Maybe something, maybe nothing.

Category Archives: taxes

“The Election: Implications for Policy Change?”

That’s the title of an informal panel at the UW La Follette School of Public Affairs on Tuesday. Here are the slides that underpin my presentation.

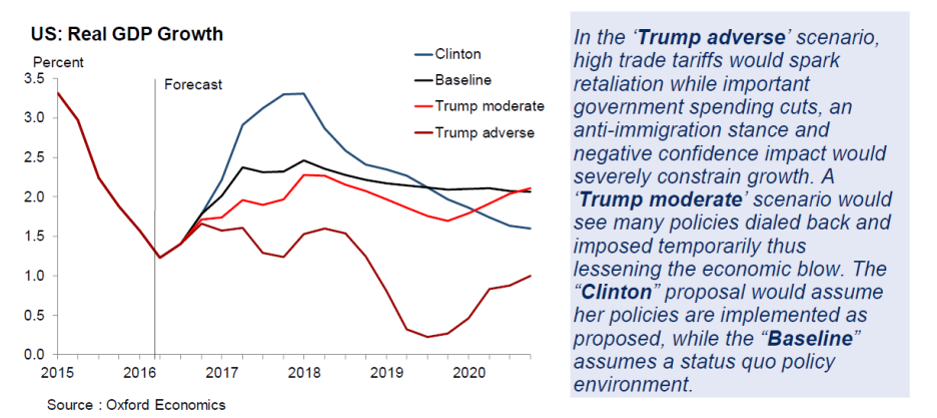

For now, let the following figure summarize the choices.

Source: “Trump vs Clinton: Polarization & uncertainty,” Research Briefing (Oxford Economics, 19 Sept. 2016) [not online].

The other panelists are Pam Herd, Greg Nemet, Rourke O’Brien, and Tim Smeeding.

Still Lovin’ Debt

Instead of zooming to 130% debt-to-GDP ratio, the new Trump plan only takes it up to 105%.

Continue reading

Assessing Industrial Policy in Wisconsin

The Wisconsin Budget Project concludes “Costly Tax Credit has Done Little to Boost [manufacturing] Employment”.

“Kansas loses patience with Gov. Brownback’s tax cuts”

The experiment continues…

What Is “Solid Economic Reasoning”?

Writing in The Nation, Robert Pollin asserts:

All of [Bernie Sanders’s] major proposals are grounded in solid economic reasoning and evidence.

Kansas Macro and Fiscal Crash

Economic activity stalls, and the Republicans conclude that higher taxes are necessary for higher tax revenue.

[with update 6/2 on the April forecast]

Newly Revamped Coincident Indices Indicate … Wisconsin Still Lags

and is forecasted to continue to lag.

I Agree with Ed Lazear (and Alan Auerbach)!

If you dynamic score, dynamically score both expenditure and revenue measures.

Symmetric Application of Dynamic Scoring

Republicans are keen to sacrifice CBO’s role as impartial arbiter of fiscal measures on the altar of “dynamic scoring” of tax measures.[0] But there is no economic reason for restricting this approach to only tax measures.