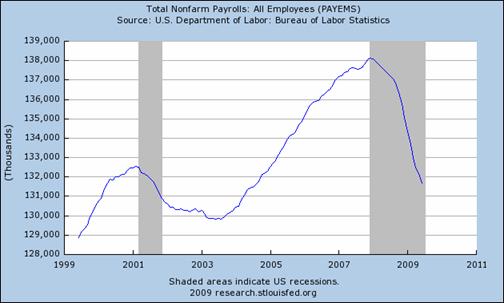

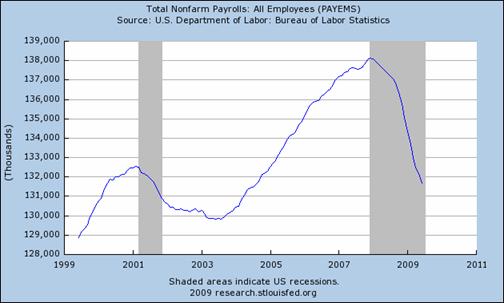

BLS reported that the total number of Americans employed in June on nonfarm payrolls came to 131.7 million workers on a seasonally adjusted basis. That’s below the June 2000 figure of 131.8 million with which we started the decade.

|

BLS reported that the total number of Americans employed in June on nonfarm payrolls came to 131.7 million workers on a seasonally adjusted basis. That’s below the June 2000 figure of 131.8 million with which we started the decade.

|

Autos are worth watching as one sector where economic growth could resume first. But despite what others are saying, I don’t believe that it’s happening yet.

As James Morley has pointed out, often a sharp economic downturn is followed by an equally sharp economic recovery. One reason for that is the liquidation of inventories that accompanies any recession and restocking that takes place in recovery. What should we expect this time?

The Conference Board Leading Economic Index increased by more than 1% in both April and May. Since I’ve been scratching my head trying to find some confirmation for recent economic optimism, I was curious to take a look at what’s responsible for the favorable reading from the LEI.

Gasoline prices (in case you’ve been hiding in a cave and didn’t know) have been on something of a roller coaster the last few years. And it looks as though we’re climbing back up another hill at the moment. How much are the recent increases in gas prices likely to weigh down American consumers?

I’m still looking for, and still not seeing, the economic recovery that everybody is talking about.

Often after a sharp economic downturn we observe an equally dramatic recovery. But nobody can claim to be seeing that so far in the currently available data.

In today’s NYT, Casey Mulligan presents an interesting picture of GDP during the “1980-82 recession” — the conjoining of the two NBER defined recessions in 1980 and 1981-82. Based on the comparison with the current recession, he concludes:

While the job losses, foreclosures, stock declines and other casualties of the current recession have been very painful, substantially more bad economic news is needed to make this recession worse than the downturns of 1980-’82, at least in G.D.P. terms.

Do recently rising oil prices signal a resurgence of economic growth?

This morning, the Joint Economic Committee of the U.S. Congress took up the implications of rising world oil demand for the U.S. economy. I was invited to participate along with Daniel Yergin, Co-Founder and Chairman of Cambridge Energy Research Associates.

I have some more discussion at the Washington Post as well as the following links: