From Ed Yardeni’s website:

Bitcoin 34% below Peak, 12.5% below January 1st

Even as VIX declines.

EJ Antoni’s Scary Picture … and a(nother) Emily Litella* Moment

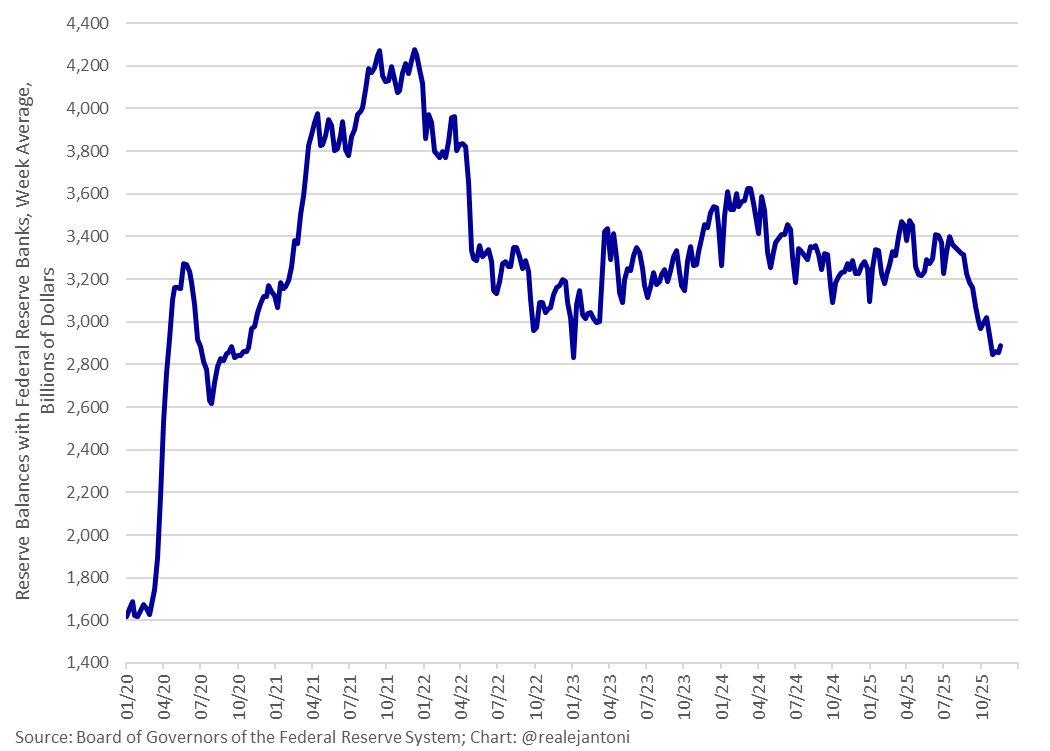

This matters more than today’s jobs report or the inflation data when it comes to the Fed’s monetary policy decisions – Powell & Co. have painted themselves into a corner and the only way out is money printer go brrr:

What’s an Essential Worker (or Activity)? No October CPI, Employment Release, but We Get a Hole Where the East Wing Used to Be

I hear that no government funds (allegedly) were used to fund demolition of the East Wing of the White House (which raises a completely separate legal question of whether donations can be used for government operations), but really, the Administration couldn’t be bothered to call in BLS workers so we would know where the economy was going?

Consumer Sentiment in November: Near Record Low

Michigan November final almost as low at June 2025:

Manufacturing in September

BLS measures (employment, hours) are down through September.

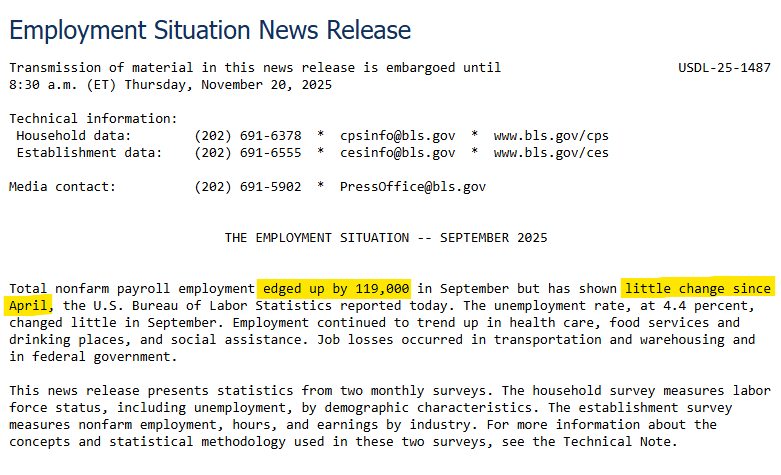

EJ Antoni Continues to See a Vast Conspiracy at BLS

From EJ Antoni on X today:

Not even hiding it anymore – since when is a 119k increase just “edging up”? And since when is a 193k increase “little change”? They mentioned Apr b/c that’s when Trump announced tariffs; whether you’re for or against Trump’s trade policies, this is obviously a biased narrative:

Cumulative Percent Growth in Private NFP from BLS, ADP Compared

From the latest release:

Updated Business Cycle Indicators, Including Employment

Incorporating employment (including implied benchmark NFP):

Business Cycle Indicators and Nowcasts

Tomorrow, we get results for September employment. Bloomberg consensus is for +55K, compared to +42K at the originally scheduled release date (and +22K in August). Here are key indicators followed by the NBER Business Cycle Dating Committee.