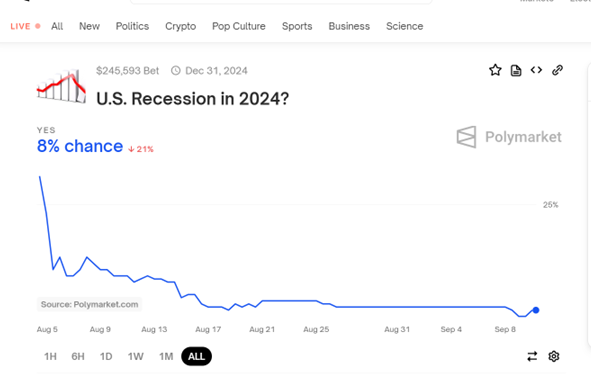

From Polymarket, accessed 4pm CT today:

Category Archives: recession

Nowcasts – Updated

GDPNow Q3 growth nowcast now up to 2.5%, from 2.1%.

GDP Nowcasts: Continued Growth into Q3

We have plenty of competing assessments as of today. From three Federal Reserve Banks and Goldman Sachs.

EJ Antoni/Heritage on What Unemployment Rate We Should Be Looking At

EJ Antoni/Heritage writes alarmingly about how excluding marginally attached workers from the calculation of unemployment is misleading:

Kudlow: “We Are in the Front End of a Recession”

Audio here, at 2:30 approximately. He also says private NFP gain is down to +56K, while private ex-health care and social services (all essentially government), was only up +12K. Here’s the picture I get looking at current vintage/latest release:

Goldman Sachs on the Post-Election Economy

From Alec Phillips, David Mericle and Tim Krupa (Goldman Sachs, 3 September 2024):

Business Cycle Indicators and the Employment Release

Employment growth is slowing. Even taking the preliminary benchmark at face value, we’re not in recession as of mid-August (when the survey is taken).

Peter Schiff on Recession

Peter Schiff today:

This morning has seen a trifecta of weak economic data. Aug. PMI & ISM manufacturing both came out even weaker than expected, while July construction spending unexpectedly fell. It’s becoming clear the #economy is entering a #recession just as #inflation is poised to turn higher.

Business Cycle Indicators as of September’s Start

Including monthly GDP out today from S&P Global Market Insights, and preliminary benchmark NFP:

It’s Almost as If Some People Were Rooting for Recession

EJ Antoni (Heritage) is dubious about GDPNow’s (and other nowcasts) regarding Q3 growth. From X aka Twitter today: