Today we are fortunate to have a guest post written by Yuriy Gorodnichenko (UC Berkeley).

Continue reading

Category Archives: international

Russian ForEx Reserves and Balance of Payments Vulnerabilities

Russian foreign exchange reserves, while large, are declining. Since reserve holdings (or lack thereof) are one of the best predictors of balance of payments/currency crises, it’s worth taking a look at their trajectory. (See Frankel and Saravelos, 2012 for a recent example)

Guest Contribution: “Sovereign to Sovereign Capital Flows”

Today we are fortunate to have a guest contribution authored by Laura Alfaro (Harvard), Sebnem Kalemli-Ozcan (U. Maryland) and Vadym Volosovych (Erasmus University Rotterdam). This post is based on “Sovereigns, Upstream Capital Flows, and Global Imbalances” (2014).

Guest Contribution: “Forex reserves: why following China won’t work for India”

Today we are fortunate to have a contribution by Joshua Aizenman, Dockson Chair in Economics and International Relations at the University of Southern California. This post was originally published at East Asia Forum.

“Risk Aversion, Global Asset Prices, and Fed Tightening Signals”

In the IMF analysis of capital flows highlighted in yesterday’s post, the VIX is used to proxy for risk. This variable has a lot of explanatory power [1] [2], but there is more to be investigated. Jan Groen and Richard Peck at the NY Fed examine the nature of risk in international financial markets, in a Risk Aversion, Global Asset Prices, and Fed Tightening Signals :

The global sell-off last May of emerging market equities and currencies of countries with high interest rates (“carry-trade” currencies) has been attributed to changes in the outlook for U.S. monetary policy, since the sell-off took place immediately following Chairman Bernanke’s May 22 comments concerning the future of the Fed’s asset purchase programs. In this post, we look back at global asset market developments over the past summer, and measure how changes in global risk aversion affected the values of carry-trade currencies and emerging market equities between May and September of last year. We find that the initial signal of a possible change in U.S. monetary policy coincided with an increase in global risk aversion, which put downward pressure on global asset prices.

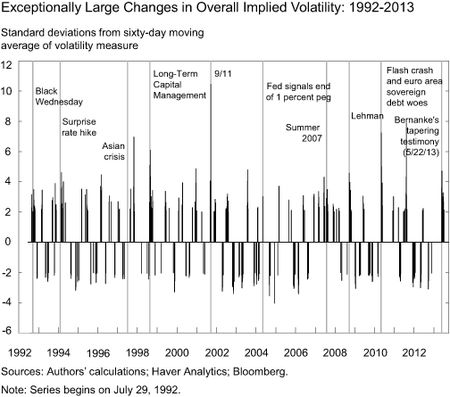

Implied volatility measures across different assets reflect, among other factors, market participants’ views on risk. Therefore, we conjecture that shifts in their risk aversion coincide with exceptionally large changes in implied volatility measures. An “exceptionally large” change in this case is defined as when overall implied volatility is at least two standard deviations above or below its mean over the previous sixty days. (“Overall implied volatility” is constructed as the average of the VIX index for U.S. equities, the Merrill Lynch Option Volatility Estimate [MOVE] Index for U.S. Treasury bonds, and the J.P. Morgan Global FX Volatility Index.) The chart below depicts changes in overall implied volatility for daily data from 1992 to September 2013, with labels for some key events that caused market turmoil. Exceptional volatility changes often occur in conjunction with these events, suggesting that these volatility changes are positively correlated with changes in (unobserved) risk aversion.

After examining the impact on the US dollar, carry trade returns and emerging market equity indices, the authors conclude:

Measuring changes to global risk aversion is a difficult exercise. The model used here suggests that substantial changes in risk aversion coincided with Chairman Bernanke’s May 22 testimony, resulting in substantial downward pressure on global asset prices in the two months after the May 22 testimony.

More in the post.

“Taper Tantrum or Tedium”

“How Will the Normalization of U.S. Monetary Policy Affect Latin America and the Caribbean?”

“Financial Adjustment in the Aftermath of the Global Crisis 2008-09: A New Global Order?”

That’s the title of a conference that took place at USC this weekend, co-organized by Joshua Aizenman, Menzie Chinn and Robert Dekle, and cosponsored by the USC Center for International Studies, USC School of International Relations, Journal of International Money and Finance, and the Federal Reserve Bank of San Francisco.

“The Oxford Handbook of the Economics of the Pacific Rim”

That’s a new volume out from Oxford University Press, co-edited by Inderjit Kaur and Nirvikar Singh.

An Economic Sanctions Menu Targeting Russia

Global Supply Chains and Macroeconomic Relationships in Asia

The increase in vertical specialization in Asia has implications for the strength of linkages between the region’s economies, and the tendency to manage intra-regional exchange rates.