn-Nong (2016) methodology; however, even there, based on the FEER methodology, they find neither under- nor overvaluation of the RMB.

Commodities, International Finance, and Real Exchange Rates

Those are the topics covered tomorrow (Friday, 10/14) at the 5th annual West Coast Workshop in International Finance 2016, taking place at Santa Clara University. As usual, these look like a set of fascinating papers, and a must-see for those interested in international finance/open economy macro (A post discussing last year’s conference proceedings is here).

Re-Writing the (International) Textbook: Interest Parity Conditions

Literally.

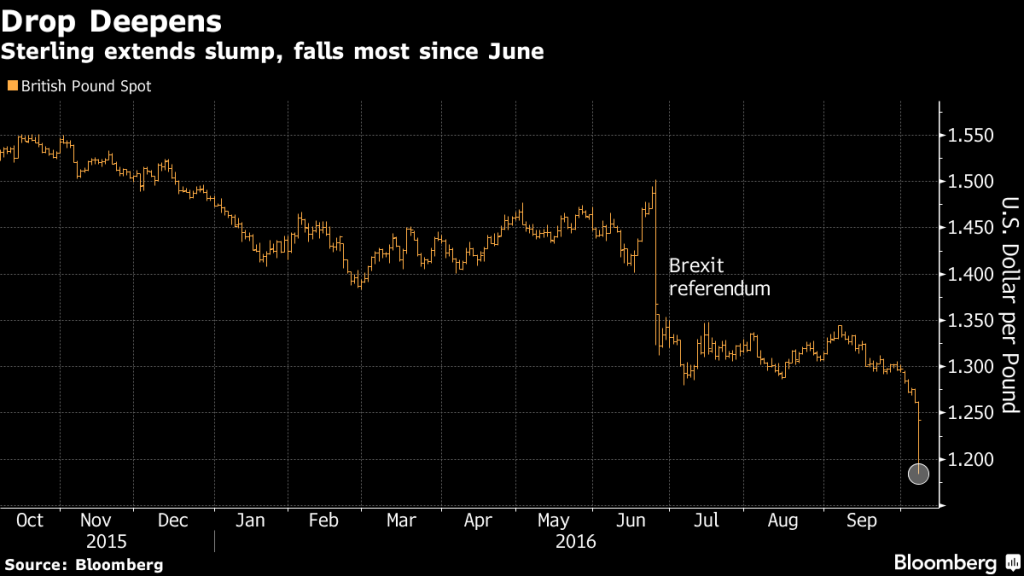

No Kidding: “Hard Brexit has haunted the sterling.”

Ron Alquist brings my attention to this ongoing story:

Source: Bloomberg 10/6/2016.

IMF World Economic Outlook, October 2016

Today, the IMF released forecasts of substantially downwardly revised growth estimates for the US. UK 2017 growth revised down 1.1 percentage points relative to pre-Brexit forecast (World Economic Outlook).

US Employment Implications of Preferential Trade Arrangements

In the debate on Monday, Donald J. Trump comments on Nafta’s impact:

You go to New England. You go to Ohio, Pennsylvania. You go anywhere you want, Secretary Clinton, and you will see devastation where manufacturing is down thirty, forty, sometimes fifty percent — NAFTA is the worst trade deal maybe ever signed anywhere but certainly ever signed in this country.

The Dollar, Tradables, and Monetary Policy

One argument for tightening monetary policy is derived from the argument the Fed needs to raise rates to close a “confidence gap”. Instead of psycho-analyzing the markets, I think it better to focus on data.

“Exchange Rate Prediction Redux: New Models, New Data, New Currencies”

That’s the title of a new paper, coauthored with Yin-Wong Cheung, Antonio Garcia Pascual, and Yi Zhang.

“Policy Challenges in a Diverging Global Economy”

That’s the title of the volume of proceedings of the 2015 Asia Economic Policy Conference, edited Reuven Glick and Mark M. Spiegel.