Today, we’re fortunate to have Willem Thorbecke, Senior Fellow at Japan’s Research Institute of Economy, Trade and Industry (RIETI) as a guest contributor. The views expressed represent those of the author himself, and do not necessarily represent those of RIETI, or any other institutions the author is affiliated with.

Category Archives: Trade Policy

A Modest Proposal: “Victory Tofu”

America needs all-tofu school lunches, subsidized tofu pizza, a Tofutti ice-cream substitute campaign… and more. I figure 205.4 pounds of tofu per American should do the trick. The situation facing American soybean farmers is dire, as shown below.

Home Before the Leaves Fall – The US in Trade War

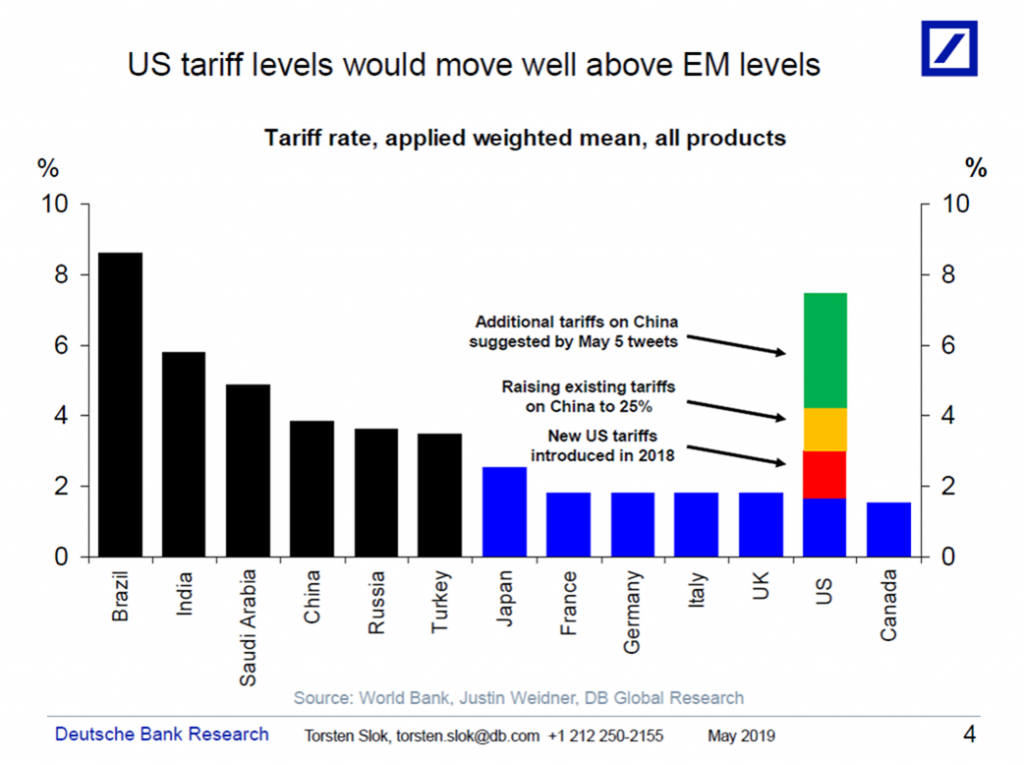

Here is the state of play for US tariffs. We’re a developing country!

As Mr. Trump’s trade war lumbers on, with American consumers bearing the bulk of the burden thus far, it’s useful to review the facts regarding the war. Here are the EconoFact articles on trade policy.

“White House Considers Economist Judy Shelton for Fed Board”

That’s the title of an article in Bloomberg:

Shelton, who’s served as an informal adviser to Trump, holds a Ph.D. in business administration with an emphasis on finance and international economics from the University of Utah.

Of Chinese Swine, US Hog Exports, Soybean Prices, and News

Soybean prices continue to plunge (July ’19 futures). Some have argued that decreased demand for soybeans, due to the ongoing African swine fever epidemic in China. The April 9th USDA FAS report contained information on both this, and soy market conditions. If decreased demand for soybeans was due to news about Chinese swine stocks, we would have expected rising US hog and declining soy prices. Yet hog prices have fallen for most of the time since then.

Who’s Getting the Rents?

The import quota rents that is. From Brian Riley/NTUF:

Soybean Prices on the Eve of the US-China Trade Deal

Why haven’t they risen?

When the Textbook Is Right: Implications of the Trump Fiscal/Trade Regime

Today we learned that through March, the Federal budget deficit was 15% larger than the corresponding point in the last fiscal year — as expected given a not particularly stimulative tax cut (so much for tax cuts paying for themselves, as Stephen Moore claimed) and the ending of spending restraints. The dollar remains at elevated levels, as interest rates have risen. The trade deficit, excluding petroleum, continues to deteriorate. As I explained to my macro class today… it’s all textbook (notes).

A Pyrrhic Victory (Perhaps) on China Trade

From Bradsher in NYT:

…spurred by tariffs and trade tensions, global companies are beginning to shift their supply chains away from China, just as some Trump administration officials had wanted.

Does Policy Uncertainty Matter?

The Atlanta Fed along w/Bloom (Stanford) and Davis (Chicago) survey business operators and finds it does!